Tag Archive: Turkey

FX Daily, April 01: China Reanimates the Animal Spirits, While Europe Finds New Ways to Disappoint

Overview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China's official PMI and Caixin's manufacturing reading. However, the spillover from China was limited in Asia. Japan's Tankan survey and outlook disappointed and South Korea's exports and imports were weaker than expected.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

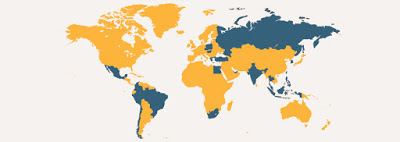

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM.

Read More »

Read More »

FX Weekly Preview: Five Traps in the Week Ahead

Officials have taken steps to make it more difficult and more expensive to short the lira, but that did not prevent a 5% slide ahead of the weekend. There is no interest rate, within reason, that can compensate for such currency risk.

Read More »

Read More »

FX Weekly Preview: Testing the Dollar’s Breakout

The US dollar surged last week, with the Dollar Index rising 1.25%, the most since April. The dollar is being boosted by two drivers. The first is the policy mix and interest rate divergence. The other is the intensification of pressure on emerging market. Turkey has a disastrous combination of more fundamentals, large short-term foreign currency debt obligations, unorthodox policies, and the lack of credibility.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.

Read More »

Read More »

FX Daily, August 10: The Dollar Muscles Higher as Turkey Melts Down

The US dollar has surged. The main impetus comes from the dramatic slide in the Turkish lira. After moving above TRY5.0 yesterday, it reached TRY6.30 today before stabilizing a little below TRY6.0 as the European morning progressed. The trigger seemed to be the lack of credibility of the government's response as investors await officials to elaborate on the outline of the "new economic model" provided yesterday.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity just starting to emerge. We remain...

Read More »

Read More »

Emerging Markets: What Changed

PBOC fixed USD/CNY at the highest level since December 14. Bank Indonesia delivered a larger than expected 50 bp to 5.25%. Bulgarian Prime Minister Boyko Borissov survived a second no-confidence vote this year. Turkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. Saudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday on a mixed note, capping off a roller coaster week for some of the more vulnerable currencies. We expect continued efforts by EM policymakers to inject some stability into the markets. However, we believe the underlying dollar rally remains intact. Central bank meetings in the US, eurozone, and Japan this week are likely to drive home that point.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses.

Read More »

Read More »

What Happened Monday?

Italian politics dominated Monday's activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections.

Read More »

Read More »

Emerging Markets: What Changed

President Trump canceled the planned summit with North Korea’s Kim Jong Un. Malaysia’s new Finance Minister Lim was sworn in along with 13 other cabinet ministers. Philippine central bank cut reserve ratios for commercial banks by one percentage point to 18% effective June 1. The United Arab Emirates opened up its economy to more foreign investment.

Read More »

Read More »