Tag Archive: they really don’t know what they are doing

Chart of the Week: The Dreaded Full Frown

I’m going to break my personal convention and use the bulk of the colors in the eurodollar futures spectrum, not just the single EDM’s (June) contained within each. The current front month is January 2019, and its quoted price as I write this is 97.2475. The EDH (March) 2019 contract trades at 97.29 currently and it will drop off the board on March 18.

Read More »

Read More »

And Now For Something Completely Different

Back in February, Japan’s Cabinet Office reported that Real GDP in Japan had grown in Q4 2017 for the eighth consecutive quarter. It was the longest streak of non-negative GDP since the 1980’s. Predictably, this was hailed as some significant achievement, a true masterstroke of courage and perseverance. It was taken as a sign that Abenomics and QQE was finally working (never mind the four years).

Read More »

Read More »

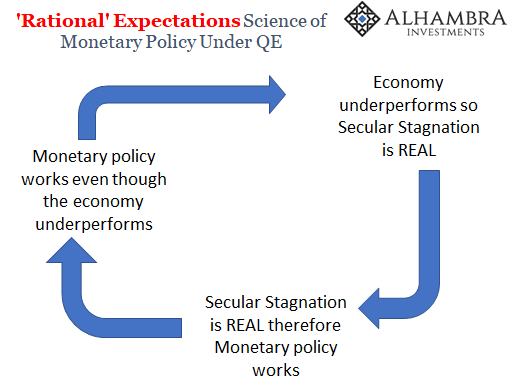

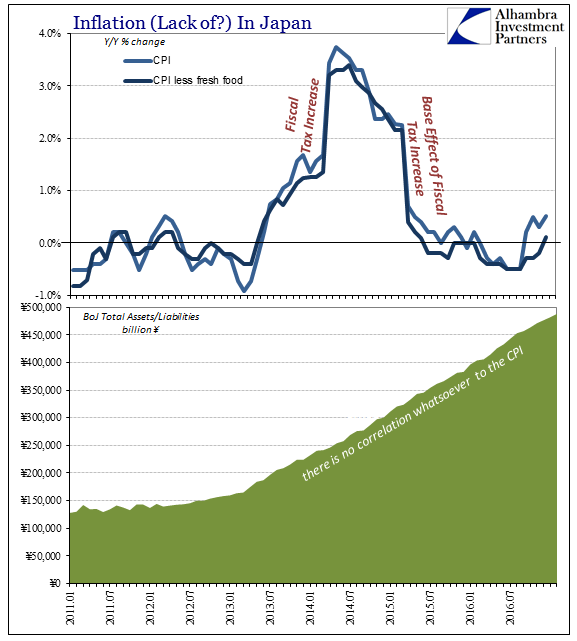

The Science of Japanification

The term itself gives it away. They called it quantitative easing for a specific reason. Both words mean to convey substantial concepts. The first part, quantitative, was used because it sounds deliberate, even scientific. It implies a program where great care and study was employed to come up with the exact right amount. It’s downright formulaic, where you intend that by doing X you can predictably create Y.

Read More »

Read More »

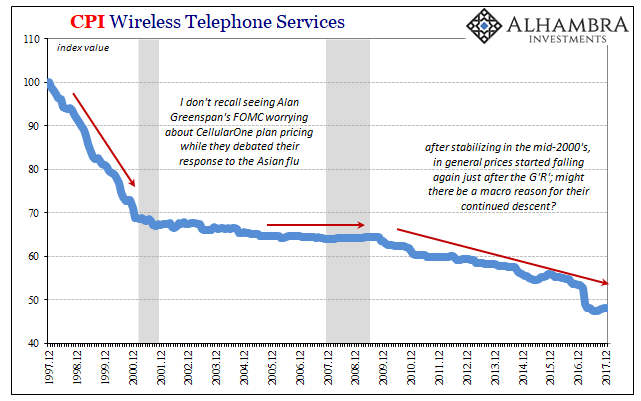

Good or Bad, But Surely Not Transitory

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator).

Read More »

Read More »

Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found.

Read More »

Read More »

What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery.

Read More »

Read More »

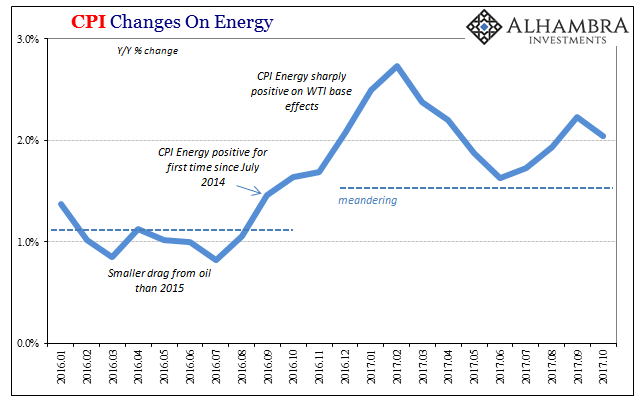

Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions.

Read More »

Read More »

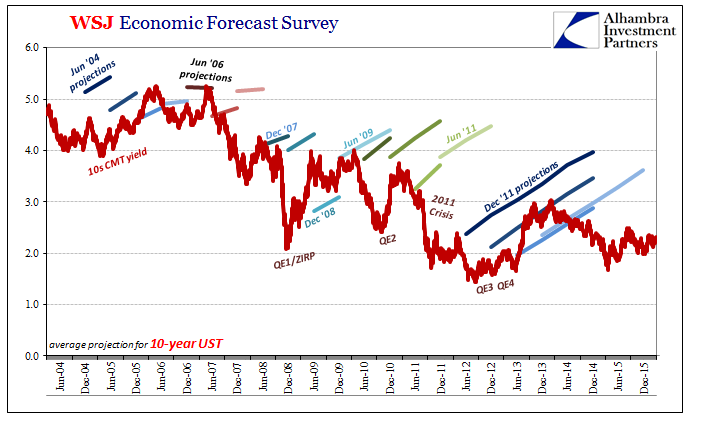

US Federal Funds, Bond Market and WSJ Economic Survey: The Hidden State of Money

Correctly interpreting the bond market is more than just how and when to invest your money in UST’s. Not that it isn’t useful in such a money management capacity, but interest rates starting at the risk-free tell us a lot about what is wholly unseen. There is simply no way to directly observe inside an economy what is taking place at all levels and in all transactions. We try to estimate as best we can in the aggregate, but the real economy works...

Read More »

Read More »

Maybe Deep Dissatisfaction Has A Point

To complete a trifecta, maybe someone could interview Alan Greenspan about rational exuberance. The last of the latest Fed Chairmen, Janet Yellen, purports today that the next financial crisis will not be in “our lifetimes.” The issue, however, isn’t even crisis so much as credibility. Given that she and the rest of them had no idea about the last one until it was almost over, we might be forgiven for rejecting her thesis outright – and it having...

Read More »

Read More »

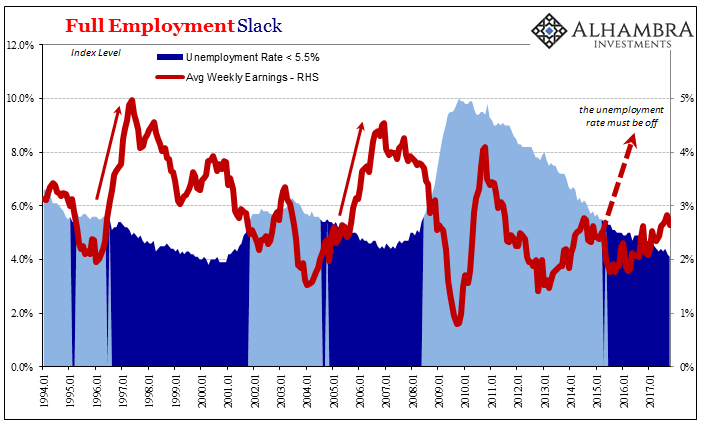

Signs of Something, Just Not Wage Acceleration

I have been writing for many years that they really don’t know what they are doing. I only wish it was that simple. There has been developing another layer or dimension to that condition, a second derivative of stupid, whereby when faced with this now well-established fact the same people, experts and authorities all, they have no frame of reference to figure out what next to do. In other words, they really don’t know what to do when they realize...

Read More »

Read More »

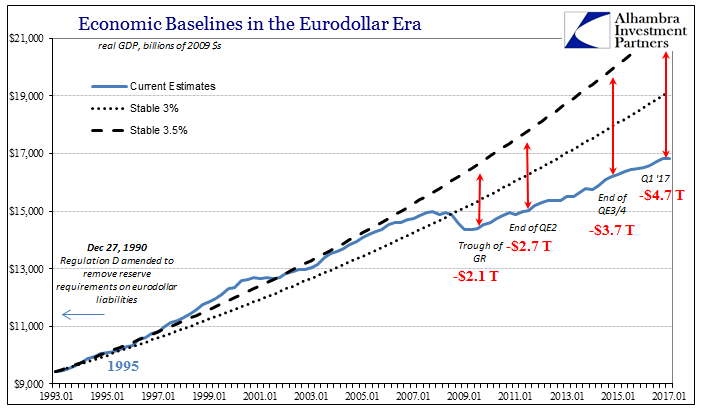

Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs.

Read More »

Read More »

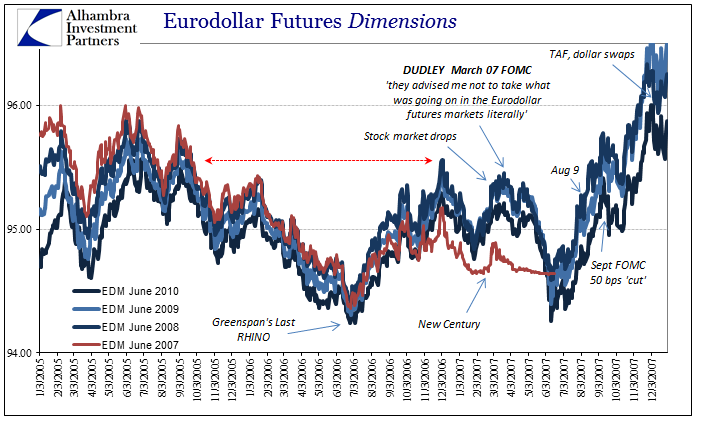

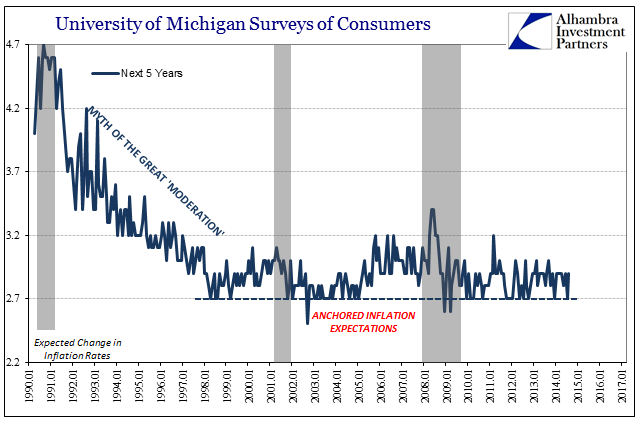

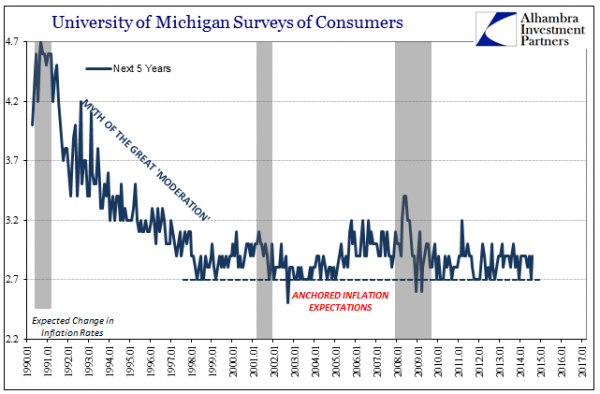

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »