Tag Archive: the fed

US CPI Data Release Update

It is easy to get caught up in data releases. The media is keen to read a lot into them, hoping it will offer some sense of what is really going on, so often the news is about numbers just announced or expectations for what one economic measure will show from one month to the next.

Read More »

Read More »

Will Silver Prices Go Up to $300?

This week’s guest is so bullish on silver that he’s even written a best-selling book ‘The Great Silver Bull’ where he takes an in-depth look at why silver will outperform gold once again and even go as high as $300 an ounce.

Read More »

Read More »

A muddled message from The Fed

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went.

Read More »

Read More »

Inflation Crisis 2022 – Marc Faber Interview (Full)

Tune into GoldCore TV where we have just released the full, frank and direct interview with Dr. Marc Faber of the Gloom, Boom, Doom Report in a no-holds barred interview.

Read More »

Read More »

New Russia/China Gold Backed Currency Imminent

We were delighted to welcome Simon Hunt to GoldCore TV this week. David Russell interviewed the expert economist and global observer to ask him about the Russia-Ukraine war, central bank tightening, and the future of the US Dollar hegemony.

Read More »

Read More »

Expect the Unexpected from the Fed

It has been a rough week in most markets with both equities and bonds declining sharply. Tech stocks have been pummeled with many ‘big names’ plunging more than 50% (from their 52-week high). Some of the bigger names include Zoom Video -75%, PayPal -73%, Netflix -72%, Meta Platforms (Facebook), -53%.

Read More »

Read More »

The Fed Has No Idea What’s Coming Next!

We will let you know what we are doing once we know what we are doing was the message from the Federal Reserve statement and Chair Powell’s press conference that followed.

Read More »

Read More »

The ‘Fed Put’ – Gone Until There’s Blood in the Streets

The ‘Fed put’ – gone until there’s blood in the streets

Well, it’s happening. Bitcoin (and other cryptocurrencies are sharply down, along with equity markets in many advanced economies.

And the Federal Reserve (the U.S. Central Bank) statement and press conference on Wednesday didn’t indicate any backing down from raising interest rates, maybe as soon as the March meeting.

The Fed’s stance pivot from ‘the economy needs...

Read More »

Read More »

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold price fell to $1,808 an ounce in the wake of the release of the minutes of the December Federal Reserve meeting, having hit an intra-day high of $1,829. Silver price fell to $22.72 an ounce from an intra-day high of $23.26.

Read More »

Read More »

Is Now a Good Time to Buy Gold? Market Report 16 March

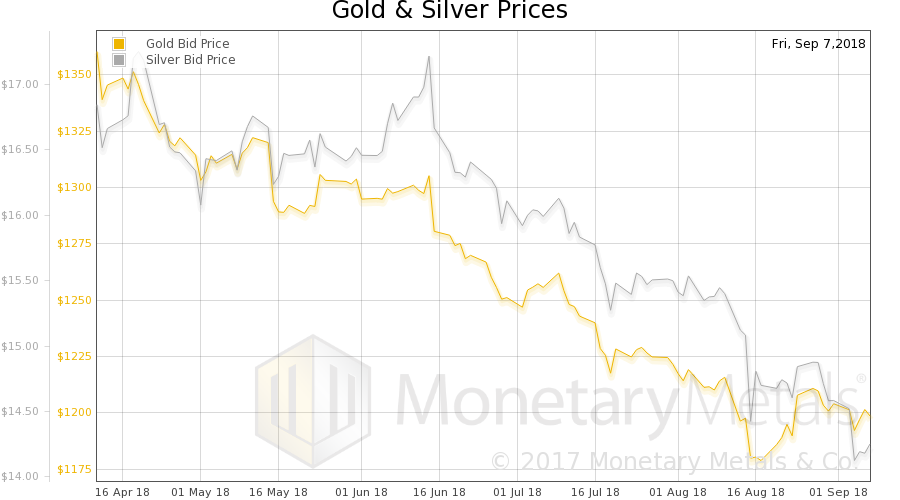

We got hate mail after publishing Silver Backwardation Returns. It seems that someone thought backwardation means silver is a backward idea, or a bad bet. “You are a *&%#! idiot,” cursed he. “Silver is the most underpriced asset on the planet,” he offered as his sole supporting evidence. He doesn’t know that backwardation means scarcity, not that a commodity’s price is too high.

Read More »

Read More »

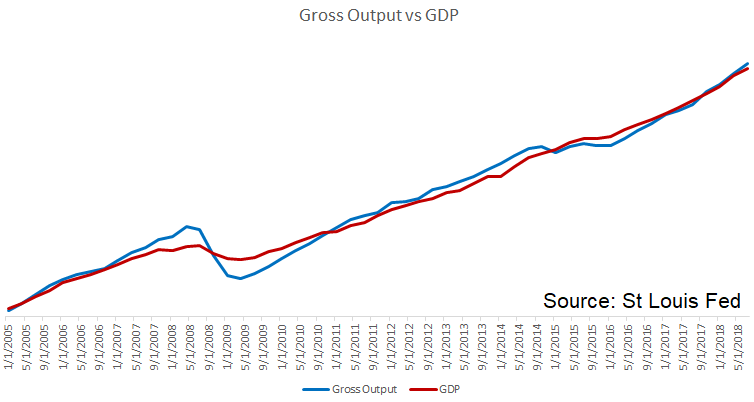

Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP).

Read More »

Read More »

Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

13 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa -

Warum Lebensverlängerung nicht das eigentliche Problem löst.

Warum Lebensverlängerung nicht das eigentliche Problem löst. -

Silber & Gold: Kommen jetzt neue Rekorde?

Silber & Gold: Kommen jetzt neue Rekorde? -

Private Credit Funds Falling Out Of Favor

Private Credit Funds Falling Out Of Favor -

Wichtige Morning News mit Oliver Klemm #537

Wichtige Morning News mit Oliver Klemm #537 -

Quartalszahlen Crash – United Health Aktie 22% im Minus!

Quartalszahlen Crash – United Health Aktie 22% im Minus! -

Covid ist nicht vorbei – die Folgen bleiben

Covid ist nicht vorbei – die Folgen bleiben -

Gold, Silber, Bitcoin: Jetzt einsteigen?

Gold, Silber, Bitcoin: Jetzt einsteigen? -

Bitcoin: Ich kaufe JETZT!

Bitcoin: Ich kaufe JETZT! -

Was kocht man einem Multimillionär?

More from this category

Here are three things you can learn from the Fed

Here are three things you can learn from the Fed13 Jan 2023

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022

Inflation Crisis 2022 – Marc Faber Interview (Full)

Inflation Crisis 2022 – Marc Faber Interview (Full)21 Jul 2022

New Russia/China Gold Backed Currency Imminent

New Russia/China Gold Backed Currency Imminent20 May 2022

Expect the Unexpected from the Fed

Expect the Unexpected from the Fed28 Apr 2022

The Fed Has No Idea What’s Coming Next!

The Fed Has No Idea What’s Coming Next!18 Mar 2022

The ‘Fed Put’ – Gone Until There’s Blood in the Streets

The ‘Fed Put’ – Gone Until There’s Blood in the Streets30 Jan 2022

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes9 Jan 2022

Is Now a Good Time to Buy Gold? Market Report 16 March

Is Now a Good Time to Buy Gold? Market Report 16 March16 Mar 2020

Is Capital Creation Beating Capital Consumption? Report 3 Mar

Is Capital Creation Beating Capital Consumption? Report 3 Mar4 Mar 2019

Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

Why the Fed Denied the Narrow Bank, Report 9 Sep 201811 Sep 2018

Here are three things you can learn from the Fed

2023-01-13

by Stephen Flood

2023-01-13

Read More »