Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity market sell-off, bond market rally, and the continued rise in LIBOR.

Read More »

Tag Archive: Switzerland ZEW Expectations

FX Daily, November 29: Sterling Charges Ahead on Brexit Hopes

Prospects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a four-day low. It is the strongest of the major currencies today, gaining about 0.4%. With today's gains has met our retracement target near $1.3415. The momentum appears to give it potential toward $1.3500 in the...

Read More »

Read More »

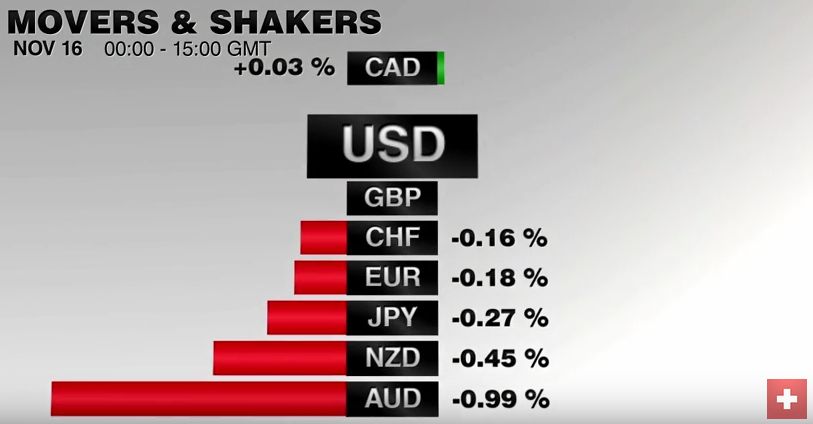

FX Daily, November 16: The Greenback Remains Resilient

The US dollar remains bid. It is at its year high against the euro and five-month highs against the Japanese yen. Sterling, which has performed better recently, remains in the trough around 30-year lows. It surge since the election reflects three considerations. The first is December Fed hike. Prior to the election, the market was assessing around a two-thirds chance. Now both the CME and Bloomberg's WIRP estimate the odds above 90%....

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

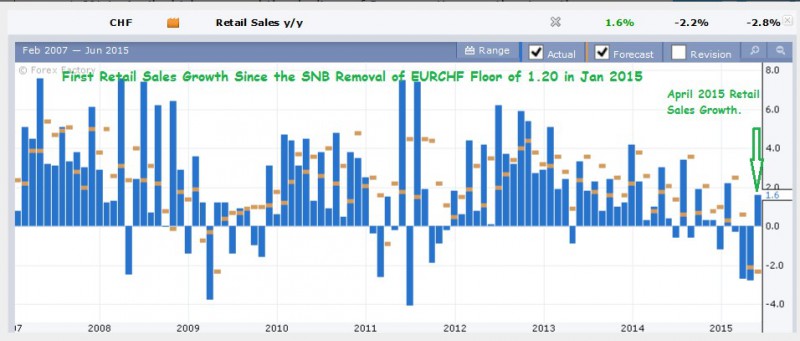

Impressive Swiss Recovery After SNB Peg Removal

Retail data shows that the SNB peg removal in January 2015 as early as April 2015 with minimal adverse impact on the economy.

Trade surplus showed that Switzerland had fully recovered its lost trade surplus in May and expectations crossed an important threshold into positive territory in June.

CHF strengthened since May end, as the market caught wind of the Swiss recovery, and the Grexit would further strengthen the CHF if it were to occur.

Read More »

Read More »

Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years

The Swiss ZEW investor sentiment has risen to 4.8 by 2.6 points, news that do not influence markets. More interesting is the following: Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years * Majority see no change in euro/franc for next 6 months (Reuters) – The Swiss National Bank will most … Continue reading »

Read More »

Read More »