Tag Archive: Switzerland Gross Domestic Product

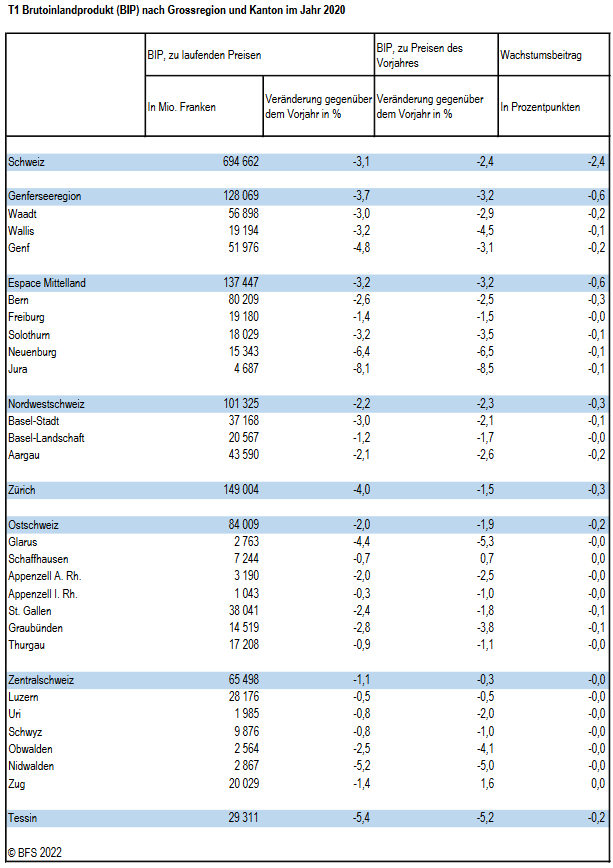

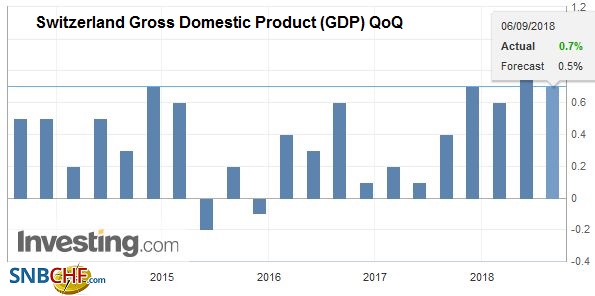

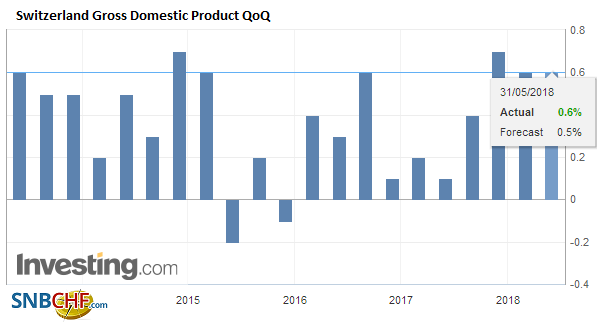

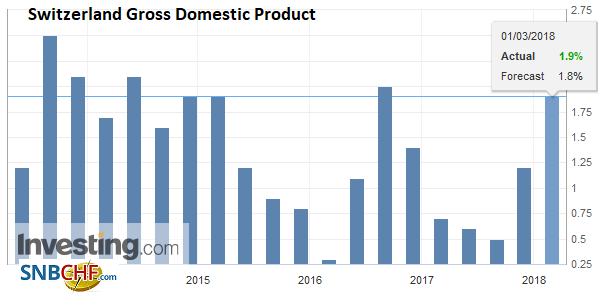

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

The Changing International linkages of Switzerland: An Overview

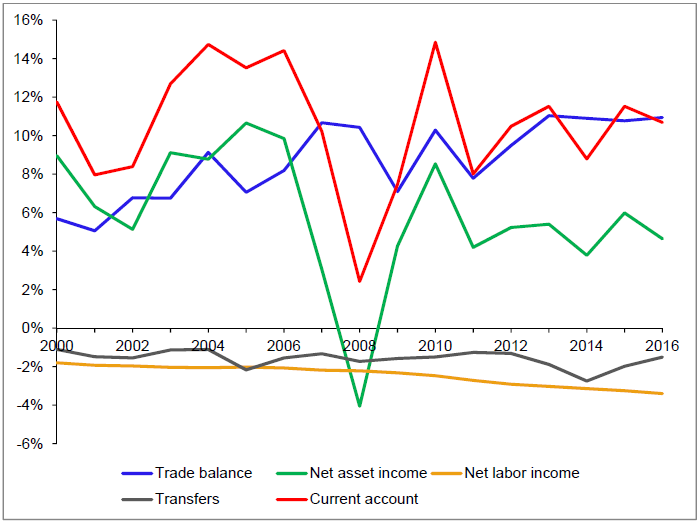

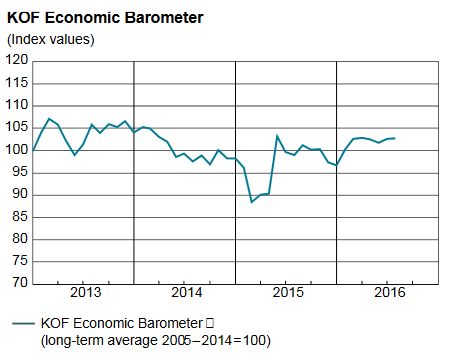

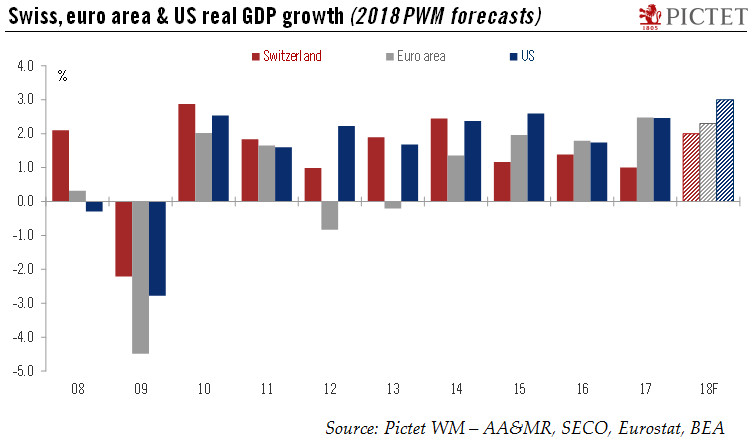

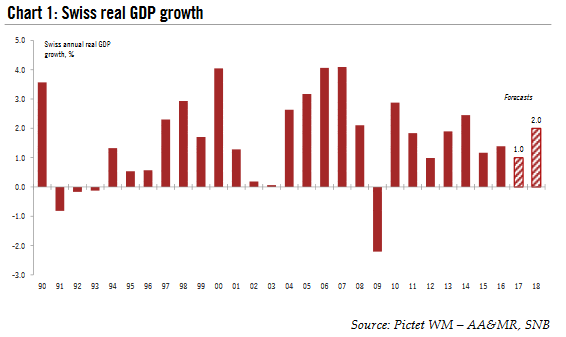

Being a small open economy Switzerland is highly exposed to the girations of the world economy, both through international trade and financial flows. The country’s trade surplus for instance accounted for nearly half the GDP growth between 2000 and 2007.2 While the growth contribution from trade has slowed during the global crisis, the linkages with the world economy remain important for Switzerland.

Read More »

Read More »

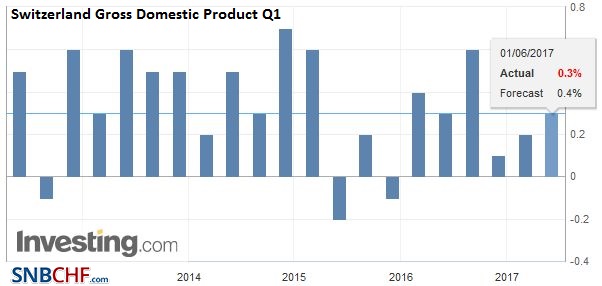

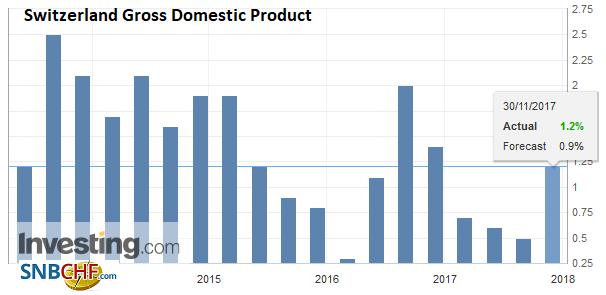

Switzerland GDP Q1 2017: +0.3 percent QoQ, +1.1 percent YoY

Switzerland’s real gross domestic product (GDP) grew by 0.3 % in the first quarter of 2017*. Private consumption growth expanded only slightly, while government consumption rose moderately. Following the previous quarter’s fall, investment in construction and equipment increased.

Read More »

Read More »

FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

The US dollar is mostly firmer against the major currencies. It is consolidating yesterday's losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday's lows. On the other hand, even strong data from Japan did not drive the yen higher.

Read More »

Read More »

Who’s Playing The Long Game–and What’s Their Game Plan?

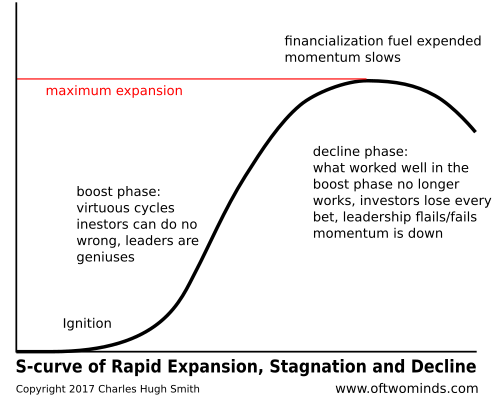

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »

Switzerland GDP Q4 2016: +0.1 percent QoQ, +0.6 percent YoY

The Swiss economy relies very much (and probably too much) on exports. In the fourth quarter export of goods fell by 3.8%, while imports remained the same. Investments dipped, too. On the other side, consumption rose by a strong 0.9%. In total, the economy grew by only 0.1% QoQ (+0.6% YoY).

Read More »

Read More »

FX Daily, December 02: Is it About US Jobs Today?

The capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable.

Read More »

Read More »

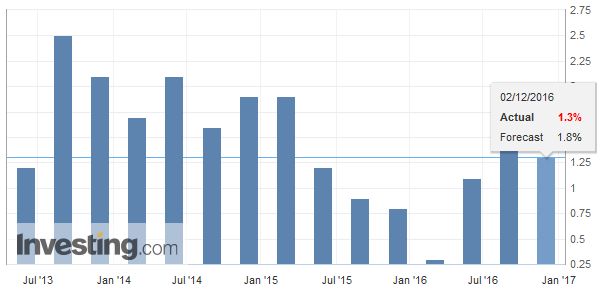

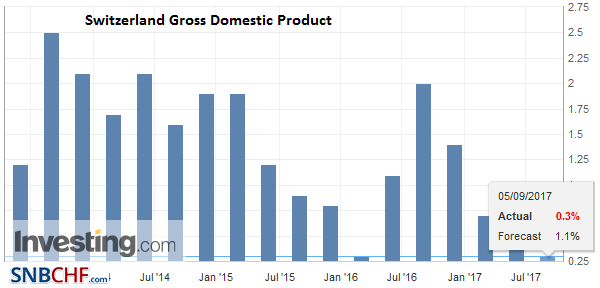

Swiss Q3 GDP: +0.0 percent QoQ, +1.3 percent YoY

Switzerland's real gross domestic product (GDP) has remained almost unchanged in the 3rd quarter of 2016 (+0.0%). Consumption was nearly stagnated, while net exports had a decline. But investments increased by 0.5% on the quarter.

Read More »

Read More »

If Everything Is So Great, How Come I’m Not Doing So Great?

While the view might be great from the top of the wealth/income pyramid, it takes a special kind of self-serving myopia to ignore the reality that the bottom 95% are not doing so well. We're ceaselessly told/sold that the U.S. economy is doing phenomenally well in our current slow-growth world -- generating record corporate profits, record highs in the S&P 500 stock index, and historically low unemployment (4.9% in July 2016).

Read More »

Read More »

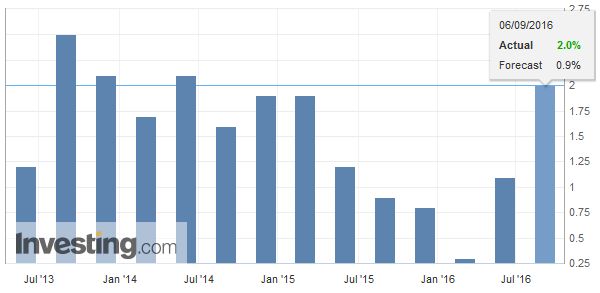

Swiss Q2 GDP: +0.6 percent QoQ, +2.0 percent YoY

Each quarter, the SECO estimates the GDP and its components. The main purpose of these estimations is to provide data that allow for an assessment of the cyclical development of the main macroeconomic aggregats in a timely adequate and credible manner.

Read More »

Read More »

FX Daily, September 6: Dollar Heavy in Quiet Markets

The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »

Read More »

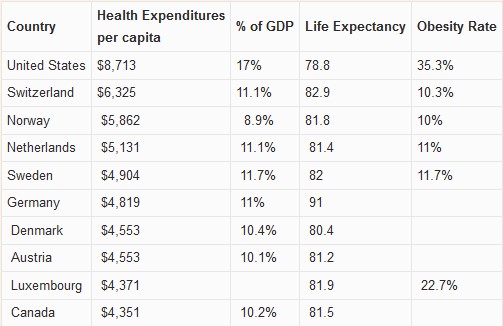

Ten Most Expensive Countries for Healthcare in the World

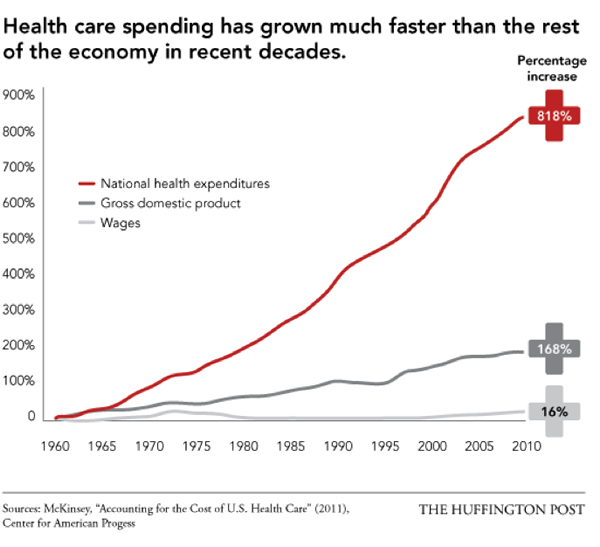

The United States spends 17% of GDP for health care, compared to around 10% in many other advanced economies. Thanks to rising health care costs, GDP growth was higher in the U.S. in recent years. The question is if this kind of GDP growth enriches the whole population or only the privileged.

Read More »

Read More »

Retirement Torpedoes and Democracy

Bonner compares Total credit market debt, federal government debt and GDP – an economy running on debt, and now running on empty.

Read More »

Read More »

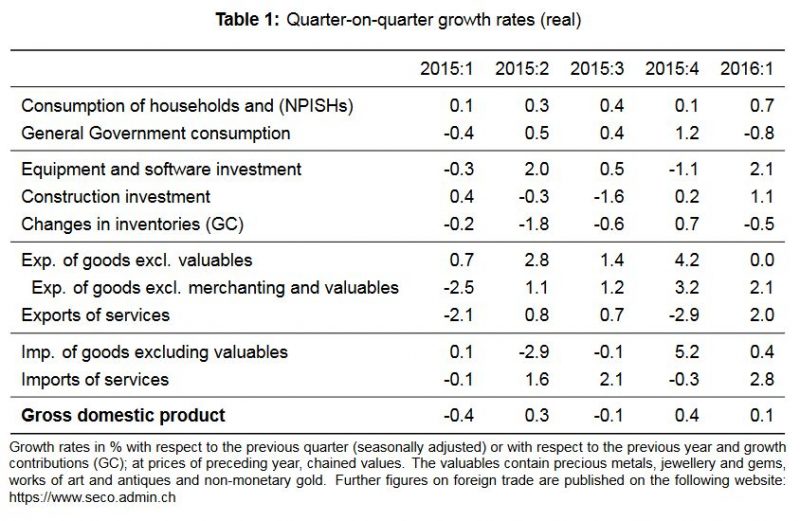

Gross domestic product in the 1st quarter 2016

Switzerland’s real gross domestic product (GDP) grew by 0.1% in the 1st quarter of 2016.* GDP was underpinned by consumption expenditure from private households and investments in construction and equipment but curbed slightly by government consumption. On the production side, the picture was mixed: whilst financial services and the hotel and catering industry saw a decline, value added in manufacturing,

Read More »

Read More »

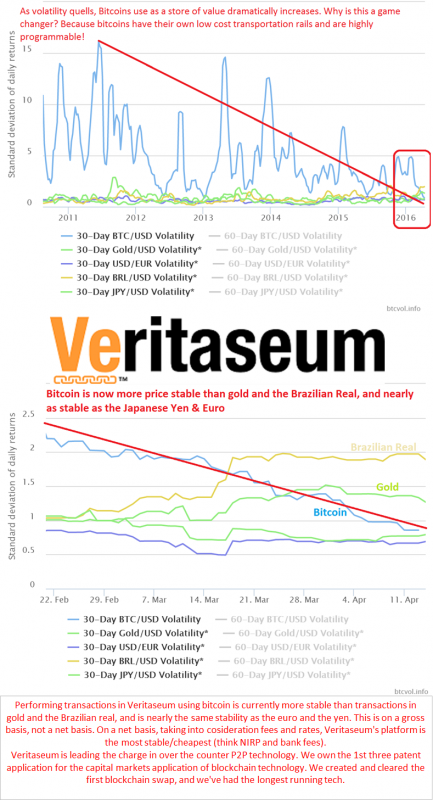

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »

SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a "toothless measure" if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

Read More »

Read More »

“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3...

Read More »

Read More »

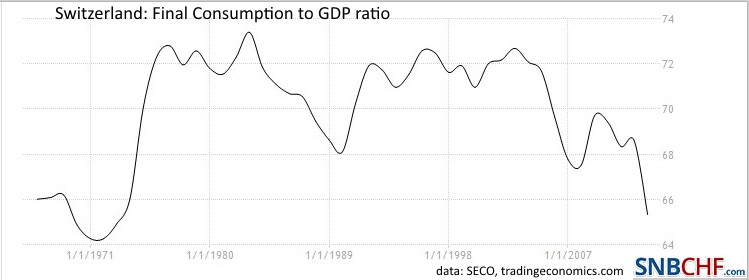

Swiss GDP 2014 +1.9%. Trade Surplus Contributed More than Half, Consumption Lagged

According to the figures of Swiss Statistics, the Swiss trade surplus rose by 10.4% in 2014. Therefore its contribution to the 2014 real GDP is higher than 50%. Private consumption lagged compared to the other components of Gross Domestic Product.

Read More »

Read More »

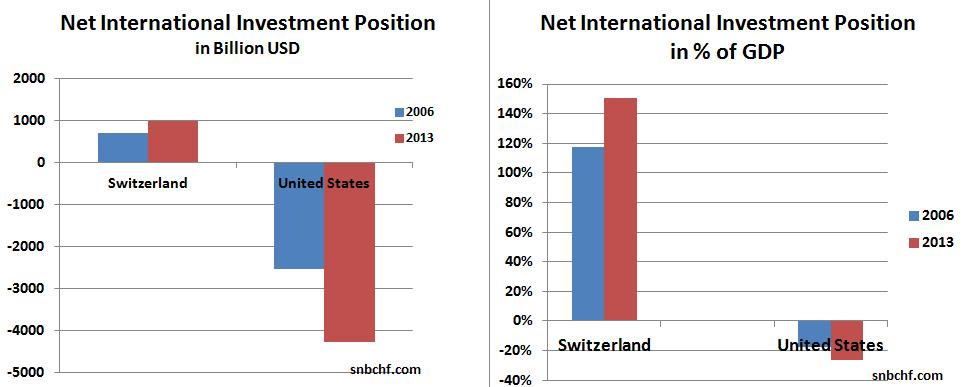

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

Keith Weiner: SNB Must Keep Euro over 1.20 To Avoid Losses of Swiss Banks

The recognized Austrian economist Keith Weiner and the Wall Street Journal argue that the SNB must keep the euro over 1.20 in order maintain stability in the Swiss banking system. A rapid appreciation of the franc would create losses on the balance sheet of Swiss banks.

Read More »

Read More »