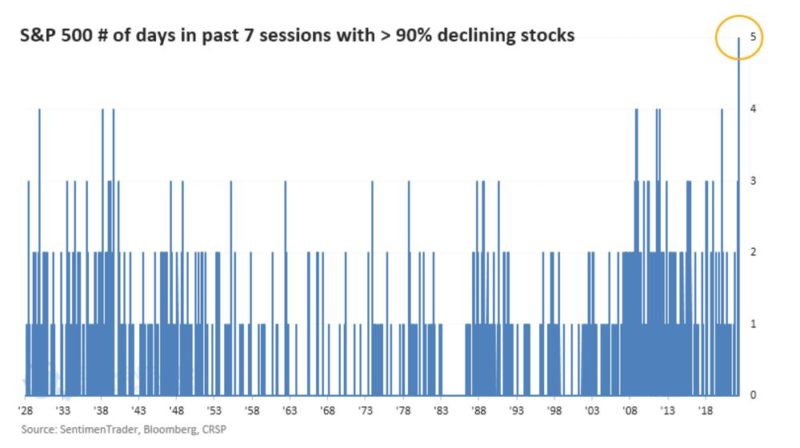

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Tag Archive: speculation

Weekly Market Pulse: Inflation Scare!

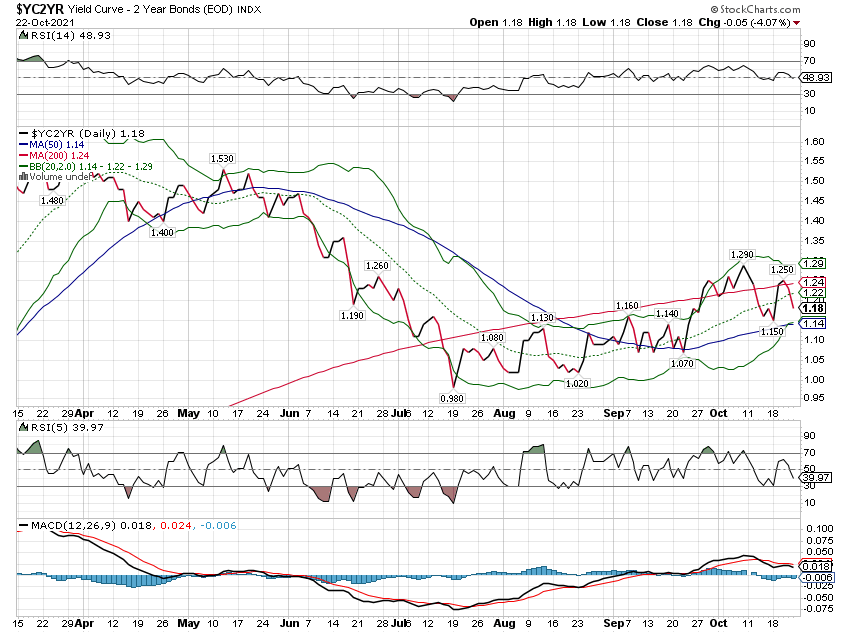

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year.

Read More »

Read More »

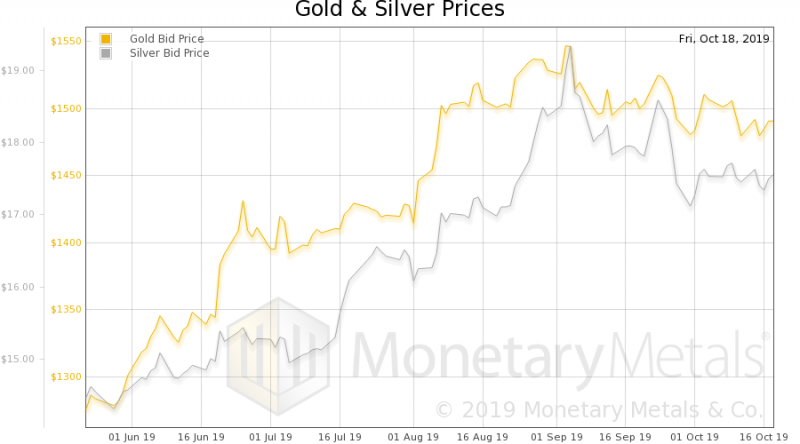

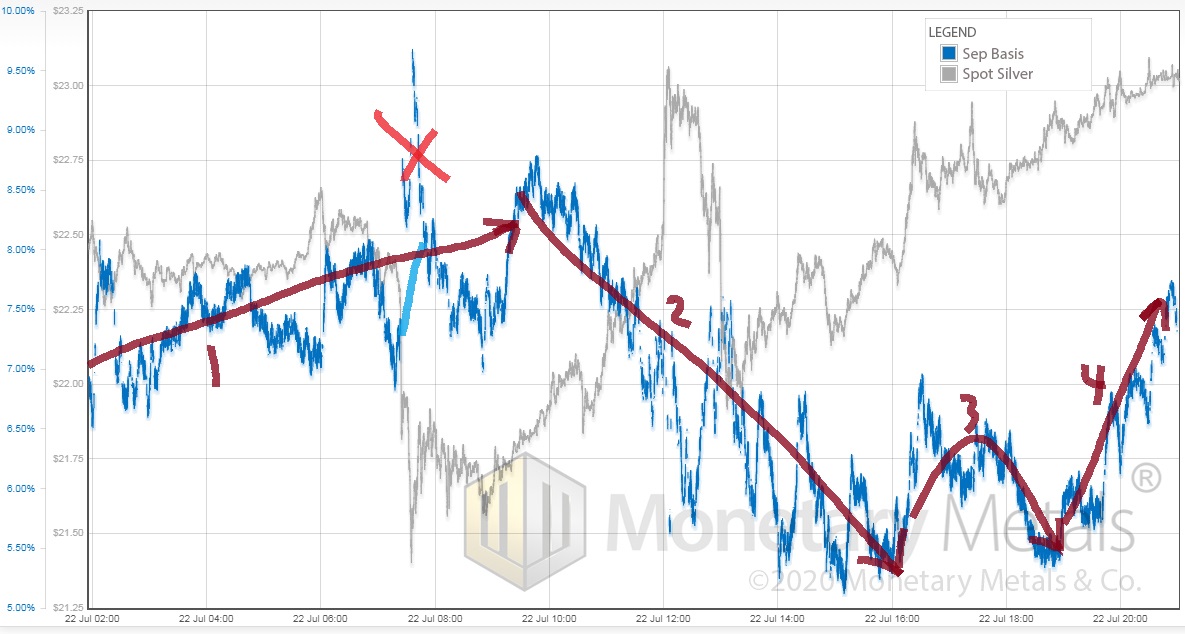

One of These Silver Days is Not Like the Other, 23 July

Yesterday, the price of silver spiked about 10%. We wrote that it was driven by: “…buying of physical metal.” And we added: “This is a pretty good signal that a bull market may be returning to silver. Let’s watch the basis and price action closely and see how it develops, before we join the pack…”

Read More »

Read More »

The End of an Epoch, Report 8 Dec

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

Read More »

Read More »

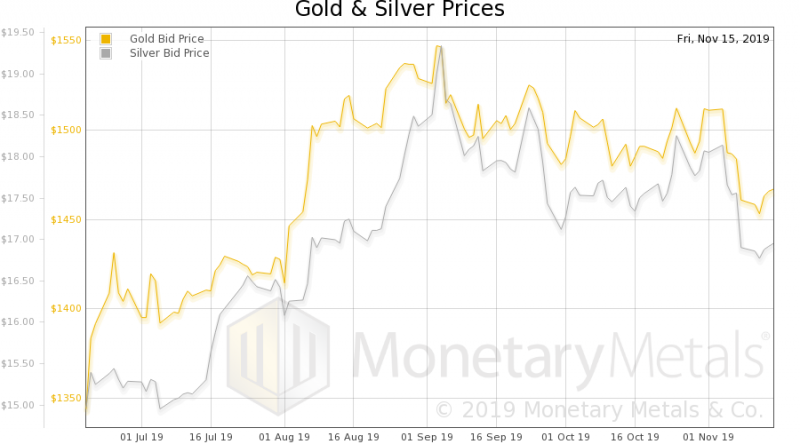

The Perversity of Negative Interest, Report 17 Nov

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is...

Read More »

Read More »

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

We talk a lot about the falling interest rate, the too-low interest rate, the near-zero interest rate, the zero interest rate, and the negative interest rate. Hat Tip to Switzerland, where Credit Suisse is now going to pay depositors -0.85%. That is, if you lend your francs to this bank, they take some of them every year. Almost 1% of them.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

9 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

SAP verliert 30 Milliarden Euro Börsenwert in wenigen Stunden!

SAP verliert 30 Milliarden Euro Börsenwert in wenigen Stunden! -

Video_7_Deal oder kein deal europa

Video_7_Deal oder kein deal europa -

High on a Swiss hill: the oldest playable organ in the world

High on a Swiss hill: the oldest playable organ in the world -

Why the Federalists Hated the Bill of Rights

-

Paukenschlag: Nächste SPARKASSE musste dran glauben! Wilhelmshaven im Schock!

Paukenschlag: Nächste SPARKASSE musste dran glauben! Wilhelmshaven im Schock! -

Fällst Du auf unsere Geld-Fallen rein?

Fällst Du auf unsere Geld-Fallen rein? -

Die wichtigsten Änderungen für Deine Finanzen 2026

Die wichtigsten Änderungen für Deine Finanzen 2026 -

SCHOCK: Maschmeyer warnt ALLE Deutschen Bürger?!

SCHOCK: Maschmeyer warnt ALLE Deutschen Bürger?! -

Doktor-Titel Eklat: Höcke wischt mit Mario Voigt den Boden auf!

Doktor-Titel Eklat: Höcke wischt mit Mario Voigt den Boden auf! -

Dollar Gyrations but Little Changed ahead of the North American Session

Dollar Gyrations but Little Changed ahead of the North American Session

More from this category

Market Pulse: Mid-Year Update

Market Pulse: Mid-Year Update24 Jun 2022

Weekly Market Pulse: Inflation Scare!

Weekly Market Pulse: Inflation Scare!25 Oct 2021

One of These Silver Days is Not Like the Other, 23 July

One of These Silver Days is Not Like the Other, 23 July24 Jul 2020

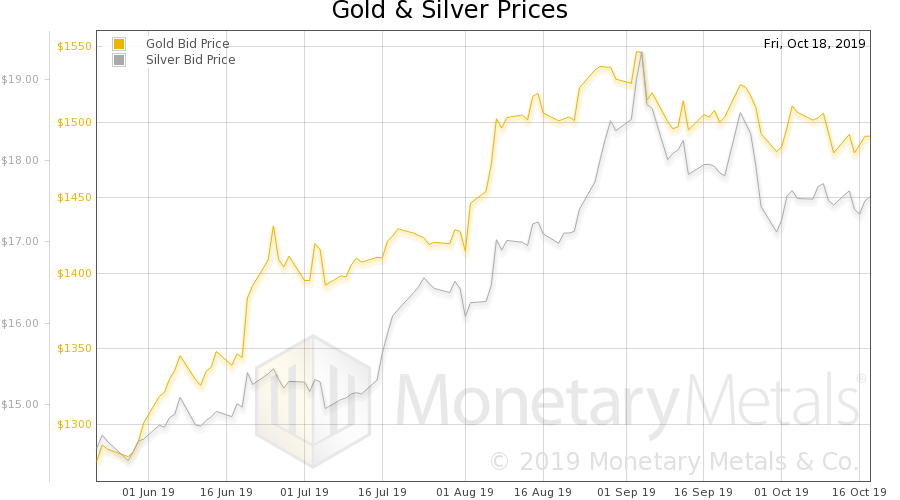

The End of an Epoch, Report 8 Dec

The End of an Epoch, Report 8 Dec10 Dec 2019

The Perversity of Negative Interest, Report 17 Nov

The Perversity of Negative Interest, Report 17 Nov18 Nov 2019

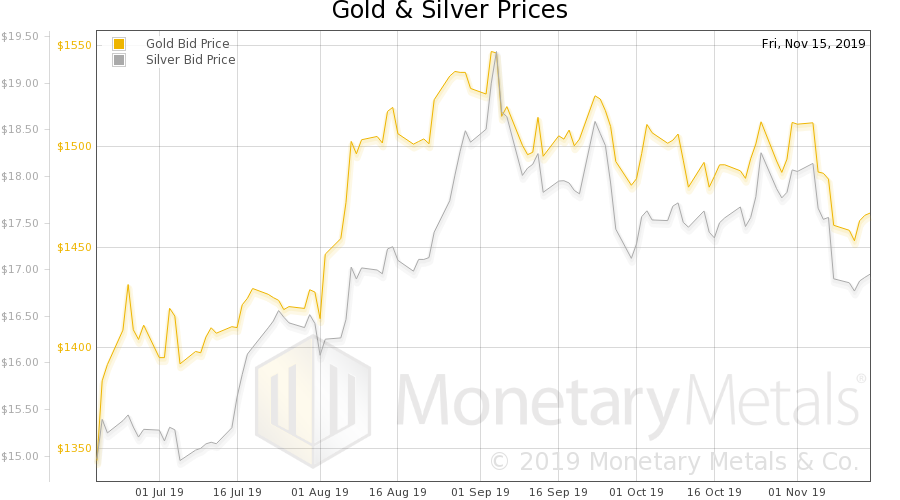

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

Wealth Accumulation Is Becoming Impossible, Report 20 Oct22 Oct 2019