Tag Archive: Spain Gross Domestic Product

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

FX Daily, June 30: When Primary is Secondary

The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday's gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3%...

Read More »

Read More »

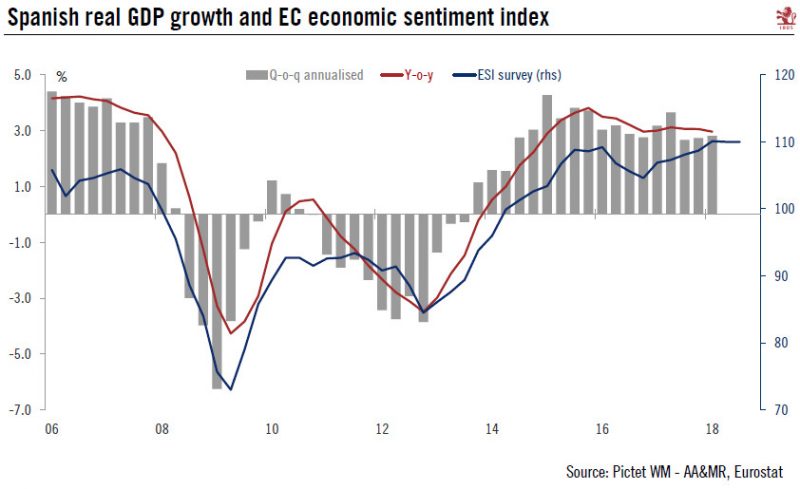

Europe chart of the week – Spanish growth

This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver.

Read More »

Read More »

FX Daily, April 27: Dollar Puts Finishing Touches on Best Week Since November 2016

The US dollar's recent gains have been extended, and it is having one of its best weeks since November 2016. The Dollar Index is up 1.7% for the week, as US session is about to start. Though it took this week's gains to change market's narrative, the fact of the matter, as we have pointed out is that April is the third consecutive month in which the Dollar Index fell in only one week. That translates into rising 10 of the past 13 weeks.

Read More »

Read More »

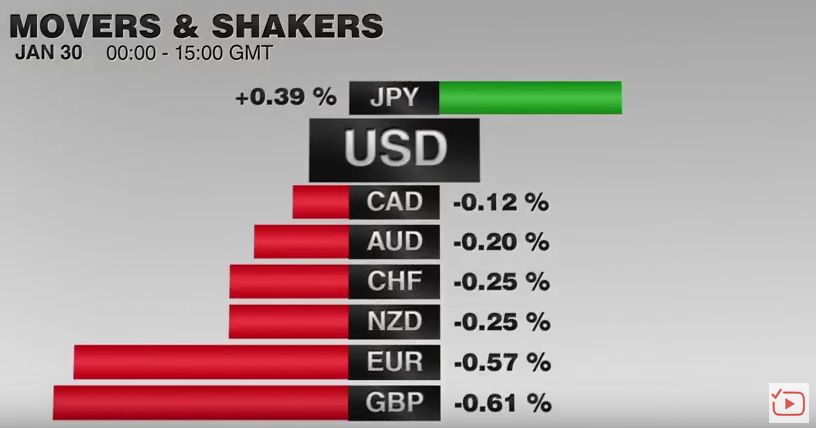

FX Daily, March 01: USD Snaps 3-Month Slide, Firm Ahead of Powell Part II

The US dollar rebounded last September and October before the downtrend resumed in November, and lasted through January. The dollar gained broadly last month, except against the yen, which rose almost 2.4% in February. This pattern is evident today, the first trading day of March. The dollar is extending its gains against most currencies but is only managing to consolidate in a narrow range against the yen.

Read More »

Read More »

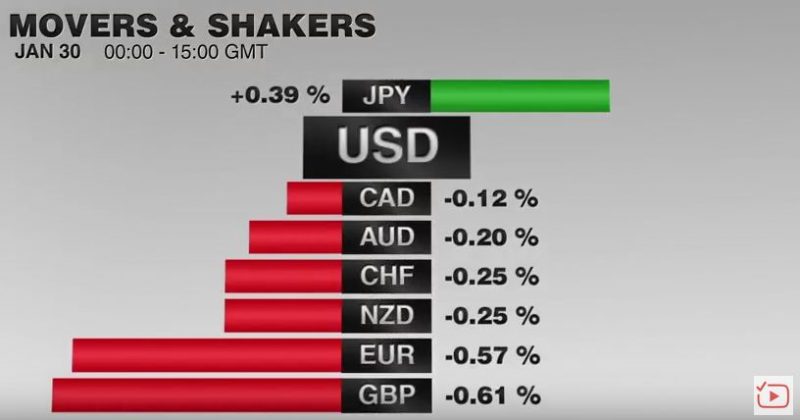

FX Daily, January 30: Dollar and Bonds Stabilize; Equities not Yet

The US dollar is paring yesterday's gains, and the 10-year Treasury yield has slipped back below the 2.70% level after pushing 2.73% briefly. European bonds have also eased, with yields one-two basis points lower. It is thus far a mild Turn Around Tuesday but suggests that the market psychology that has driven the dollar lower and yields higher persistently since mid-December have not been broken.

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

FX Daily, August 24: Greenback Firmer in Becalmed Markets

The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump's threat to exit NAFTA and force Congress to fund the Wall or face a government shutdown recovered fully and is now slightly higher on the week.

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

FX Daily, May 25: Euro Strength more than Dollar Weakness

The Dollar Index is heavy, just above the lows set earlier this week set near 96.80. However, this exaggerates the dollar's weakness because the weight of the euro and currencies that shadow it, like the Swiss franc and Swedish krona. As the North American session is about to start, the dollar is higher against the dollar-bloc currencies and the Japanese yen.

Read More »

Read More »

FX Daily, April 28: Markets Limp into Month End

Equity markets are stalling into the end of the month. MSCI Asia-Pacific Index is snapping a six-day advance, and the week's gain was sufficient to extend the advancing streak for the fourth consecutive month. The Dow Jones Stoxx 600 is trading off for the second consecutive session, after rallying for six consecutive sessions.

Read More »

Read More »

Who’s Playing The Long Game–and What’s Their Game Plan?

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »

FX Daily, March 02: Dollar Remains Bid

The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President's commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move.

Read More »

Read More »

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »