Tag Archive: South Korea

FX Daily, February 11: New Calm in the Capital Markets Continues, Powell Moves to Center Stage

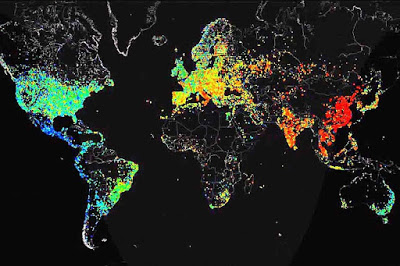

Overview: Investors are taking solace from reports indicating that the increase in the new coronavirus at ground zero (Hubei) is slowing. After the S&P 500 reversed early losses yesterday to close at new record highs helped keep the bullish sentiment intact. Benchmarks in Hong Kong, South Korea, Australia, and China rose for the sixth session.

Read More »

Read More »

FX Weekly Preview: Back to Macro?

The US-China trade conflict and then US-Iran confrontation distracted investors from the macroeconomic drivers of the capital markets. It is not that there is really much

closure with the exogenous issues, but they are in a less challenging place, at least on the surface.

Read More »

Read More »

FX Daily, December 2: PMIs Provide Latest Fuel for Equity Markets

Mostly better than expected manufacturing PMI readings for December, including in China, is providing the latest incentive for equity market bulls. Led by the Nikkei, which was aided by a weaker yen major equity markets in Asia Pacific rallied and recouped most of the nearly 1% loss before the weekend. Europe's Dow Jones Stoxx 600 is also shrugging off the pre-weekend loss and to challenge the multiyear high recorded last week.

Read More »

Read More »

FX Daily, November 21: Markets Hear What it Wants from China’s Chief Negotiator, but HK maybe New Obstacle

Overview: The strongest signs to date that even phase one of a US-China trade deal is proving elusive helped spur the risk-off mood that had already been emerging. The S&P 500 fell by the most in a month (~-0.40%) yesterday, closing the gap from last week we had noted was the risk, and follow-through selling was seen in Asia Pacific and Europe.

Read More »

Read More »

FX Daily, November 12: Farage Declares Truce with Tories after being Offered a Peerage, Underpins Sterling

Global capital markets are calm as investors look for a new catalyst. The MSCI Asia Pacific Index snapped back after posting its first back-to-back decline in a month. All the equity markets were higher, but Australia. The Nikkei, Kospi, and Taiex led the advance with about a 0.8% gain. European shares closed firmly near session highs yesterday, even if still lower on the day, and there has been some follow-through buying today.

Read More »

Read More »

FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Overview: An unexpected increase in China's Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of gains in China, Hong Kong, Korea, and Taiwan began November with a gain.

Read More »

Read More »

FX Daily, October 31: No Good Deed Goes Unpunished

Overview: The equity and bond rally in North America yesterday carried over into today's session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P 500 rose to new record highs.

Read More »

Read More »

FX Daily, October 25: Limping into the Weekend both Fighting and Talking

Overview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe's Dow Jones Stoxx 600 is little changed, and it too is closing in on its third weekly advance.

Read More »

Read More »

FX Daily, October 21: Dollar Soft, but Stage is being Set for Turn Around Tuesday

Overview: The UK's departure from the EU remains up in the air as a new attempt to pass the necessary legislation through Parliament continues today. Many market participants seem to remain optimistic that Prime Minister Johnson's plan will ultimately succeed. After slipping to $1.2875 initially, sterling briefly pushed through $1.30, which had held it back last week.

Read More »

Read More »

FX Daily, October 16: Fickle Market Tempers Enthusiasm

Overview: Fading hopes that a Brexit agreement can be struck is seeing sterling trade broadly lower, while China's demand that US tariffs be rescinded in exchange for a commitment to buy $40-$50 bln of US agriculture goods over two years, makes the handshake agreement less secure. At the same time, Hong Kong is becoming another front in the US-Sino confrontation.

Read More »

Read More »

FX Daily, October 1: Dollar Jumps to Start New Quarter

Overview: The US dollar is rising against nearly every currency today as global growth concerns deepen. Japan's Tankan Survey showed large manufacturers confidence is a six-year low. The Reserve Bank of Australia cut 25 bp as widely expected and kept the door open for more. The final EMU PMI ticked up from the flash, but it is still at a seven-year low.

Read More »

Read More »

FX Daily, September 30: A Busy Week Begins Quietly

Overview: As the quarter ends, the capital markets are mixed. Equities in Asia Pacific were heavier, except in Hong Kong and Australia, while shares were mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. US shares are trading firmer. Benchmark 10-year bond yields are 2-3 basis points higher, though Australia's bond yield was up seven basis points.

Read More »

Read More »

FX Daily, August 1: Mid-Course Correction Sends Greenback Higher

Overview: The Federal Reserve delivered the first rate cut since the Great Financial Crisis but couched it in terms of a mid-course correction rather than the start of a larger easing cycle. By doing so, Fed chief Powell cast the cut in less dovish terms than the market expected and the reaction function of the market has been clear.

Read More »

Read More »

FX Daily, July 25: ECB Takes Center Stage

The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are lower. The Turkish lira is weaker ahead of its central bank meeting, which is expected to deliver a large cut (~250 bp).

Read More »

Read More »

FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new Prime Minister.

Read More »

Read More »

FX Daily, July 18: Dollar on Back Foot as Equities Slide

Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month.

Read More »

Read More »

FX Daily, July 9: No Turn Around Tuesday, as Equities Extend Losses and the Greenback Remains Firm

Overview: Global equity benchmarks are headed for their third consecutive loss today as caution prevails at the start of Q3 after a strong first half. Ten-year benchmark yields are edging higher after a soft start in Asia. Italian bonds continue to outperform. Greek bonds have been set back as the new government reiterated its commitment to ease fiscal commitments as if Tsipras did not try, and got a similar rebuff.

Read More »

Read More »

FX Daily, June 28: The World may Look Different Come Monday

Overview: Quarter-end positioning seems to dominate today's activity. The outcome of bilateral talks at the G20 gathering partly reflects the influence of the US President who eschews multilateral efforts as a hindrance to its sovereignty. Equities in Asia Pacific slipped today but held on to modest gains for the week.

Read More »

Read More »

FX Daily, June 03: US Penchant for Tariffs Keeps Investors on Edge

Overview: The weekend failed to break the grip of investor worries that is driving stocks and yields lower. The US Administration's penchant for tariffs is not simply aimed at China, where there is some sympathy, but the move against Mexico, dropping special privileges for India, and apparently, had considered tariffs on Australia. At the same time, the threat of 25% tariff on auto imports.

Read More »

Read More »

FX Daily, April 25: Equities Waiver, the Dollar Does Not

Overview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a month. It is off about 4.6% this week, which if sustained tomorrow, would be the largest loss in six months.

Read More »

Read More »