Tag Archive: South Africa

Nervous Calm Hangs over the Markets

Overview: A nervous calm hangs over the markets as the US goes to the polls. The proximity of the presidential contest warns that the results may not been known as soon as people hope. Indeed, many fear the voting simply begins the next phase of the contest, with premature declarations of victory and disputes over votes. The dollar is in mostly narrow ranges today, but the Antipodeans and Scandis are the strongest, and the Reserve Bank of Australia...

Read More »

Read More »

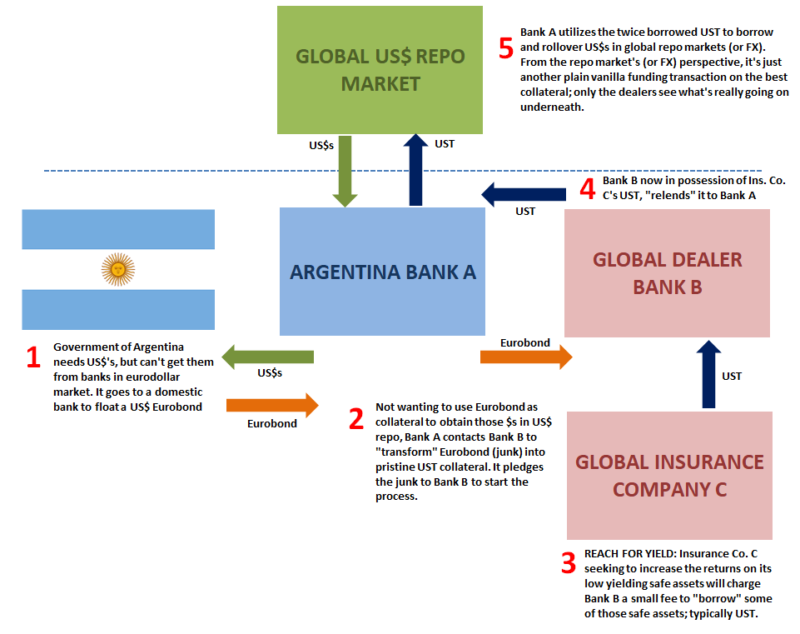

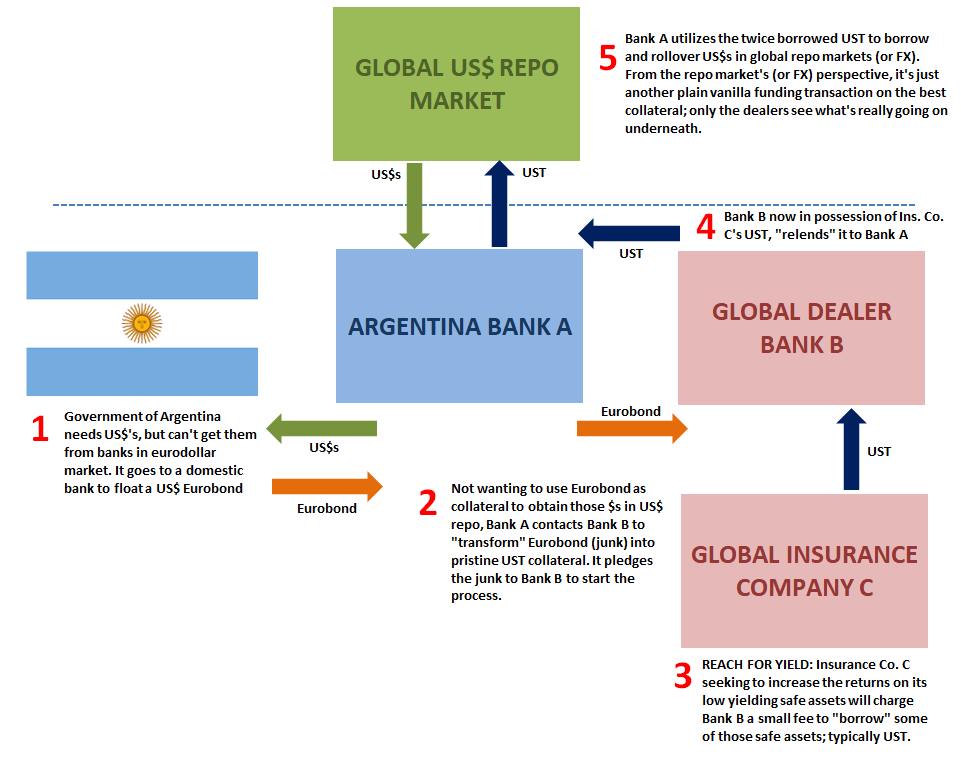

Eurobonds Behind Euro$ #5’s Collateral Case

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat.

Read More »

Read More »

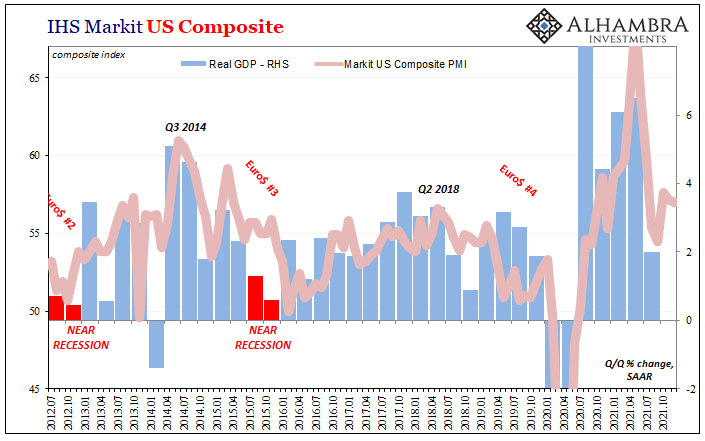

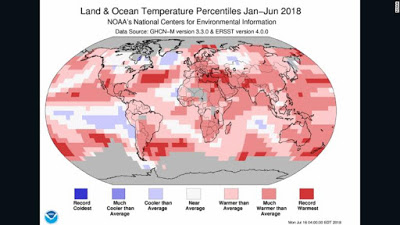

As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Sentiment indicators like PMI’s are nice and all, but they’re hardly top-tier data. It’s certainly not their fault, these things are made for very times than these (piggy-backing on the ISM Manufacturing’s long history without having the long history). Most of them have come out since 2008, if only because of the heightened professional interest in macroeconomics generated by a global macro economy that can never get itself going.

Read More »

Read More »

FX Daily, January 21: It is the ECB’s Turn but Little New to be Said or Done

Overview: The S&P 500 and NASDAQ gapped higher yesterday to record-levels, and the reflation theme lifted Asia Pacific shares for the third session today. South Korea, Taiwan, and China led the advance.

Read More »

Read More »

FX Daily, November 23: Markets Look Past Near-Term Challenges

Overview: News that the AstraZeneca vaccine was 70% effective but could be enhanced by changing dosage is lifting spirits and boosting equities. Japan's markets were closed for a national holiday, but all the equity markets in the region advanced and many by more than 1%.

Read More »

Read More »

FX Daily, November 20: US Treasury-Fed Dispute Spurs Handwringing but Immediate Market Impact was Exaggerated

Overview: News that the stimulus talks between the House Democrats and Senate Republicans was the excuse traders were looking for to extend the US equity gains yesterday, but shortly after the close, confirmation that Treasury was not going to agree to extend several Fed facilities sent stocks reeling.

Read More »

Read More »

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »

FX Daily, March 30: Monday Blues

Overview: Risk appetites remain in check as the spread of the coronavirus is leading to more and longer shutdowns. Asia Pacific equities fell with Australia, the notable exception. Its benchmark rallied a record 7%, encouraged by additional stimulus measures.

Read More »

Read More »

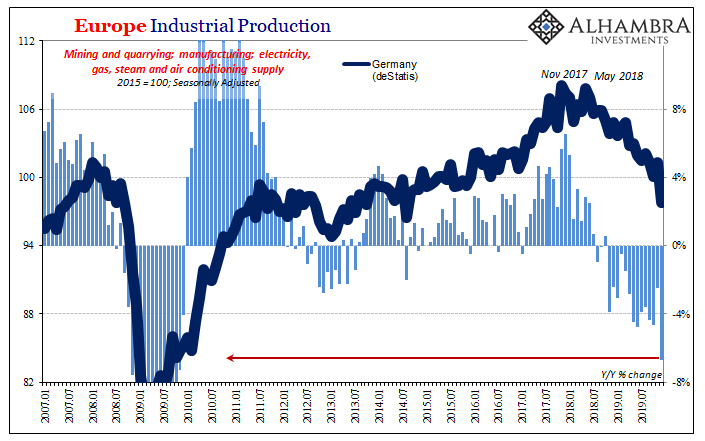

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Asia Pacific equities mostly declined in sympathy with yesterday's large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia's 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the move lower. Europe's Dow Jones Stoxx 600 fell 1.6% yesterday, the largest loss in two months, and is extending the losses for a third session today.

Read More »

Read More »

FX Daily, November 4: Investor Optimism Carries into the New Week

Overview: Investor optimism is reflected by the risk-taking appetite that is lifting equity markets and bond yields. With Japanese markets closed for a national holiday, the MSCI Asia Pacific Index was led higher by more than 1% gains in Hong Kong, Taiwan, South Korea, and Thailand. The regional benchmark advanced for the seventh session in the past eight and is approaching the year's high.

Read More »

Read More »

EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly.

Read More »

Read More »

Emerging Market Week Ahead Preview

EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday.

Read More »

Read More »

FX Weekly Preview: Macroeconomic Considerations

The force that had pushed the US 10-year Treasury yield to 3% and the dollar above JPY113 at the start of the month, and the euro to $1.13 a couple of weeks ago has dissipated. The 10-year yield is near 2.80%. The dollar was near two-month lows against the yen a week ago, and the euro was back toward the middle of its previous $1.15-$1.18 trading range.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish markets are closed this week for holiday.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.

Read More »

Read More »