Tag Archive: silver basis

The Purchasing Power of Capital, Report 29 Sep

We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer. First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size.

Read More »

Read More »

Treasury Bond Backwardation, Report 22 Sep

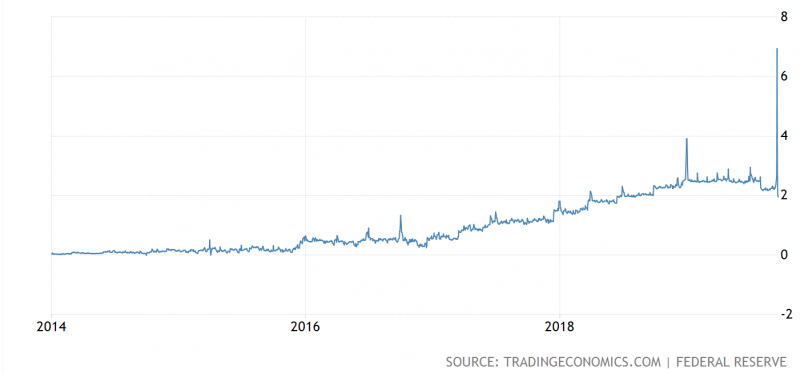

Something happened in the credit market this week. A Barron’s article about it began: “There have been disruptions in the plumbing of U.S. markets this week. While the process of fixing them was bumpy, it was more of a technical mishap than a cause for investor concern.” Keep Calm and Carry On. So, before they tell us what happened, they tell us it’s just plumbing, it’s been fixed, and that we should not be concerned.

Read More »

Read More »

Why Are People Now Selling Their Silver? Report 15 Sep

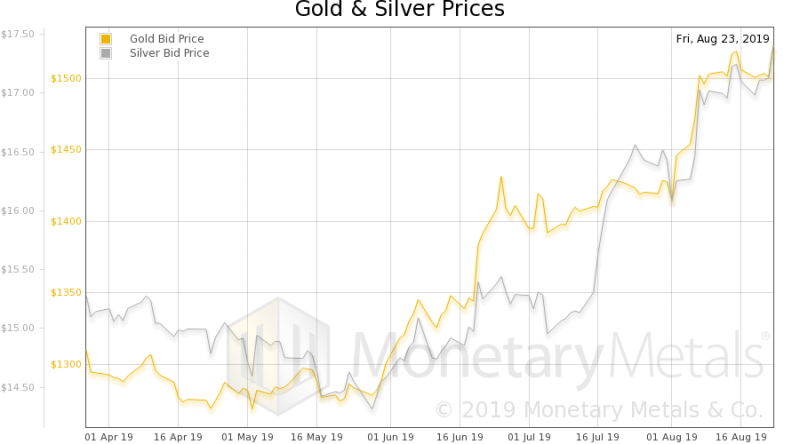

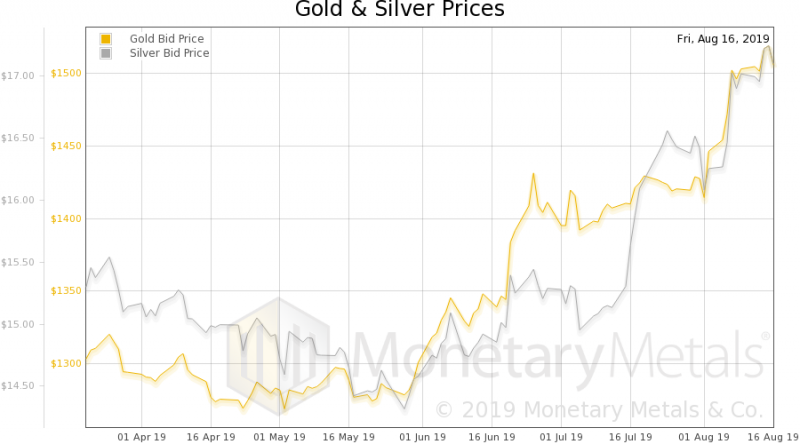

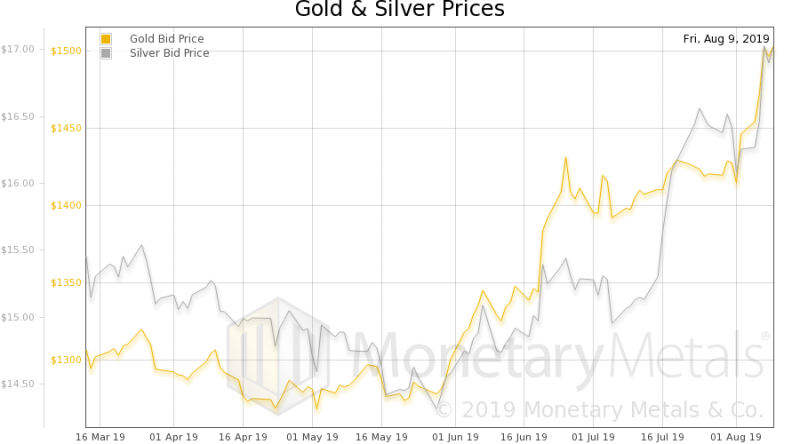

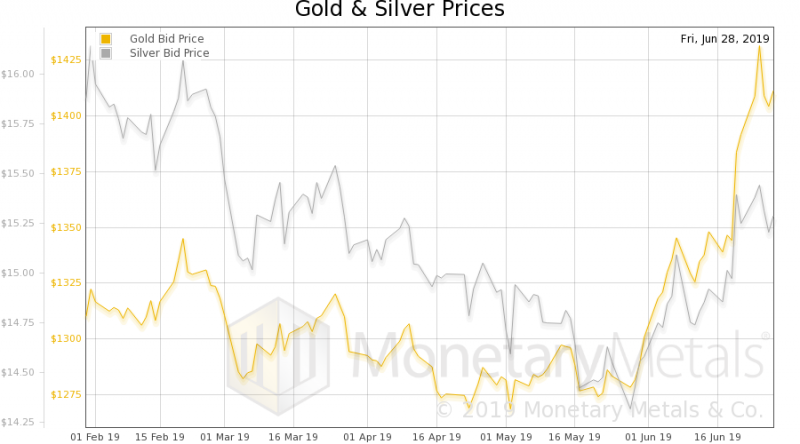

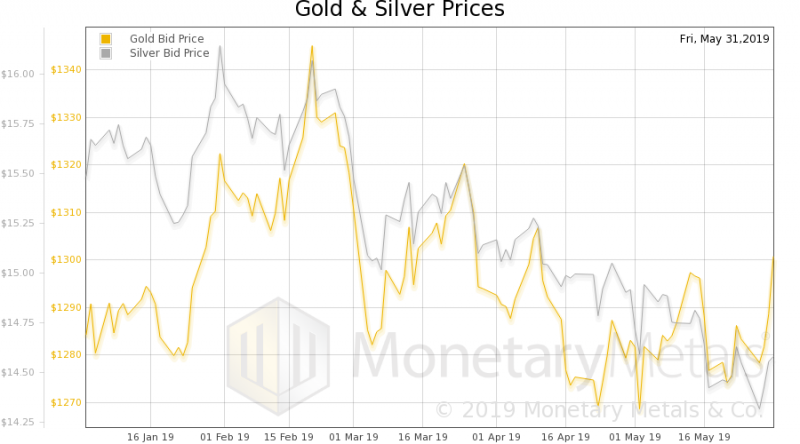

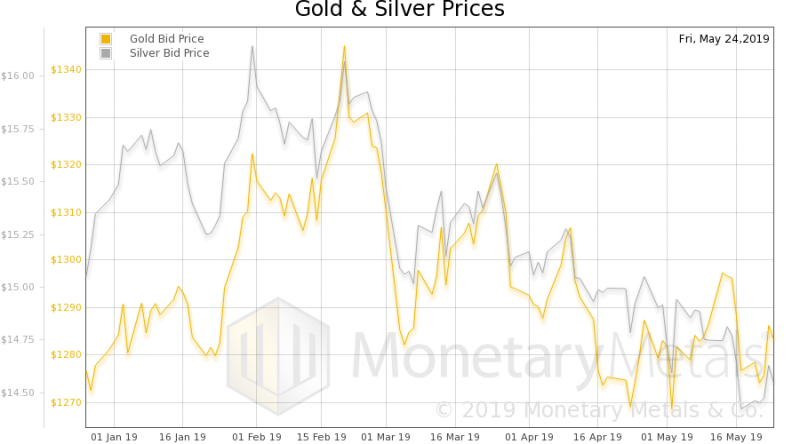

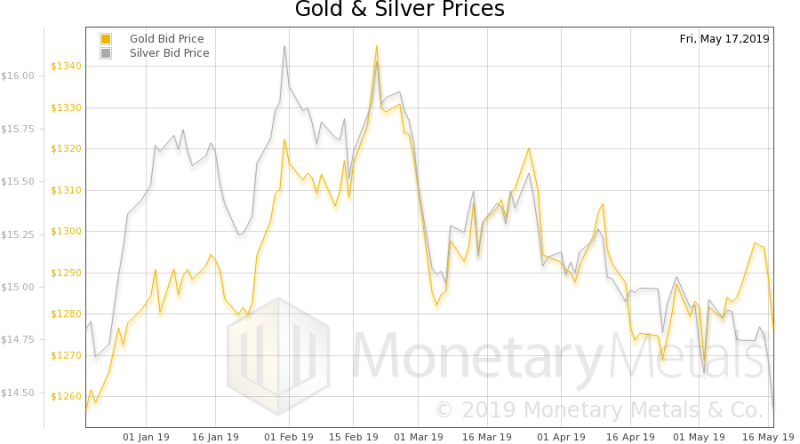

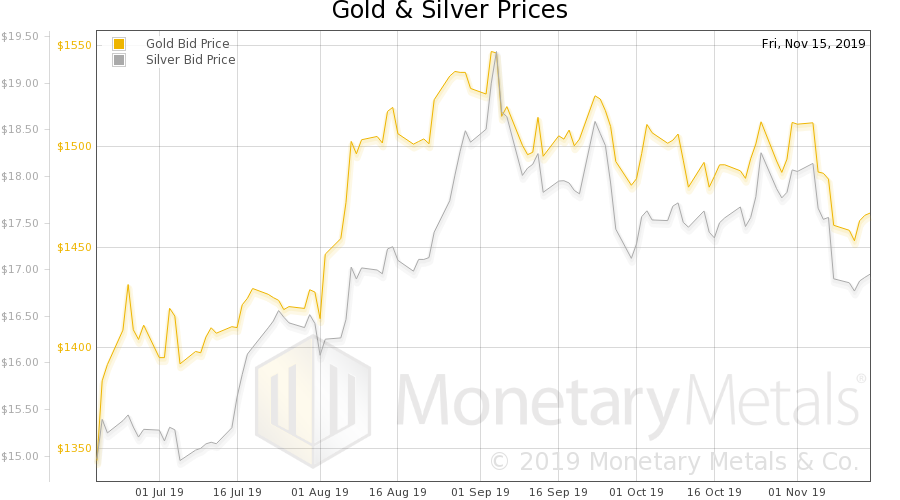

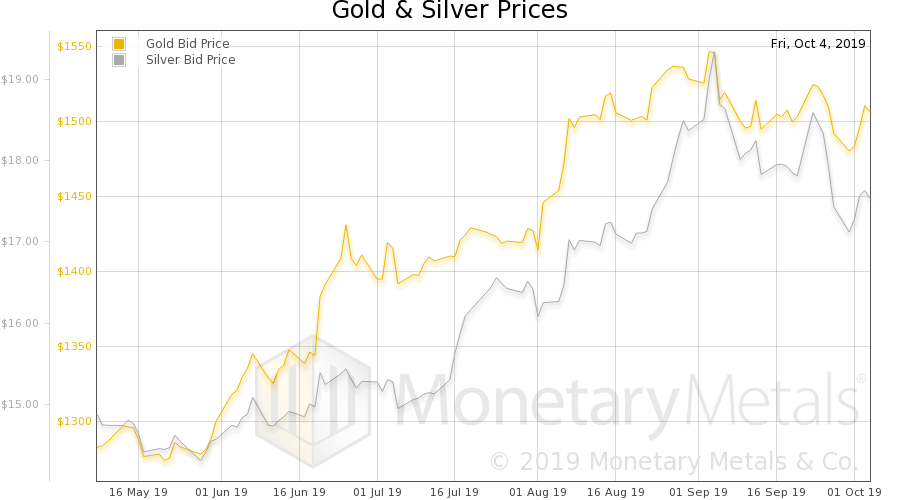

This week, the prices of the metals fell further, with gold -$18 and silver -$0.73. On May 28, the price of silver hit its nadir, of $14.30. From the last three days of May through Sep 4, the price rose to $19.65. This was a gain of $5.35, or +37%. Congratulations to everyone who bought silver on May 28 and who sold it on Sep 4.

Read More »

Read More »

How Is Negative Interest Possible? Report 8 Sep

Germany has recently joined Switzerland in the dubious All Negative Club. The interest rate on every government bond, from short to 30 years, is now negative. Many would say “congratulations”, in the belief that this proves their credit risk is … well … umm … negative(?) And anyways, it will let them borrow more to spend on consumption which will stimulate … umm… well… all of the wasteful consumption for which governments are rightly...

Read More »

Read More »

Asset Inflation vs. Consumer Goods Inflation, Report 1 Sep

A paradigm is a mental framework. It has a both a positive pressure and a negative filter. It structures one’s thoughts, orients them in a certain direction, and rules out certain ideas. Paradigms can be very useful, for example the scientific method directs one to begin with facts, explain them in a consistent way, and to ignore peyote dreams from the smoke lodge and claims of mental spoon-bending.

Read More »

Read More »

Directive 10-289, Report 25 Aug

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms).

Read More »

Read More »

Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins

Read More »

Read More »

The Economic Singularity, Report 11 Aug

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet.

Read More »

Read More »

I Know Usury When I See It, Report 4 Aug

“I know it, when I see it.” This phrase was first used by U.S. Supreme Court Justice Potter Stewart, in a case of obscenity. Instead of defining it—we would think that this would be a requirement for a law, which is of course backed by threat of imprisonment—he resorted to what might be called Begging Common Sense. It’s just common sense, it’s easy-peasy, there’s no need to define the term…

Read More »

Read More »

Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day.

Read More »

Read More »

The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists.

Read More »

Read More »

How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity.

Read More »

Read More »

More Squeeze, Less Juice, Report 7 Jul

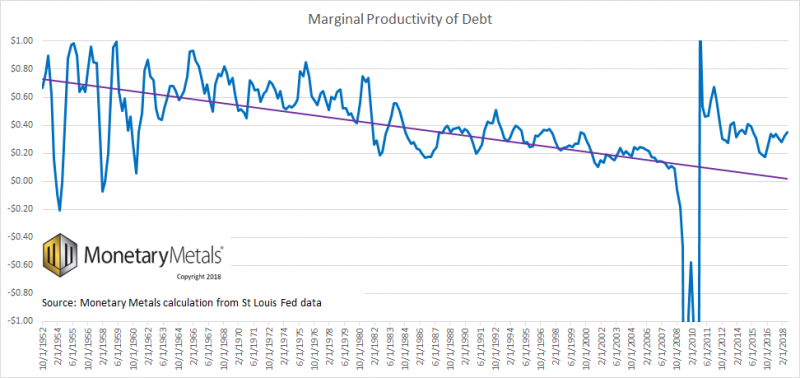

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops.

“OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!”

Read More »

Read More »

GDP Begets More GDP (Positive Feedback), Report 30 June

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth.

Read More »

Read More »

What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”).

Read More »

Read More »

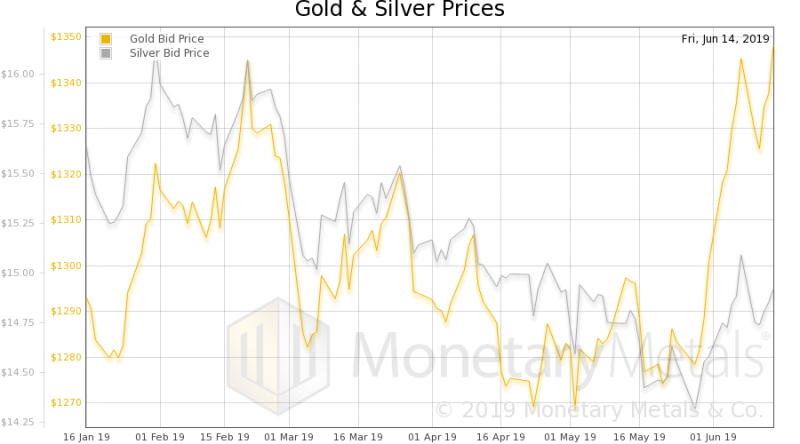

The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy!

Read More »

Read More »

Irredeemable Currency Is a Roach Motel, Report 9 June

In what has become a four-part series, we are looking at the monetary science of China’s potential strategy to nuke the Treasury bond market. In Part I, we gave a list of reasons why selling dollars would hurt China. In Part II we showed that interest rates, being that the dollar is irredeemable, are not subject to bond vigilantes.

Read More »

Read More »

Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market.

Read More »

Read More »

The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another currency, it merely tightens...

Read More »

Read More »

China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

Basel III’s Effect on Gold and Silver

Basel III’s Effect on Gold and Silver13 Jul 2021

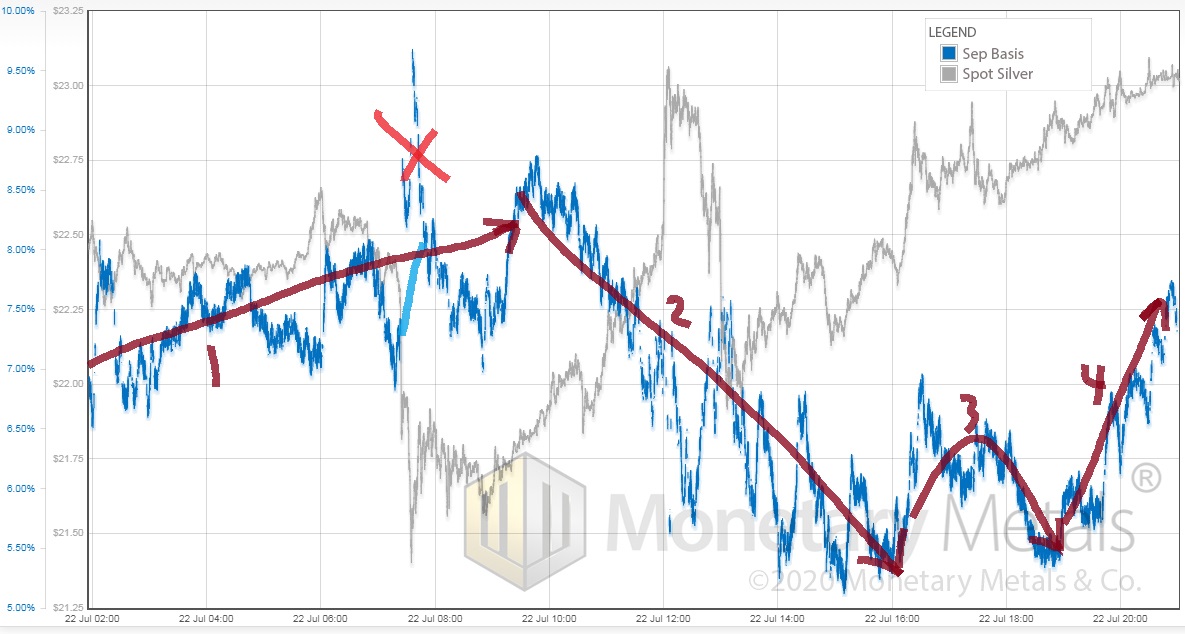

One of These Silver Days is Not Like the Other, 23 July

One of These Silver Days is Not Like the Other, 23 July24 Jul 2020

Defaults Are Coming, Market Report, 22 June

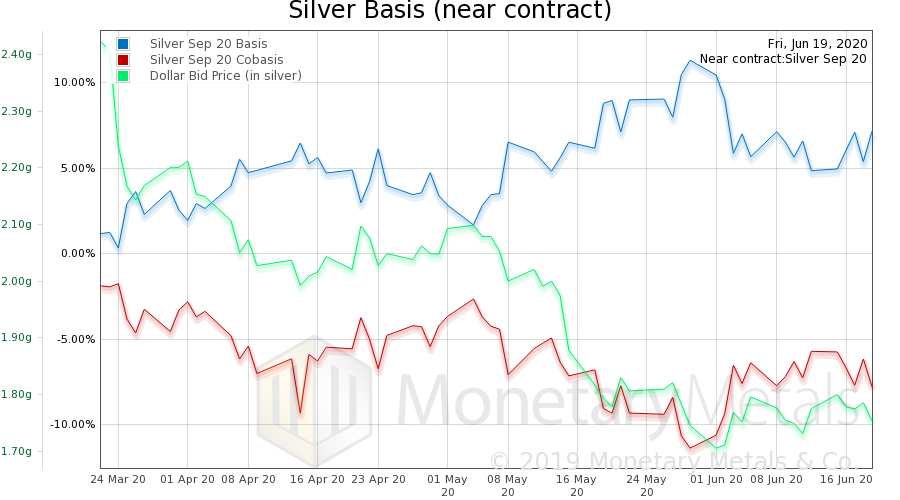

Defaults Are Coming, Market Report, 22 June23 Jun 2020

When Is a Capital Gain Capital Consumption? Market Report, 25 May

When Is a Capital Gain Capital Consumption? Market Report, 25 May26 May 2020

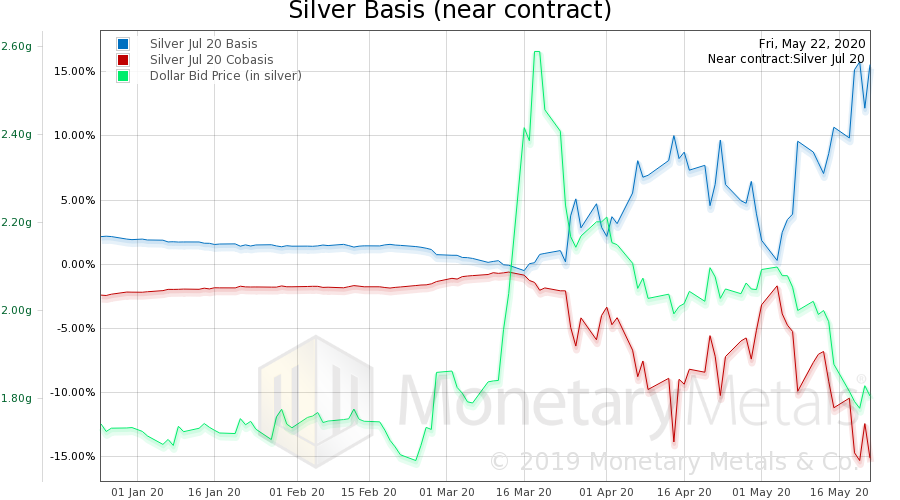

Gold and Silver Markets Start to Normalize, Report 4 May

Gold and Silver Markets Start to Normalize, Report 4 May5 May 2020

Crouching Silver, Hidden Oil Market Report 20 Apr

Crouching Silver, Hidden Oil Market Report 20 Apr21 Apr 2020

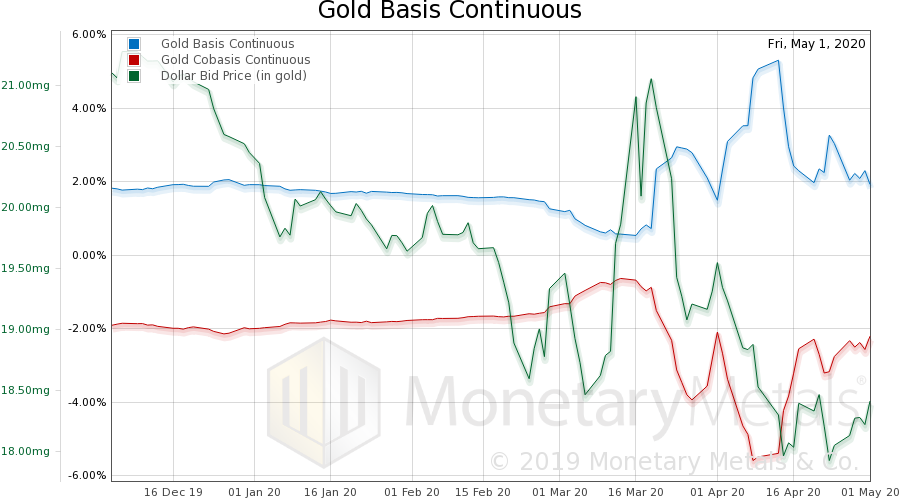

Silver Backwardation Returns, Gold and Silver Market Report 2 March

Silver Backwardation Returns, Gold and Silver Market Report 2 March2 Mar 2020

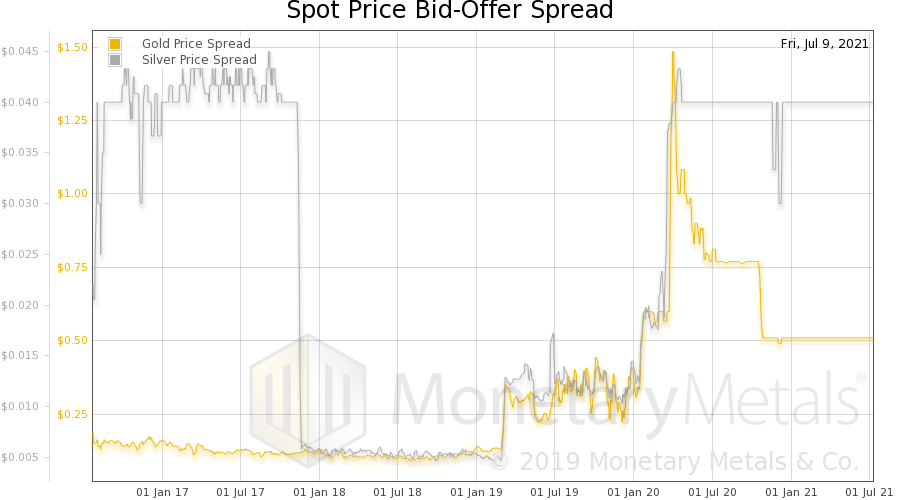

Widening Bid-Ask Spreads, Gold and Silver Market Report 17 February

Widening Bid-Ask Spreads, Gold and Silver Market Report 17 February17 Feb 2020

Wealth Consumption vs. Growth – Precious Metals Supply and Demand

Wealth Consumption vs. Growth – Precious Metals Supply and Demand3 Jan 2020

Open Letter to John Taft, Report 17 Dec

Open Letter to John Taft, Report 17 Dec18 Dec 2019

The End of an Epoch, Report 8 Dec

The End of an Epoch, Report 8 Dec10 Dec 2019

Money and Prices Are a Dynamic System, Report 1 Dec

Money and Prices Are a Dynamic System, Report 1 Dec3 Dec 2019

Raising Rates to Fight Inflation, Report 24 Nov

Raising Rates to Fight Inflation, Report 24 Nov26 Nov 2019

The Perversity of Negative Interest, Report 17 Nov

The Perversity of Negative Interest, Report 17 Nov18 Nov 2019

What’s the Price of Gold in the Gold Standard, Report 10 Nov

What’s the Price of Gold in the Gold Standard, Report 10 Nov12 Nov 2019

Targeting nGDP Targeting, Report 3 Nov

Targeting nGDP Targeting, Report 3 Nov5 Nov 2019

Bitcoin Myths, Report 27 Oct

Bitcoin Myths, Report 27 Oct28 Oct 2019

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

Wealth Accumulation Is Becoming Impossible, Report 20 Oct22 Oct 2019

Motte and Bailey Fallacy, Report 13 Oct

Motte and Bailey Fallacy, Report 13 Oct15 Oct 2019

A Wealth Tax Consumes Capital, Report 6 Oct

A Wealth Tax Consumes Capital, Report 6 Oct7 Oct 2019