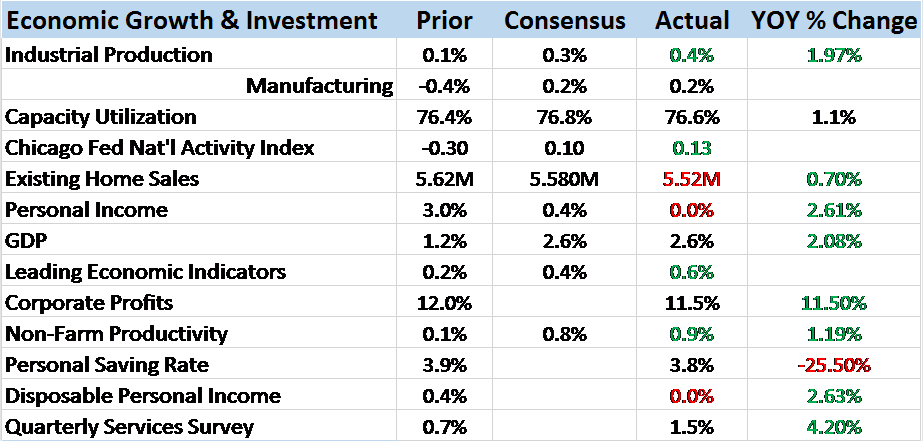

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk.

Read More »

Tag Archive: Savings Rate

Bi-Weekly Economic Review: As Good As It Gets?

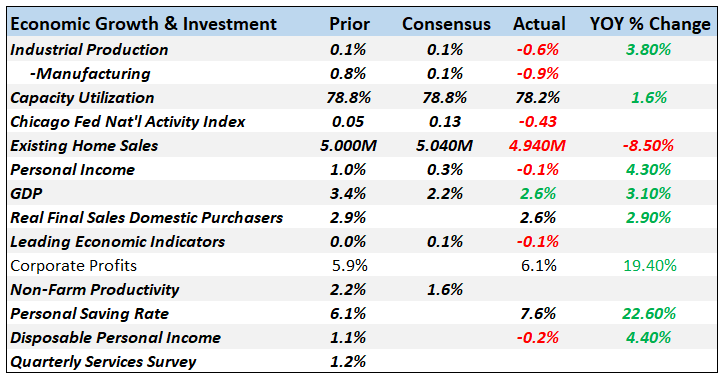

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not.

Read More »

Read More »

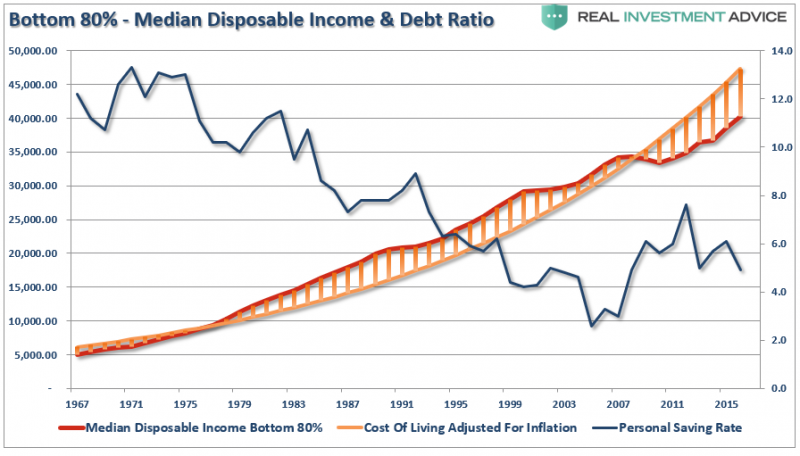

The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth.

Read More »

Read More »

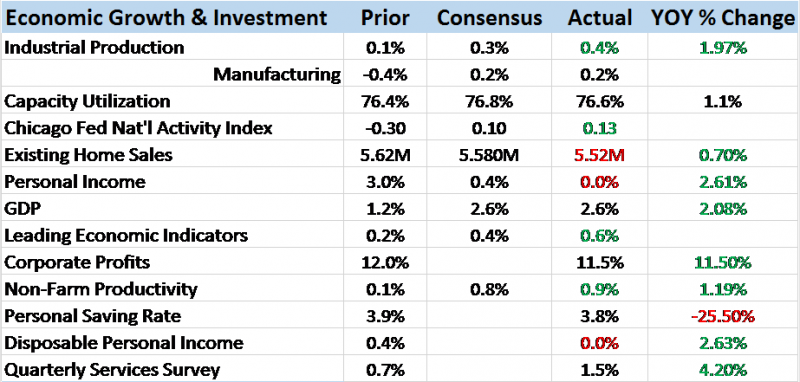

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

NIRP Has Failed: European Savings Rate Hits 5 Year High

One year ago, when it was still widely accepted conventional wisdom that NIRP would "work" to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those European nations which had...

Read More »

Read More »

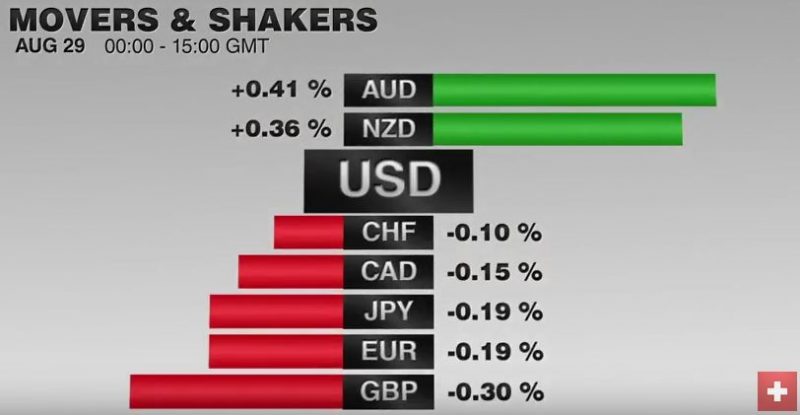

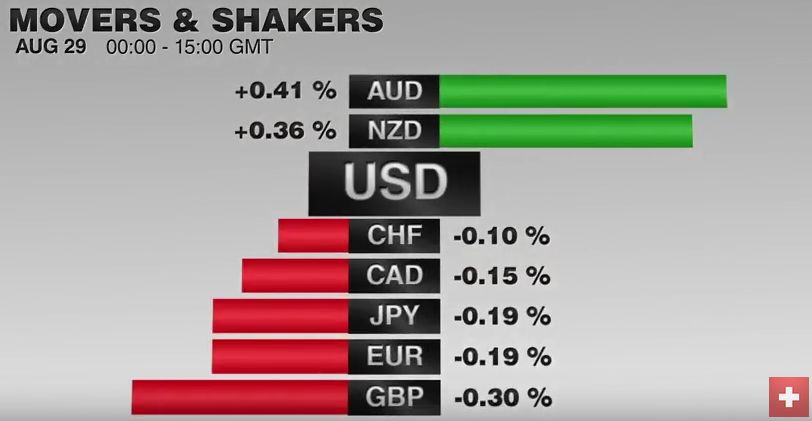

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »