Tag Archive: S&P 500

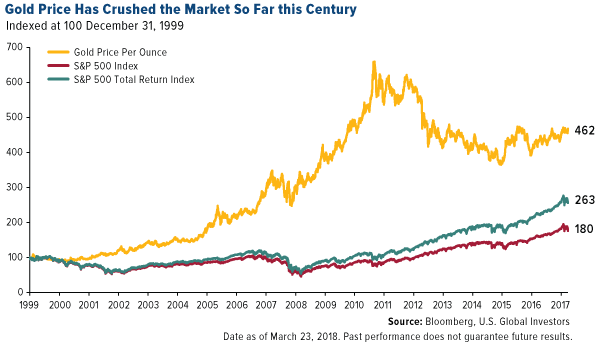

Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

– Gold outperforming stocks in 2018 and this century (see chart)

– Gold up close to 2% in 2018 while S&P 500 is down 2%

– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish

– Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”

– Market volatility could drive gold to $1,500/oz in 2018 – Holmes

Read More »

Read More »

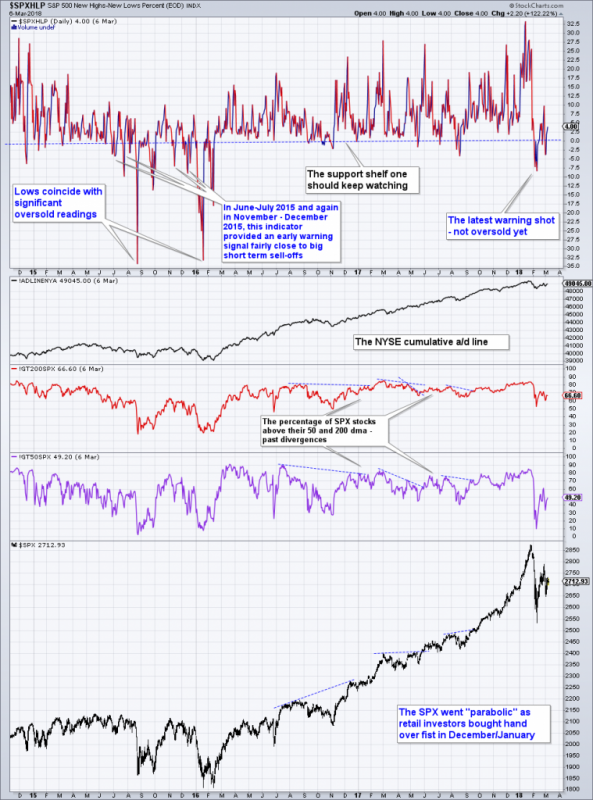

US Equities – Mixed Signals Battling it Out

Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator.

Read More »

Read More »

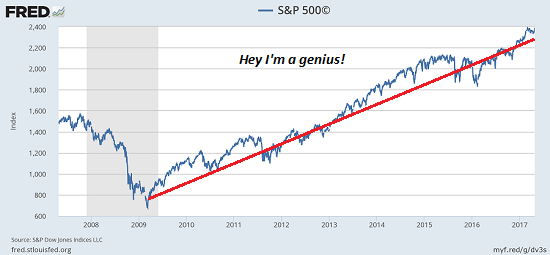

Never Mind Volatility: Systemic Risk Is Rising

So who's holding the hot potato of systemic risk now? Everyone. One of the greatest con jobs of the past 9 years is the status quo's equivalence of risk and volatility: risk = volatility: so if volatility is low, then risk is low. Wrong: volatility once reflected specific short-term aspects of risk, but measures of volatility such as the VIX have been hijacked to generate the illusion that risk is low.

Read More »

Read More »

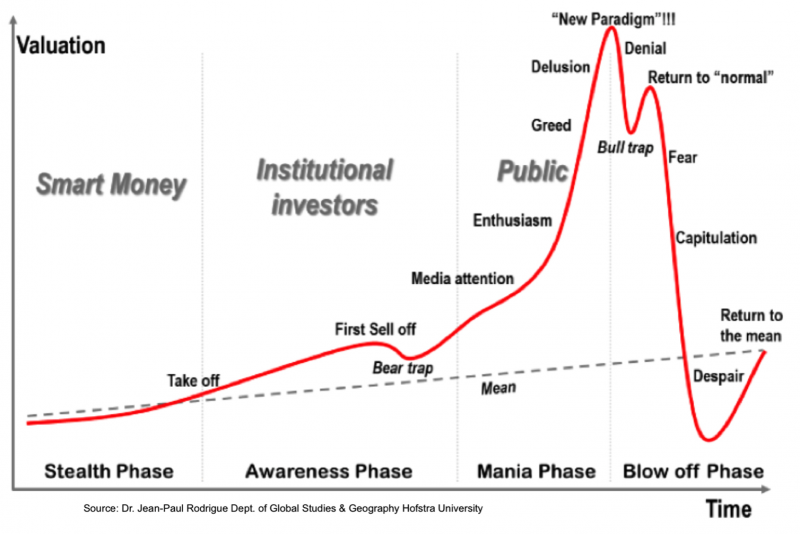

“This Is Where They Completely Lost Their Minds” – Hussman

“This Is Where They Completely Lost Their Minds” – Hussman. Hussman warns ‘the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle’. ‘the market has lost value, even since 2009, when overvalued, overbought, overbullish conditions were joined by divergent internals’. Believes the market is going to learn lessons about the crash ‘the hard way’.

Read More »

Read More »

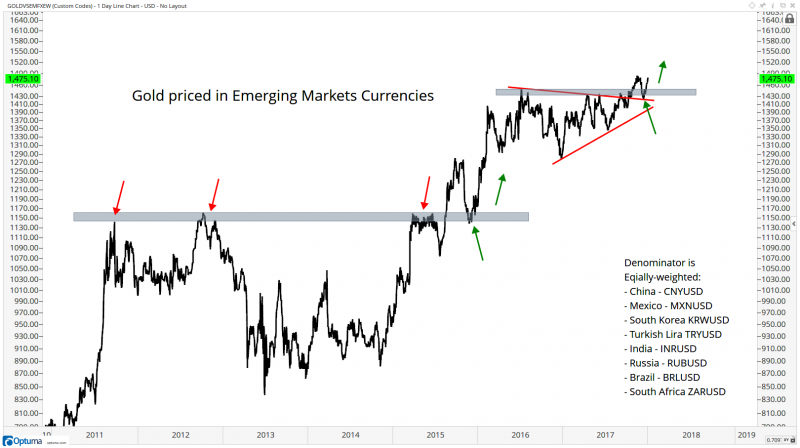

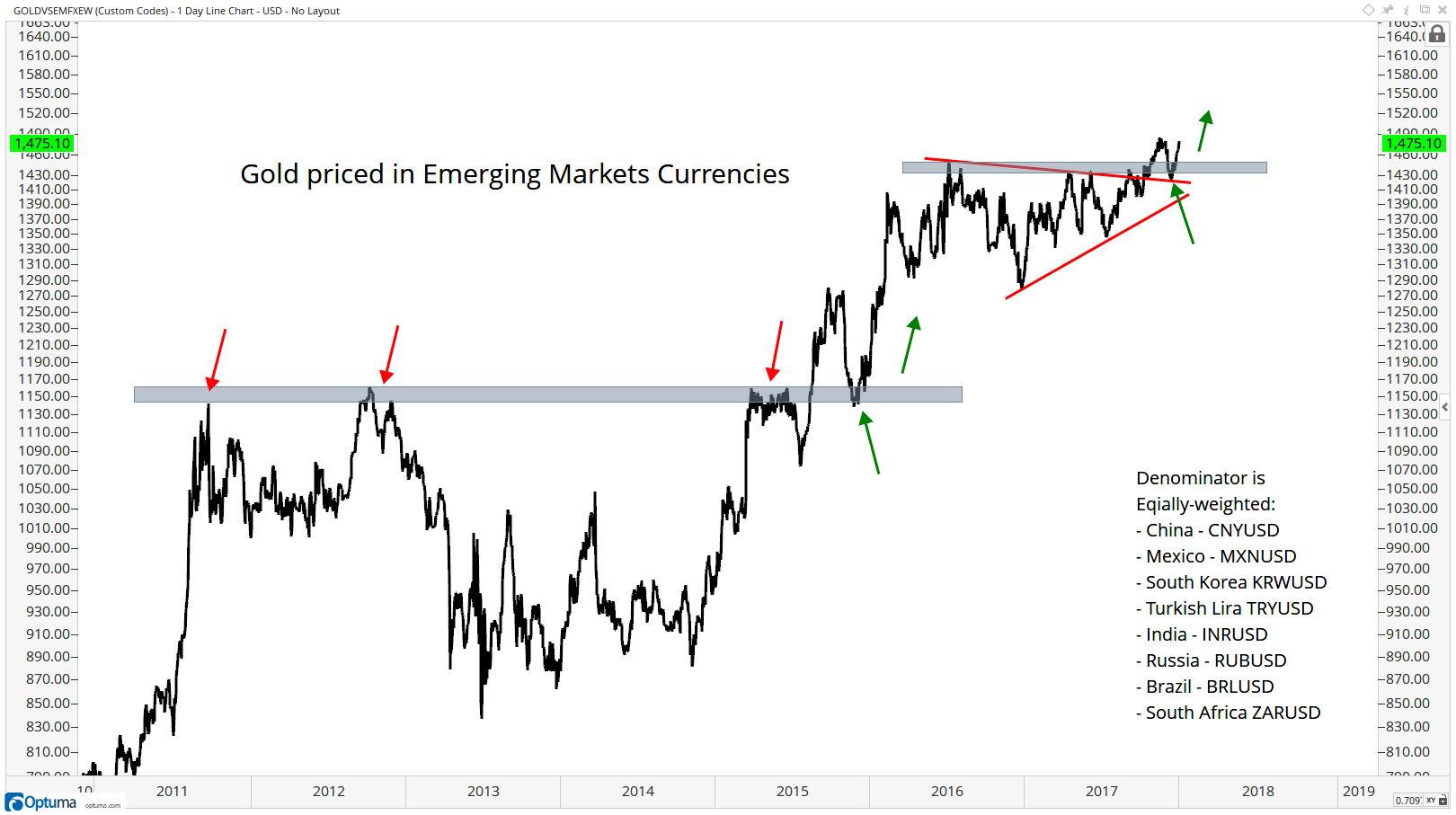

Gold Hits All-Time Highs Priced In Emerging Market Currencies

Gold Hits All-Time Highs Priced In Emerging Market Currencies. Gold at all time in eight major emerging market currencies. A stronger performance than seen when priced in USD, EUR or GBP. As world steps away from US dollar hegemony expect new gold highs in $, € and £. Gold is a hedge against currency debasement and depreciation of fiat currencies.

Read More »

Read More »

How the Asset Bubble Could End – Part 2

There is just one more positioning indicator we want to mention: after surging by around $126 billion since March of 2016, NYSE margin debt has reached a new all time high of more than $561 billion. The important point about this is that margin debt normally peaks well before the market does. Based on this indicator, one should not expect major upheaval anytime soon. There are exceptions to the rule though – see the caption below the chart.

Read More »

Read More »

The Stock Market and the FOMC

As the final FOMC announcement of the year approaches, we want to briefly return to the topic of how the meeting tends to affect the stock market from a statistical perspective. As long time readers may recall, the typical performance of the stock market in the trading days immediately ahead of FOMC announcements was quite remarkable in recent decades. We are referring to the Seaonax event study of the average (or seasonal) performance across a...

Read More »

Read More »

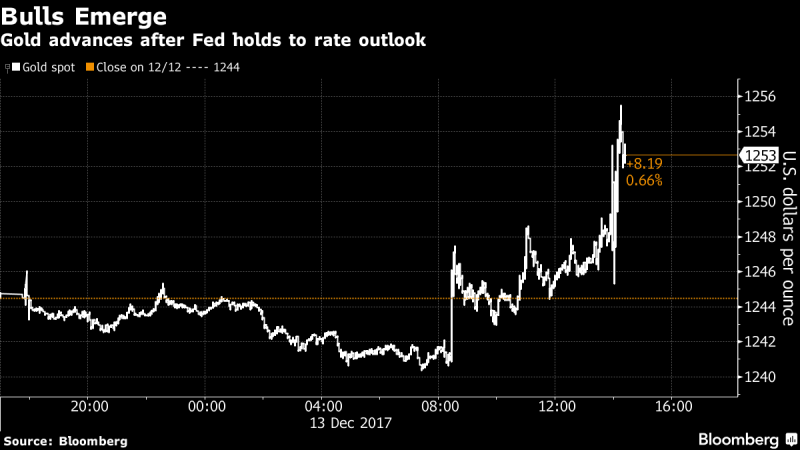

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

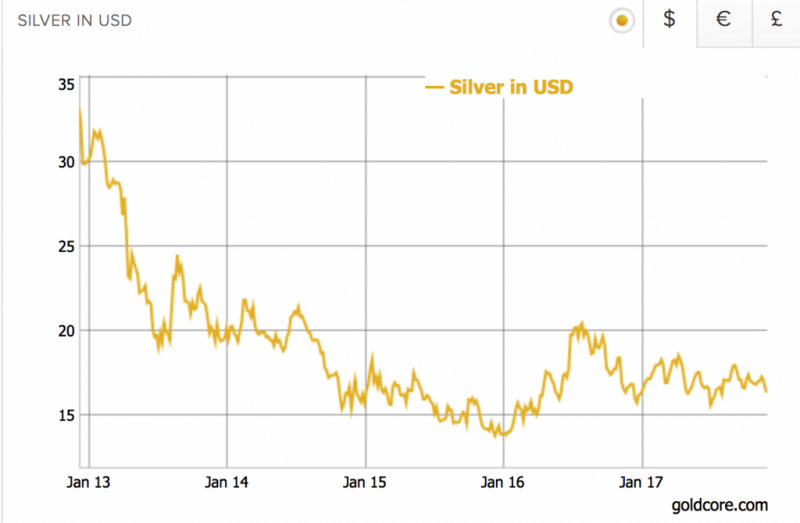

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries. Increased efforts in green energy and advanced technology set to boosts silver’s demand. Four-year supply deficit set to increase due to fewer mine openings and discoveries. Bank manipulation may be why silver under performing. TD Securities and the Bank of Montreal expect silver to be best performing precious metal in 2018.

Read More »

Read More »

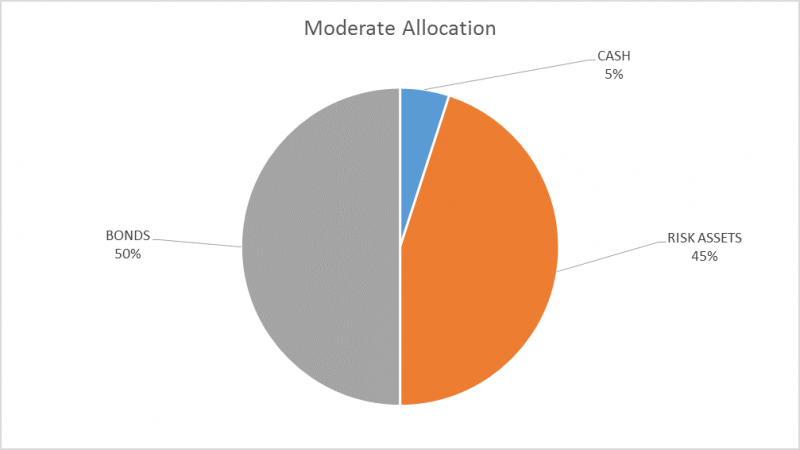

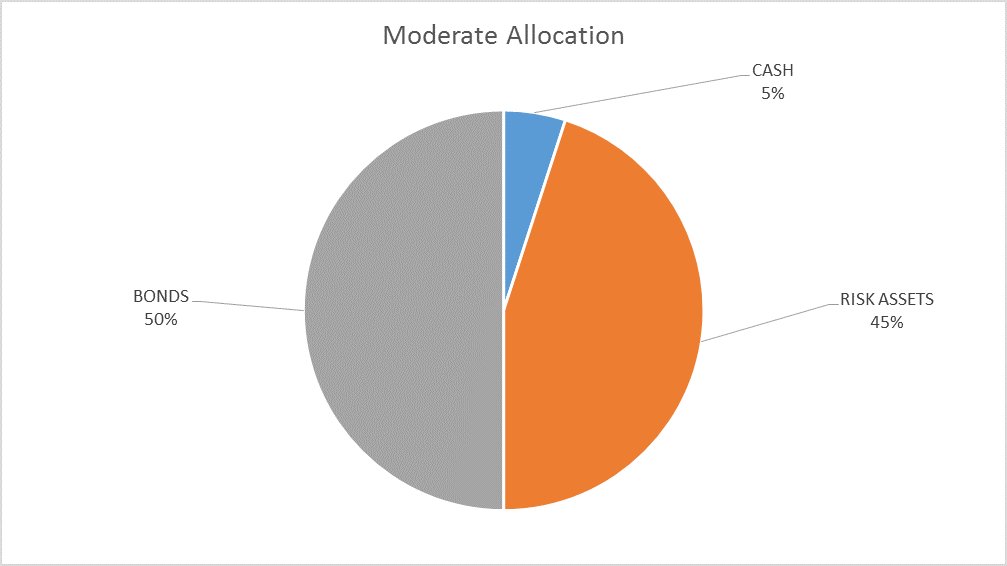

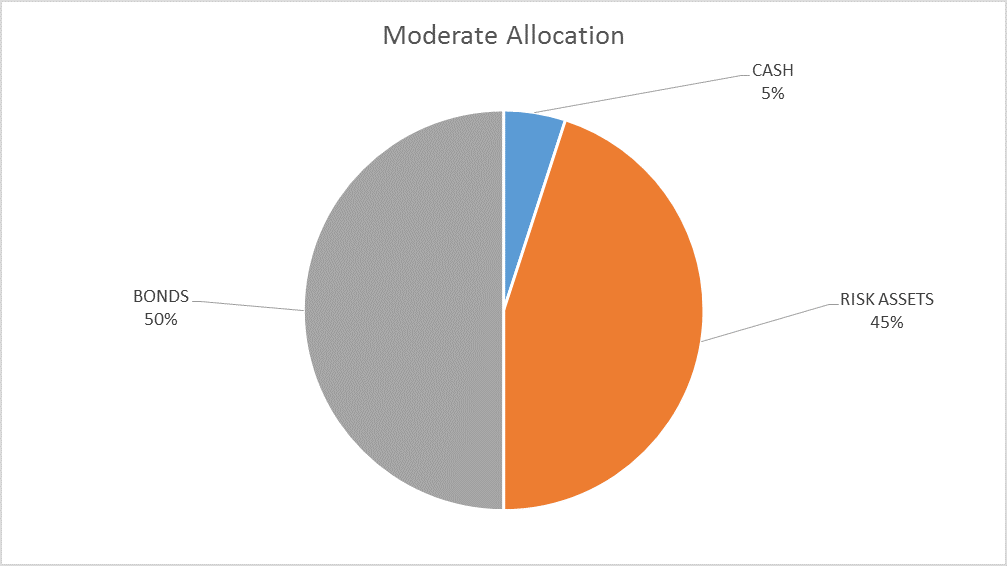

Global Asset Allocation Update

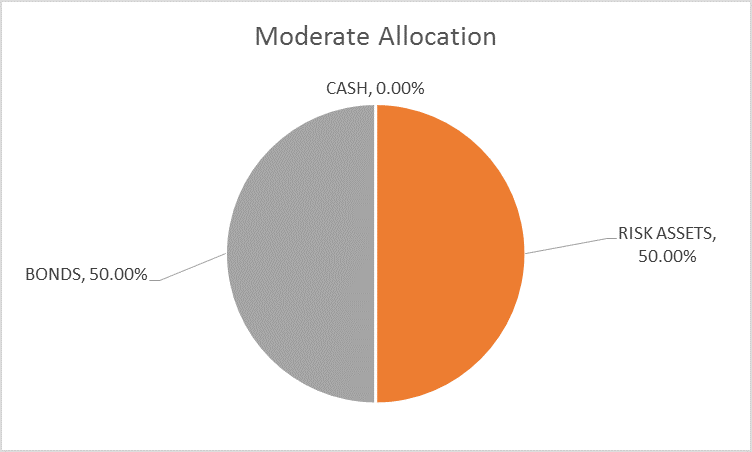

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »

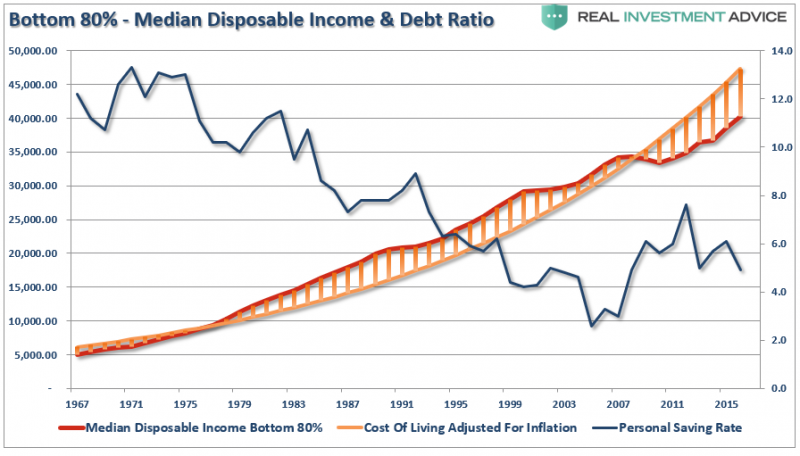

The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth.

Read More »

Read More »

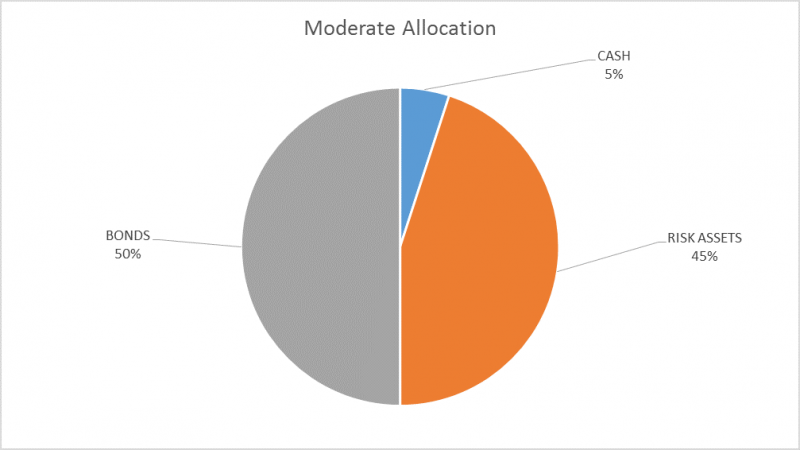

Global Asset Allocation Update

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise.

Read More »

Read More »

Where To Invest When (Almost) Everything’s in a Bubble

Many things that are scarce and thus valuable cannot be bought on the global marketplace. Now that almost every asset class is in a bubble, the question of where to invest one's capital has become particularly vexing. The ashes of wealth consumed by the 2008-09 Global Financial Meltdown are still warm, at least to those who never recovered, and so buying assets at nosebleed valuations in the hopes of earning another 5% aren't very compelling to...

Read More »

Read More »

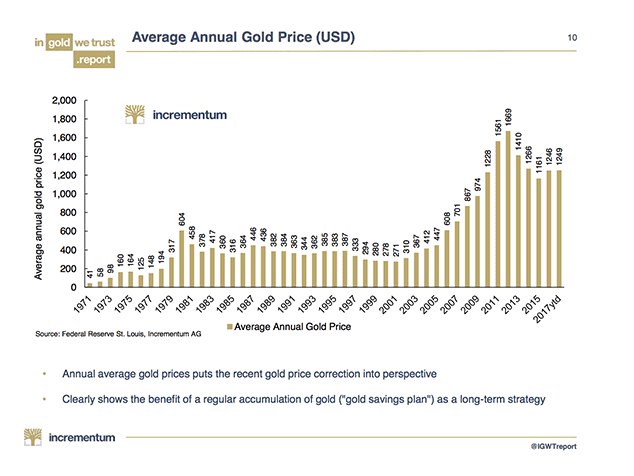

Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book.

Read More »

Read More »

Can We See a Bubble If We’re Inside the Bubble?

If you visit San Francisco, you will find it difficult to walk more than a few blocks in central S.F. without encountering a major construction project. It seems that every decrepit low-rise building in the city has been razed and is being replaced with a gleaming new residential tower.

Read More »

Read More »

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month.

Read More »

Read More »