Tag Archive: Russia

Greenback Pares Yesterday’s Gains

Overview: As the long-holiday ends, risk appetites

have returned. Equities and yields are mostly higher. The dollar is seeing

yesterday's gains pared. Yesterday's setback in the yen helped lift Japanese

stocks, with the Nikkei advancing 1%. Several other markets in the region also

gained more than 1%, including Australia and South Korea. China's CSI was an

exception. It slipped fractionally. Europe's Stoxx 600 is up nearly 0.6%

through the European...

Read More »

Read More »

Yields Pull Back to Start the New Week

Overview: The modest economic goals announced as

China's National People's Congress starts was seen as a cautionary sign after

growth disappointed last year. It seemed to weigh on Chinese stocks, though

others large bourses in the region advanced, led by Japan's Nikkei and South

Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after

rising for the past two sessions. US index futures are slightly softer. Strong

gains were seen...

Read More »

Read More »

A Day of Surprises

(I

am on a business trip and did not intend to post any analysis today. However,

there have been a number of unexpected developments that warrant some

commentary. Thanks for bearing with me.) Japanese press reports that the BOJ Deputy

Governor Amamiya turned down the opportunity to become the next BOJ governor. Instead,

next week, former BOJ board member Kazuo Ueda will be nominated. The market

reacted dramatically, taking the yen sharply higher...

Read More »

Read More »

Greenback Extends Recovery

Overview: The honeymoon for risk assets that began

the year ended with a bang at the end of last week with the monster US jobs

report and the rebound in the service ISM. Disappointing news from several large

US tech companies provided extra encouragement. The yen's weakness helped

Japanese stocks today, but the other larger bourses in the Asia Pacific area

were sold, with losses in Hong Kong, the CSI 300, South Korea, and Taiwan off

more than 1%....

Read More »

Read More »

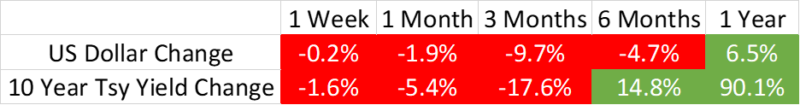

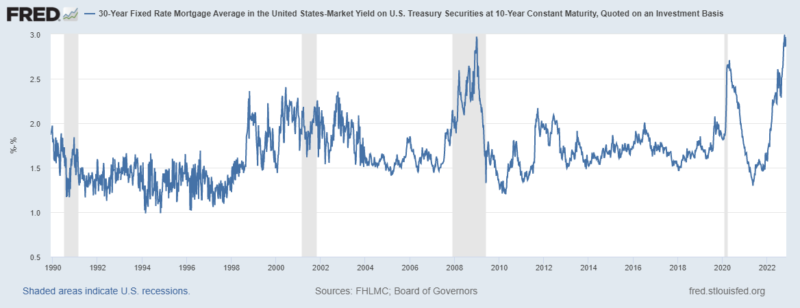

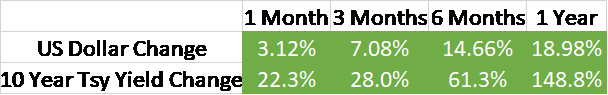

Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

Attention turns to US Jobs while the Yen’s Surge Continues

Overview: There have been significant moves in the capital markets this week

and participants are turning cautious ahead of the US employment report. After the

US equity market rally stalled yesterday, nearly all the Asia Pacific bourses fell

today. The strength of the yen (~3.8% this week) has weighed on Japanese equities

(Nikkei -1.8% this week) and spurred the BOJ to buy ETFs today for the first

time in five months. Europe’s Stoxx 600 is...

Read More »

Read More »

Weekly Market Pulse: Currency Illusion

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately,...

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

New Week, but same Old Stocks (Heavier) and Dollar (Stronger)

The start of the new week has not broken the bearish drive lower in equities. Several Asia Pacific centers were closed, including Japan, Taiwan, and South Korea. China’s markets re-opened, and the new US sanctions coupled with the disappointing Caixin service and composite PMI took its toll.

Read More »

Read More »

Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year.

Read More »

Read More »

Putin and Powell Lift Dollar

Overview: Between Putin’s mobilization of 300k Russian troops and Fed

Chair Powell expected to lead the central bank to its third consecutive 75 bp

hike later today, the dollar rides high. It has recorded new two-year highs

against the dollar bloc and Chinese yuan, while sterling was sent to new lows

since 1985. Asia Pacific bourses were a sea of red for the sixth decline in the

regional benchmark in the past seven sessions. Surprisingly, Europe’s...

Read More »

Read More »

The Greenback Firms to Start the New Week, Stocks Slide

Overview: The busy week is off to a slow

start as Japan is on holiday and the UK and Canadian markets are closed to

honor Queen (Australia will commemorate with a holiday on Thursday). Nevertheless,

the sell-off in equities continues and the US dollar is firm. Most of the large

markets in Asia fell. India is a notable exception. Its benchmark rose for the

first time in four sessions, helped by bank shares and Infosys. Europe’s Stoxx

600 is off for...

Read More »

Read More »

Careful about Chasing the Dollar Lower in North America Today

The bout of profit-taking on long dollar positions begun last week has carried into the start of this week. Despite the escalating rhetoric, the yen is not participating today and is trading within the pre-weekend ranges. The greenback’s lows have been set in the European morning and have stretched the intraday momentum indicators, suggesting that North American dealers may not follow suit.

Read More »

Read More »

US Dollar Soft while Consolidating Yesterday’s Drop

Overview: The US dollar is consolidating yesterday’s losses but is still trading with a heavier bias against the major currencies and most emerging market currencies. The US 10-year yield is soft below 2.77%, while European yields are mostly 2-4 bp higher.

Read More »

Read More »

Greenback Jumps Back

Overview: With the exception of Japan, Taiwan, and India, the large equity

markets in the Asia Pacific region traded higher today. The Hang Seng led the

move (1.65%) amid reports that Alibaba will seek its primary listing there. Europe’s

Stoxx 600 is edging higher today. If it can hold on to the gains, it will be

the fourth consecutive rise, the longest advance since May. US futures are slightly

under water. Benchmark 10-year yields are mostly...

Read More »

Read More »

Market Prices in More Aggressive Fed AND is more Confident of Rate Cuts by the End 2023

Overview: The higher-than-expected US CPI and the strong expectation of a 100 bp hike by the Fed in two weeks is propelling the dollar higher.

Read More »

Read More »

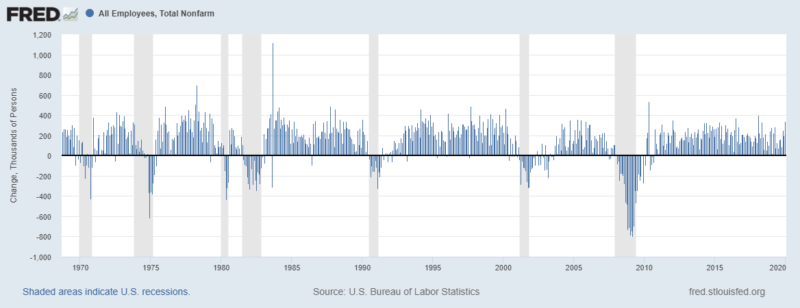

Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy.

Read More »

Read More »

The Dollar Jumps and the Euro Slips under $1.03

Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below $1.03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar.

Read More »

Read More »

US midterms set to favour gold

2022-11-10

by Stephen Flood

2022-11-10

Read More »