Tag Archive: Reuters

Swiss financial watchdog publishes ICO guidelines

The Swiss financial watchdog has published guidelines on digital currency fundraisers - known as initial coin offerings - under which it will regulate some ICOs, either under anti-money laundering laws or as securities. The Financial Market Supervisory Authority (FINMA) says the guidelines “also define the information FINMA requires to deal with such enquiries and the principles upon which it will base its responses,” according to a press...

Read More »

Read More »

In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Read More »

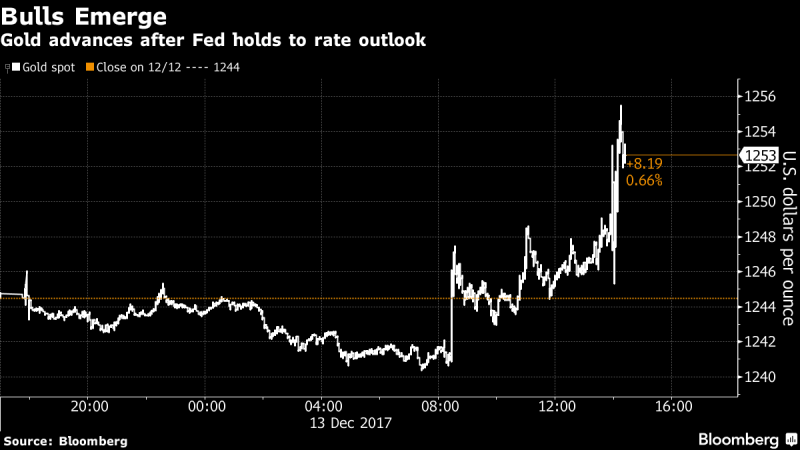

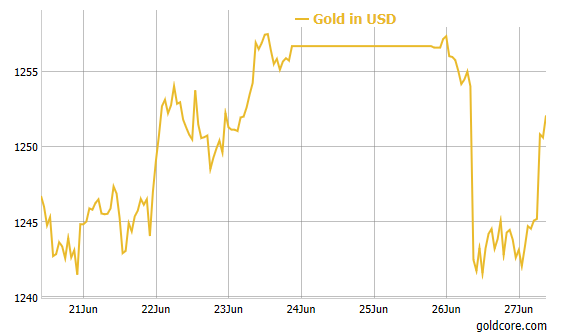

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

Frustrated Investors File Lawsuits Against World’s Largest ICO

ere's the latest sign that the massively fraudulent ICO market is headed for a collapse. Tezos’s investors are still waiting to learn when they can expect to receive the digital tokens that they paid a premium for during the company’s record-setting crowdsale. But as reports of abuse, internal strife and outright embezzlement have surfaced in the press, three groups of angry investors have filed class action lawsuits accusing the company of fraud...

Read More »

Read More »

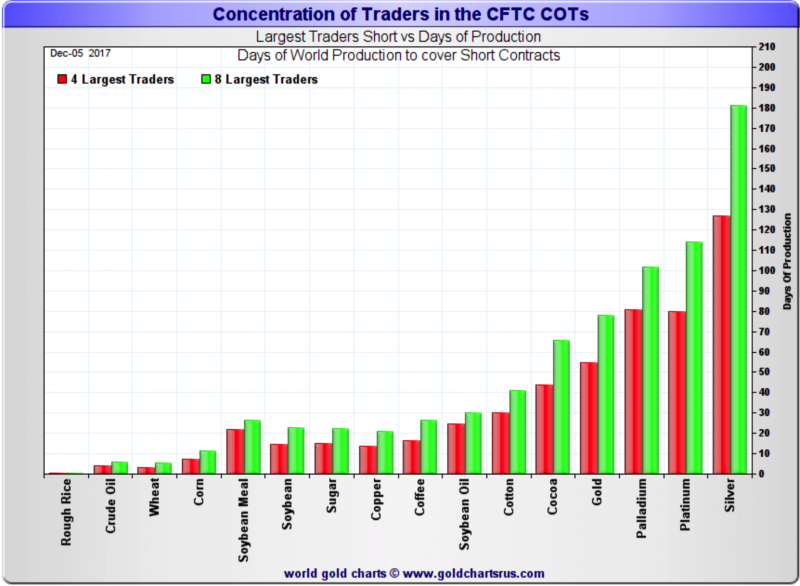

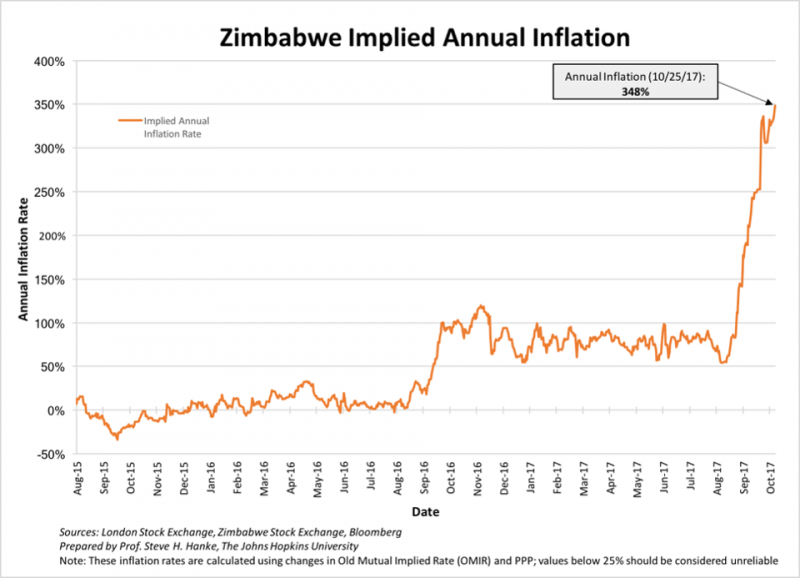

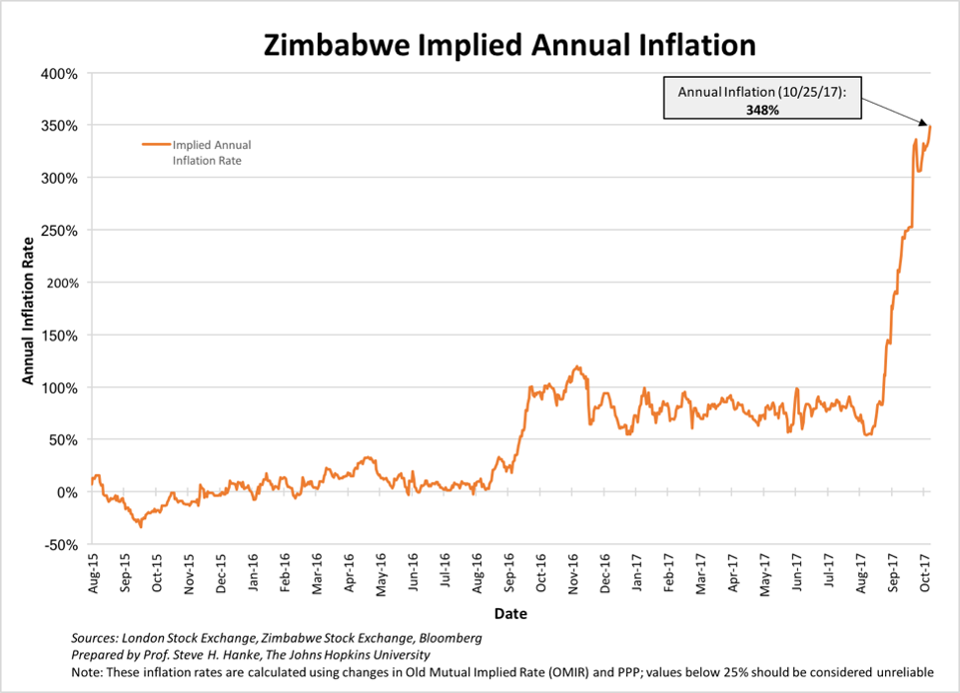

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

The World’s Largest ICO Is Imploding After Just 3 Months

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public, demand soared as investors...

Read More »

Read More »

Swiss Flush $3 Million In Gold And Silver Down The Drain Every Year

When it comes to flushing valuables down the toilet, the Swiss are hardly "Austrians", and appear to be equity-opportunity dumpers, whether it is fiat or hard money. Last month we reported that Switzerland was gripped in a mystery, after it was discovered that someone tried to flush $120,000 in €500 bills down the toilet in a bathroom close to a UBS bank vault as well as three nearby restaurants, which in turn clogged the local toilets requiring...

Read More »

Read More »

Hard times continue for Swiss private banks

Over half of private banks in Switzerland analysed by KPMG last year experienced net outflows of client cash. In a difficult period for finance, many could be forced to shut down or be bought out. “Implement truly radical change, or continue to see performance deteriorate.” This was the message of a study released Thursday by audit group KPMG with the University of St. Gallen, evaluating the performance of 85 Swiss private banks.

Read More »

Read More »

Swiss employee associations not opposed to a 60 hour week

Swiss employee associations are not opposed to a 60 hour week. Several parliamentary initiatives aim to loosen Swiss labour rules. The first aims to allow staff and employers more flexibility regarding hours worked and time off. The second aims to loosen rules on recording hours of work by managers and specialists. Another initiative aims to extend this to include employees with shareholdings in start-ups.

Read More »

Read More »

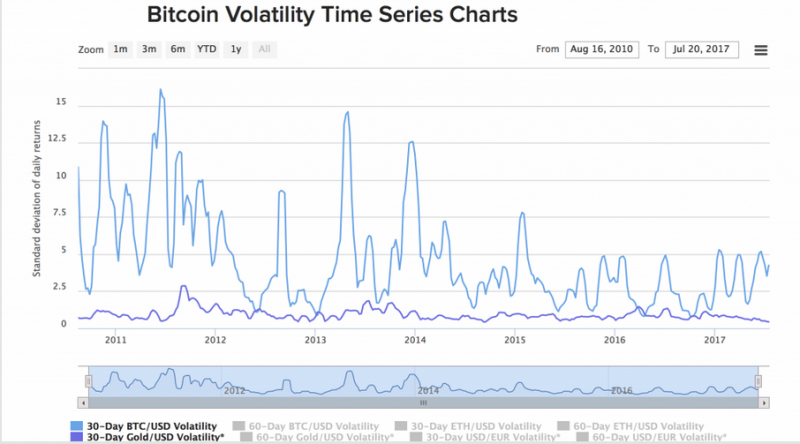

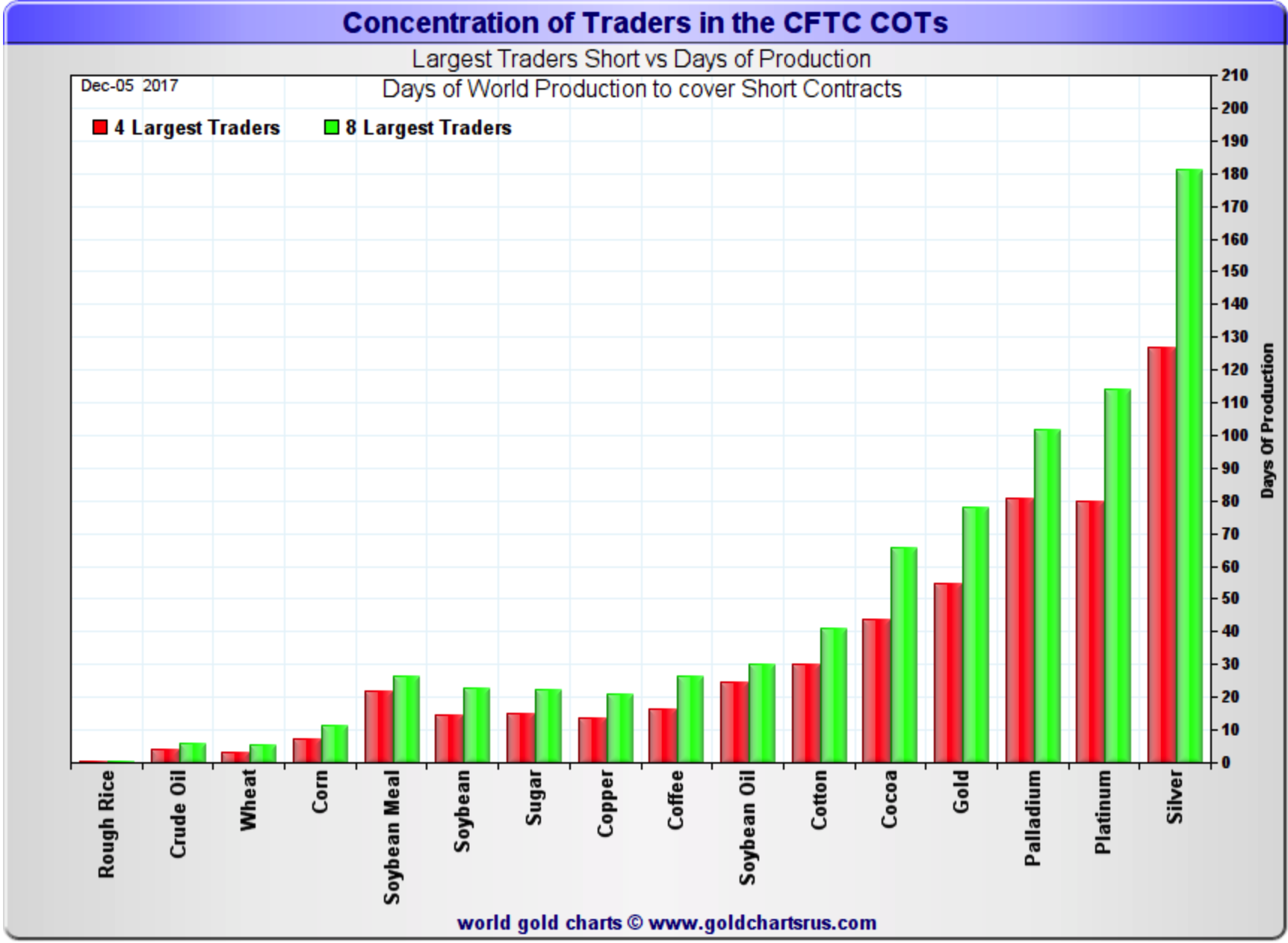

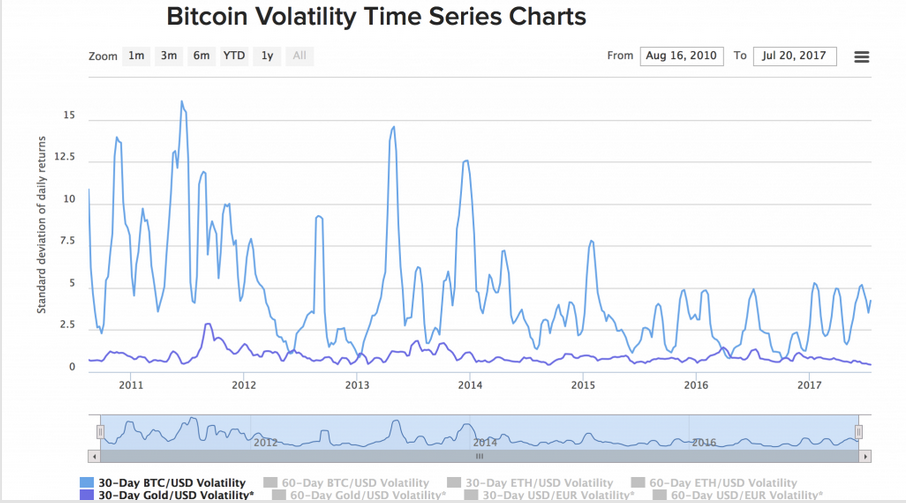

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »

Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

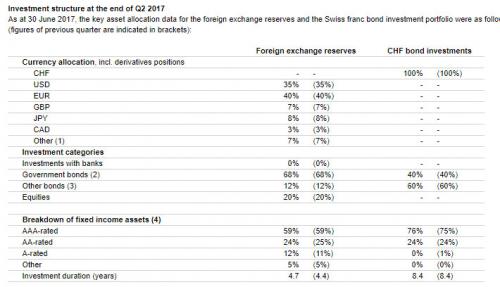

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and "other bonds", at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below.

Read More »

Read More »

Switzerland Opens Door To Bitcoin Asset-Management Business

Bitcoin and other cryptos have fallen sharply over the past month in a shakeout that saw some of the early longs decide to take their winnings and walk away. But a 20% drop from the all-time highs hasn’t done much to temper wealthy investors interest in bitcoin and other cryptocurrencies as alternative investments potentially worthy of diversification.

Read More »

Read More »

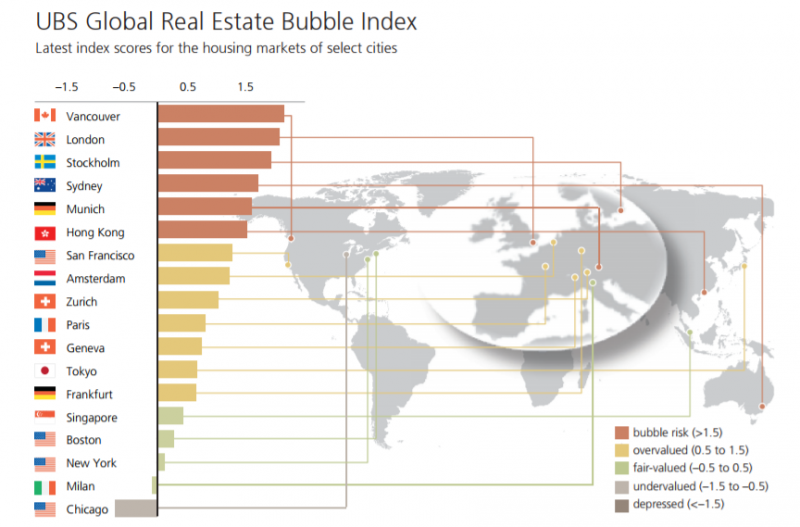

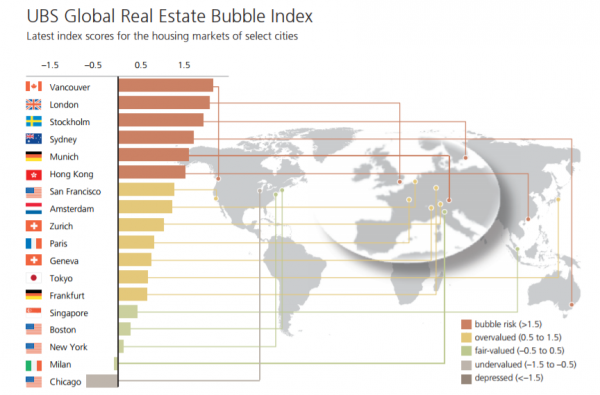

London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

Is the London property market heading for tough times? The most recent housing figures and a new Bank of England report suggest it may well be. Recent figures show that 77% of London houses sold in May went at below asking price, up from 72% in April.

Read More »

Read More »