Tag Archive: recession

No Longer Hanging In, Europe May Have (Been) Broken Down

Mario Draghi can thank Jay Powell at his retirement party. The latter being so inept as to allow federal funds, of all things, to take hold of global financial attention, everyone quickly shifted and forgot what a mess the ECB’s QE restart had been. But it’s not really one or the other, is it? Once it actually finishes, the takeaway from all of September should be the world’s two most important central banks each botching their...

Read More »

Read More »

Focus Is On The Pre-recession Condition

Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession.

Read More »

Read More »

A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

Read More »

Read More »

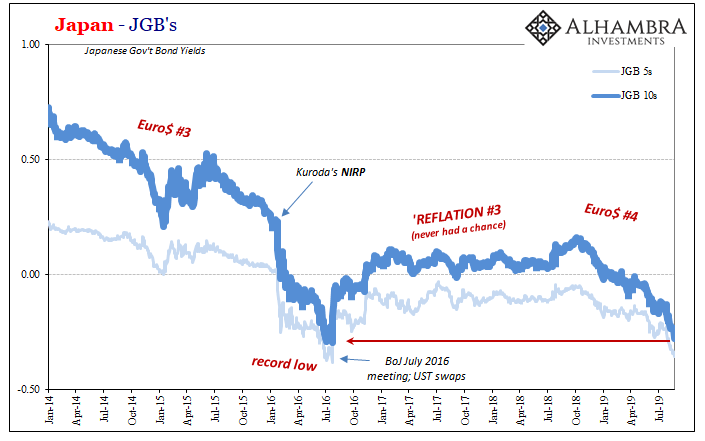

Japan: Fall Like Germany, Or Give Hope To The Rest of the World?

After trading overnight in Asia, Japan’s government bond market is within a hair’s breadth of setting new record lows. The 10-year JGB is within a basis point and a fraction of one while the 5-year JGB has only 2 bps to reach. It otherwise seems at odds with the mainstream narrative at least where Japan’s economy is concerned.

Read More »

Read More »

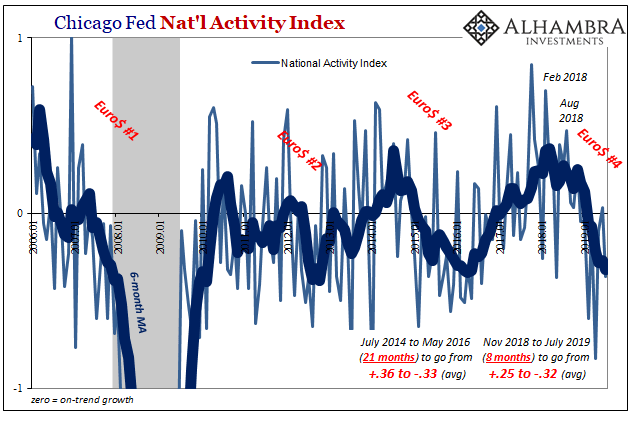

Definitely A Downturn, But What’s Its Rate of Change?

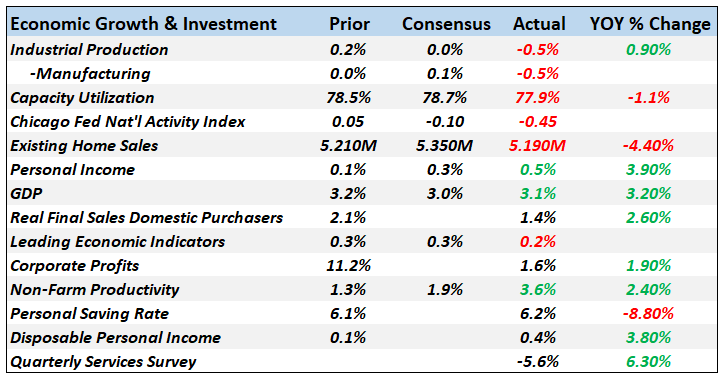

The Chicago Fed’s National Activity Index (NAI) fell to -0.36 in July. That’s down from a +0.10 in June. By itself, the change from positive to negative tells us very little, as does the absolute level below zero. What’s interesting to note about this one measure is the average but more so its rate of change.

Read More »

Read More »

Monthly Macro Monitor: Does Anyone Not Know About The Yield Curve?

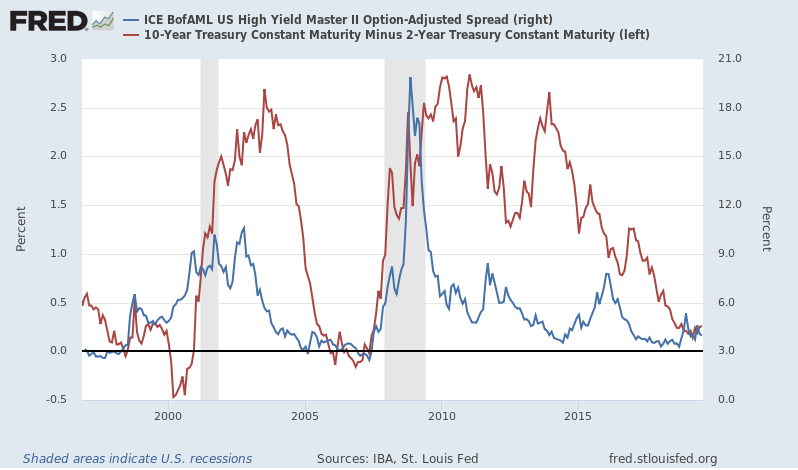

The yield curve’s inverted! The yield curve’s inverted! That was the news I awoke to last Wednesday on CNBC as the 10 year Treasury note yield dipped below the 2 year yield for the first time since 2007. That’s the sign everyone has been waiting for, the definitive recession signal that says get out while the getting is good.

Read More »

Read More »

Germany’s Superstimulus; Or, The Familiar (Dollar) Disorder of Bumbling Failure

The Economics textbook says that when faced with a downturn, the central bank turns to easing and the central government starts borrowing and spending. This combined “stimulus” approach will fill in the troughs without shaving off the peaks; at least according to neo-Keynesian doctrine. The point is to raise what these Economists call aggregate demand.

Read More »

Read More »

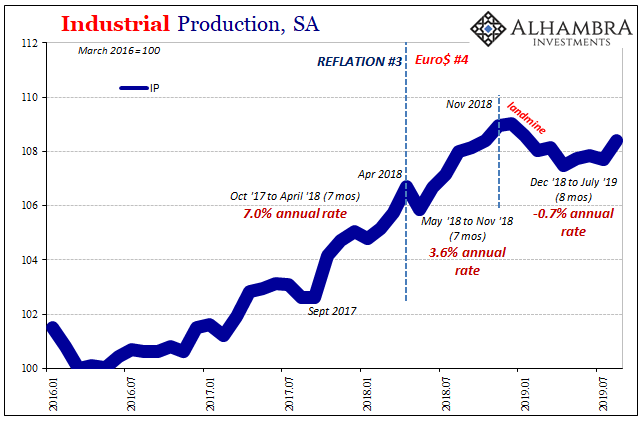

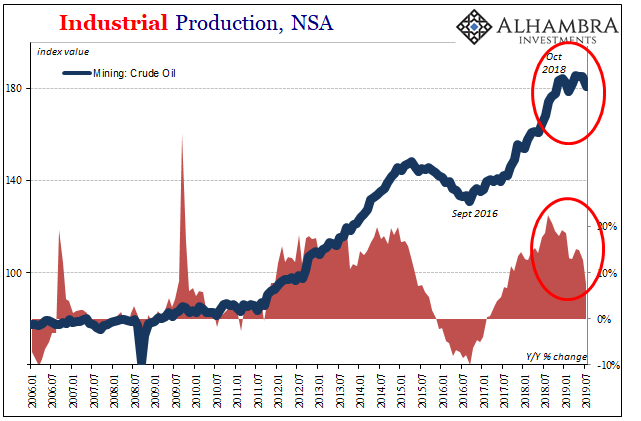

US Industrial Downturn: What If Oil and Inventory Join It?

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one.

Read More »

Read More »

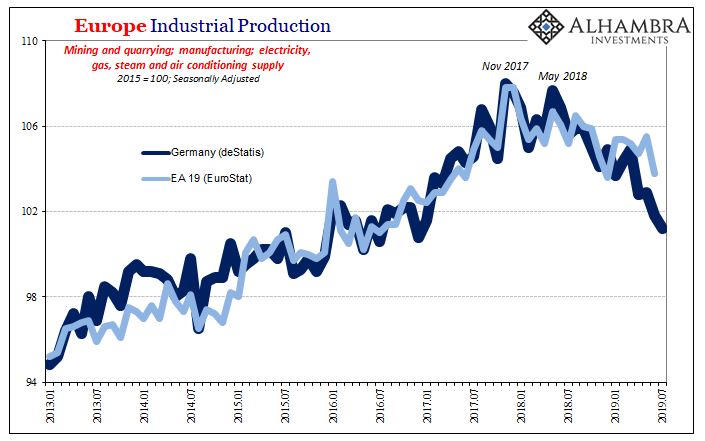

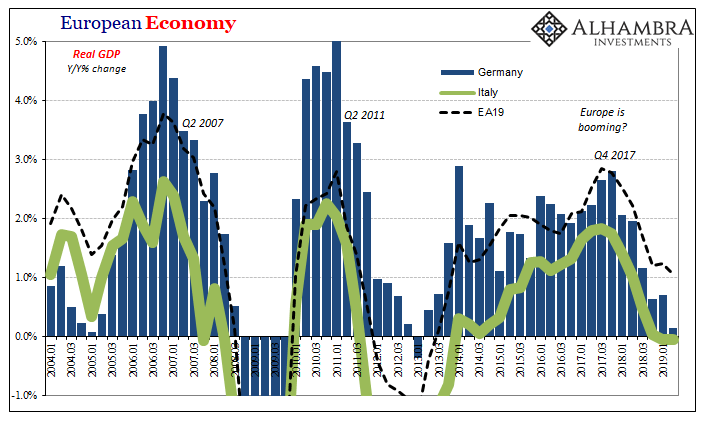

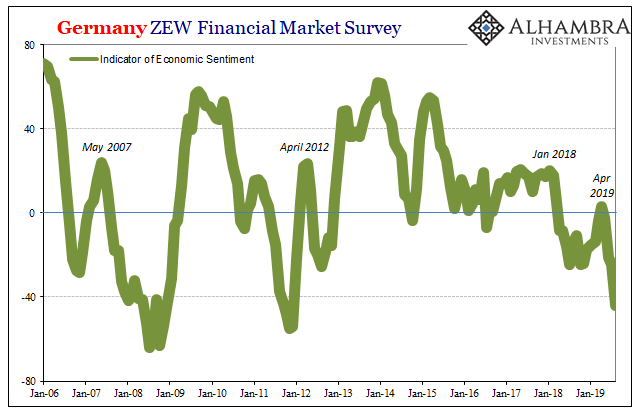

Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else.

Read More »

Read More »

Monthly Macro Monitor: We’re Not There Yet

I first wrote about the current economic slowdown a year ago and Jeff Snider actually started seeing signs of slowdown in the Eurodollar market as early as May 2018. So, the slowdown we’re in now certainly isn’t a surprise here at Alhambra. I think though that we often forget how long these things take to develop.

Read More »

Read More »

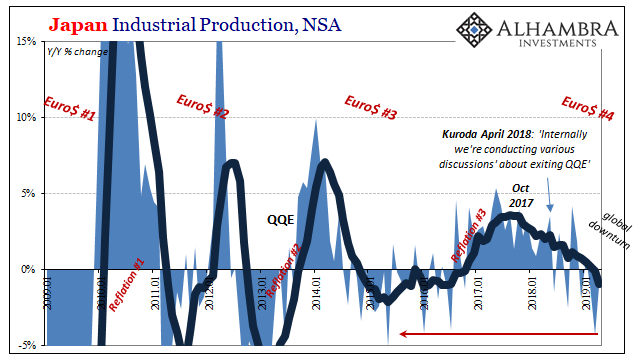

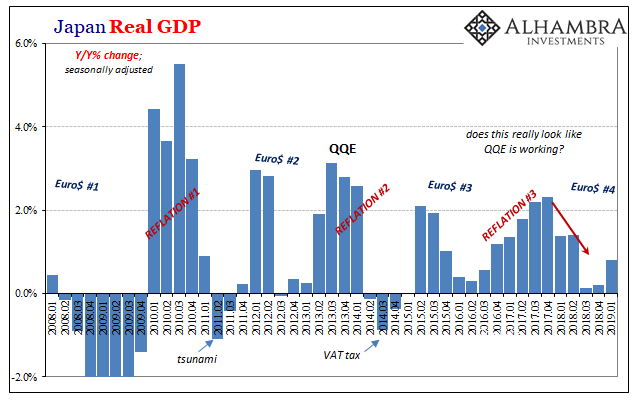

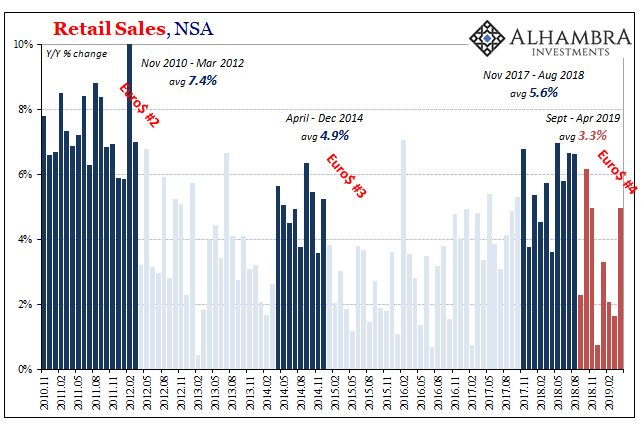

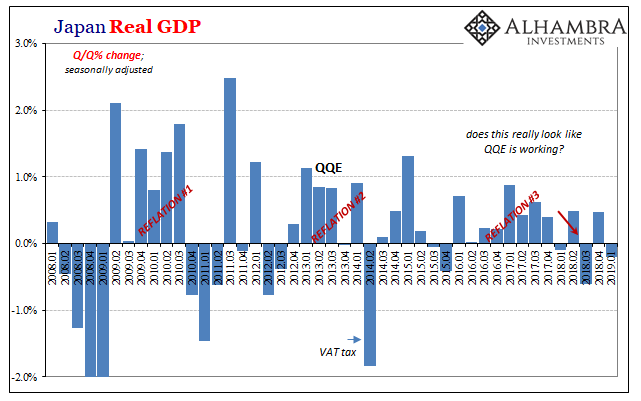

Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best.

Read More »

Read More »

All Of US Trade, Both Ways, And Much, Much More Than The Past Few Months

The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied.

Read More »

Read More »

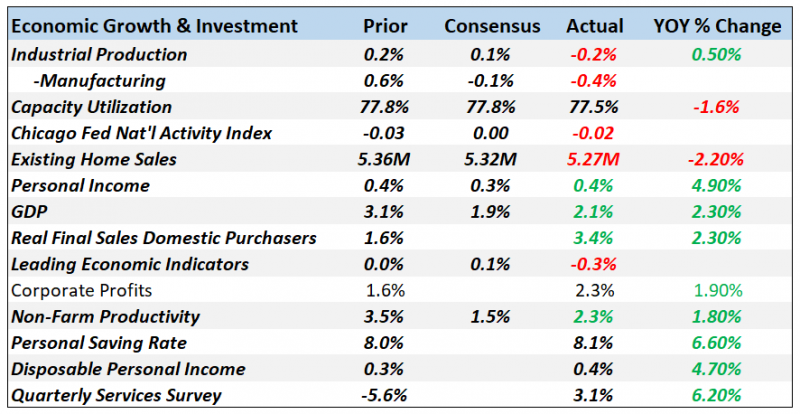

Monthly Macro Monitor: Economic Reports

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction.

Read More »

Read More »

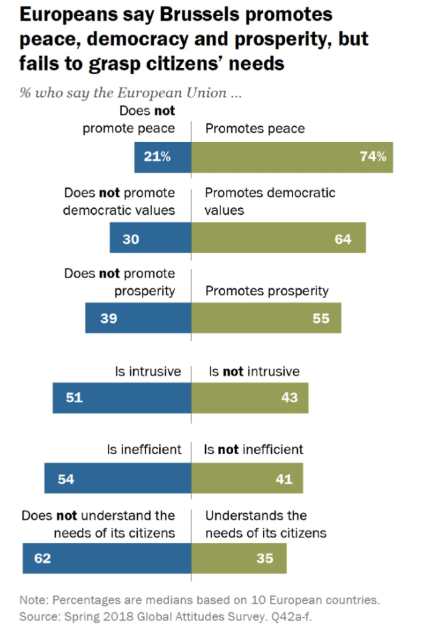

Europe Comes Apart, And That’s Before #4

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey.

Read More »

Read More »

Japan’s Surprise Positive Is A Huge Minus

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five.

Read More »

Read More »

Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough.

Read More »

Read More »

Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so straightforward.

Read More »

Read More »

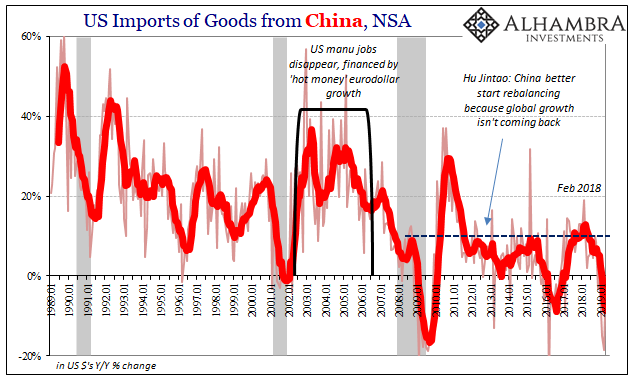

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

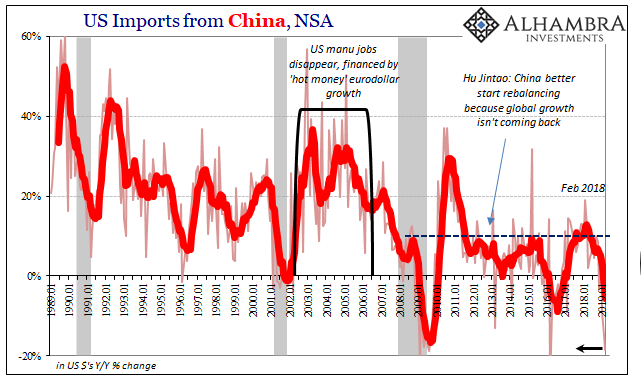

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging.

Read More »

Read More »

What’s Germany’s GDP Without Factories

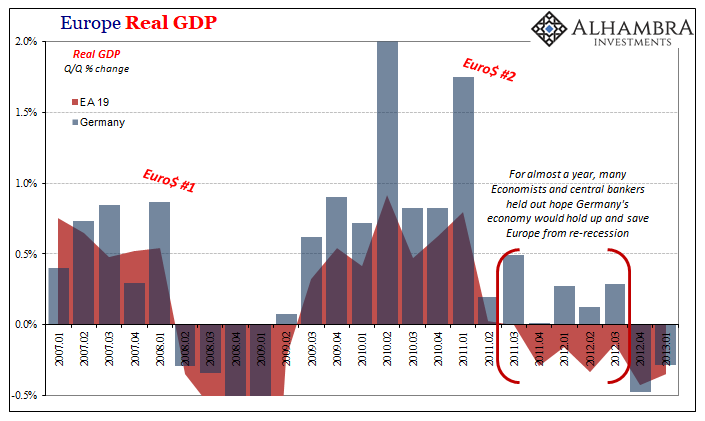

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of crisis and economic weakness...

Read More »

Read More »