Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the...

Read More »

Tag Archive: Purchasing Power Parity

(2) FX Theory: Purchasing Power Parity

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power.

Read More »

Read More »

(2.2) Purchasing Power Parity: Big Mac and Starbucks Tall Latte

The following table compares the Big Mac and the Starbucks Tall Latte index among different countries. It explains the issues with these measurements.

Read More »

Read More »

(3.1) FX Theory: Interest Rate Parity

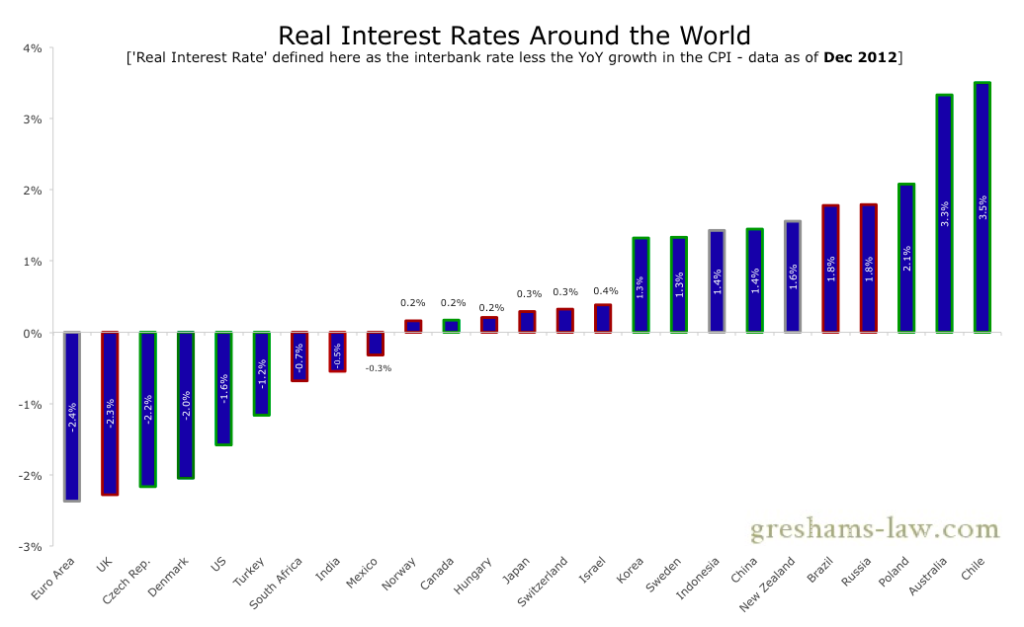

The interest rate parity gives a mathematical explanation for the purchasing power parity and real effective interest rates

Read More »

Read More »

The Three Main Forex strategies: Trend Following, Mean Reversion and the Carry trade. Is the Carry Trade Dead ?

Submitted by Mark Chandler, from marctomarkets.com Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 15 Market participants have to confront a stark asymmetry. There are many ways to lose money, but there appears to be only three ways to make money. Nearly all strategies seem to come down to some variant …

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »

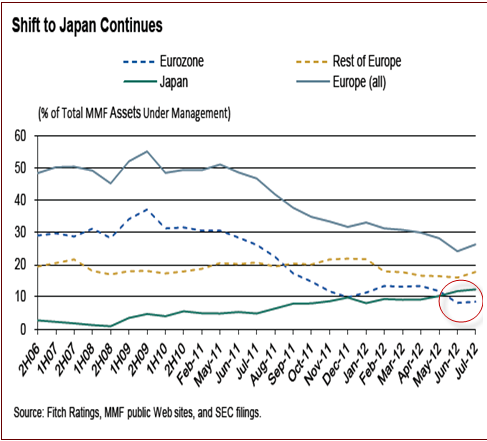

EUR/CHF, A History of Interventions: What markets say, July 2012

More Chatter About The EUR/CHF Peg The FT reports that Switzerland is ‘new China’ in currencies Chatter that the SNB was buying 3 billion francs worth of euros per day. “The picture is one of a central bank that’s not coping with how much money is coming in,” said Kit Juckes, foreign currency analyst at Société … Continue reading »

Read More »

Read More »

EUR/CHF, A History of Interventions: What markets say, June 2012

SNB In A Bind With Euro Holdings Today’s reserve data showed skyrocketing reserves at the Swiss National Bank as they defend the EUR/CHF floor. Reserves were at 365B francs at the end of Q2 compared to 245B at the end of March, with all the growth coming in the final two months of the quarter … Continue reading »

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »