Tag Archive: Portugal

Japan’s Q4 23 Contraction Revised Away, Helping Keep Yen Bid

Overview: News that the Japanese economy expanded rather than contracted in Q4 23 has fanned expectations that rates could be as early as next week. This is helping keep the yen supported, though it remains in the pre-weekend range, albeit barely.

Read More »

Read More »

Dollar Retreat Extended, but Turn Around Tuesday may have Already Begun

Overview: Last week's dollar losses have been

extended today. The yen is leading the move, encouraged by talk of a buying by

a large US real money fund. The Dollar Index is off about 0.35% after sliding

1.8% last week. It is below the 200-day moving average for the first time since

late August. As was the case last week, the Canadian dollar is the laggard. Emerging

market currencies are also mostly higher. The Chinese yuan's 0.67% rise is the

most...

Read More »

Read More »

Total Funding to Portuguese Fintech Companies Surpasses EUR 1B Mark

In 2022, the Portuguese fintech ecosystem entered a new stage of development, marked by greater maturity of the sector, continued innovation through partnerships and a dynamic venture capital (VC) market, a new report by industry trade group Portugal Fintech, in collaboration with KPMG, Visa and law firm Morais Leitao, claims.

The Portugal Fintech Report 2022, released in October, shows a resilient fintech industry that has continued to grow,...

Read More »

Read More »

Italian Election–Two Months and Counting

Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members.

Read More »

Read More »

Euro Shrugs off European Banking Woes

Spain's Banco Popular is scrambling ahead of its meeting with the ECB tomorrow; shares are around 50% in three sessions. Italy has two banks that may see the same deal Monte Paschi negotiated with the EU. Portugal banks are still putting loan loss reserves and provisions aside.

Read More »

Read More »

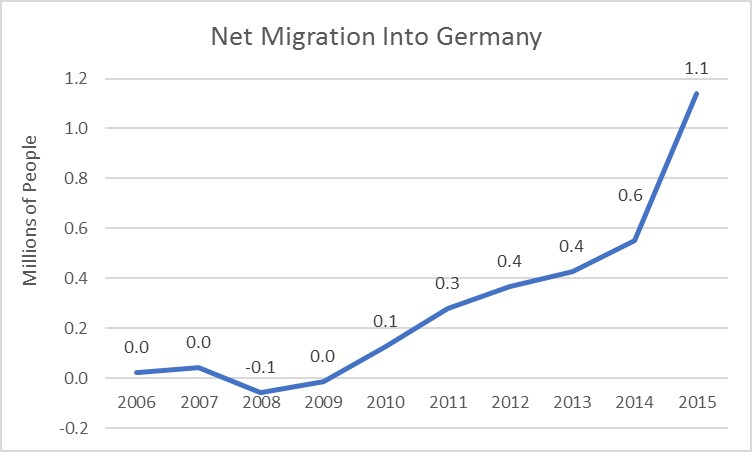

Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives economic activity magnitudes beyond what the numbers would indicate.

Read More »

Read More »

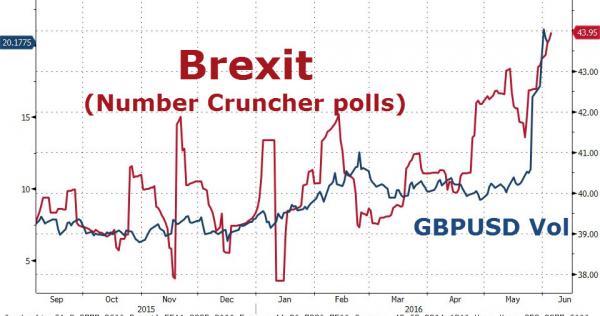

Martin Armstrong: “EU in Disintegration Mode”

Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong's piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that,

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

Adoption Of The Euro Has Been ‘Unequivocally Bad’ For Southern European Economies

Some say that the common currency prevents less productive economies from cheating by weakening their national currencies and forces them to become more efficient and competitive. Industrial production data shows that it is not the case. Italy, France, Greece and Portugal have not only stopped producing more; they are producing now less than in 1990! The decay started immediately after the introduction of the euro in 2002!

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

Why Portugal Matters

DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating.

Read More »

Read More »

Global Peace Index: Only 10 countries not at war (among them Switzerland)

The world is becoming a more dangerous place and there are now just 10 countries which can be considered completely free from conflict, according to authors of the 10th annual Global Peace Index, among them Switzerland.

Read More »

Read More »

Switzerland’s Gotthard Base Tunnel: Swiss Engineered, Foreign Made

Earlier we introduced the Gotthard Base Tunnel, the longest and deepest tunnel in the world. The 35 mile long tunnel which cuts underneath the Alps helps remove natural barriers to trade and tourism, and is undoubtedly a testament to Swiss precision ...

Read More »

Read More »

Three unintended consequences of NIRP

Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues differently: Falling prices are a consequence of low interest rates.

Read More »

Read More »