Tag Archive: Paul Krugman

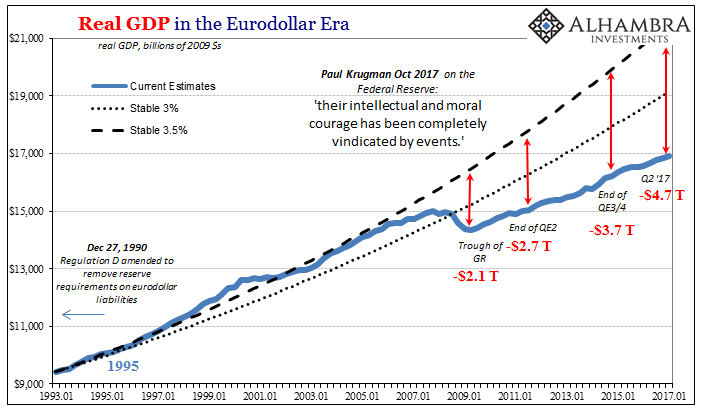

Krugman’s Keynesianism Has Made Him Wrong about Much More Than Economic Theory

Let me tell you about Keynesian economists. They are different from you and me. They learn their mathematical models and aggregate terminology early and easily, and it does something to them, makes them proud and self-omniscient where the rest of us are circumspect, in a way that, unless you were born a Keynesian economist, is very difficult to understand.

Read More »

Read More »

Political Economics

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t the usual R vs. D, left vs....

Read More »

Read More »

Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change.

Read More »

Read More »

We Should Take Our Cues From Markets – Not Politicians

I grew up a block away from the 7-train, where I’d take a short ride from the 90th Street station to the Willets Point–Shea Stadium station to watch my favorite team, the New York Mets. Sitting in the stands as a young child, I learned quickly that there were a number of ways to obtain and interpret information. I could watch the umpire and immediately have known whether Al Leiter threw a strike or a ball. Another option was to watch the scoreboard...

Read More »

Read More »

EC Pushes Back on (8) Draft Budgets

Long before the UK referendum, many argued that monetary union was undermining the European Union. Many had expected Greece to be forced out not once but twice. There is a cottage industry of books forecasting the demise of EMU.

Read More »

Read More »

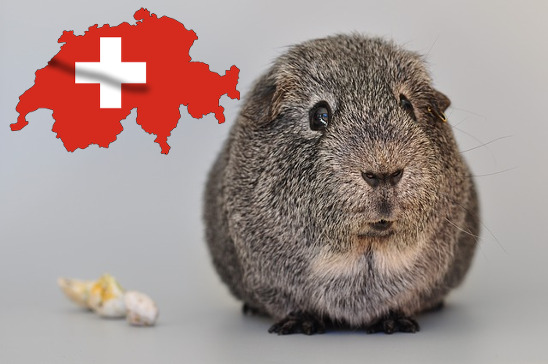

Negativzinsen: Unsere Schweiz als Versuchskaninchen

In der gestrigen Ausgabe der NZZ am Sonntag wird Nobelpreisträger Paul Krugman zitiert, wie er den Mindestkurs der SNB und deren Negativzinsen lobt. Die Negativzinsen seien ein „wertvolles Experiment“ meint er und „bedankt“ sich dafür sogar bei der SNB. „Die Schweiz eruiert neues Territorium. Aus akademischer Sicht liebe ich das.“

Read More »

Read More »

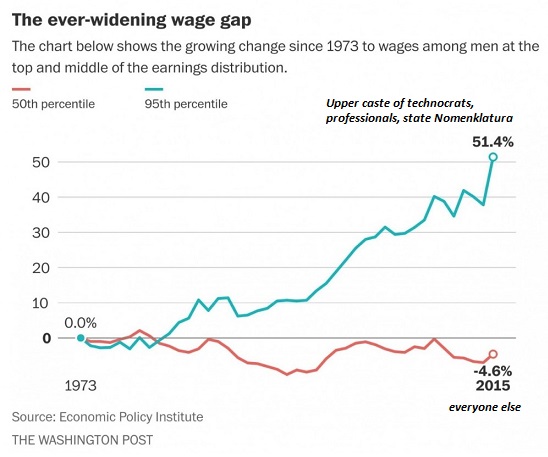

Why Wages Have Stagnated–and Will Continue to Stagnate

Mainstream economists are mystified why wages/salaries are still stagnant after 7+ years of growth / "recovery." The conventional view is that wages should be rising as the labor market tightens (i.e. the unemployment rate is low) and demand for workers increases in an expanding economy.

Read More »

Read More »

The World’s Central Banks Are Making A Big Mistake

While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments.

Read More »

Read More »

FX Daily, July 12: Easing Political Uncertainty Encourages Animal Spirits

Further risk appetite means rising euro and weaker CHF. The SNB typically sustains such risk appetite phases with smaller FX interventions of around 300 million per day. Sterling is leading the new appetite for risk as one element of political uncertainty has been lifted. It is moving higher for the third consecutive session today; advancing by more than 1.5 cents to reach $1.3180.

Read More »

Read More »

Why it Makes Sense to Exit the Euro Zone in Times of Balance Sheet Recessions

Italy will follow Japan for decade(s) of balance sheet recession. There is one mean to avoid it. The periphery should use current positive market sentiments and low inflation to exit the euro zone.

Read More »

Read More »

Paul Krugman in 1990s: Long Live the French Franc!

Krugman in the 1990s: "France represents the most extreme case of “eurosclerosis”: of “ludicrously overregulated” labor markets and overprotected jobs. These issues and the unsuited German monetary policies to create the euro were the source of France’s troubles." View Craig Willy's...

Read More »

Read More »

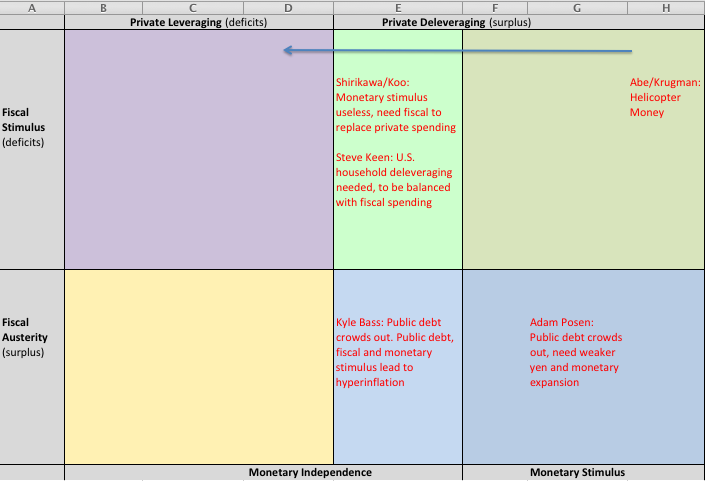

Opinions of Leading Economists on Japan and the Unholy Alliance of Kyle Bass and Shinzo Abe

We give an overview of opinions of leading economists that want to help Japan out of deflation. Paul Krugman, Richard Koo, Adam Posen and Kyle Bass.

Read More »

Read More »