We compare aspects of the Net International Investment Positions for Italy and Switzerland

Read More »

Tag Archive: NIIP

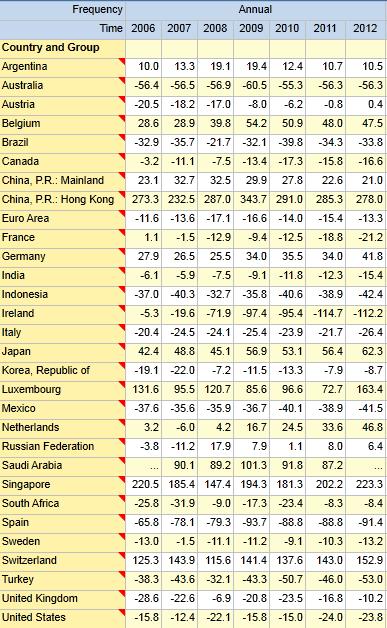

(9.1) Net International Investment Position

A comparison of the net international investment position (NIIP) of several countries. We explain why asset valuation effects this position at the example of the United States.

Read More »

Read More »

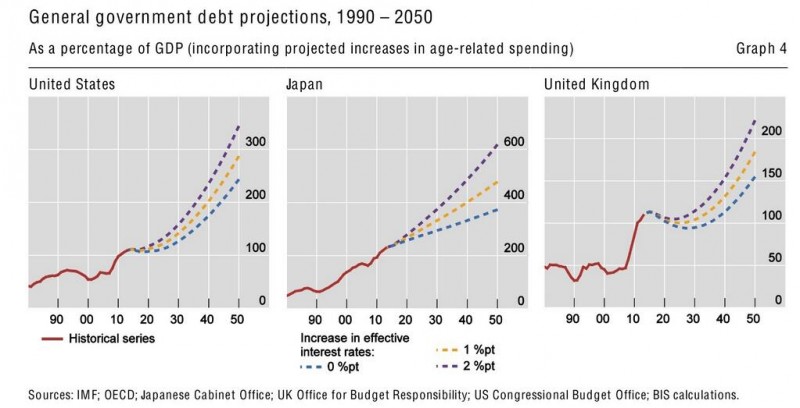

What Drives Government Bond Yields, Part2: Emerging Markets and Recent Discussions

Two additional criteria important for Emerging Markets: High foreign debt, a weak net investment position and a current account deficit increases government bond yields.

Read More »

Read More »

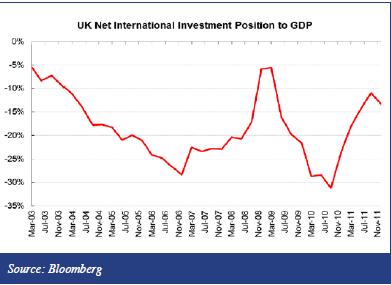

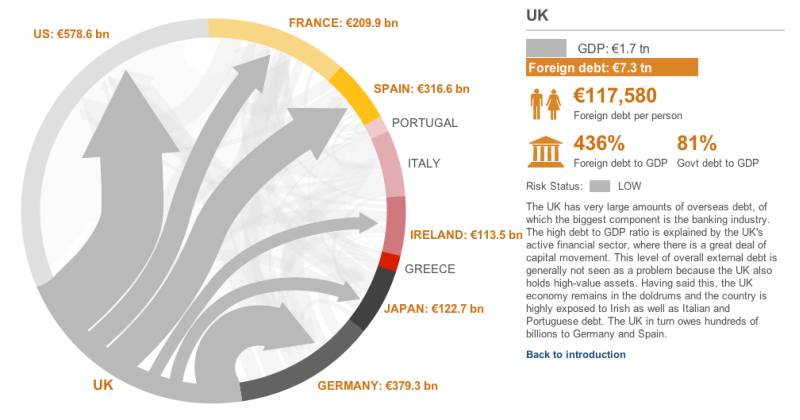

Who’s the Next Downgrade Domino to Fall?…The UK?

Who Downgrades France MUST downgrade the UK, too After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”. According to the BBC, each citizen …

Read More »

Read More »

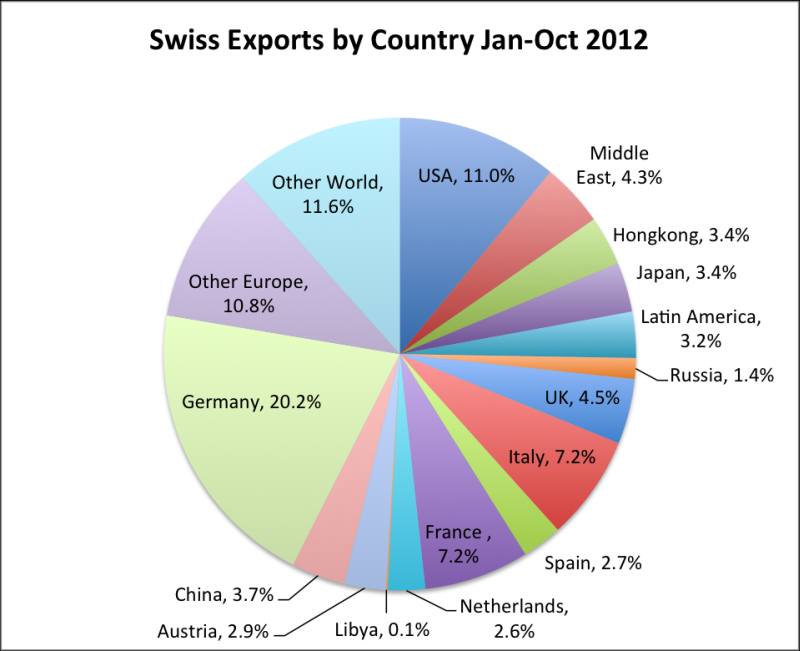

Standard and Poor’s critique of the Swiss National Bank, part 1

Part 1: Swiss investments abroad [This paper includes some of the S&P critique, but also aims to clarify some of S&P’s misleading points] Last Thursday Thomas Moser, a member of the Swiss National Bank (SNB) governing council, said that one of the main reasons for the strong franc is the conversion of Swiss foreign incomes …

Read More »

Read More »

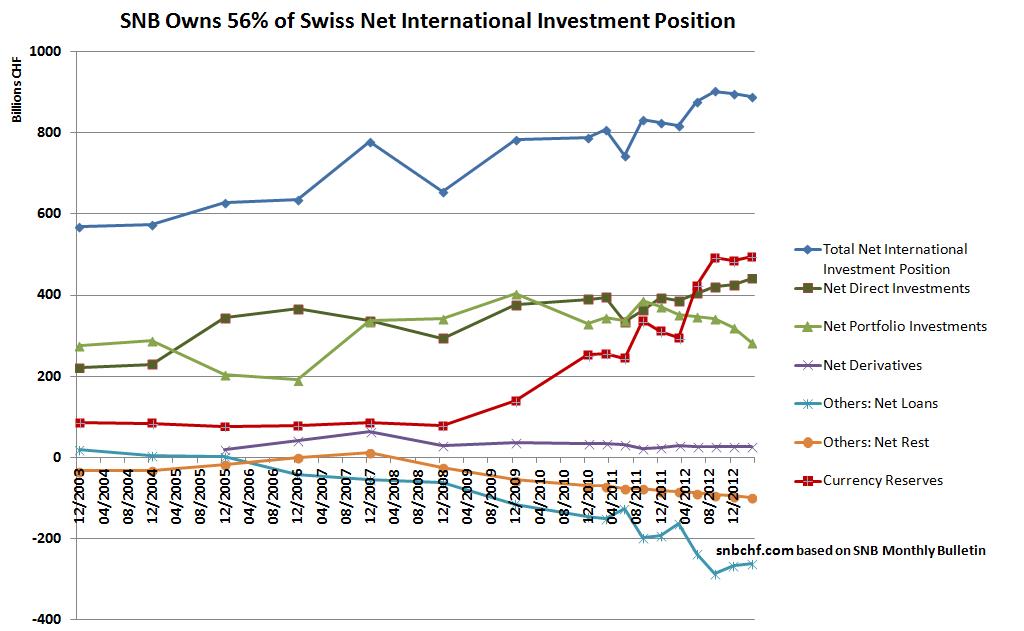

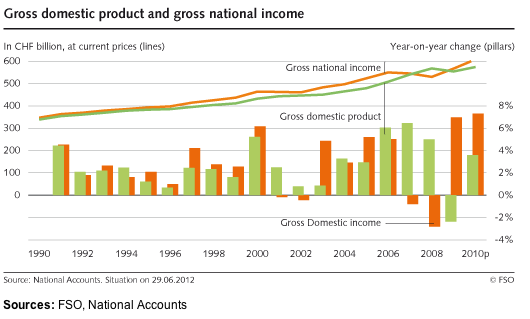

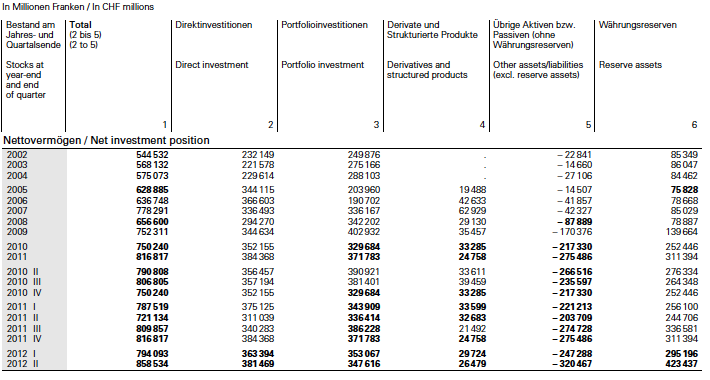

Swiss Net International Investment Position Increases by 64 Billion Francs

Swiss Gross National Income (GNI) rises by 1.8% in Q2, after Q1 +0.5% According to the latest SNB Monthly Bulletin, the Swiss net international investment position (NIIP) has improved by 64.5 billion francs. The Gross National Income (GNI) rises by 1.8% in Q2. The SNB currency reserves rose by 128 Bln. Francs in the …

Read More »

Read More »