Tag Archive: newsletter

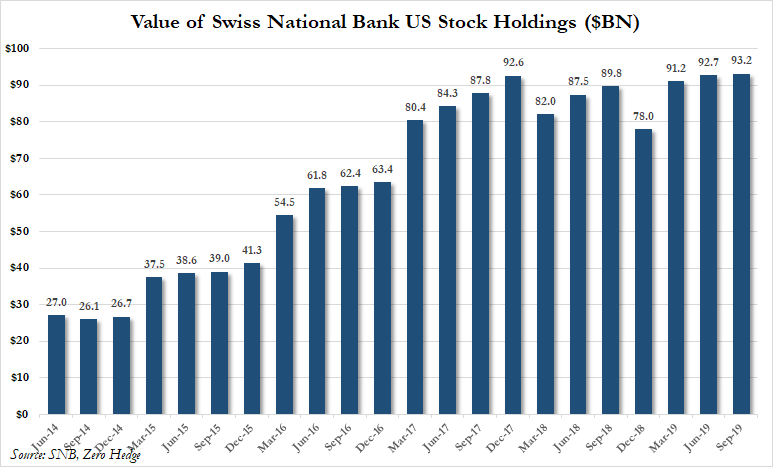

Swiss National Bank Now Owns Record $94 Billion In US Stocks After Q3 Buying Spree

In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump's "trade optimism" tweets.

Read More »

Read More »

Banknoten können künftig unbegrenzt umgetauscht werden

Der Bundesrat hat am Mittwoch beschlossen, die Teilrevision des Bundesgesetzes über die Währung und Zahlungsmittel (WZG) auf den 1. Januar 2020 in Kraft zu setzen. Das Parlament hatte diese im Juni verabschiedet.

Read More »

Read More »

Telecom operator Sunrise to pay up for failed deal

Following shareholder pushback, Swiss telecom operator Sunrise has cancelled the purchase contract for the cable network operator UPC, officially burying the controversial deal. This is another failed attempt to challenge industry leader Swisscom.

Read More »

Read More »

Stock Market Cheerleading: Why Do We Celebrate the Super-Rich Getting Richer?

It's not too difficult to predict a political rebellion against the machinery of soaring wealth and income inequality. The one constant across the media-political spectrum is an unblinking focus on the stock market as a barometer of the national economy: every major media outlet from the New York Times to Fox News prominently displays stock market action, and TV news anchors' expressions reflect the media's emotional promotion of the market as the...

Read More »

Read More »

Cross-border workers entering Switzerland set record in 2019

The number of people from neighbouring countries commuting to Switzerland for work each day reached a record 325,000 this year. The increase was felt especially in cantons Ticino and Geneva. Following a slight drop in 2018, the Swiss job market is once again attracting cross-border workers in historically high numbers. Some 325,291 peopleexternal link entered the country each day in the third quarter of 2019, beating the previous record of 316,491...

Read More »

Read More »

FX Daily, November 13: Investors Temper Euphoria

Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is fragile and will likely follow prices.

Read More »

Read More »

SNB’s Jordan: Swiss franc remains highly valued

Foreign exchange market remains fragile. Negative rates, readiness for intervention still necessary. Danger of a worsening international situation remains large. Imbalances in Swiss real estate market still persist.

Read More »

Read More »

Swiss crypto bank SEBA outlines ambitions

Crypto bank SEBA is confident of attracting a “three-digit” number of Swiss clients by the end of the year before setting its sights on global expansion and raising more than CHF100 million ($101 million) in extra funding from the public.

Read More »

Read More »

USD/CHF technical analysis: Greenback loses steam against Swissy, trades near 0.9930 level

USD/CHF erased its intraday gains, settling near the 0.9930 level. Support is seen at the 0.9920 level. On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The spot is holding just above the 50 SMA today at the 0.9921 level.

Read More »

Read More »

No Swiss citizenship for WEF founder Schwab, reports say

World Economic Forum founder Klaus Schwab will not be receiving honorary Swiss citizenship, despite the idea having being mooted earlier this year. Such an honorary conferral of the passport has no basis in Swiss law, the Federal Justice Office announced on Tuesday, after it was contacted by the daily Südostschweiz newspaper.

Read More »

Read More »

Now That We’ve Incentivized Sociopaths–Guess What Happens Next

As long as central banks create and distribute trillions in conscience-free credit to conscience-free financiers and corporations, the incentives for sociopathy only increase. "Sociopath" is a word we now encounter regularly in the mainstream media, but what does it mean? Here is a list of 16 traits, many of which are visible in lionized corporate and political leaders and entrepreneurs.

Read More »

Read More »

FX Daily, November 12: Farage Declares Truce with Tories after being Offered a Peerage, Underpins Sterling

Global capital markets are calm as investors look for a new catalyst. The MSCI Asia Pacific Index snapped back after posting its first back-to-back decline in a month. All the equity markets were higher, but Australia. The Nikkei, Kospi, and Taiex led the advance with about a 0.8% gain. European shares closed firmly near session highs yesterday, even if still lower on the day, and there has been some follow-through buying today.

Read More »

Read More »

Billionaires’ club shrinks as economy wobbles

The world lost 57 billionaires last year as economic woes and the unexpected strengthening of the US dollar wiped $388 billion (CHF386 billion) from their combined wealth. Switzerland had three fewer billionaires; the 33 who remain saw their bank accounts shrink by $16 billion.

Read More »

Read More »

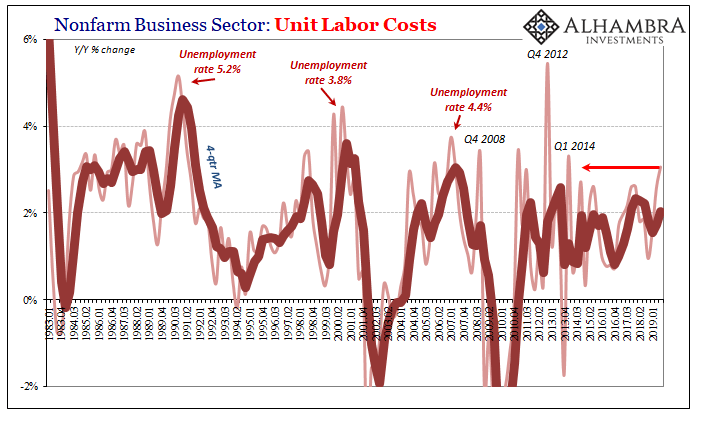

For Labor And Recession, The Bad One

There’s a couple of different ways that Unit Labor Costs can rise. Or even surge. The first is the good way, the one we all want to see because it is consistent with the idea of an economy that is actually booming. If workers have become truly scarce as macro forces sustain actual growth such that all labor market slack is absorbed, then businesses have to compete for them bidding up the price of marginal labor.

Read More »

Read More »

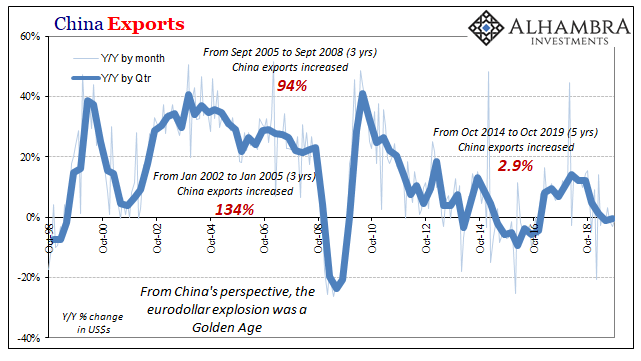

The Real Boom Potential

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving.

Read More »

Read More »

The Feds Spend More on National-Debt Interest Than You Think

Recently, the Treasury Department reported a 26% increase in the federal budget deficit with a 2019 deficit of $984 billion. The reported data on the budget can be misleading. You might think that a budget deficit is the amount of spending that exceeds budget revenue, in other words, the amount of borrowing needed to make up for this shortfall. However, in the world of Washington D.C., not all spending is counted as spending and it’s possible for...

Read More »

Read More »

FX Daily, November 11: Dollar Consolidates and Equities Follow Asia Lower

Overview: Escalating violence in Hong Kong and the continued fall in Chinese producer prices weighed on equities in Asia Pacific trading. The MSCI Asia Pacific Index has risen nearly 7% during the five-week rally and is off to a weak start this week. Hong Kong's Hang Seng fell around 2.6%, its biggest loss in three months, and China's CSI 300 was off 1.75%. Nearly all the local markets fell but Australia.

Read More »

Read More »

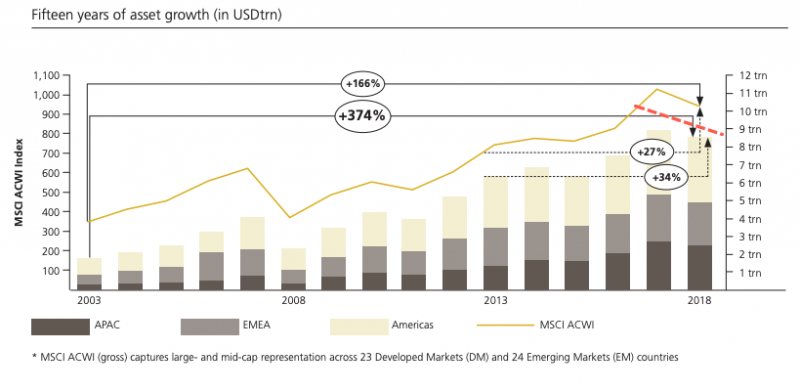

Billionaire Boom “Has Now Undergone A Natural Correction”

Over the last five years ending in 2018, the billionaire boom created more billionaires than the world has ever seen. These financial elites saw their wealth increase by more than a third over the same period, but as soon as 2018 rolled around, the billionaire boom deflated, according to a new UBS/PwC Billionaires Report.

Read More »

Read More »

French-speaking cantons biggest winners from next year’s fiscal transfers

The amount of money paid by “rich” cantons to “poor” ones will rise by CHF 61 million to CHF 5.3 billion in 2020, according to a recent government press release. The only French-speaking canton paying will be Geneva. All of the rest will see the sums they receive rise compared to 2019. In 2020, Geneva will pay CHF 275 million, down slightly from the CHF 300 million it paid in 2019.

Read More »

Read More »