Tag Archive: newsletter

Gerd Kommer Capital im Test | Erfahrungen mit dem neuen Robo-Advisor | Digitales Weltportfolio

Gerd Kommer Capital: Wie gut ist der neue Robo-Advisor?

Jetzt in Kommers Weltportfolios investieren: ►► https://de.extraetf.com/go/gerd-kommer-capital

ℹ️ Infos zum Video:

Gerd Kommer Capital Test: In diesem Video stelle ich Ihnen den Robo-Advisor von Dr. Gerd Kommer vor. Gemeinsam mit meinem Team habe das Angebot bereits im Vorfeld detailliert analysiert und für Sie bewertet. Erfahren Sie, welche Vorteile die Kommer Weltportfolios bieten.

Im...

Read More »

Read More »

FX Daily, January 13: PBOC Sends Signal as Market Looks Past Impeachment Vote

The US dollar is regaining ground lost in yesterday's setback against the major currencies. Sterling is the notable exception. It was toying with the $1.37 area, perhaps helped by the Governor of the Bank of England signal that there still are hurdles to adopting negative interest rates, which the futures market is still discounting for as soon as midyear.

Read More »

Read More »

Covid: Switzerland grants approval for second vaccine

On 12 January 2021, Swissmedic, the Swiss agency for the authorisation and supervision of pharmaceutical products, approved a second vaccination against the SARS-CoV-2 virus for the Swiss market.

Read More »

Read More »

Über Professor Jesús Huerta de Sotos Buch: „Die Theorie der dynamischen Effizienz“

11. Januar 2021 – Lesen Sie nachfolgend einen Auszug aus der von Hardy Bouillon verfassten Einleitung zum Buch „Die Theorie der dynamischen Effizienz“ von Professor Jesús Huerta de Soto – eine Aufsatzsammlung, die im vergangenen Jahr im Verlag Duncker & Humblot erschienen ist. Herausgeber des Buches ist ebenfalls Hardy Bouillon.

Read More »

Read More »

Covid-hit restaurants call for ‘compensation now’

Half of all hotel and restaurant businesses in Switzerland will go bankrupt by the end of March if they do not receive immediate financial compensation for the effects of coronavirus restrictions, warns the sector’s umbrella organisation.

Read More »

Read More »

Episode 8: Why The Dollar Isn’t Money – PART 2

In a prior episode, we introduced the distinction between money and fiat currency, discussing what gives the dollar – or any fiat currency – its value. Now, we continue that conversation discussing additional characteristics of money, and illustrate how a false definition of money can lead to a corrupt state that wields blank checks.

Read More »

Read More »

Let Unsound Money Wither Away

Chairman Paul and members of the subcommittee, I am deeply honored to appear before you to testify on the topic of fractional-reserve banking. Thank you for your invitation and attention. In the short time I have, I will give a brief description of fractional reserve-banking, identify the problems it presents in the current institutional setting, and suggest a potential solution.

Read More »

Read More »

Dollar Runs Out of Steam as Sterling Leads the Way

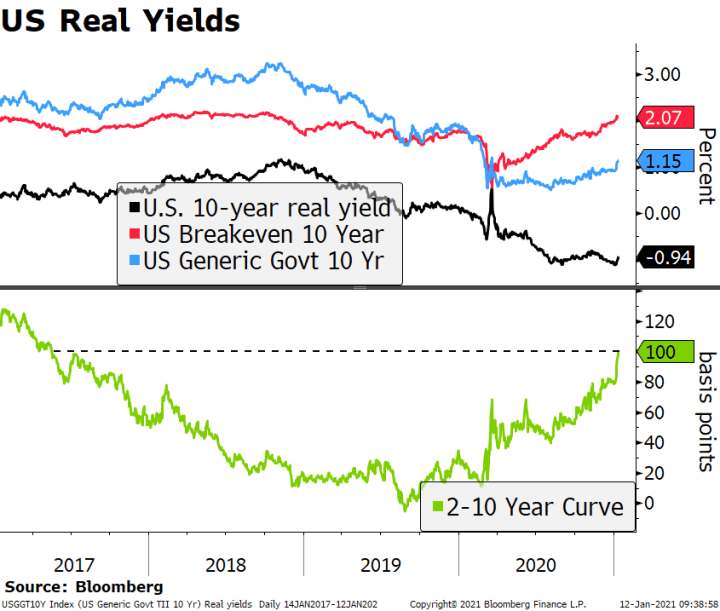

The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation.

Read More »

Read More »

FX Daily, January 12: Markets Catch Collective Breath

Overview: The capital markets were stabilizing today after dramatic moves yesterday. Equity markets are recovering, and the dollar is paring yesterday's gains. Most equity markets in the Asia Pacific region rose, though Taiwan, South Korea, and Australia were notable exceptions.

Read More »

Read More »

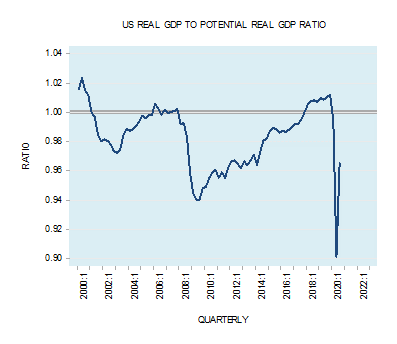

Fiscal Stimulus vs. Economic Growth

[unable to retrieve full-text content]For most experts a key factor that policymakers should be watching is the ratio between actual real output and potential real output. The potential output is the maximum output that the economy could attain if all resources are used efficiently. In Q3 2020, the US real GDP–to–potential US real GDP ratio stood at 0.965 against 1.01 in Q3 2019.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 11 janvier 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

FX Daily, January 11: Greenback Extends Recovery

Julius Ceasar is said to have "crossed the Rubicon" on January 10, 49 BCE, taking the 13th Legion into Rome, defying orders from the Senate, and precipitating the Roman Civil Wat that marked the end of the republic and the birth of the empire.

Read More »

Read More »

Covid: closing Swiss schools one of most effective measures, says study

The number of Covid cases went down significantly in Switzerland during spring as a result of schools closing, according to a study by ETH Zurich, reported RTS. Researchers at the university analysed anonymised mobile phone data of 1.5 billion movements of the Swiss population between 10 February and 26 April 2020. They used this data to calculate how much certain measures reduced mobility and contact.

Read More »

Read More »

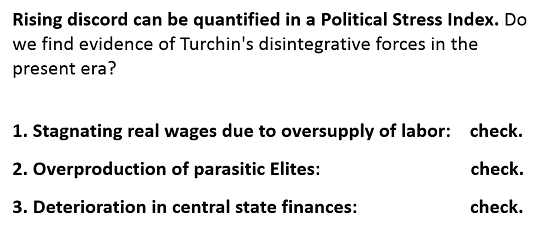

2021: If It Wasn’t For Bad Luck, We Wouldn’t Have No Luck At All

If we have indeed begun a sustained "reversal of fortune", it might be prudent to consider the possibility we're only in the first inning of a sustained run of back luck.

Read More »

Read More »

Switzerland hit by widespread malware campaign

Several security bodies in Switzerland have been targeted by emails that appear to come from official organisations such as banks or the police and contain a password for a zip file. When this file is opened, the computer becomes infected with a trojan called Emotet.

Read More »

Read More »

There Ain’t No Success like Failure

Like me you are probably looking over photos of supposed Trump supporters breaching the ramparts and storming the Capitol yesterday. That is if you can find them. To “protect” us from viewing these incredibly “disturbing” scenes, Twitter has helpfully announced that it will severely restrict their distribution across its network.

Read More »

Read More »

The Capitol Riot Wasn’t a Coup. It Wasn’t Even Close.

On Wednesday, a mob apparently composed of Trump supporters forced its way past US Capitol security guards and briefly moved unrestrained through much of the capitol building. They displayed virtually no organization and no clear goals.

Read More »

Read More »

They’ve Gone Too Far (or have they?)

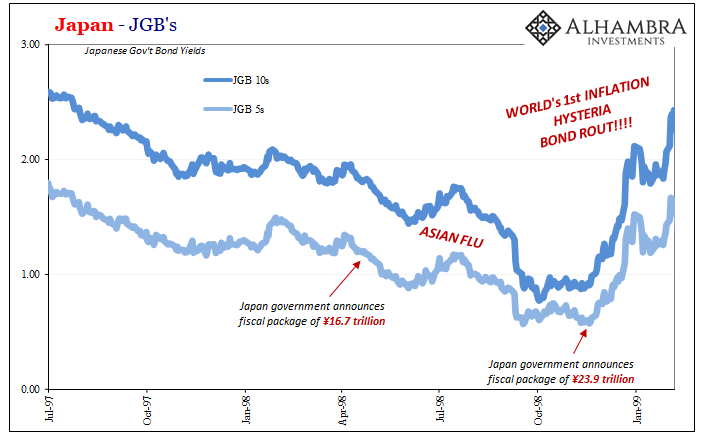

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

Company bankruptcies fell sharply in Switzerland in 2020

Despite the economic impacts of the coronavirus, significantly fewer Swiss companies went bankrupt in 2020 than the year before, according to the business data company Bisnode.

Read More »

Read More »