Tag Archive: newsletter

Weekly Highlights from The Real Investment Show for Week Ending

It was the week of The Big Thaw, and Texas got back to business:

* What Happens When the Fiscal Sugar Rush Wears Off

* How You Know You're Investing at the Peak of the Market

* The Tik-Tok Investing Couple (what could possibly go wrong??)

* The Fed's Two Elephants in the Room

- Chief Investment Strategist Lance Roberts w Portfolio Manager, Michael Lebowitz, CFA, & Senior Advisor, Danny Ratliff, CFP

Read More »

Read More »

Fed Considers New Interventions as Bond Markets Tumbles

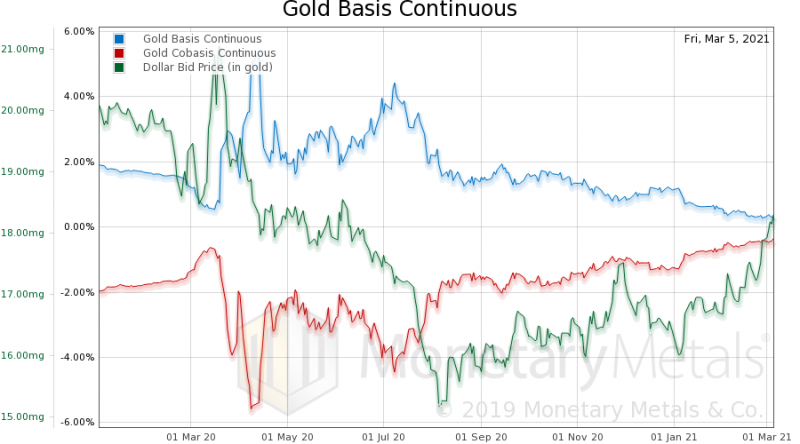

As financial markets sold off this week, precious metals got dragged down in the selling. The culprit, once again, was rising bond yields...

Read More »

Read More »

FX Daily, March 8: Greenback Trades Higher in Asia before Momentum Stalls in Europe

Overview: The attack on Saudi Arabia's largest crude terminal reverberated through the capital markets, where sentiment was already fragile, despite the lack of disruption. Brent rose to nearly $71.40, and April WTI to almost $68 extended their gains for the fourth consecutive session before being fully unwound.

Read More »

Read More »

CK*TV: Wie umgehen mit der Angst? Helmut Reinhardt im Gespräch mit Dr. Daniele Ganser

Aktuell leiden viele Menschen unter großen Ängsten. Während die einen um ihre Existenz bangen, fürchten sich andere vor der Ansteckung mit einem Virus, wieder andere sind gelähmt von dem Gedanken, dass die Demokratie verloren geht und wir uns einem totalitären System nähern. Helmut Reinhardt spricht mit dem Schweizer Historiker Dr. Daniele Ganser darüber, wie man mit den eigenen - und den Ängsten anderer - besser umgehen kann...

Sehen Sie weitere...

Read More »

Read More »

Jordan Petersons wichtigste Lebensregel

8. März 2021 – Jordan Peterson ist zurück, und die wichtigste Lektion aus seinem Buch bleibt so wichtig wie eh und je.von John MiltimoreJohn MiltimoreVor fast zwei Jahren kauften Freunde für mich ein Exemplar des Bestsellers 12 Regeln fürs Leben von Jordan Peterson.

Read More »

Read More »

The Battle between Inflation and Deflation – [Rich Dad’s StockCast]

Right now, there is a battle going on in our economy. This battle has created confusion for most investors. We received quite a few comments about this struggle. Our viewer Stephan Shapiro, sums it up perfectly: “I read so many conflictive forecasts and data about the economy continuing boom or going bust I have a case of analysis paralysis.”

Read More »

Read More »

US Arbeitsmarkt springt an – US Opening Bell mit Marcus Klebe – 05.03.2021

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler Anbieter von Multi-Asset-Trading- und Investmentlösungen.

Read More »

Read More »

Bitcoin – Ende der Blase? Gibt es Gemeinsamkeiten mit Tesla #BTC #TSLA

Seit Erreichen des Allzeit-Hochs hat der Bitcoin Preis bereits 20% nachgelassen. Deutliche #Abstürze wechseln sich mit #Aufschwüngen ab. Einen ähnlichen Anstieg hat auch der Tesla Kurs gezeigt. Seit dem #All-Time-High hat auch die Tesla Aktie massiv nachgelassen. Ich suche nach Erklärungen und diskutiere Ähnlichkeiten.

Read More »

Read More »

The Economics and Ethics of Government Default, Part II

The economic analysis of repudiation applies to the debt of all levels of government and to all countries. The central question is not how big the government is or how much it owes, but rather whether the debt is funded by taxes.

Read More »

Read More »

WICHTIGE WORTE AN ALLE! MARKUS KRALL PROGNOSE & ANALYSE & UBER GELD & WIRTSCHAFT

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Read More »

Read More »

Too Busy Frontrunning Inflation, Nobody Sees the Deflationary Tsunami

Those looking up from their "free fish!" frolicking will see the tsunami too late to save themselves. It's an amazing sight to see the water recede from the bay, and watch the crowd frolic in the shallows, scooping up the flopping fish. In this case, the crowd doing the "so easy to catch, why not grab as much as we can?" scooping is frontrunning inflation, the universally expected result of the Great Reflation Trade.

Read More »

Read More »

Währungen verlieren im Zeitablauf an Kaufkraft: Na und? // Ankündigung Special Guest

Warum es irrelevant ist, dass Währungen über die Zeit an Kaufkraft verlieren.

? Du möchtest nach dem Weltportfolio-Konzept von Gerd Kommer investieren? Erfahre mehr über den neuen Robo Advisor Gerd Kommer Capital: http://gerd-kommer-capital.de/youtube-promo/ *

ℹ️ Infos zum Video:

Häufig wird an modernen Währungen ("Fiat-Money") kritisiert, dass sie in den letzten 100 Jahren durch Inflation über 90% ihrer Kaufkraft verloren hätten....

Read More »

Read More »

Alasdair Macleod: Bitcoin Will Die Along with Fiat Currencies

Tom welcomes a new guest to the show, Alasdair Macleod. Alasdair is the Head of Research for Goldmoney and an advocate for sound money.

Read More »

Read More »

Die ökonomischen Effekte der Pandemie: Eine Österreichische Analyse

5. März 2021 – Nachfolgend finden Sie die Einleitung des Aufsatzes „Die ökonomischen Effekte der Pandemie: Eine Österreichische Analyse“ von Jesús Huerta de Soto. Den Text in voller Länge können Sie hier herunterladen.

Read More »

Read More »

Swiss government wants to keep control of weapons exports

The Swiss government has rejected calls to allow voters and cantons to set conditions for weapons exports. A people’s initiative collected enough signatures in 2019 to force a nationwide vote on the issue.

Read More »

Read More »

Markus Krall: Schuldenorgie und Geldflut, der Kollaps des Fiat-Geldsystems!

MARKUS KRALL: Schuldenorgie und Geldflut, der Kollaps des Fiat-Geldsystems! Wir befinden uns bereits in einer Krise, nur ist sie fein getarnt!

Read More »

Read More »

Playing Games with Stocks

The GameStop saga—can we call it an insurrection?—wants easy heroes and villains. Both are available. The populist version of the story goes like this: a few thousand angry gamers, colluding via the now infamous WallStreetBets subreddit, brought at least one powerful hedge fund to its knees.

Read More »

Read More »

14.000 zum Freitag – “DAX Long oder Short?” mit Marcus Klebe – 05.03.2021

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler Anbieter von Multi-Asset-Trading- und Investmentlösungen.

Read More »

Read More »

Bitcoin Price, Regulation and how fast can you invest 1 billion (German Subtitles)

Exclusive interview with Michael Saylor: Bitcoin price, Next company acquisitions and regulation. Michael J. Saylor is an American entrepreneur and business executive. He is the co-founder and head of MicroStrategy, a company that provides business intelligence, mobile software and cloud-based services. MicroStrategy currently holds approximately 90,859 Bitcoins. Enjoy the interview with German subtitles.

Read More »

Read More »