Tag Archive: newsletter

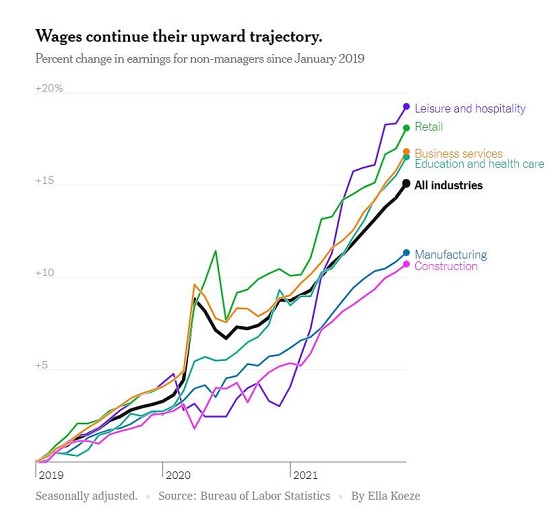

What’s Worse Than Inflation? Depression + Inflation

If "markets" controlled by the rich are allowed to distribute essentials, the result will be civil disorder and the overthrow of regimes. What's worse than inflation? Depression + Inflation. And that's where we're heading. As I explained yesterday in The Fed Can't Stop Supply-Side Inflation, central banks are trying to reduce inflation by crushing demand.

Read More »

Read More »

WELLE BEGINNT ZU KIPPEN!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Ukraine Nuclear Chief warns over Russian activity at nuclear site | Latest World News | WION

Zaporizhzhia Nuclear Power Plant which is at the center of the Ukraine conflict continues to worry over a possible nuclear disaster. Reports now suggest that a detailed plan has been drawn up by Russia to disconnect Europe's largest nuclear plant from Ukraine's grid, citing concerns ahead of Ukraine's atomic energy.

Read More »

Read More »

Number of businesses and jobs fell in 2020 for the first time since 2011

25.08.2022 - In 2020, the Swiss economy had almost 617 000 businesses and just under 5.3 million jobs. After uninterrupted growth since the start of the statistical series in 2011, the number of businesses and jobs has declined for the first time. Compared with 2019, around 900 fewer units and 33 000 fewer workplaces were recorded, a decline of 0.1% and 0.6% respectively.

Read More »

Read More »

Jeffrey Snider about US Dollar

Jeffrey Snider about US Dollar: How the global monetary system actually works. What really make the FED. What is QE and QT.

Read More »

Read More »

ANDREAS POPP WARNT JETZT!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

WARUM SIE IHRE EIGENE BIOGRAFIE SCHREIBEN SOLLTEN (& wie es mit minimalem Aufwand geht)

Wieso jeder sein Leben festhalten sollte und wie man dies bewerkstelligen kann. Außerdem: Wieso der Spirit so wichtig ist für Zufriedenheit, Motivation und Erfolg, privat und wirtschaftlich.

? Salomon Heine *https://amzn.to/3v02ZOn

Tagebücher *https://amzn.to/3cAud80 *https://amzn.to/3yWrEof *https://amzn.to/3OkMIKB

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ WKN: 663307

„ME Fonds - PERGAMON“ WKN:...

Read More »

Read More »

Alasdair Macleod: The Current System is Close to Collapse

Tom welcomes back Alasdair Macleod to the show. Alasdair is the Head of Research for GoldMoney and an advocate for sound money.

Palisade is also on Odysee https://odysee.com/@PalisadesGoldRadio:c and Rumble https://rumble.com/c/c-1586024

To subscribe to our newsletter and be notified of new shows, please visit http://palisadesradio.ca

Tom welcomes back Alasdair Macleod to the show. Alasdair is the Head of Research for GoldMoney and an advocate...

Read More »

Read More »

Long-Chance in Dax und Nifty

Die jüngste Korrektur im Dax wurde von unserem Analysten Martin Goersch erwartet. Allerdings hat der Index nun knapp über 13.000 Punkte Unterstützung gefunden. Auch das wurde erwartet. Ist sie jetzt hier - die neue Long-Chance?

Deutlich stabiler als die meisten anderen Indizes läuft aktuell der Nifty in Indien. Auch dieser ist bei Tickmill handelbar. Martin schaut auf den Chart und zeigt die Chancen auf.

Read More »

Read More »

It’s ALL about Anticipation….

If you can anticipate the nuances of the market, you can become an All Star trader.

Athletes and traders have a lot of parellels that make comparisons easy and informative.

A medical study on athletes showed that pro athletes don't have reflexes that are faster than the general public. What differentiates the all stars from the rest, is their ability to anticipate the future.

Successful traders need to anticipate as well. Traders need to...

Read More »

Read More »

Breaking: Russia & China Makes Case For GOLD… But Nobody Noticed | Alasdair Macleod | Gold Price

Breaking: Russia & China Makes Case For GOLD... But Nobody Noticed | Alasdair Macleod | Gold Price

⬇ Inspired By: ⬇

#alasdairmacleod #goldprice

--------

? Checkout These Similar Videos?:

-------

? Don't Forget To Subscribe For More: shorturl.at/twPQ2

Read More »

Read More »

1 Euro = 0,99 Dollar oder 0,96 Rappen – Wie geht es weiter? / Hans A. Bernecker am 24.08.2022

Themencheck von Walter Tissen ("Bernecker.TV") mit Hans A. Bernecker ("Die Actien-Börse"), verkürzte FreeTV-Variante des Gesprächs im Rahmen von Bernecker.TV am 24.08.2022. Schlaglichter:

++ Fehlende Impulse in den kommenden Wochen

++ Kritische Stimmen zum #Euro in der Vergangenheit

++ Euro als Weichwährung

++ Deutschland mit begrenztem Einfluss in der #EZB

++ Aktienmarkt Schweiz verdient einen Platz im #Depot

++...

Read More »

Read More »

Verschuldet mit 22: Teufelskreis Konsumschulden

Originalvideo:

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect: *http://www.minimalfrugal.com/comdirect

► Onvista:...

Read More »

Read More »

GESAMTMÄRKTE – CRASH ODER HOPIUM? Das machen gute Investoren!

Wie sieht es aus mit den Gesamtmärkten? In diesem kurzen Video findest du alle Informationen, wie es weitergehen könnte und was du beachten sollst. Nicht verpassen!

- Ausschnitt vom Video: LIVE: WICHTIGE GEDANKEN ZUR AKTUELLEN SITUATION

------------

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr verpassen?...

Read More »

Read More »

Ukraine beschlagnahmt Cryptocoin Wallets mit Verbindungen zu Russland

Schon beim Freedom Convoy in Kanada wurden Inhalte von Crypto-Wallets staatlich beschlagnahmt. Auf diversen Plattformen wurden Wallets blockiert und die darin befindlichen Cryptocoins konfisziert, sofern diese in Verbindung mit den regierungskritischen Protesten standen. In der Ukraine wird nun dieselbe Strategie verfolgt.

Read More »

Read More »

Unsicherheit am Markt: So findest du Dividenden mit Potential

Dividenden sind ein immer währendes Thema an der Börse, aber lohnt es sich auch im aktuellen Markt für dich, dir ein Dividendenportfolio zusammenzustellen? Ab wann sich Dividenden für dich lohnen und wie du dieses Thema angehen kannst, verrate ich dir in diesem Video.

Read More »

Read More »

Major US indices higher and trading between 100/200 hour MA and awaits the next shove.

The last week, the major US stock indices have seen the price come off the short covering boil and return between the shorter term 100 and 200 hour MA. Today the prices are higher and that took the indices more toward the middle of those MA ranges.

Often ahead of a key event, traders will take the price toward these neutral areas as a way to keep both the bullish and bearish options open.

With Jackson Hole Symposium getting underway, the...

Read More »

Read More »

ETHEREUM MERGE! JETZT ETH KAUFEN?

Ethereum Merge ist ein heisses Thema in der Cryptowelt, positiv oder negativ? Extrem viele User schreiben mich an, da sie unsicher sind, was der Merge genau bedeutet für sie. Jetzt ETH kaufen?

- Ausschnitt vom Video: LIVE: WICHTIGE GEDANKEN ZUR AKTUELLEN SITUATION

---------------

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

?...

Read More »

Read More »

Markt sucht nach Antworten auf die Geldpolitik der FED – US Opening Bell mit Marcus Klebe – 25.08.22

Markt sucht nach Antworten auf die Geldpolitik der FED - US Opening Bell mit Marcus Klebe - 25.08.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:...

Read More »

Read More »