Tag Archive: newsletter

Andreas Beck: Warum Stock Picking bei Aktien nicht funktioniert

Innerhalb von nicht mal drei Jahren hat Dr. Andreas Beck das Fondsvermögen seines „GlobalPortfolioOne“ auf mehr als 330 Millionen Euro steigern können – nicht zuletzt auch, weil er im Corona-Börsencrash im März 2020 bewiesen hat, dass seine antizyklische ETF-Strategie gerade in Krisenzeiten seine Stärken ausspielt.

Der promovierte Mathematiker investiert breit gestreut und wissenschaftlich fundiert mittels Indexfonds und ETFs weltweit in Aktien...

Read More »

Read More »

FED WILL WEHTUN

Fed will Haushalten und Unternehmen wehtun

Die FED muss die Zinsen nach Aussage von Jerome Powell weiter anheben und auf einem höheren Niveau halten, bis sie sicher ist, dass die Inflation unter Kontrolle ist. Dieser Prozess werde wahrscheinlich den Arbeitsmarkt schwächen und den Haushalten und Unternehmen einige Schmerzen bereiten, sagte Powell in seiner weithin erwarteten Rede beim geldpolitischen Symposium der Kansas City Fed in Jackson Hole....

Read More »

Read More »

Is a Recession Simply a Decline in GDP? What Does That Mean?

According to the National Bureau of Economic Research (NBER), the institution that dates the peaks and troughs of the business cycles: A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP [gross domestic product], real income, employment, industrial production, and wholesale-retail sales.

Read More »

Read More »

Zuseherfrage: Krankenstand, Arbeitnehmerrechte und Unternehmen

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Teespring ► https://unterblog.creator-spring.com/

Der Krankenstand in der Bevölkerung steigt. Das merken Unternehmen mehr, als der unaufmerksame Bürger. Unternehmen tragen dabei die große #Last des #Arbeitsausfalls. Ich finde das richtig, denn Unternehmen können diese Last leichter schultern als der kleine Angestellte. ABER! Man muss den Unternehmen auch #Reserven und #Polster...

Read More »

Read More »

Rüdiger Born blickt auf den Dow direkt nach der Powell-Rede

Jerome Powell hat ab 16 Uhr seine mit Spannung erwartete Rede gehalten. Was sagen die Märkte? Ich schaue mir im folgenden Video schwerpunktmäßig den Dow Jones an.

Wollen Sie meine Analysen im "Trade des Tages" erhalten? Dieses Angebot ist für Sie völlig kostenfrei! Melden Sie sich dafür einfach hier an.

https://finanzmarktwelt.de/trade-des-tages-von-ruediger-born-und-seinem-analystenteam/

BORN-4-Trading - Trading-Ideen kostenfrei aufs...

Read More »

Read More »

FED’s NEXT MOVE in Wake Of INFLATION | Fiat Currency Collapse | Alasdair Macleod

Is it really possible that the world's major fiat currencies could be replaced soon, perhaps by a hard-asset backed solution?

Today's guest expert, Alasdair Macleod believes so, having the made the case on this channel a few months ago.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

RESOURCES :

? Get $100 Bonus with iTrustCapital (Tax-Free Crypto IRA):

? https://itrust.capital/LWL The Best Crypto IRA Platform in America*, helping investors access Crypto, Gold and...

Read More »

Read More »

Um 16:00Uhr geht es heute los!!! – US Opening Bell mit Marcus Klebe – 26.08.22

Um 16:00Uhr geht es heute los!!! - US Opening Bell mit Marcus Klebe - 26.08.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR SIND:

JFD ist...

Read More »

Read More »

The US morning forex technical report. Fed Powell speech. Better PCE data weakens the USD

Fed Powell to speak at 10 AM ET

The core PCE data in the US came in better than expectations with helped to lower the dollar on hopes that a terminal rate can be found sooner rather than later. However, Fed Chair Powell will be speaking at 10 AM ET and could cause a shifting of the bias if he chooses to talk more above quantitative tightening. However, that would be outside his lane and that of Fed officials. So it is not expected.

The EURUSD,...

Read More »

Read More »

JETZT BITCOIN KAUFEN? Meine Bewertung und Meinung!

Wann Bitcoin kaufen? Diese Frage bekomme ich sehr oft gestellt. Mit diesem zeitlosen Video werde ich diese Frage beantworten, also nicht verpassen!

- Ausschnitt vom Video: LIVE: WICHTIGE GEDANKEN ZUR AKTUELLEN SITUATION

-----------

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr verpassen? ABONNIERE meinen Kanal:...

Read More »

Read More »

Balkonkraftwerk: Wie funktioniert das & was ist erlaubt?

Dürft Ihr einfach so eine Mini-PV-Anlage auf dem Balkon installieren? Worauf müsst Ihr dabei achten? Das und mehr erklärt Euch Saidi im Video.

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Finanztip Basics ► https://www.finanztip.de/youtube/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=...

Read More »

Read More »

GOLD, LITHIUM, URAN! Was DU bei MINEN Aktien beachten solltest

0:00 Intro - TESLA IST DA!

1:00 Minen-Aktiengesellschaften

2:30 In welche Aktien investieren?

4:30 Ein großes Risiko vs. Eine große Chance!

5:00 First Quantum Minerals Aktie

7:10 Franco-Nevada Corporation Aktie

9:00 Weitere Chancen und Risiken

10:30 Vorsicht vor PennyStocks

12:30 Die Wirtschaft passt sich an!

Read More »

Read More »

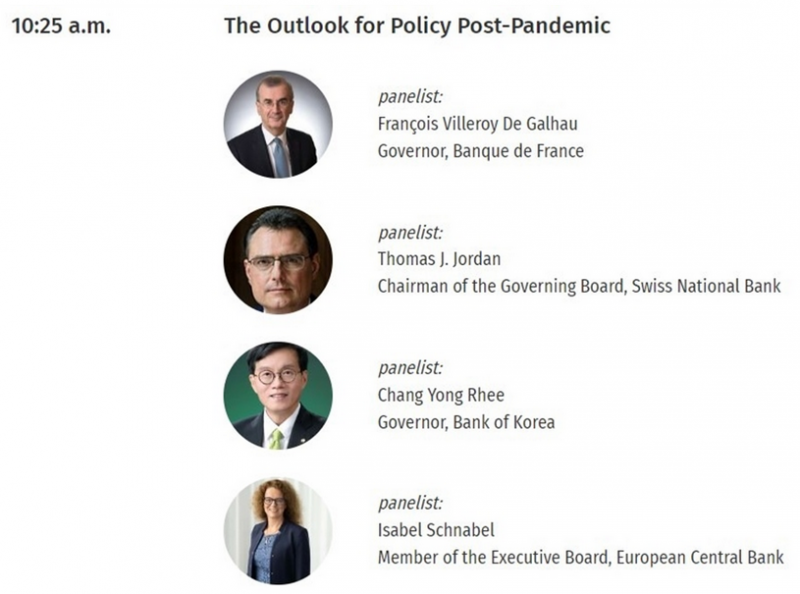

Heads up for ECB, SNB, BoK speakers over the weekend

On Saturday at the Jackson Hole symposium there will be speakers from the European Central Bank, Swiss National Bank and Bank of Korea.

Read More »

Read More »

Jackson Hole and More

Overview: Ahead of the much-anticipated speech by

Federal Reserve Chair Powell, the Fed funds futures are pricing in about a 70%

chance of a 75 bp hike next month. The

US 10-year yield is up nearly five basis points today to 3.07% and the two-year

yield is firm at 3.38%. Asia Pacific equities

were mostly higher, with China the main exception among the large markets, after

US equities rallied yesterday. Europe’s

Stoxx 600 is off about 0.3% to...

Read More »

Read More »

Novartis job cuts to heavily impact management roles

Of the 1,400 job cuts announced by the pharma giant in Switzerland, up to half of them will involve staff in leadership positions, the company said on Monday. For these executive roles, the consultation process has been finalised, and the first individuals concerned will be informed “in the coming weeks”, said the head of Novartis Switzerland Matthias Leuenberger at a media event in Zurich.

Read More »

Read More »

Dirk Müller: ? Panik an den Strombörsen – ein vornehmlich deutsches Problem

????? ??? ??? ????? ???????? ??????? ??? ???? ?ü???? ????:

https://bit.ly/CashkursSpezial220825

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Cashkurs Spezial vom 25.08.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre...

Read More »

Read More »

Warum Hebelprodukte dein Ende bedeutet | Mario Lüddemann

Des einen Freud, des anderen Leid! ? Das Thema: Hebelprodukte. Nirgendwo scheiden sich die Geister mehr bei den Tradern. Welche Vorteile es hat und wie es dir aber auch das Genick brechen kann, erfährst du in meinem heutigen Video.?

► INFOWEBINAR: 90 Tage Trader-Ausbildung von Börsenexperten. Informiere dich jetzt in unserem kostenlosen Webinar.

https://mariolueddemann.com/90tt_info1/

► Jetzt Termin vereinbaren und vom Experten beraten lassen!...

Read More »

Read More »

Die Blicke richten sich auf die Zentralbanken – “DAX Long oder Short?” mit Marcus Klebe – 26.08.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

Das neue Geldsystem – Was ist der Plan von Russland, USA, China? Interview mit Ernst Wolff

Reset des Finanzsystems – Der digitale Euro führt zum Spionage- und Kontrollsystem

Geldsicherheit LIVE: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Mehr zu Ernst Wolff: https://apolut.net/autoren/ernst-wolff/

Ernst Wolff auf YouTube: https://www.youtube.com/results?search_query=ernst+wolff+wolff+of+wall+street

Brisantes Interview mit Ernst Wolff zum digitalen Euro...

Read More »

Read More »

Die wichtigsten DIVIDENDEN-Kennzahlen als Investor

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss resident)

Die wichtigsten DIVIDENDEN-Kennzahlen als Investor

Wir schauen uns wichtige Schritte und Informationen zum Thema Dividenden an, mit denen man direkt das Wichtigste in Kürze erkennen kann.

#dividendentipps #investor #Finanzrudel

?? Dividenden-Aktien besser? ►►...

Read More »

Read More »