Tag Archive: newsletter

How the Policy of Price Stability Generates Greater Economic Instability

Many mainstream economists believe that economic stability refers to an absence of excessive fluctuations in the overall economy. An economy with constant output growth and low and stable price inflation is likely to be regarded as stable, while an economy with frequent boom-bust cycles and variable price inflation would be seen as unstable.

Read More »

Read More »

SILVER & GOLD: All Bets Are OFF – Alasdair Macleod | Gold Price Prediction

SILVER & GOLD: All Bets Are OFF - Alasdair Macleod | Gold Price Prediction

⬇ Inspired By: ⬇

#Goldprice #alasdairmacleod

--------

? Checkout These Similar Videos?:

SILVER & GOLD: All Bets Are OFF - Alasdair Macleod | Gold Price Prediction

-------

? Don't Forget To Subscribe For More: shorturl.at/twPQ2

Read More »

Read More »

Zerstört die FED die Wirtschaft? (Weltwirtschaftskrise)

Die momentanen Zeiten sind hart und sollte die Politik nicht eine starke Wendung einlegen, so drohen uns gar Unruhen. Heute beantworte ich euch, warum die massiven Leitzinserhöhungen der FED eine weltweite Schuldenkrise verantworten, wo wir im Zyklus stehen, ob es schon einmal geschichtliche Ähnlichkeiten gab und wie du dich momentan aufstellen solltest, all das in einer dieser Folge "Finanzielle Intelligenz". Viel Spaß!...

Read More »

Read More »

Willst Du Deine Renditen an der Börse steigern?

Http://traderiq.net/stillhalter

Meine Studenten bekommen mit dem System der Stillhalter Monat für Monat Traumrenditen, bei minimalen Risiken und geringem Zeitaufwand. Wie das geht?

Genau das zeige ich im kommenden Online-Event "Geheimnisse der Stillhalter".

http://traderiq.net/stillhalter

In mehreren Live Webinaren werde ich Schritt-für-Schritt aufzeigen, wie jeder an der Börse hohe Renditen bekommen kann - ohne sich vor einem Crash zu...

Read More »

Read More »

Ab wie viel € lohnt sich investieren? (Rentabilitäts-Check)

? Brandneues Krypto Rendite Training

? https://kryptorendite.com/yt/updates

? Jetzt eintragen & alle Updates erhalten!

#WieInvestieren mit 5000 Euro? Ab welcher Summe machen Investments wie #Aktien , ETFs, Bitcoin, Gold & Co eigentlich Sinn? Lohnt es sich mit 50 Euro monatlich einen ETF #Sparplan zu starten oder werden Gebühren und Steuern die Gewinne aus dem Investment auffressen? Ab wieviel Euro im Monat investieren wirklich Sinn macht,...

Read More »

Read More »

Übersterblichkeit und desolate Gesundheitszustände! Kommt es zu einer Finanzdepression?

Wir haben 15 Faktoren für unsere Investment Club Mitglieder bereitgestellt, welche euch erklären, warum man ganz anders investieren muss als die letzten 40 Jahre. Unter diesem Link könnt ihr einen Antrag auf eine Mitgliedschaft stellen https://florian-homm.com/

Die letzten 40 Jahre waren zum Investieren ein Nirvana und jetzt kommt ein tiefes schwarzes Loch.

Es geht um Übersterblichkeit und desolate Gesundheitszustände, welche sich seit dem Jahre...

Read More »

Read More »

Diese eine Sache hat mein Leben komplett verändert!

Heute lebe ich entspannt, ohne mir Sorgen um Geld machen zu müssen,

ohne die billige Übernachtung nehmen zu müssen, einfach freier.

Doch wie bei den Meisten, hat das nicht von Heute auf Morgen funktioniert!

Jeder kann das schaffen. Man muss nur gewisse Dinge beachten.

kostenloses Webinar ansehen???:

► https: https://go.investorenausbildung.de/3qNN7Mo

vereinbare jetzt dein kostenloses Beratungsgespräch??:

► https:...

Read More »

Read More »

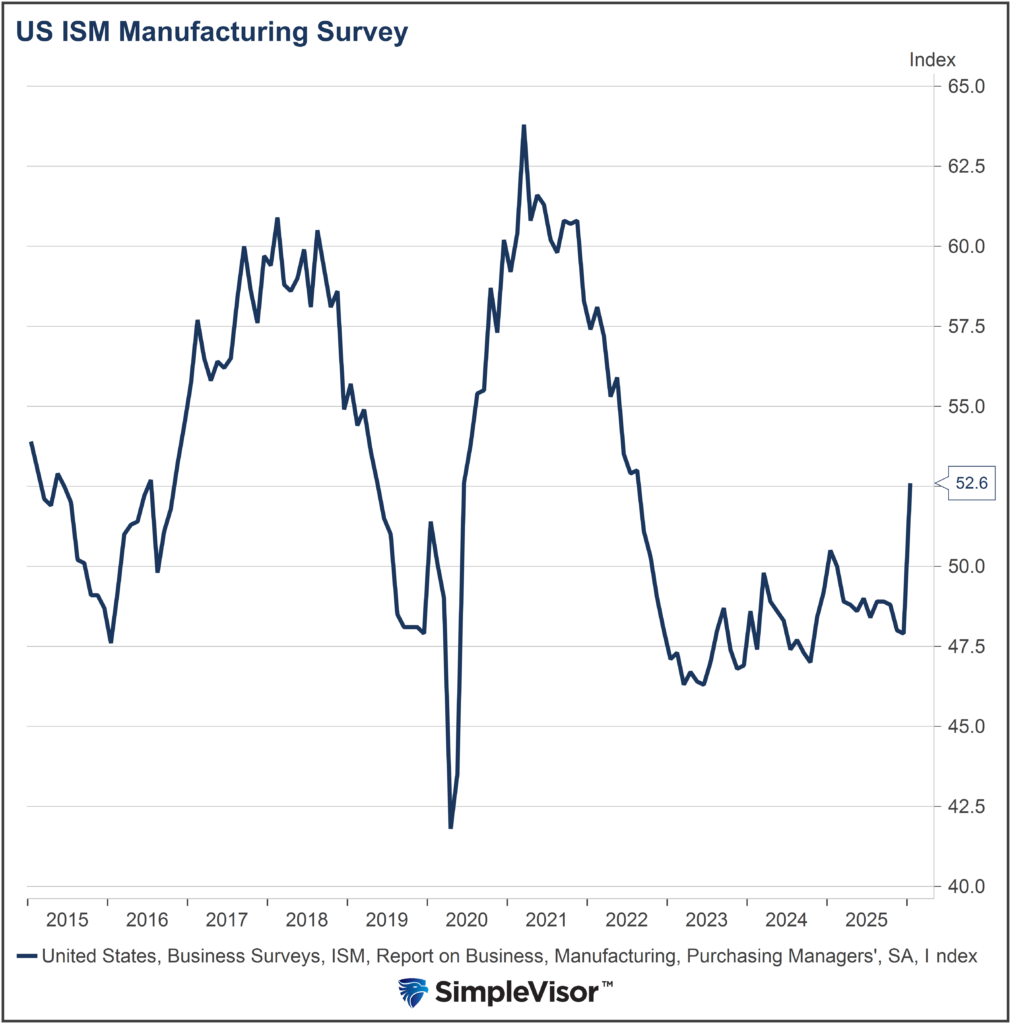

So LEICHT ist MARKET TIMING nicht!

Market Timing aufgrund von wirtschaftlicher Indikatoren ist schwieriger, als viele zu glauben scheinen.

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Aktien ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

? Mein Buch! Der Rationale Kapitalist...

Read More »

Read More »

October 2022 Monthly

The historic dollar rally accelerated in September. By some measures, it is as rich as it has been in the half-century since the end of Bretton Woods. Persistent price pressures, a robust labor market in many dimensions, and the Federal Reserve's latest forecasts warn that financial conditions will tighten into next year

Read More »

Read More »

Trading Wochenanalyse für KW 40/2022 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#BigPicture #Chartanalyse #MarcusKlebe

HIER geht es zur Webinarserie: TRADEN MIT KLEINEM KONTO IN 2022...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 05.10.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 05.10.22

US Opening Bell mit Marcus Klebe - 05.10.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe,...

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 06.10.22

US Opening Bell mit Marcus Klebe - 06.10.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe,...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 04.10.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 04.09.22

US Opening Bell mit Marcus Klebe - 04.09.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe,...

Read More »

Read More »

NVDA technical analysis

The next technical analysis video for Nvidia Corp. stock shows that bulls can plan a series of buys and set buy orders at lower prices to target a reversal.

I created a new approach. The 'Fibonacci Entry' Why?

As the price falls, Fibonnaci orders are placed.

1 NVDA is purchased

Then 2 NVDA stocks are bought at a lower price

Then 3 NVDA stocks are bought at a lower price

5, 8, 11, etc.

You decide the series' length. So are entry prices (which...

Read More »

Read More »

Reich werden vs. Reich bleiben: Der große Unterschied

Vermögen erhalten: So schützt du dein Vermögen!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=533&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=533&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️ Weitere Infos...

Read More »

Read More »

Ist FTX die günstigste Börse? inkl. Anleitung

Ist FTX die günstigste Börse? Spot, Future und Hebel Trading mit FTX

5% Lifetime Rabatt auf die FTX Gebühren ► https://www.talerbox.com/out/ftx *?

Bis zu 8% Cashback mit der Plutus Karte (10€ Bonus) ► https://www.talerbox.com/out/plutus *

Kostenloses Depot eröffnen (inkl. 20€ Bonus) ► https://talerbox.com/go/depot *?

Investor-Community Discord ►https://www.talerbox.com/go/discord ?

Zum Krypto-Börsen Vergleich ►...

Read More »

Read More »