Tag Archive: New Normal

Weekly Market Pulse: What Is Today’s New Normal?

Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be:

“a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the...

Read More »

Read More »

An unexpected blow to the ECB

Since the beginning of the year, the corona crisis has come to monopolize the news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling out of the German Constitutional Court in early May, that challenged the actions and remit of the ECB.

Read More »

Read More »

Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable.

Read More »

Read More »

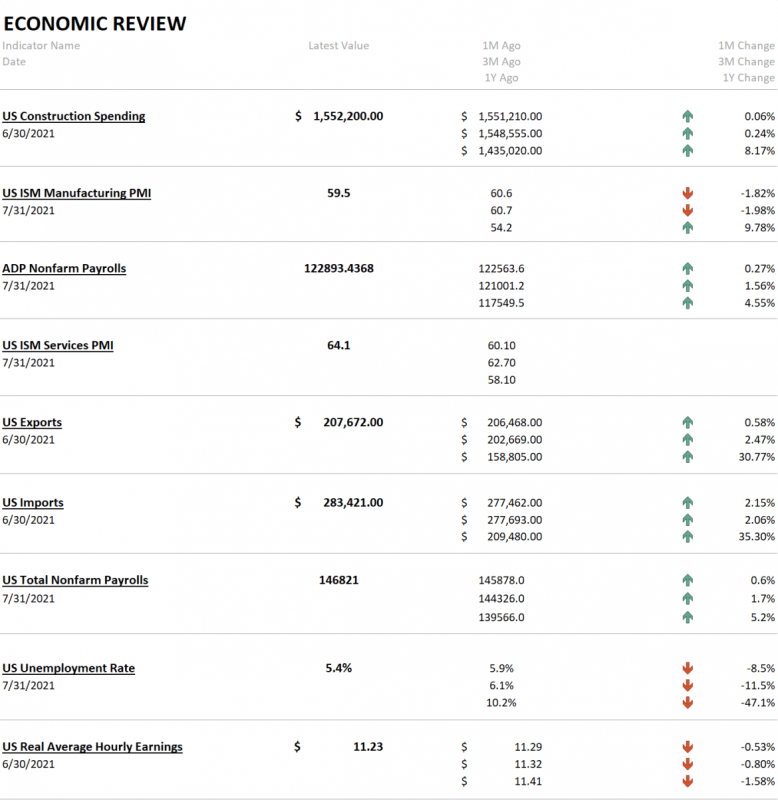

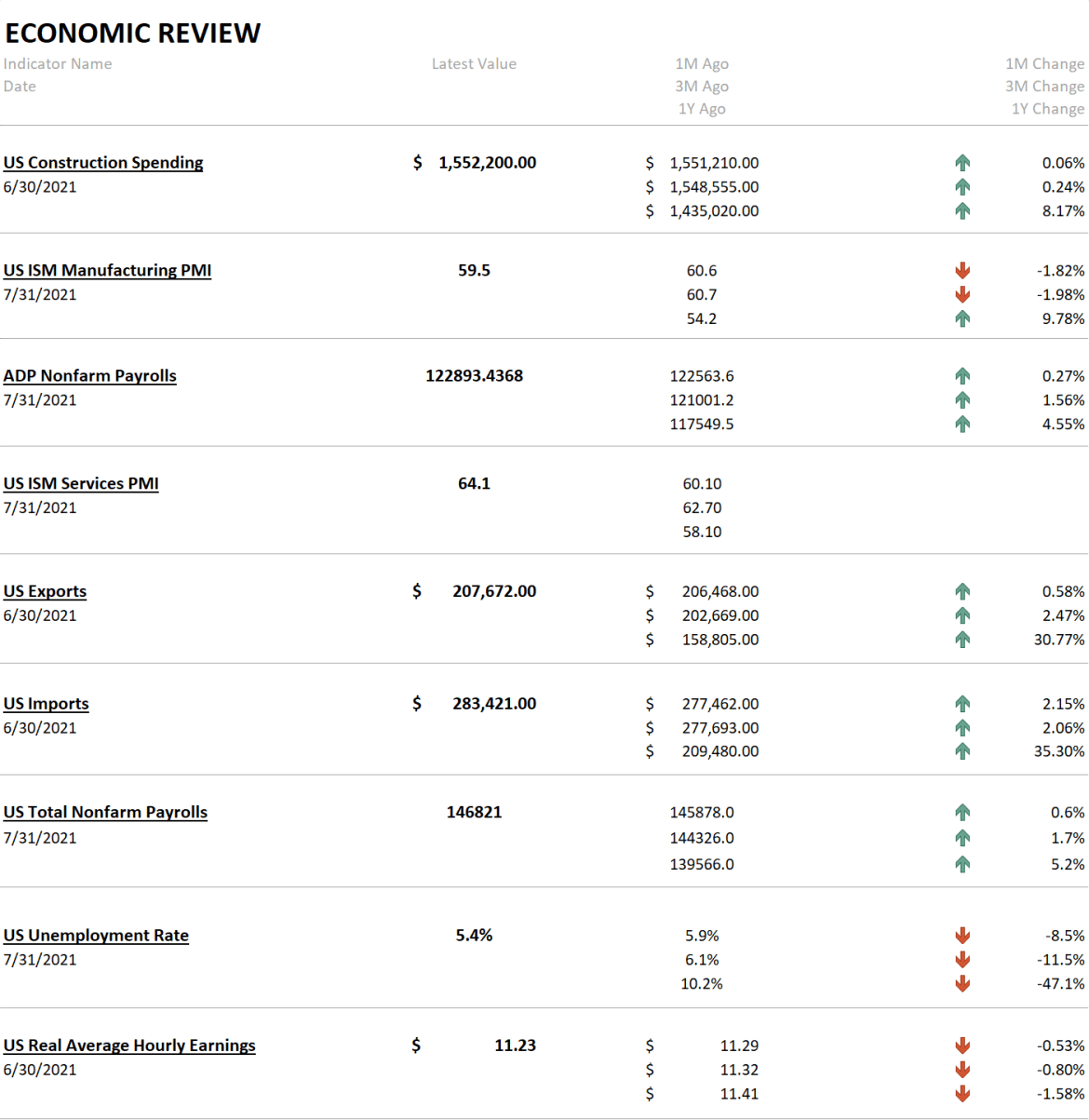

Monthly Macro Monitor: Market Indicators Review

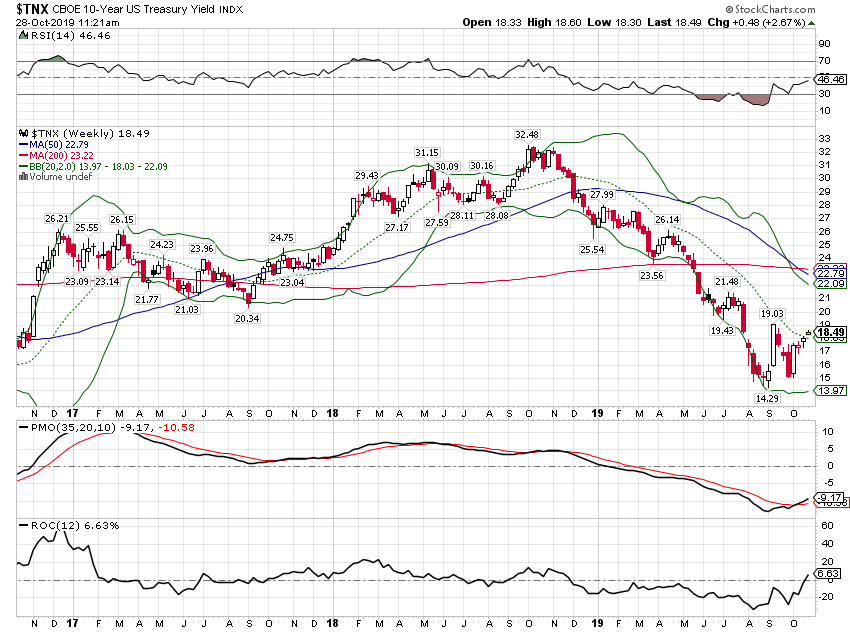

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations.

Read More »

Read More »

Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 - and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce competition in the industry has induced...

Read More »

Read More »

SNB to Follow the Bank of Japan? Part1

Questions to George Dorgan Is there any chance that the SNB or other central banks could follow the BOJ and just depreciate the currency? George Dorgan: What did the BoJ do? Monetary easing and talk down the yen in a mercantilist style. A central bank is able to talk down a currency only if there … Continue reading »

Read More »

Read More »