Tag Archive: money-market funds

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »

Effective Fed Funds and Money Markets

Fed funds have been trading firmly. There are several reasons and one of them is the shift that is taking place in the US money markets. Still the risk of a Fed hike has increased, just as speculation increases of easing in other major centers.

Read More »

Read More »

Great Graphic: Aussie Approaches Two-Month Uptrend

Australian dollar is the second heaviest currency this week after a key downside reversal at the end of last week. It is approaching an uptrend line near $0.7450. Many perceive an increased likelihood that the RBA eases and many are reassessing chance of a Fed hike later this year.

Read More »

Read More »

FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment.

Read More »

Read More »

Kuroda and the BOJ

Following today's FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow.

The SNB will keep its powder dry to be able to respond to the results of the UK

referendum if needed. The Bank of England is als...

Read More »

Read More »

Share buybacks and dividends with borrowed money: Cure Worse than the Disease

The Fed’s monetary policies have made funding share buybacks and dividend payments with borrowed money an attractive management tactic. In the face of stalling business prospects, these short-term gimmicks can make business operations appear healthy.

Read More »

Read More »

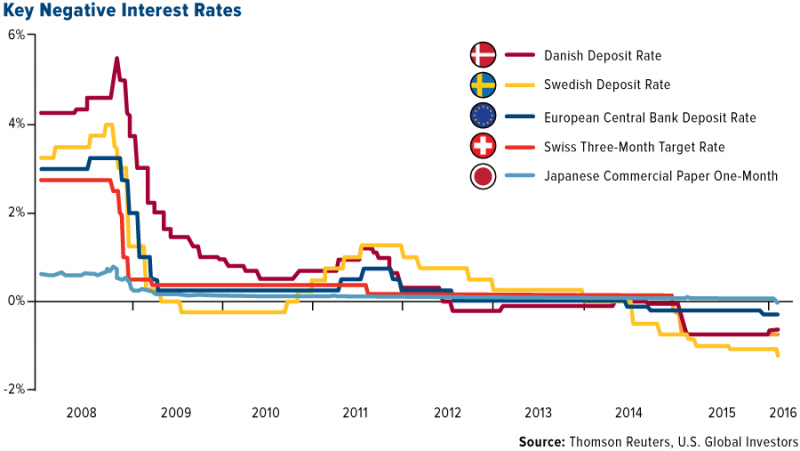

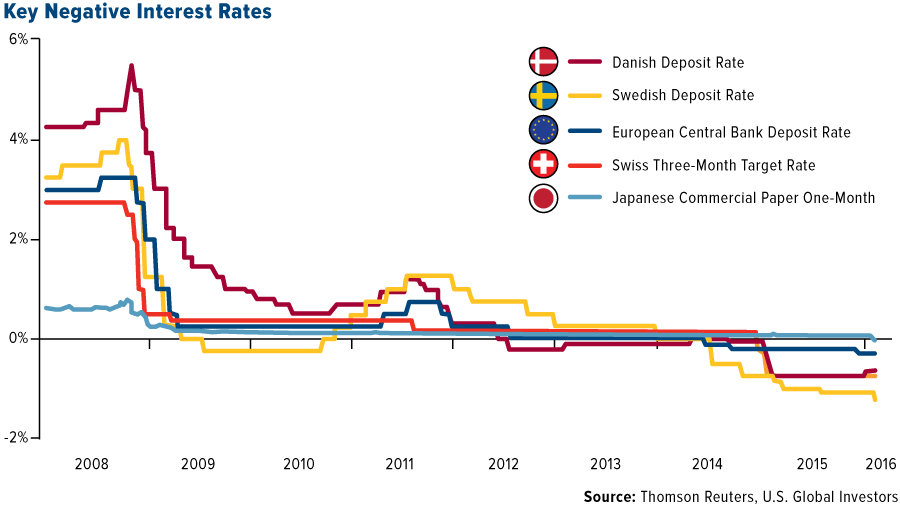

The Path to the Final Crisis and Negative Rates

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided ...

Read More »

Read More »

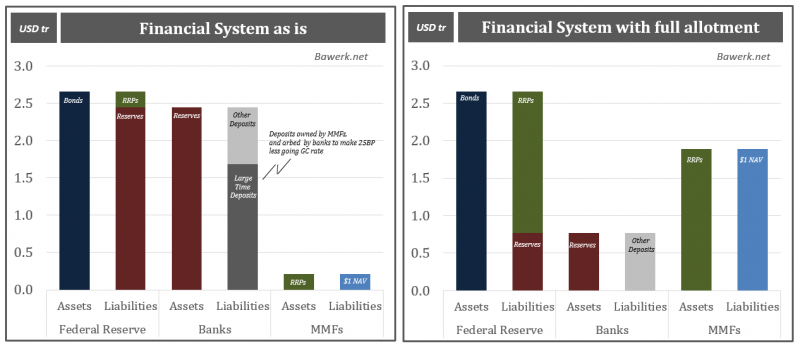

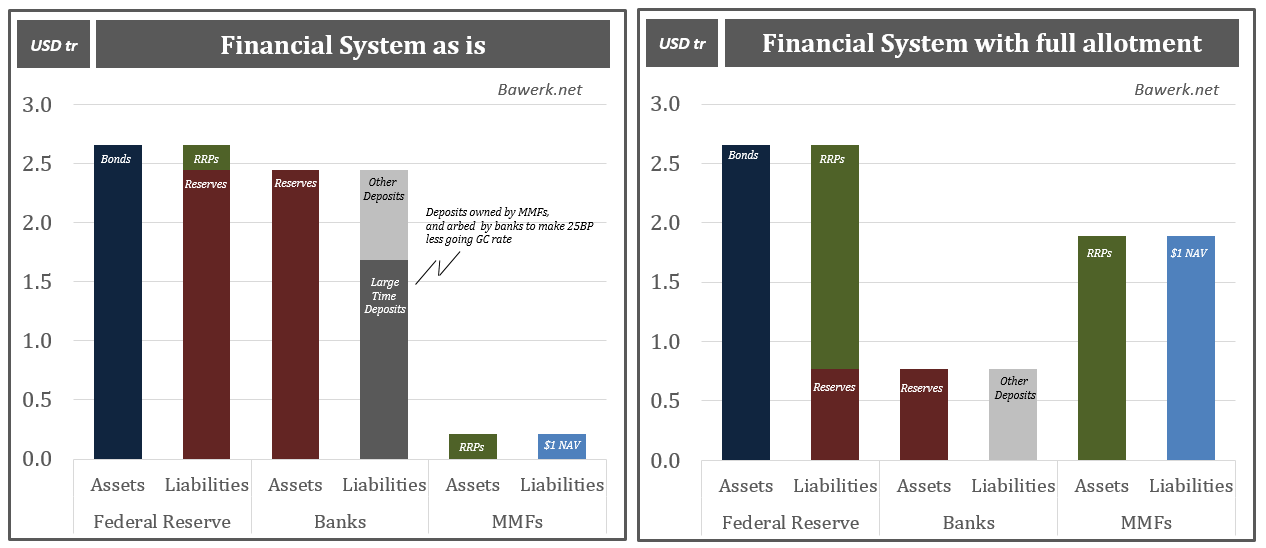

Unintended consequences of lift-off in a world of excess reserves

Bar a disastrous NFP print this coming Friday the US Federal Reserve will change the target range for the Federal Reserve (Fed) Bank’s Funds rate from the current level of zero – 25bp to 25 – 50bp on December 16th. The Fed will effectively raise the...

Read More »

Read More »

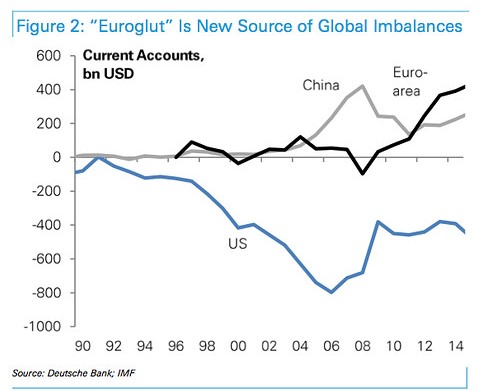

The Euro Glut: The Summer 2015 Update

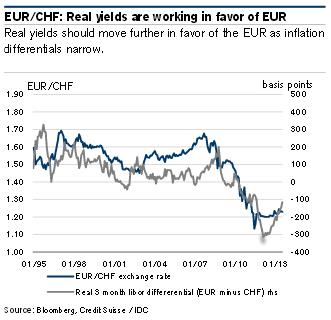

Deutsche Bank's George Saravelos was one of the first to use the term "euro glut". He anticipated a massive capital outflow from Europe that countered the huge European current account surplus. The Euro glut also led to the end of the EUR/CHF peg. Reasons are missing investment opportunities in Europe despite the high savings rate.

Read More »

Read More »

(6.1) FX Theory: The relationship between Current Accounts Surpluses and the Carry Trade

The EUR/USD is going on its longest winning streak for a long time. Since May 27, it has improved from 1.2850 to 1.3396 and is approaching 1.34. What are the reasons?

Read More »

Read More »

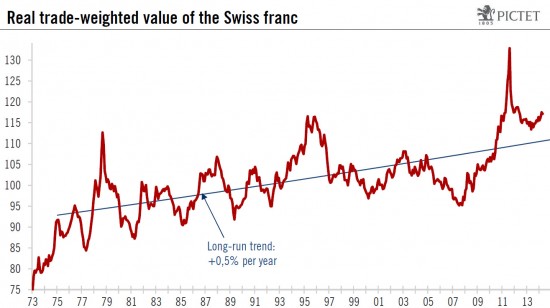

SNB Follows ECB? Pictet’s Negative SNB Interest Call

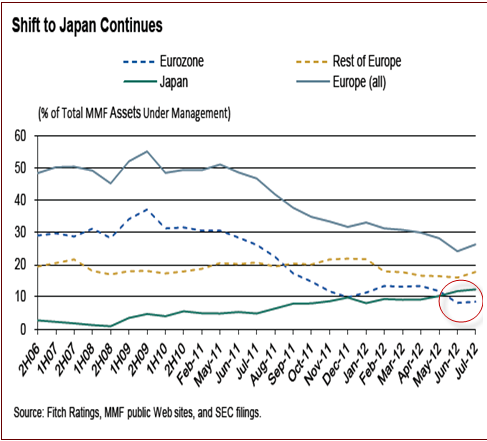

Pictet calls for negative interest rates in Switzerland in order to maintain rate differentials between the euro zone and Switzerland. Maintaining rate differentials would be useful for FX speculators and for money market funds that still invest in the euro zone.

Read More »

Read More »

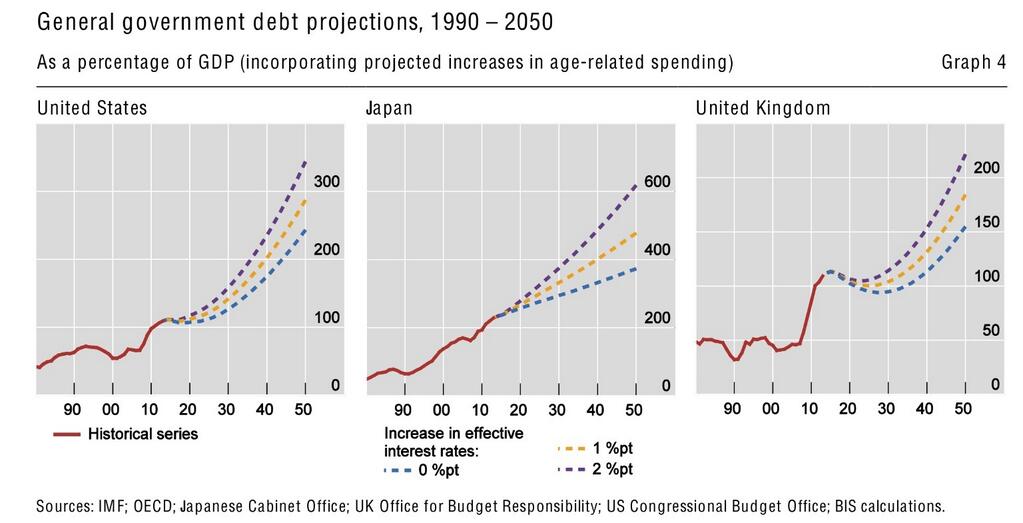

Central Banks’ Quasi-Fiscal Deficits and Potential Hyperinflation

There are different discussions ongoing if a central bank may monetize debt and act of a quasi-fiscal agent. One opinion was the Modern Monetary Theory that advocates monetizing debt.

Read More »

Read More »

ECB rate cut creates complex situation for SNB

Says Thomas Jordan.

Need to wait to assess impact of ECB rate cut

Wasn’t totally surprised by the cut

Interest rates will remain low in Switzerland

Low rates may lead to property bubble risk which SNB will respond to if necessary

SNB monitoring property market which is already in difficult situation

I did wonder about the lack of movement in EUR/CHF yesterday considering that nearly every other euro pair took a hit. It’s either become the...

Read More »

Read More »

Currency Positioning and Technical Outlook August 12: Corrective Pressures Dominate

Submitted by Marc Chandler, Global Head of Currency Strategy, Brown Brothers Harriman The main tension in the foreign exchange market is between positions adjusting pressures, which are US dollar negative, and widely held ideas that the trajectory of growth and interest rate differentials favor the US, which is dollar positive. There are some important economic data due …

Read More »

Read More »

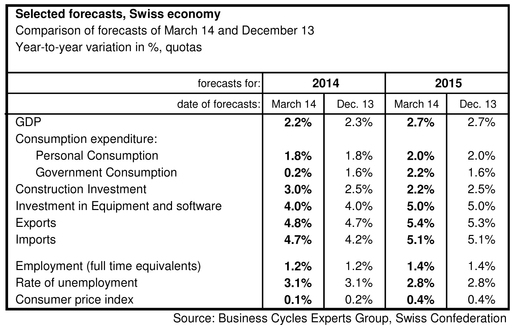

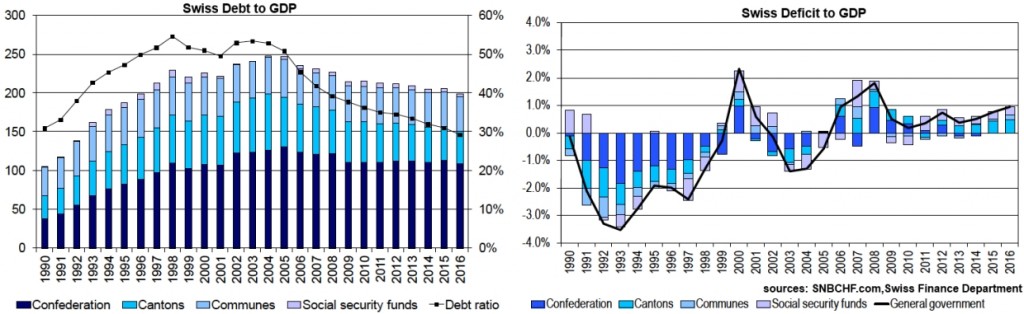

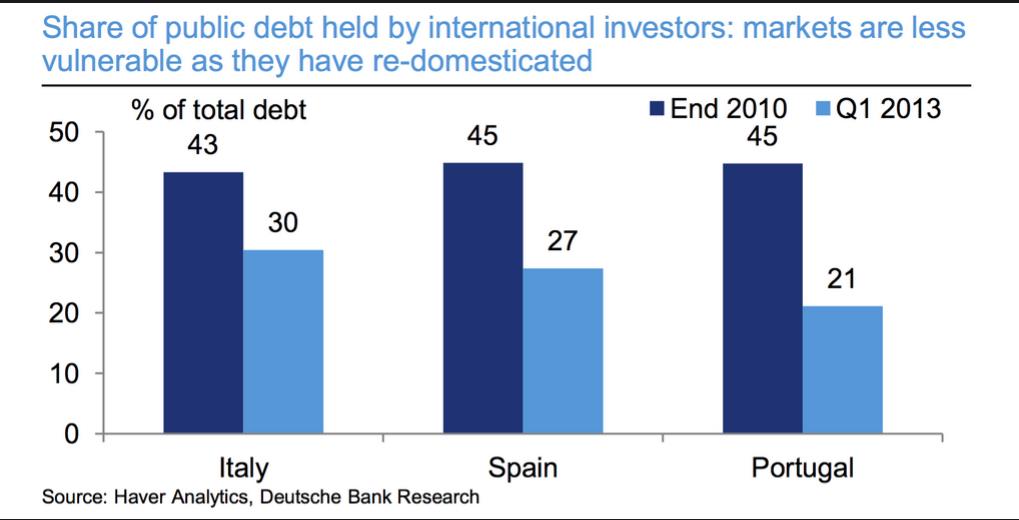

Debt Reduction, the new Financial Cycle, an Important Driver of EUR/CHF

In this analysis we describe why the long-lasting financial cycle of debt reduction is one key driver of the EUR/CHF exchange rate. We claim that EUR/CHF can rise more strongly only when the competitiveness of the European periphery increases. When this happens, then debt will be reduced and both public and private deficit spending will stop.

Read More »

Read More »

European Banking Assets and Debt

Still in summer 2013, too much debt was an issue. By 2014 things have changed: Europeans have too many savings.

Read More »

Read More »

Why There Won’t Be A Strong Dollar, Even If The Financial Establishment Thinks So

In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

Read More »

Read More »