Tag Archive: Mexico

FX Daily, May 11: Stocks Slide but Little Demand for Safe Havens

The sell-off in US shares yesterday has triggered sharp global losses today, and there is no flight into fixed income as benchmark yields are higher across the board. Nor is the dollar serving as much as a safe haven. It is mostly softer against the major currencies.

Read More »

Read More »

House View, April 2021

We believe that robust earnings growth will overcome concerns about rate increases. Within a neutral position on developed-market equities, we believe sectoral rotation will continue and we remain overweight cyclical markets like the UK and Japan. But while we believe the attractiveness of stocks subject to wild valuation swings will fade, we continue to like cash-rich ‘structural grower’ stocks.

Read More »

Read More »

FX Daily, March 15: Big Week Begins Quietly

The capital markets are beginning a new and busy week in a non-committal fashion. Equities are mixed. Except for Japan, Hong Kong, and Australia, most markets in the Asia Pacific region were lower, led Chinese and Indian shares.

Read More »

Read More »

FX Daily, March 9: Turn Around Tuesday Strikes

It is not clear the trigger, but risk-taking appetites rebounded smartly today after the NASDAQ completed a more than 10% pullback from its highs yesterday. Ironically, the Dow Jones Industrials set new record highs yesterday too. Most equity markets in the Asia Pacific region rallied. The notable exceptions were South Korea and China.

Read More »

Read More »

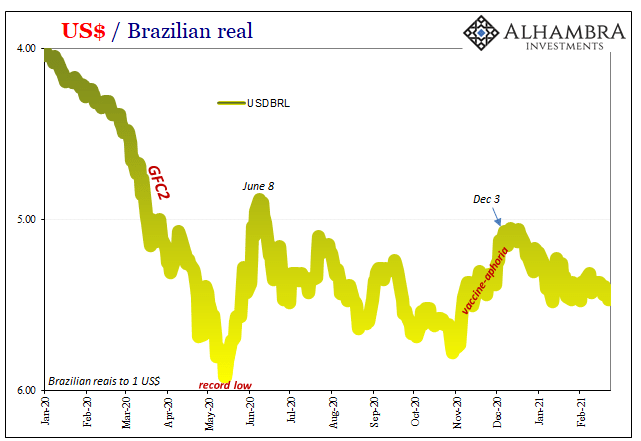

For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

FX Daily, February 22: Stocks Wilt under Pressure from Rising Yields

Higher interest rates, driven by inflation expectations, is forcing an adjustment to equity markets. The S&P 500 is poised to gap lower today following slides in the Asia Pacific region and Europe. Japanese and Taiwanese indices advanced by steep losses were seen in China, Hong Kong, and India.

Read More »

Read More »

FX Daily, February 12: Animal Spirits Start the Weekend Early

Profit-taking weighs on equity markets, and the dollar is trading higher ahead of the weekend. Most Asia Pacific markets are still closed for the holiday, but Victoria's snap lockdown dragged Australian shares lower.

Read More »

Read More »

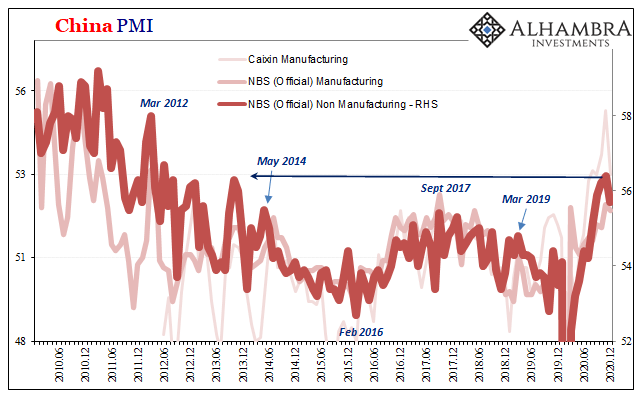

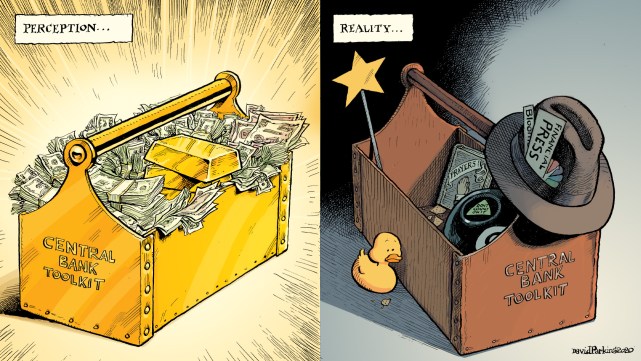

Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

FX Daily, November 25: Risk Appetites Stall Ahead of the US Thanksgiving Holiday

The global equity rally appears to be stalling after the US markets rallied strongly yesterday. Chinese, Taiwan, Korean, and Indian indices fell, and the MSCI Asia Pacific Index appears to have posted only its second loss this month. European shares are narrowly mixed, leaving the Dow Jones Stoxx 600 little changed.

Read More »

Read More »

FX Daily, November 13: Greenback Pares this Week’s Gains while the Turkish Lira Continues to Squeeze Higher

Overview: The largest bourses in the Asia Pacific region followed the US equity market lower, with the Nikkei posting its first loss in nine sessions. China, Hong Kong, and Australia moved lower as well. On the week, the MSCI Asia Pacific Index gained about 1% after rising 6.3% in the prior week.

Read More »

Read More »

FX Daily, November 12: Nervous Calm in the Capital Markets

There is a nervous calm in the capital markets today. The equity rally in the Asia Pacific region stalled to end an eight-day rally, though the Nikkei's rally remains intact.

Read More »

Read More »

FX Daily, November 9: Markets are not Waiting for Official Closure in the US

The new week has begun with robust risk appetites, driving stocks and stocks higher and sending the dollar broadly lower. Nearly all the equity markets in the Asia Pacific region gained more than 1%, except Malaysia and Indonesia.

Read More »

Read More »

FX Daily, October 27: Markets Take Collective Breath and Beijing Tweaks Fixing Mechanism

The surging pandemic sapped the risk-taking appetites as some investors hunker down for what could be a volatile period ahead. The S&P 500 lost nearly 3% at its lows before rebounding 1% in late dealings.

Read More »

Read More »

FX Daily, October 07: The Day After

President Trump's tweet announced that negotiations with the House Democrat leadership had collapsed, and there will be no further talks until after the election. Many economists had been removing it from their Q4 GDP projections, but the market was caught wrongfooted. Risk came off.

Read More »

Read More »

FX Daily, October 1: Hope Springs Eternal

Speculation that a new round of fiscal stimulus from the US is possible is encouraging risk-taking today. Many large Asian centers were closed for holidays today, and a technical problem prevented the Tokyo Stock Exchange from opening.

Read More »

Read More »

FX Daily, September 25: Sentiment Remains Fragile Ahead of the Weekend

The dramatic week is finishing on a quieter note. The modest gains in US equities yesterday helped the Asia Pacific performance today. Most markets but China and Hong Kong pared the weekly losses, and easing regulations in Australia spurred a rally in financials that saw its stock market close higher on the week.

Read More »

Read More »

FX Daily, September 24: Darkest Before Dawn

The two recent market developments, push lower in stocks, and higher in the dollar is continuing. Tuesday's gains in the S&P 500 and NASDAQ were unwound on Wednesday and this is helping drag global markets lower. The MSCI Asia Pacific Index fell for the fourth consecutive session today and many markets (India, Shenzhen, Taiwan, and Korea) fell more than 2% and most others were off more than 1%.

Read More »

Read More »

FX Daily, September 21: Risk Appetites Join Tokyo on Vacation

Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week's gains. The Dow Jones Stoxx 600 is off around 2.7% near midday in Europe.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »

FX Daily, September 10: ECB and Beyond

Overview: A strong recovery in US stocks, a softer dollar, and higher gold and oil prices may signal the end of the brief though dramatic correction, but the market is in a bit of a holding pattern ahead of the ECB meeting. Most of the major equity markets in the Asia Pacific region stabilized, except for Hong Kong and China.

Read More »

Read More »