Tag Archive: Mario Draghi

Consensus Inflation (Again)

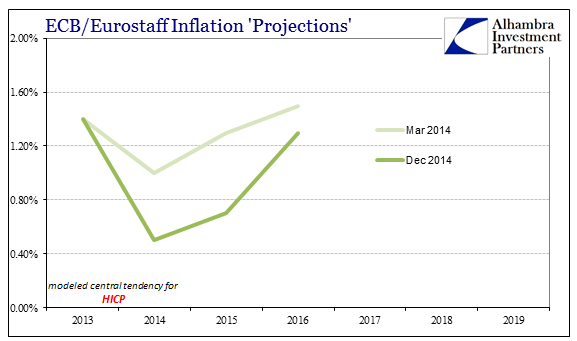

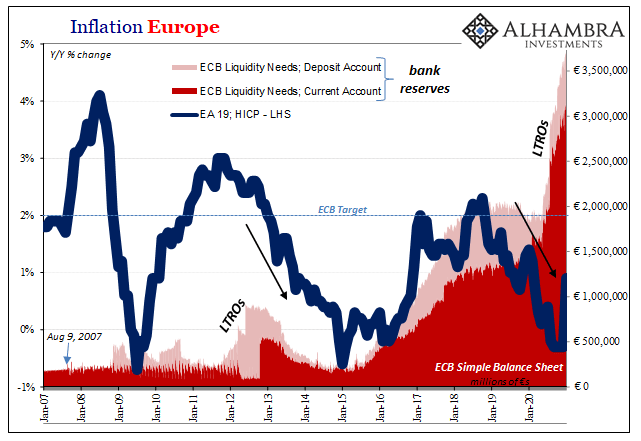

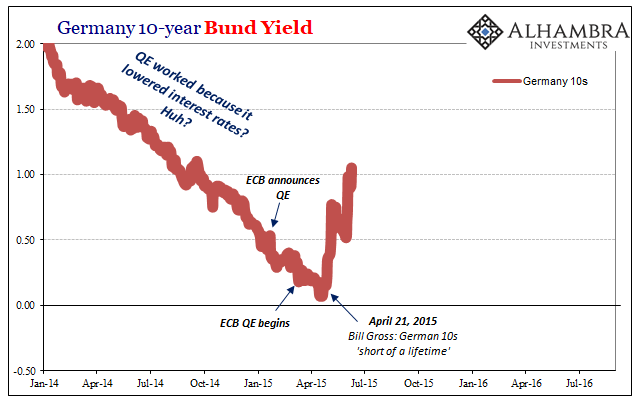

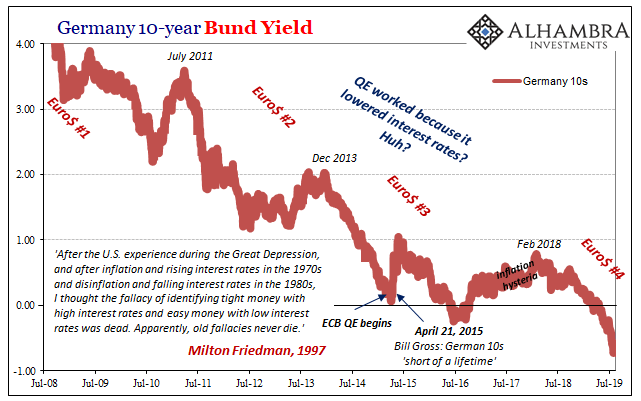

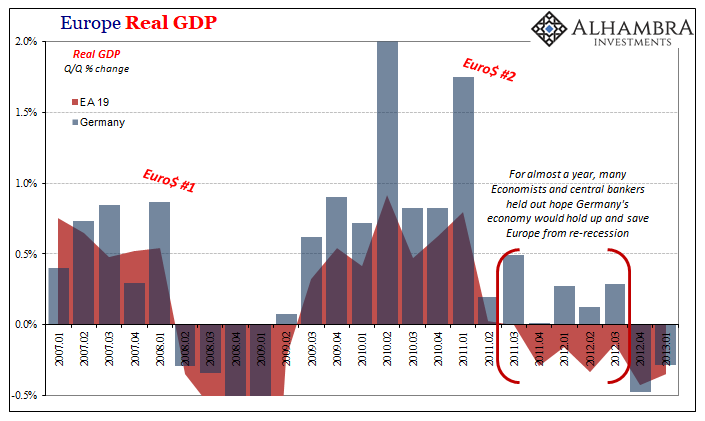

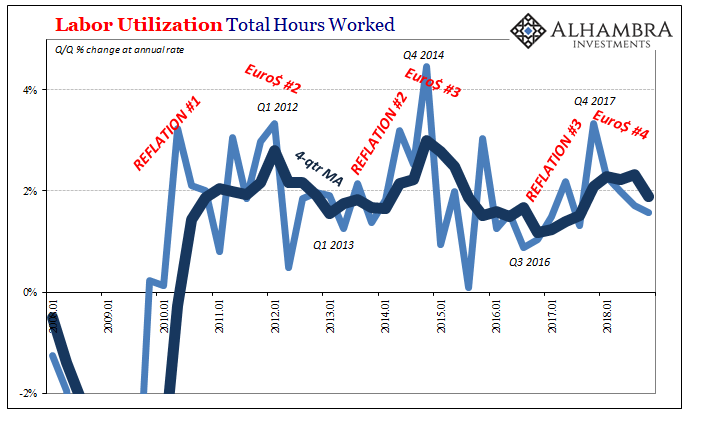

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January 2014:

Read More »

Read More »

FX Weekly Review, March 27 – 31: Euro breaks down against USD and CHF

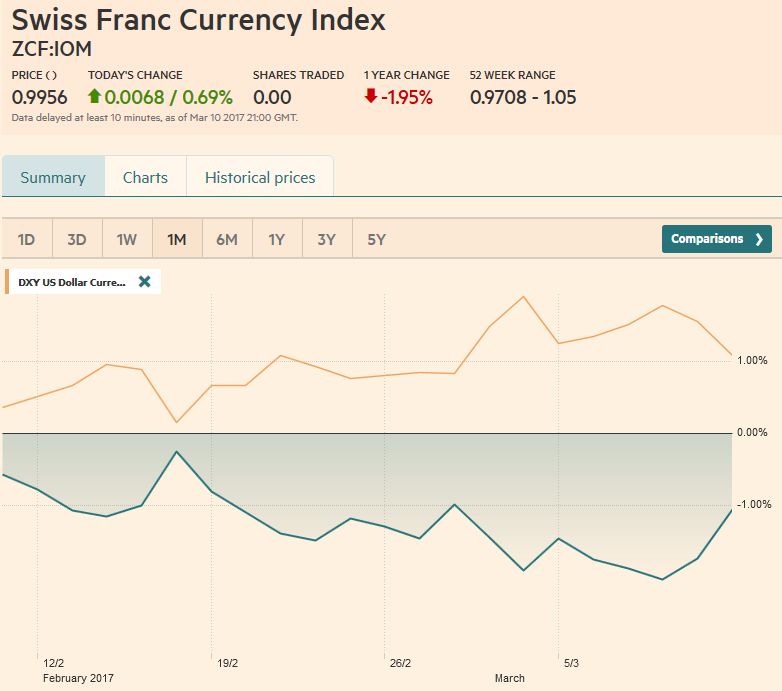

Weak inflation figures in the euro zone let the common currency fall against both the dollar and the Swiss franc. Still last week, the Swiss Franc index had some losses against the US dollar index.

Read More »

Read More »

FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%. Position adjustments: The dollar tended to trade heaviest against those currencies that speculators were short, like the euro, yen, and sterling.

Read More »

Read More »

FX Weekly Review, March 13 – March 18: Fed Disappoints, Dollar Losses

The failure of the Fed to signal an increased pace of normalization and the prospects of other central banks raising rates spurred dollar losses, which deteriorated its technical outlook.

Read More »

Read More »

FX Weekly Review, March 06 – March 11: CHF loses against the euro

The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by "real money" (investments in cash, bonds, stocks) will be visible in Monday's sight deposits release.

Read More »

Read More »

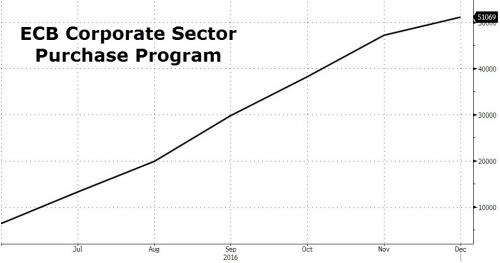

ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB's nationalization of the European corporate bond sector continues. In the ECB's latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

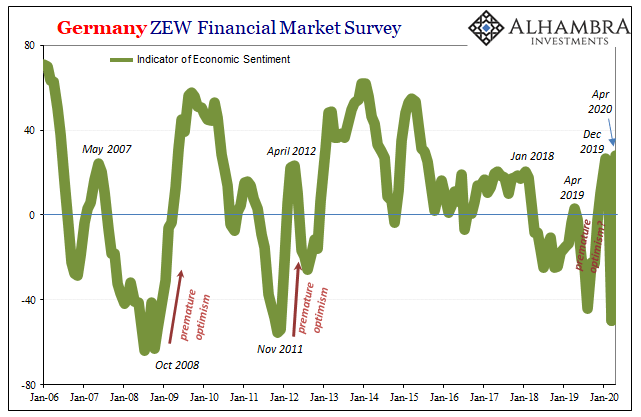

Uncertainty prevails everywhere, says Draghi, but apparently investors don’t mind

According to European Central Bank President Mario Draghi “uncertainty prevails everywhere” but apparently investors don’t mind. Market participants shrugged off last weekends “no” to constitutional reform in Italy and the subsequent resignation of Prime Minister Matteo Renzi to push European indices to 12 month highs this week.

Read More »

Read More »

ECB: Dovish Taper or Hawkish Ease?

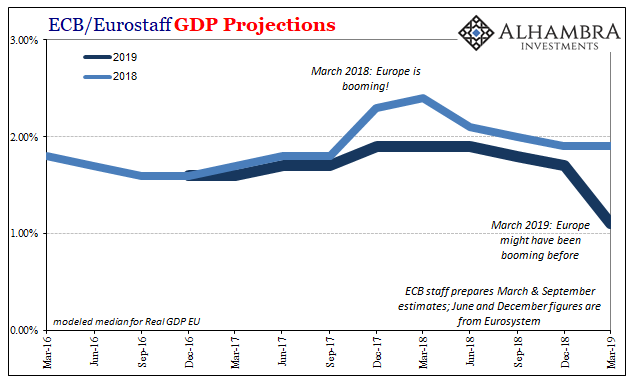

Purchases increased for longer but at a lower level; overall, more purchases than anticipated. Euro spiked higher on the announcement, but has subsequently dropped 2 cents. Lower inflation forecast for 2019 shows scope for a further extension.

Read More »

Read More »

Und nun kommt der Nobelpreisträger daher und will uns weismachen, wir müssten den Mindestkurs wieder einführen

„Es kostet fast nichts, Franken im richtigen Umfang zu drucken.“ Das sagte der Wirtschaftsnobelpreisträger Joseph Stiglitz am World Economic Forum (WEF) in Davos anlässlich eines Interviews mit dem Tages-Anzeiger.

Read More »

Read More »

ECB: Dovish Hold

Draghi will like emphasis inflation is the key to policy and ECB is committed using allow for its technical tools to achieve its legal mandate. Key decisions will be made in December. The more the euro rises against sterling, the greater the pressure for the euro to fall against the dollar.

Read More »

Read More »

Swiss central bank can cut rates further if needed, says bank president Jordan

The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted that the bank has already pushed rates quite far.

Read More »

Read More »

Will The ECB Buy Stocks?

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility. We think the ECB could legally buy ETFs that fit its requirements… but it would be controversial and we question the benefits. An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme.

Read More »

Read More »

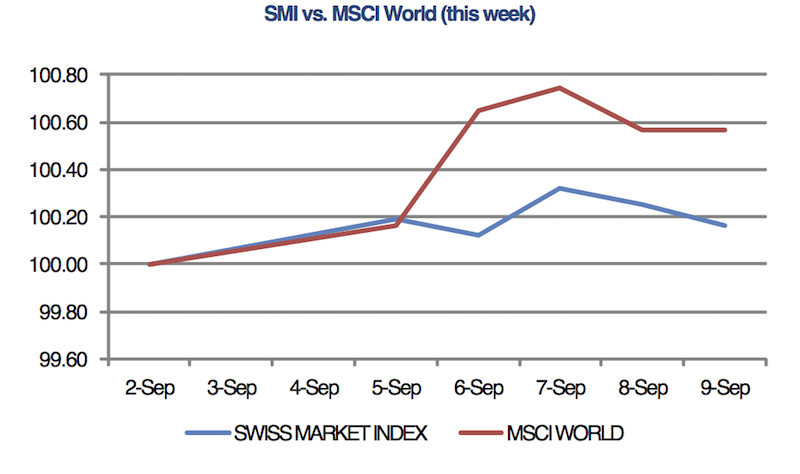

Swiss stocks fluctuate as central bank decisions dominate the landscape

The Swiss Market Index, along with other European markets, fluctuated this week as central bank decisions dominated the landscape. Equity markets advanced at the beginning of the week as chances of the Federal Reserve raising US interest rates later this month declined after a surprisingly weak report on the US service-sector earlier this week.

Read More »

Read More »

Draghi Does not Surprise and Euro Edges Away from $1.10

Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken.

Read More »

Read More »

The World’s Central Banks Are Making A Big Mistake

While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments.

Read More »

Read More »

QE and stress tests could cause a state of emergency for some insurers

European insurers, whose profits are being eroded by Mario Draghi’s quantitative-easing program, face a stress-test headache that risks requiring them to set aside more capital, further hurting their ability to make money. The timing of the regulator’s “stress test couldn’t be worse as the results will be rather negative,” said Lutz Roehmeyer, who helps oversee about $12 billion as director of fund management at Landesbank Berlin Investment.

Read More »

Read More »

FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act.

Read More »

Read More »

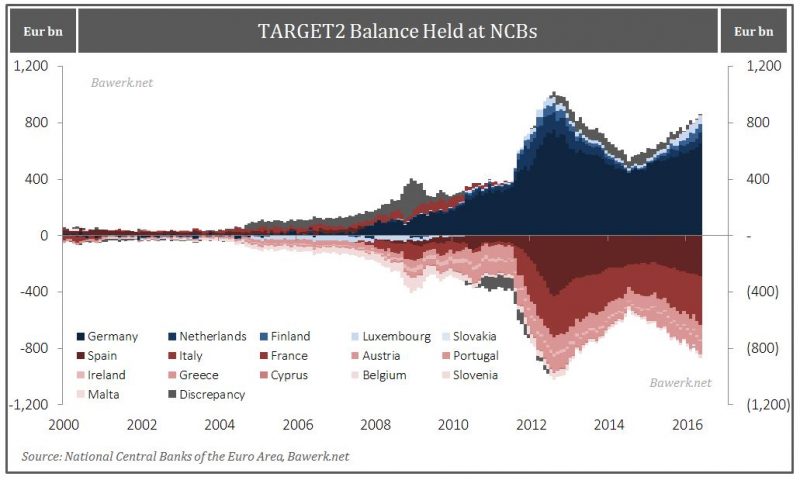

Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »