Tag Archive: Marc Faber

On the Marc Faber Controversy

By this time anyone reading this particular article on Acting Man will know about the controversy surrounding Marc Faber these last days, when a single paragraph of many from his October 2017 newsletter was published out of context.

Read More »

Read More »

Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds.

Read More »

Read More »

“Brexit Sends A Clear Message To Sick Political Elite” Marc Faber Sees “Only Good Contagion”

"We're moving into a global recession that has nothing to do with Brexit," warns Marc Faber stressing that Britain leaving the EU would not be disastrous, saying that if Switzerland can operate in a "single" market and outside of the EU so can Britain.

Read More »

Read More »

Faber: “Switzerland doing much better than any other country in Europe. So Britain should do the same?”

The European Union is an "empire that is hugely bureaucratic," warns Marc Faber, telling CNBC that he thinks that "a Brexit would be bullish for global economic growth," because "it would give other countries incentive to leave the badly organized EU...

Read More »

Read More »

Listen to the Sirens of the Stock Market at your Peril!

John Henry Smith of Grail Securities (Switzerland) shows that the financial markets have always been awash with its own brand of Sirens, who dolefully prophesy the complete collapse of whole economic systems. For him Pericles gave the best advice: “The key is not to predict the future, but to be prepared for it!”

Read More »

Read More »

Debt, the Financial Cycle Determinant between 2011 and 2017

Between 2011 and 2017, the reduction of debt , the hunt on the rich and investment into countries with low debt will become the main rational expectation and the determinant of the next financial cycle.

Read More »

Read More »

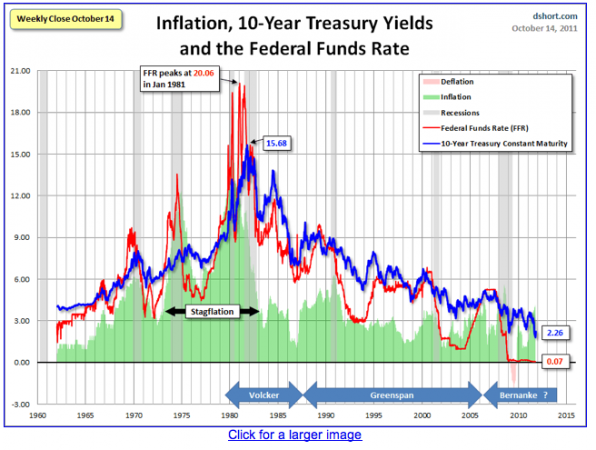

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

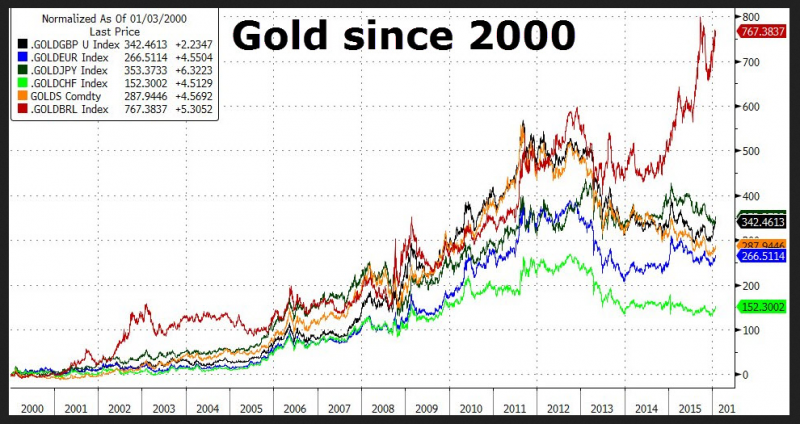

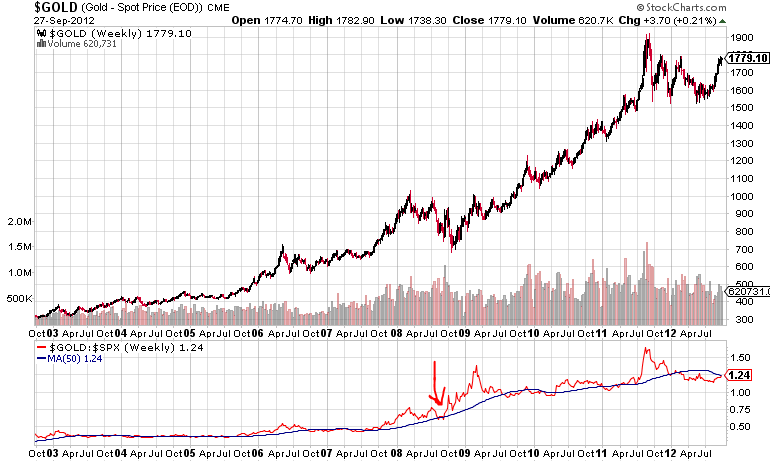

Marc Faber: Assets are overpriced, we short metals and Brent now

As we predicted on October 5 or one day later on DailyFX, metals have started their descent, silver lost one dollar, from levels around 35$ last week to 34$ now. Marc Faber joins our view and says that asset prices are quite vulnerable. “I’m not 100% in cash, for the simple reason that I could … Continue reading »

Read More »

Read More »

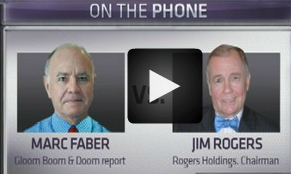

Marc Faber argues against Jim Rogers

The most famous investors Marc Faber and Jim Rogers were in a common interview on CNBC. Marc Faber is of our position, whereas Jim Rogers is still bullish on commodities. Marc points out that China’s bench mark stock index the Shanghai Stock Exchange Composite Index was at 6100 in 2007 even as it … Continue reading...

Read More »

Read More »