Tag Archive: macro

June 2024 Monthly

There

are two forces that shape the investment climate: politics and economics, and

they are both at the fore in the coming weeks.Among the highlights will be the European

Central Bank meeting that will mostly likely begin its easing cycle. The Bank of

Canada is a close call. If it does not cut rates in June, it will probably do

so in July. The Swiss National Bank may deliver its second hike in the cycle,

while the Bank of England will likely...

Read More »

Read More »

Holiday Overview: The State of Play

FX: The dollar

traded mostly higher last week. I suspect more near-term gains, but

I am less convinced than I was a week ago. Given the FOMC minutes

and more recent commentary from Fed officials, I suspect the market is

exaggerating the chances of two cuts this year. That had been my

leaning too, but I think the recent resilience of the labor market and

sticky inflation has shifted the views at the Fed. The...

Read More »

Read More »

Week Ahead: Near-Term Dollar Outlook Less Clear than a Week Ago

Stronger than expected data and hawkish FOMC minutes helped lift US

rates and the greenback last week. That market continues to also reduce the

extend of ECB easing this year is notable but did not prevent the euro from

snapping a five-week advance. The 10-year Japanese government bond yield rose

above 1% last week for the first time since 2012, but the US dollar traded above JPY157 for the first time since the BOJ is believed to have intervened...

Read More »

Read More »

Week Ahead: After Rallying Since mid-April, are the G10 Currencies Tired?

The

monthly cycle of central bank meetings and high-frequency data slow in the

week ahead, though the UK and Canada report on prices and demand (retail sales).

The highlight of the week may be the preliminary May PMI estimates. We play

down its significance in the US because its strength seems to be an outlier and

it is in expansion territory while the ISM not. The dollar has generally been

trending lower, with the yen being the only exception...

Read More »

Read More »

May 2024 Monthly

The resilience of the

US economy and stickiness of price pressures spurred a reassessment of the

trajectory of Fed policy. This sparked a sharp rise in US interest rates and

extended the dollar’s advance. The somewhat disappointing April jobs report and

a softer CPI report in the middle of May could signal that the interest rate

adjustment is over. Federal Reserve Chair Powell played down the likelihood of

the need to lift rates again, and as it...

Read More »

Read More »

Week Ahead: FOMC, US Jobs, EMU Inflation, JPY Pressure

The backing up of US rates did not lift the dollar broadly as it appeared to have done previously. The dollar-bloc currencies, led by the Australian dollar, and sterling advanced last week, while the Swiss franc and Japanese yen were unable to find traction. The Bank of Japan had an opportunity to have protested the yen's weakness more adamantly but did not do so. Recognizing the role of interest rate differentials as an important driver, the...

Read More »

Read More »

Where We Stand

I am on vacation, and then on a business trip that will interrupt the commentary until the weekly note on April 30. The May monthly analysis will be published the following week after the FOMC meeting and April employment report.

Read More »

Read More »

Week Ahead: Strong US Jobs Data Failed to Sustain Dollar Rally, Can the March CPI do Better?

The March US employment data were stronger than expected and

lend support to the re-acceleration hypothesis and an extension of US

exceptionalism. In Q1 24, nonfarm payrolls rose by an average of 276k. It was

the strongest quarter in a year and compares with an average monthly job gain

of about 251k in 2023. The unemployment rate slipped as the household survey

jumped around 500k after falling in the previous two months. The workweek

increased, and...

Read More »

Read More »

April 2024 Monthly

The macroeconomic and

geopolitical developments have not changed substantially over the past month. The

resilience of the US economy allows the Federal Reserve to put more emphasis on

achieving price stability. While the market favors a June cut (66% vs. 80% at the end of February), it has

not been fully discounted for over a month. The biggest event in March may have been the

well-telegraphed exit from negative interest rate policy and Yield...

Read More »

Read More »

Week Ahead: Enthusiasm for the Dollar Rekindled

Last

week will be remembered for several things. First, the Bank of Japan lifted its

interest rate target for the first time in 17 years and formally ended its

Yield Curve Control and ceased buying ETFs. The yen sold off and the dollar

approach the 2022 and 2023 cap slightly below JPY152. Japanese officials have

used the language that has signaled heightened risk of intervention in the

past. Second, the Swiss National Bank became the first G10...

Read More »

Read More »

Week Ahead: Central Banks

There has been a dramatic adjustment to US rates. The

two-year yield was near 4.40% before the US employment report on March 8 and it

reached near 4.73% before the weekend. The 25 bp surge is the largest weekly increase

since last May. For the first time in four months, the Fed funds futures strip

is no longer has at least three rate cuts discounted. The interest rate

adjustment underpinned the dollar, which rose against all the G10 currencies

last...

Read More »

Read More »

Week Ahead: Will Firm Headline US CPI and a Recovery in Retail Sales Help the Dollar Recover?

When everything was said and done last week, the market did not change its mind. There was still a better than 90% chance that the Federal Reserve delivers its first rate cut in June. Fed Chair Powell told Congress that the central bank was not far from the level of confidence needed

to cut rates.

Read More »

Read More »

March 2024 Monthly

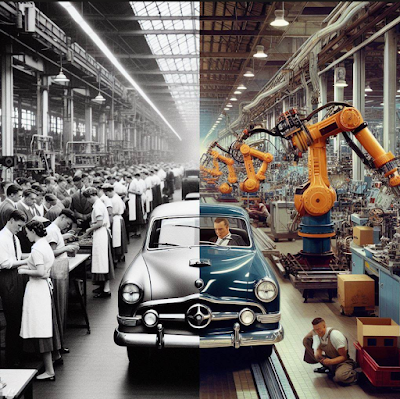

Rarely are officials able to achieve the proverbial economic soft-landing when higher interest rates help cool price pressures without triggering a significant rise in unemployment or a contraction.

Read More »

Read More »

Week Ahead: With the Markets Converging (Again) with Fed’s Dots, Is the Interest Rate Adjustment Over?

The US dollar and interest rates appear to be at an inflection point. Much of the past several weeks have been about correcting the overshoot that took place in Q4 23, when the derivatives markets were pricing in nearly seven quarter-point rate cuts by the Federal Reserve this year.

Read More »

Read More »

Week Ahead: China Returns and Flash PMI Featured after US Rate Adjustment was Extended

The US January CPI and PPI came in stronger than expected and this extended the recovery in US interest rates. In turn that helped underpin the dollar. We do not think the data itself changes the Fed's stance. At least seven Fed officials speaking in the coming days will test this hypothesis. There are still several key reports before the data dependent FOMC meets again in about four weeks.

Read More »

Read More »

Week Ahead: Will Soft US CPI and Retail Sales Mark the End of the Interest Rate Adjustment and Help Cap the Greenback?

The

markets are still correcting from the overshoot on rates and the dollar that

took place in late 2023. The first Fed rate cut has been pushed out of March

and odds of a May move have been pared to the lowest since last November. The

extent of this year's cuts has been chopped to about 4.5 quarter-point move

(~112 bp) from more than six a month ago. The market has reduced the extent

of ECB cuts to about 114 bp (from 160 bp at the end of January...

Read More »

Read More »

Week Ahead: Markets Digest New Economic Divergence after US Employment Report

The US employment data blew away expectations, jumping by 353k,

nearly twice the median forecasts. That, coupled with the 0.6% rise in average

hourly earnings, which was also twice expectations, helped drive home the

Federal Reserve's reluctance to endorse what had been market speculation of a

March rate cut and an aggressive rate cutting sequence. The dollar had softened

as US rates eased following the FOMC meeting and new strains among regional...

Read More »

Read More »

February 2023 Monthly

The coming weeks will

likely continue the correction of the trends that began last month. The markets

recognize that tightening cycle is over. However, they swung hard, pricing in

aggressive easing by most of the G10 central banks, including the Federal

Reserve and the European Central Bank. Official comments and some

high-frequency economic data have encouraged participants to rein in their

expectations, reducing the odds of a rate cuts in Q1 and...

Read More »

Read More »

Week Ahead: Too Early for Central Banks to Move, and Q4 GDP to Showcase US Economic Resilience (with the help of 6.5% budget deficit)

The week ahead features the first estimate of US Q4 GDP, which will be

revised for the next couple of years, and policy meetings by the Bank of Japan,

the European Central Bank, the Bank of Canada, and Norges Bank, Norway's

central bank. Although the market anticipates the beginning of an aggressive

easing cycle by several central banks, and an exit of the BOJ's negative

interest rate policy, the start is not expected until later in the first half....

Read More »

Read More »

Week Ahead: Real Economy

Given the world's turmoil, including the escalation, and

broadening of the conflict in the Middle East and China's continued aerial

harassment of Taiwan ahead of the election, the capital and commodity markets

have remained firm. February WTI fell about 1.7% last week and March Brent

slipped around 0.65%. Shipping costs are rising as the Rea Sea is avoided

and supply chain disruptions are threatened. Still the MSCI index of developed

equity market...

Read More »

Read More »