Tag Archive: macro

Week Ahead: How Hard Will Officials Push Against the Easing of Financial Conditions?

The combination of

soft US price data and mostly weaker economic data lends credence to a new

economic convergence. The economic news stream from Europe, Japan, and China is

not particular inspiring. Rather the convergence is driven by the materialism

of the long-anticipated slowdown of the world's largest economy. This new

convergence is negative for the dollar. Our conservative working hypothesis

continues to be that the US dollar's gains from...

Read More »

Read More »

Week Ahead: Will Softer US Price Pressures and Weakness in Retail Sales Weigh on the US Dollar and Rates?

The

recent dollar gyrations seem tightly linked to US rates. The FOMC meeting and

October jobs report saw the two-year Treasury yield drop 17 bp and the dollar

was taken broadly lower. Indeed, against several currency pairs, it approached

three standard deviations below its 20-day moving average. What seemed like a

mild adjustment to the over-extended technical development turned into a rout

after a weak reception to the US 30-year bond auction to...

Read More »

Read More »

Week Ahead: Have the Markets Turned?

An inflection point may have been reached last week. Despite,

Chair Powell's insistence that the Fed did not adopt an easing bias and

confirmed that there is still no talk of a cut, the market knows better. The

implied yield of December 2024 Fed funds futures contract is about 4.45%, which

is to say, the market is discounting not only the two cuts in the Fed's

September projections, but a third cut, and the risk again (~60%),

of a fourth cut. The...

Read More »

Read More »

November 2023 Monthly

November may be an in-between month. It will be a month of

limited monetary policy actions and a period of heightened geopolitical

tensions. Fiscal policy may be more interesting, with a Japanese supplemental

budget, more measures expected from China, and a debate in Europe over the

re-implementation of the Stability and Growth Agreement. In the US, the drama that played out in the House of Representatives could still leave the federal

government...

Read More »

Read More »

Week Ahead: Q3 US GDP to Underscore Divergence, while ECB and Bank of Canada Stand Pat

The US dollar was mixed last week.

One would have thought, based on the geopolitical tensions, the stronger than

expected US economic data that resulted in upward revisions to Q3 GDP

forecasts and a more than 30 bp surge in US 10-year yields, the greenback

would have performed better. The Dollar Index fell by almomst 0.5% last week, its biggest weekly loss in three months. It is down so far this month. On the other hand, gold rallied 2.5% to

extend...

Read More »

Read More »

Week Ahead: Softness in US Real Sector, Key UK and Canadian Data, and China’s Q3 GDP

The markets absorbed two shocks last week. The

war in Israel that seems to know of no restraint underpinned oil prices and

appeared to help boost gold and the Swiss franc, the only G10 currency to

appreciate against the dollar. The other was the continued deluge of US

Treasury supply, the coupon auctions that tailed and higher than expected PPI

and CPI. Nevertheless, the US 10- and 30-year yields fell nearly 20 bp last

week, snapping a six-week...

Read More »

Read More »

Week Ahead: King Dollar Stalls

The US reports September CPI on

October 12 and the first decline in three months in the year-over-year rate is

expected. However, the price action itself may overshadow not only the CPI but

other high-frequency data in the week ahead. US grew more than twice the number

of jobs in September as economists expected. US interest rates and the dollar

jumped initially, and stocks were dumped. And then they reversed. Many

narratives will be spun to...

Read More »

Read More »

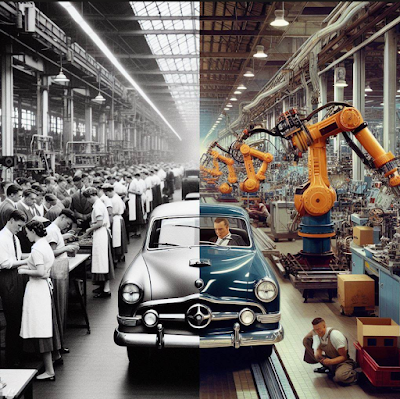

October 2023 Monthly

There are four large

macro forces shape the investment and business climate here at the start of the

last quarter of the year. First, the US economic outperformance has been stark.

This has helped underpin US rates and bolsters the dollar. The divergence is

likely to narrow in coming months as US growth slows rather than stronger

growth prospects in other high-income countries. Second, Beijing has taken

numerous measures, which although stopping...

Read More »

Read More »

Week Ahead: Digesting Implications of the FOMC, EMU and Tokyo August CPI, and China’s PMI

The

most important outcome of the last week's flurry of central bank meetings was

the median forecast of Fed officials for 50 bp less in cuts next year than it

had anticipated in June as it revised up its growth forecasts for this year and

next. The prospect for higher rates for pushed equities lower. Sterling

and the Swiss franc were the weakest currencies in the G10 last week, falling

by a little more than 1.1%. Both central banks did not hike...

Read More »

Read More »

Week Ahead: US CPI to Make the Doves Cry even if Core Eases, and Euro Vulnerable to ECB Regardless of Decision

The

diverging economic performance between the US and Europe, Japan, and China on

the other hand is stark. Yet, a greater divergence may be between widespread

discussion of de-dollarization and its incredible strength in the foreign

exchange market. The eight-week rally in the Dollar Index is the longest in

nine years. According to SWIFT, which is not comprehensive but remains by far

the largest platform, the dollar's role in international payments...

Read More »

Read More »

September 2023 Monthly

There is a sense of new

divergence. Most economists, including the staff at the Federal Reserve, no

longer think the US is recession-bound. Unprecedented in modern times,

inflation has fallen sharply, and unemployment has not risen, and the economy

appears to be enjoying its third consecutive quarter, and the fourth in the

past five, above what the Federal Reserve regards as the non-inflationary pace

(1.8%). At the same time, and despite being...

Read More »

Read More »

Week Ahead: Slowing US Jobs and Softening EMU Inflation

The

Jackson Hole symposium marks the end of summer just as much as the autumn

equinox next month. It has been a tough few months for bond markets as yields

have soared. For the US economy, which has proven more resilient than many,

including Fed officials thought, and a sharp increase in anticipated supply of

Treasuries, the rise in yields may be understandable. The rise in Japanese

government bond yields may also make sense given the rise in...

Read More »

Read More »

Week Ahead: Yen’s Recovery Ahead of the Weekend may Give the Yuan a Reprieve or Be Ready for BRICS to Disappoint High Hopes for a Dollar Alternative

There seem to be three large

forces shaping the investment climate. First is the resilience of the US

economy, with four consecutive quarters of above trend growth. It appears that the US economy may be expanding faster than the 2.4% annualized pace seen in Q2. Many of the

largest naysayers have capitulated. Second, the monetary tightening cycle is

widely seen as almost over, and many are beginning to fine tune forecasts for

the first cut by the...

Read More »

Read More »

Week Ahead: Anniversary of the End of Bretton Woods Sees Resilient Dollar and Firmer US Rates: Can it Persist?

Tuesday

marks the 52nd anniversary of the end of Bretton Woods currency arrangement,

which pegged the dollar to gold and other currencies to the dollar. Some

economists have tried framing their views in terms of Bretton Woods II and

there have even been proponents of Bretton Woods III, but these are informal

arrangements at best, no reciprocity, or mutual obligations. The point of the

matter is that the end of Bretton Woods ushered in the modern...

Read More »

Read More »

Week Ahead: Is the Dollar’s Run since Mid-July Over?

The US

and China report July CPI figures in the coming days and they are likely moving

in opposite directions. Headline US CPI is likely to rise for the first time

since peaking in June 2022. China's CPI has been slowing and is likely to go negative

on a year-over-year basis. It finished last year at 1.8% and in June was

unchanged year-over-year. The divergence of policy is what is driving force of

the exchange rate, and the question is not...

Read More »

Read More »

August 2023 Monthly

Prices

pressures are abating, albeit gradually, while economic momentum is faltering.

The data in the coming weeks will help shape expectations for rate decisions

for September. As the market pushed back against the Federal Reserve's forward

guidance that anticipated two hikes in the second half, the US dollar fell

against the G10 currencies, but found support beginning around the middle of

the July as the market was reluctant to return to pricing...

Read More »

Read More »

Week Ahead: For the Millionth Time, Markets Exaggerate

After experiencing one of its worst weeks of the year, the US

dollar is stretched from a technical point of view while the short-term

interest rate adjustment has gone as far as it can without resurrecting ideas

of a Fed rate cut this year. Given the lighter economic calendar in the coming

days, we suspect that the greenback may consolidate ahead of the FOMC meeting

that concludes on July 26. The derivatives market shows that a quarter-point

hike...

Read More »

Read More »

Week Ahead: Is the Dollar’s Downtrend Resuming?

The dollar appears at an inflection point. Its

failure to draw much traction even as US rates rose may be an important tell. The

US 2-year yield rose to a new multiyear high near 5.12%, while the 10-year

yield set a new high for the year around 4.09% after the

employment report. The dollar's broad gains in the second half of last month

looks corrective. The underlying downtrend, which we argue began last September

and October, looks set to resume....

Read More »

Read More »

July 2023 Monthly

Price pressures

remain elevated but economic momentum slowed as Q2 wound down. Many market

participants think this poses a dilemma for policymakers and are skeptical that

the hikes signaled will be delivered because of economic weakness or financial

strains. These developments are thought to limit the tightening cycle before

the inflation genie can be stuffed back into the bottle.Yet, this may underestimate the resolve of most of the

major central...

Read More »

Read More »

After Disappointing PMIs, Attention will Turn Back to Inflation in the Week Ahead

As the month and quarter wind down, inflation readings are

featured. The US May PCE deflator, which is the targeted measure is reported.

Canada and Australia report May CPI. The eurozone reports the preliminary June

CPI, and Japan see Tokyo's June CPI, which serves a similar function. Leaving

aside Japan, the others, including the UK have signaled that the monetary

tightening cycle will be extended into H2. That said, the poor preliminary PMI...

Read More »

Read More »