When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money.The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97.

Read More »

Tag Archive: M2

How Much Space Does $1,500 Rent In The World’s ‘Most Magnetic’ Cities?

New Yorkers who wince every time they slip a $1,500 rent check under their super’s door should consider moving to Shanghai, or maybe Berlin. According to a new study published on RentCafe, $1,500 will buy you three times more space in Shanghai than in Los Angeles and twice as much in Frankfurt. Meanwhile, rents per square foot are five times higher in San Francisco than they are in Berlin.

Read More »

Read More »

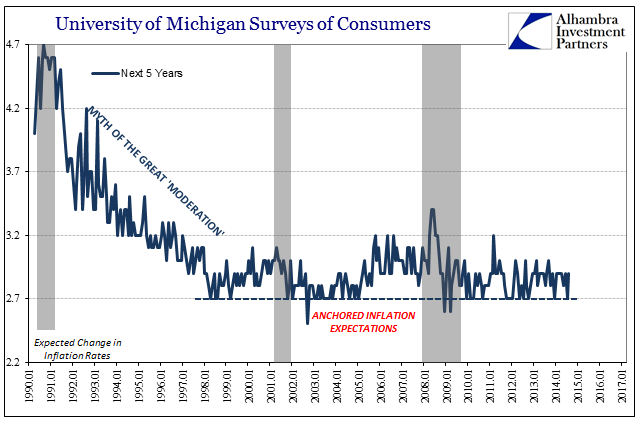

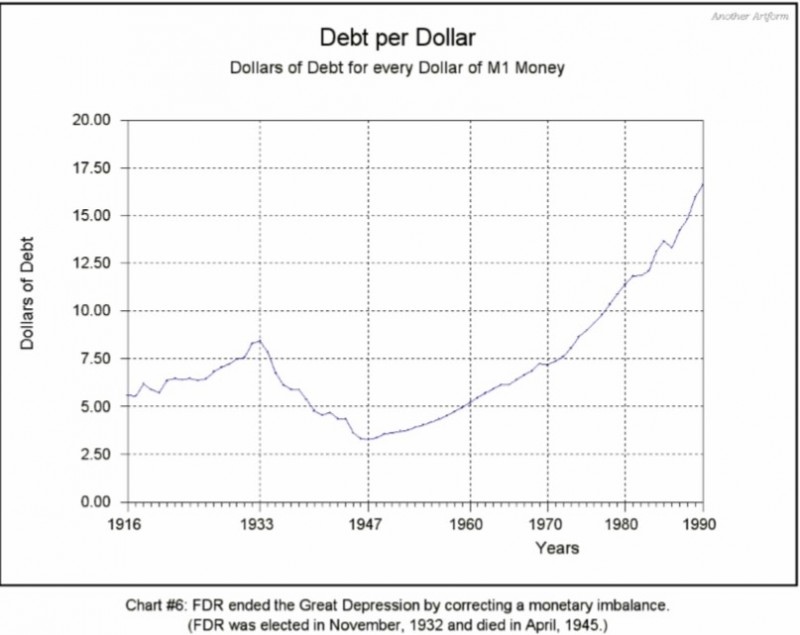

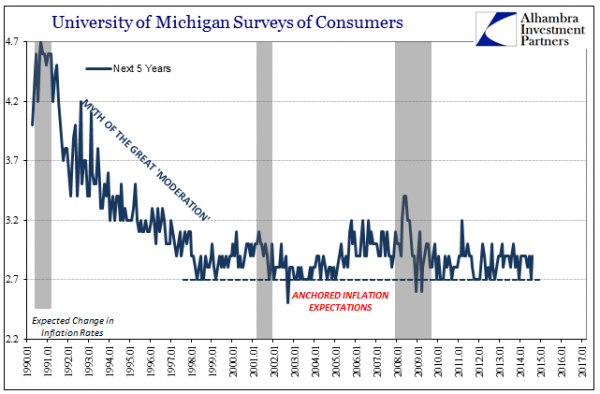

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

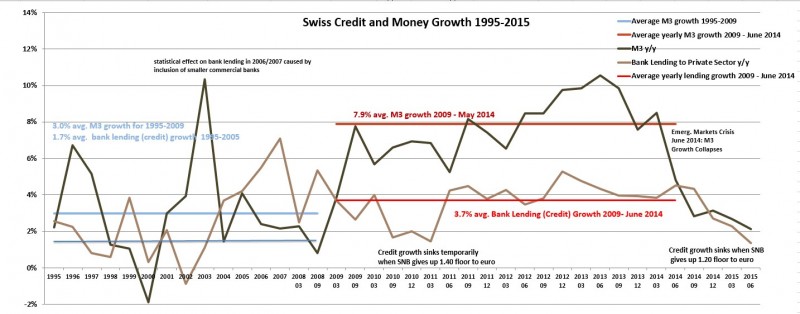

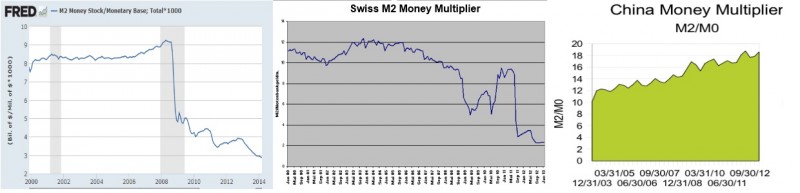

The 2015 Update: Risks on the Rising SNB Money Supply

We explain the risks on the rising money supply in Switzerland. We distinguish between broad money supply (M1-M3) and narrow money supply (M0). Both are rising quickly.

Read More »

Read More »

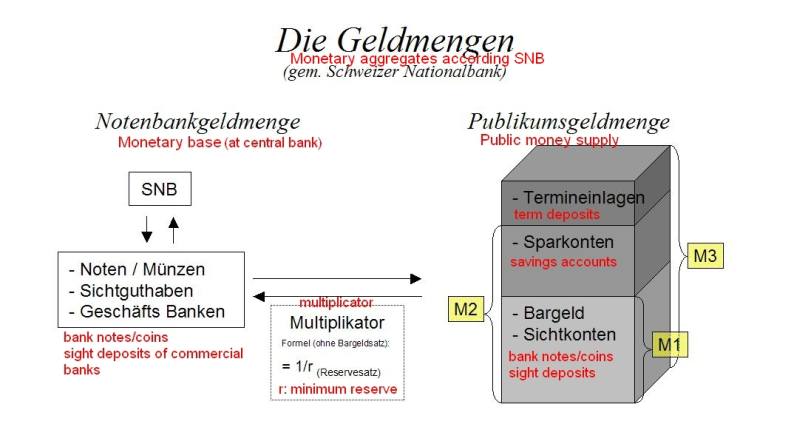

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

Will the Dollar Appreciate on higher U.S. Savings and a Smaller Trade Deficit?

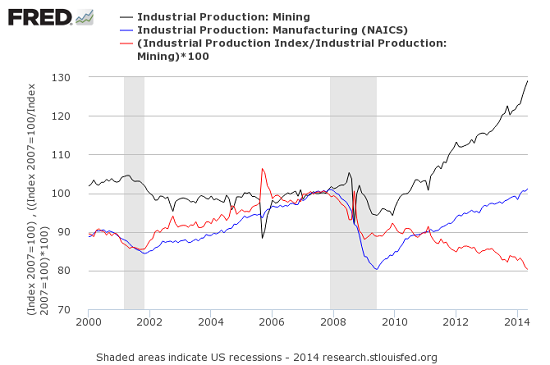

In summer 2013, even the sceptical and "gold-friendly" economist John Mauldin followed the mainstream thinking that fracking and other technology could reduce OPEC's and the Chinese advantage in global trade and reduce the U.S. trade deficit. Recently both claims got refuted: the first with WTI crude oil prices rising to nearly 108$ despite enhanced supply. Detailed data showed that rising U.S. industrial production was not caused by more...

Read More »

Read More »

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

In some countries, the money multiplier is falling, in some others it is increasing, mostly due to central bank tightening. Does this justify to speak of secular stagnation?

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »