Tag Archive: Keynesian

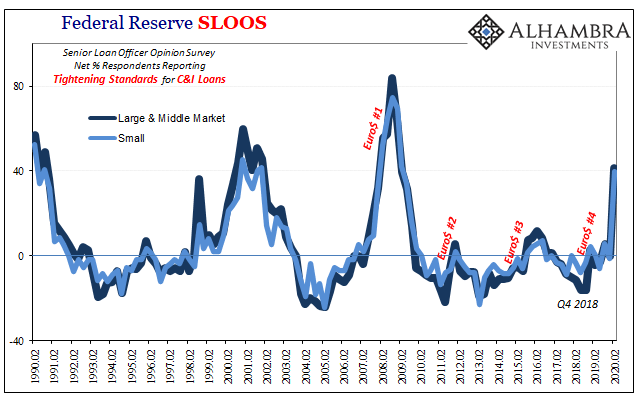

Not COVID-19, Watch For The Second Wave of GFC2

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own.

Read More »

Read More »

The ZIRP/NIRP Gods and their PhD Priesthood Have Failed

The priesthood's insane obsession with forcing people to spend their savings by punishing savers with ZIRP/NIRP has failed spectacularly for a simple reason: it completely misunderstands human psychology. Let's start with a simple chart of the Fed Funds Rate, which the Federal Reserve has pinned near zero for years.

Read More »

Read More »

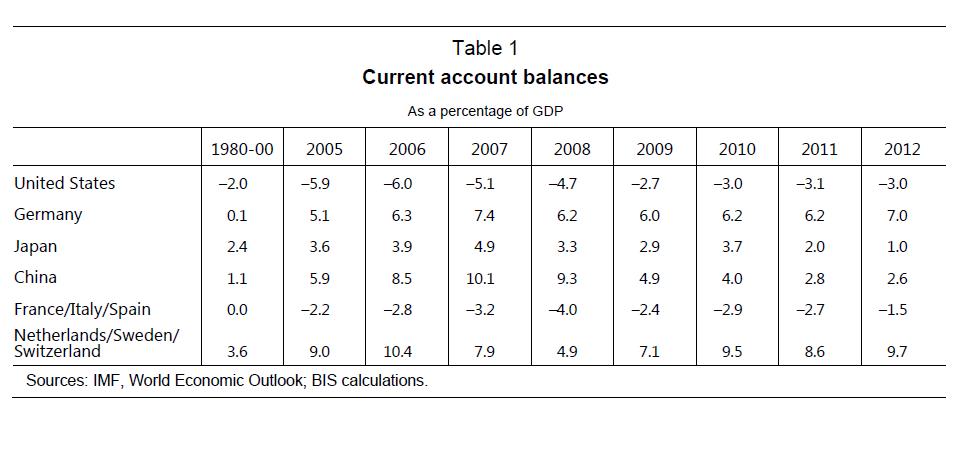

Overlending and Global Imbalances in Current Accounts

Some extracts from BIS Working Papers No 419 Caveat creditor: The Bank for International Settlement stresses the importance of getting "overlending" under control.

Read More »

Read More »

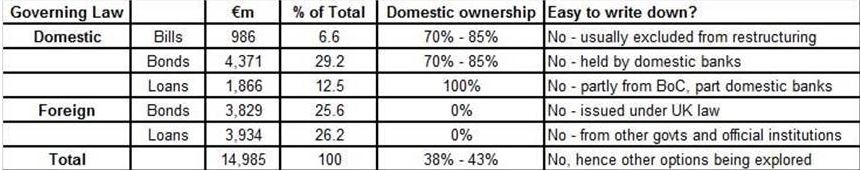

Cyprus: The initial compromise and reactions

The initial compromise The Cyprus compromise combines a 10 billion € bailout with European, basically German tax-payers money, that also obliges rich account owners (9.9% levy) – rich Russians and Brits – and poorer account owners (6.75% levy) – Cypriot tax-payers money – to take part in the deal. Initial reactions from Zerohedge over Keynesian mainstream …

Read More »

Read More »

Did Austrian Economists Get the Recovery Wrong?

Austrians got the recovery after the financial crisis wrong. Monetary expansion did not lead to hyperinflation and a collapse of central banks. Their mistake was that the Austrian principle of "too cheap money leads to wrong investments", is currently not valid. Due to high risk aversion after the financial crisis, firms do only only best projects. Austrian economists were right before the crisis, but after the crisis Keynesians and Germans with...

Read More »

Read More »

The Rise and Fall of Keynesian Economics

John Cassidy's remarkable interview with the Nobel Prize winner Paul Samuelson maybe best describes the rise and fall of Keynesian economics.

Keynesians led the world to two of its most unfortunate experiences, the 1970s stagflation and to the...

Read More »

Read More »

German Economists and Merkel, the Implicit Followers of the Gold Standard

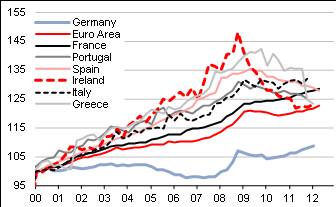

With ECB's OMT & "conditionality", that requires austerity and implicitly reduction of salaries in European periphery, Merkel & German economists have created consequences similar to a gold-standard.

Read More »

Read More »

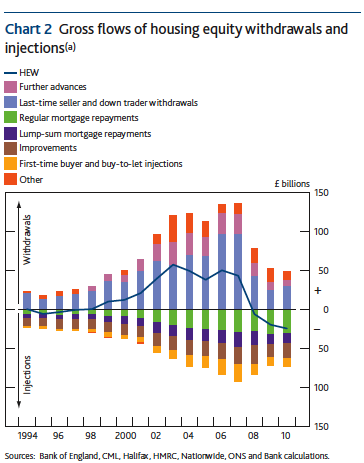

The Balance Sheet Recession: UK Q2 Housing Equity Injection Largest Since Q2 2011

The American-Taiwanese economist Richard Koo, is the chief-economist of the Nomura Research Institute. In his theory of the Balance Sheet Recession he distinguishes between the “Yang” phase of the economy and the “Yin” phase (the so-called “balance sheet recession”). In “Yang” times companies want to increase profit and people consume a big part of their pay …

Read More »

Read More »

The “Beautiful” De-Leveraging

A beautiful deleveraging balances the three options. In other words, there is a certain amount of austerity, there is a certain amount of debt restructuring, and there is a certain amount of printing of money. When done in the right mix, it isn’t dramatic. It doesn’t produce too much deflation or too much depression. There is slow growth, but it is positive slow growth. At the same time, ratios of debt-to-incomes go down. That’s a beautiful...

Read More »

Read More »

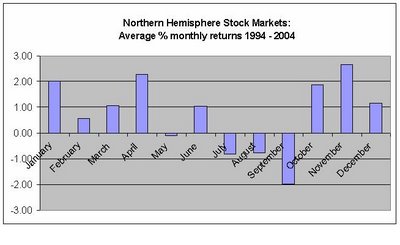

The “Sell in May, come back in October” effect and its equivalent for the SNB

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »

Keynesians vs. Anti-Keynesians: How price deflation has kick started the US growth

In recent posts Keynesians were criticized that hikes in the monetary base like Quantitative Easing (QE2) failed to lift the US economy, but it was the debt ceiling that helped to restore confidence in the US and that austerity can lead to GDP growth. Paul Krugman angrily replied that “even a huge rise in the …

Read More »

Read More »