Tag Archive: JP Morgan

J.P. Morgan Launches Tokenised Money Market Fund on Ethereum

J.P. Morgan Asset Management has launched its first tokenised money market fund, My OnChain Net Yield Fund (MONY), on the public Ethereum blockchain.

The fund is powered by Kinexys Digital Assets, the firm’s multi-chain asset tokenisation solution.

MONY is a 506(c) private placement fund offering qualified investors the ability to earn US dollar yields by subscribing via Morgan Money, J.P. Morgan’s trading and analytics platform for liquidity...

Read More »

Read More »

The Great Taking!

Interview with James Patrick, TheGreatTakingReport.com

As many of my clients, friends and regular readers know well, I’ve spent the better part of the last decade criticizing all the great evils and trespasses of the State and its crony capitalist accomplices. I’ve written extensive analyses and gave many speeches warning fellow citizens about the dangers that lie in government power grabs and authoritarian transgressions. The most important of...

Read More »

Read More »

Prepare for Another Market Face Pounding

“Better than Goldilocks” “Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean? Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. Moreover, if the market goes up for long enough, the opinions become so engrained they seek to explain why stock prices...

Read More »

Read More »

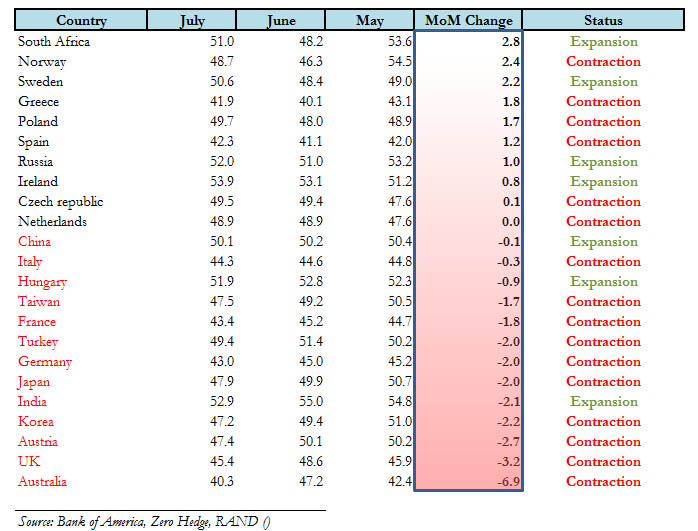

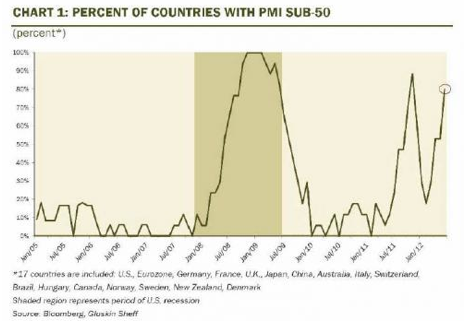

Global PMIs Contracting More – Are Stocks Overvalued?

updated August 05,2012 We publish a detailed analysis of global PMIs and compare them with the main risk indicators S&P500, Copper, Brent and AUD/USD some days after most PMIs came out. Abstract: Thanks to positive US consumer confidence, stock markets are highly valued, whereas the Purchasing Manager Indices (PMIs) for the manufacturing industry are contracting …

Read More »

Read More »

Global Macro with all Global PMIs July 4th

updated July 4,2012 This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out. JP Morgan’s Global PMI: Click for details inside the table, History of composite PMI

Read More »

Read More »

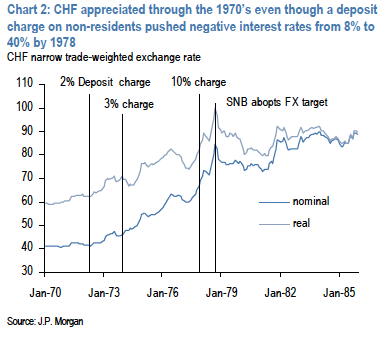

JP Morgan: Reflections on negative interest rates in Switzerland

Negative interest rates naturally attract attention given Switzerland’s use of these between 1972-1978.

Read More »

Read More »

When Rock begins to beat Paper

2022-07-24

by Stephen Flood

2022-07-24

Read More »