Tag Archive: jobs

Jobs (US) and Inflation (EMU) Highlight the Week Ahead

The new covid variant and quick imposition of travel restrictions on several countries in southern Africa have injected a new dynamic into the mix.

Read More »

Read More »

FX Daily, November 9: Falling Yields Give the Yen a Boost

Overview: Reports that the Fed's Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher against the dollar.

Read More »

Read More »

Isn’t the Labor Shortage Transitory?

Overview: The major central banks have successfully pushed back against the aggressive tightening the market had discounted. The Bank of England's decision not to raise rates after key officials seemed to suggest one was imminent. On the heels of what we argued was a dovish tapering announcement by the Fed, it spurred a dramatic decline in short and long-term interest rates. The drop in UK rates--21 bp in the 2-year and nearly 14 bp in the...

Read More »

Read More »

The Week Ahead: Four Central Banks and the US Jobs Report

The Bank of England and the Federal Reserve meetings are the highlights of the week ahead. Usually, the US jobs report is the main feature of the beginning of a new month's high-frequency data cycle. However, the FOMC meeting two days earlier may take away some of its significance, even if it still possesses some headline risk. Two other major central banks meet in the first week of November. The Reserve Bank of Australia meets early on November...

Read More »

Read More »

FX Daily, July 15: Strong Gains in US CPI and PPI Don’t Stop the Bond Market Rally

Strong inflation prints this week have not prevented the long-term US interest rates from tumbling. The 10-year yield is about 10 bp lower than where it closed on Tuesday after the lackluster 30-year auction. The 30-year yield itself is 11 bp lower.

Read More »

Read More »

FX Daily, July 02: US Jobs and OPEC+ Day

The US jobs report and OPEC+ decision are awaited. The dollar remains bid. Only the yen and Canadian dollar are showing a hint of resilience, though, on the week, the Scandis and dollar-bloc currencies are off between around 1-2%. The greenback is also firmer against the emerging market currency complex, and the JP Morgan index is off for the sixth consecutive session.

Read More »

Read More »

FX Daily, June 04: US and Canada Report on Jobs as G7 Fin Mins Talk Taxes

Stronger than expected US employment data, ahead of today's monthly report and compromise proposal on corporate tax by the White House to help secure a deal on infrastructure sent US bond yields and the dollar high. Late dollar shorts were forced to cover.

Read More »

Read More »

FX Daily, June 03: Don’t Believe Sino-American Thaw or Fed’s Corporate Bond Divestment is a Policy Signal

Market participants appear to be biding their time ahead of tomorrow's US jobs report as they digest recent developments. The dollar is firmer, equities are mixed, and benchmark bond yields are a little firmer. China and Hong Kong shares continue their recent underperformance, while most of the large markets in the Asia Pacific region edged higher.

Read More »

Read More »

FX Daily, May 10: The Dollar Remains on the Defensive

Last week's cyberattack on the largest US gasoline pipeline continues to lift oil and gasoline prices. The June gasoline futures gapped higher to extend last week's 2.4% gain but has subsequently moved lower to enter the gap.

Read More »

Read More »

FX Daily, February 05: Position Squaring Weighs on the Dollar Ahead of the Jobs Report

Overview: While equities continue to march higher, the dollar is softer amid position squaring ahead of the US jobs data. Gold has stabilized after yesterday's shellacking. Estimates for US nonfarm payrolls appear to have been creeping higher, encouraged by the ADP, PMI, and weekly initial jobless claims.

Read More »

Read More »

FX Daily, January 08: Can the Dollar Find Traction Even if the Employment Data Disappoint?

The global equity rally picked up this week as it closed in 2019. The MSCI Asia Pacific Index gained today and is up in nine of the past 10 sessions. It has fallen only in one week since the end of October. South Korea's Kospi led today's advance with a nearly 4% rally on the back of talks that were later played down between Hyundai and Apple.

Read More »

Read More »

Good Payrolls Still Say Slowdown

The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month.

Read More »

Read More »

FX Daily, November 6: A Pause that Refreshens?

Investors have piled into risk assets this week, seemingly undeterred by the US elections' lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a vaccine. MSCI Asia Pacific Index rose for the fifth consecutive session today to end its best week since April.

Read More »

Read More »

FX Daily, October 2: POTUS Infected: Is this the October Surprise?

Before a US election, there is often speculation of a last-minute game-changing development. News earlier today that the US President and his wife have tested positive for the Covid virus has injected a new unknown into not only the US election but the markets as well.

Read More »

Read More »

FX Daily, September 4: Markets Look for more Solid Footing, but Need to Get Passed US Jobs Data

The dramatic sell-off of US shares yesterday is the main focus, capturing the limelight from other forces, including today's US employment report. It was the third-worst session for the S&P 500 since the March 23 bottom, and the other two did not see follow-through selling.

Read More »

Read More »

FX Daily, August 07: Position Adjustment Dominates ahead of US/Canada Employment Reports

Escalating dramas may be behind the position adjustment today ahead of the US jobs data. The US and China feud expanded beyond Tiktok to WeChat, and efforts to tighten disclosure rules for Chinese companies listed in the US are nearing. The negotiations between the White House and the Democrats broke down, preventing or at least delaying additional stimulus.

Read More »

Read More »

FX Daily, July 2: Dollar Thumped Ahead of US Jobs Report

Market optimism over the possibility of a vaccine in early 2021 overshadowed the continued surge in US cases, where the 50k-a-day threshold of new cases has been breached. Following the NASDAQ close yesterday at record highs, global equities have advanced. Led by Hong Kong returning from yesterday's holiday, Asia Pacific equities rallied. Most local markets rose by more than 1%, though Tokyo and Taiwan lagged.

Read More »

Read More »

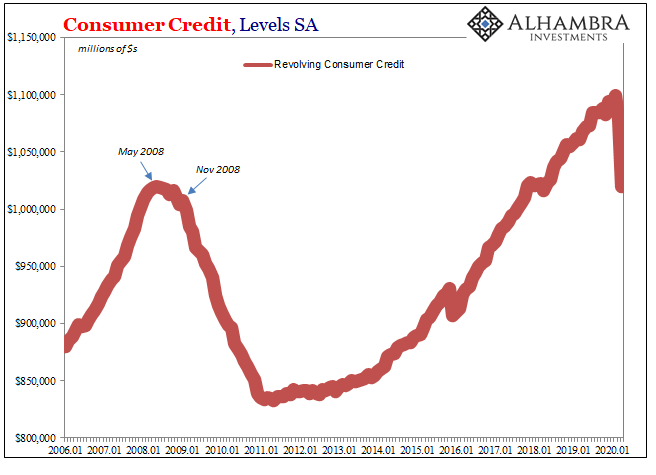

A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail.

Read More »

Read More »

FX Daily, June 9: Profit-Taking Gives Turn Around Tuesday Its Name

Overview: The S&P 500 turning higher on the year was the last straw before an arguably overdue bout of profit-taking kicked-in and is the dominant feature today in the capital markets. It began slowly in the Asia Pacific region. Equities were mixed, and Australia's 2.4% rally and the 1.6% gain in Hong Kong stood out. Europe's Dow Jones Stoxx 600 was off for a second day (~1.3%), and US stocks are trading heavily, warning that the S&P 500 may give...

Read More »

Read More »

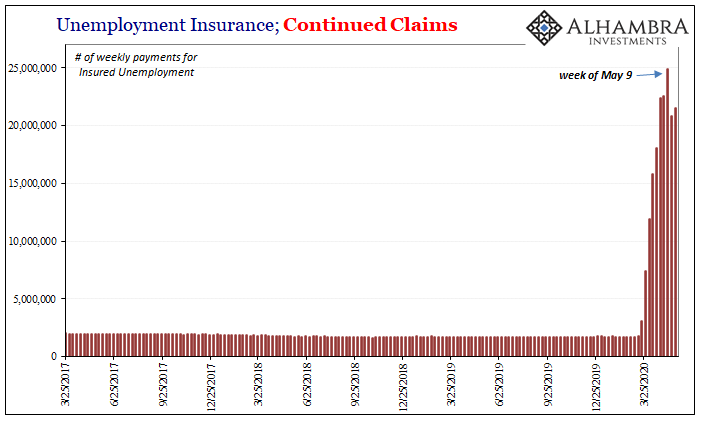

What Did Everyone Think Was Going To Happen?

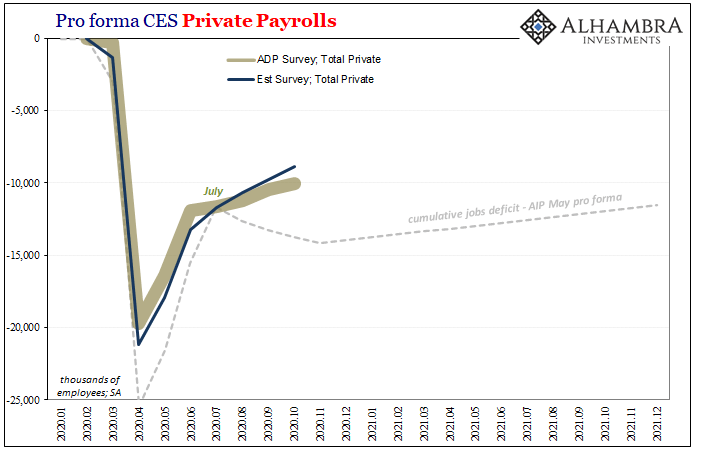

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign.The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this...

Read More »

Read More »