Tag Archive: Japanese yen

FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This …

Read More »

Read More »

Brief Look at the Start of the New Week’s Activity

The most notable thing is not what has happened, but what has not happened. The market has not responded to the soft Chinese data over the weekend. Chinese equities began softer but recovered fully and the Shanghai Composite closed on its highs. The MSCI Asia Pacific Index is snapping a two-day losing streak with a … Continue reading...

Read More »

Read More »

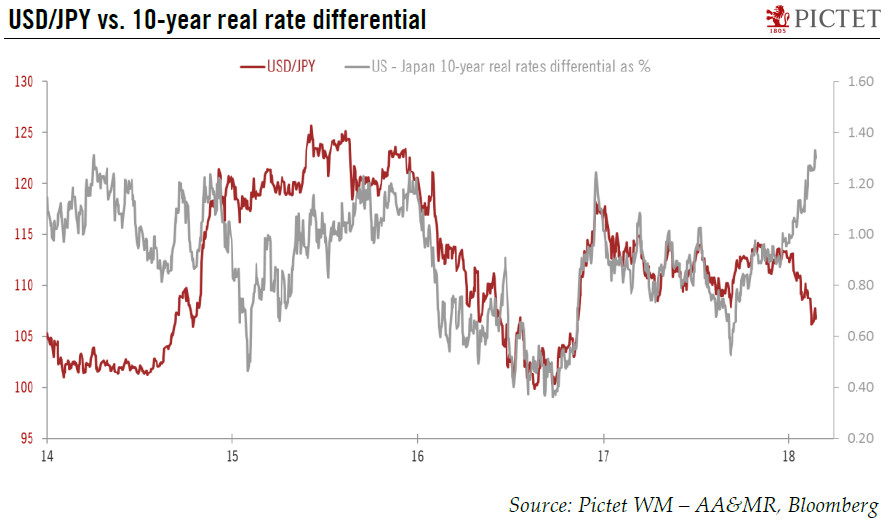

Are Dollar Fundamentals Lagging the Technical Improvement?

The US dollar extended its recovery that began on May 3. Its technical condition remains constructive, even though up until now, the gains are still consistent with a modest correction rather than a trend reversal. The details of the employment report, if not the headline, coupled with the 1.3% increase in retail sales, have boosted …

Read More »

Read More »

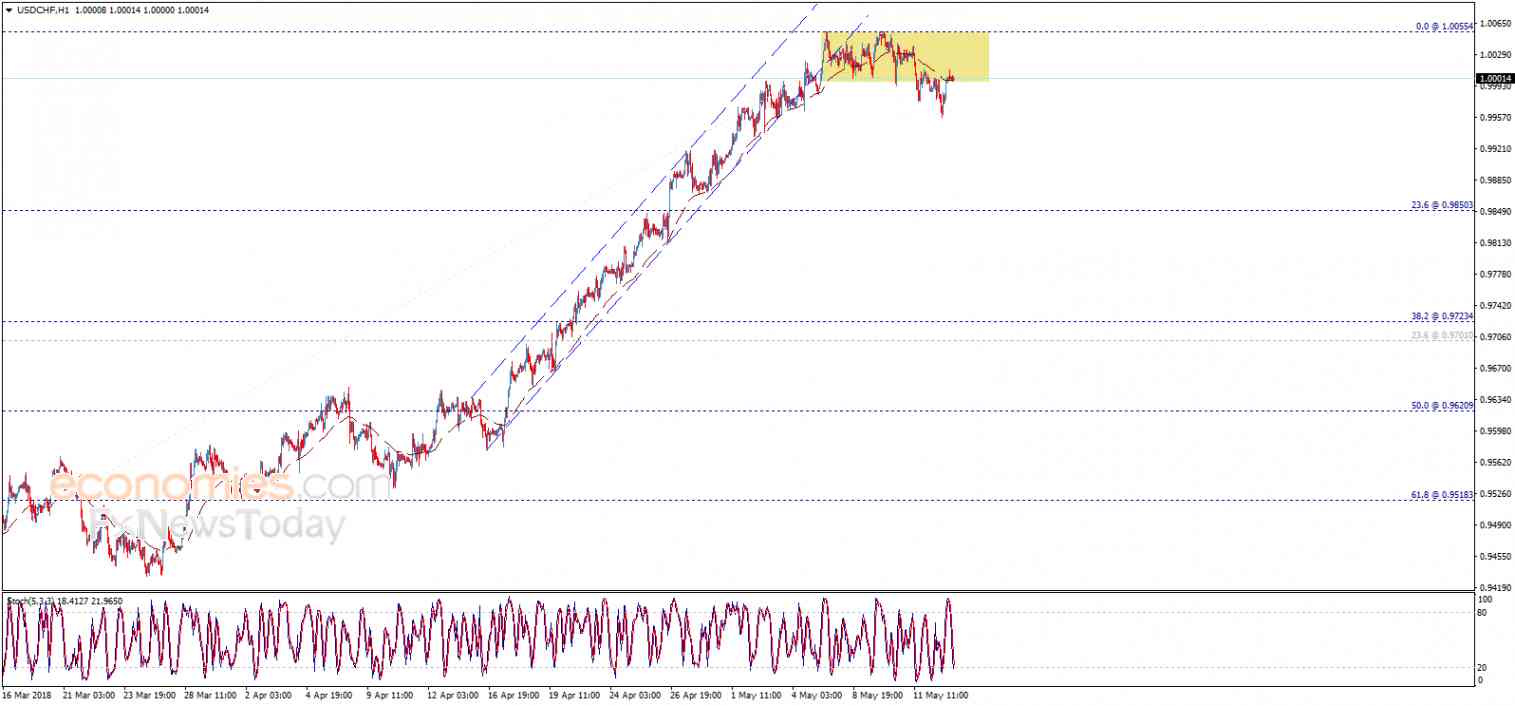

Dollar’s Technical Tone Improves, but No Breakout (Yet)

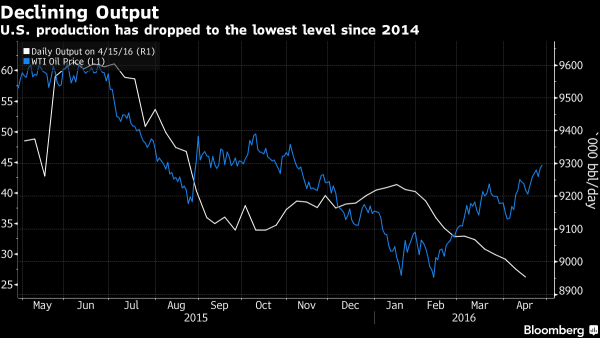

The US dollar continued the recovery begun May 3 and rose against most of the major currencies over the past week. A nearly 3.5% rally in oil prices, the fifth weekly gain in the past six weeks (a $9.5 advance over the period), helped the Norwegian krone turn in a steady performance. The Canadian dollar’s 0.2% … Continue...

Read More »

Read More »

FX Daily, May 12: Yen Recovers After Being Thrown for 2 percent

The Japanese yen is recovering from two-day two percent decline. The yen is the strongest of the majors today, rising about 0.6%. The greenback initially extended its gains marginally in early Tokyo before the selling pressure emerging. Th...

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

Dollar Drivers in the Week Ahead

The key issue facing the foreign exchange market is whether the modicum of strength the US dollar demonstrated last week is the beginning of a sustainable move. It is possible that the market is again at a juncture in which the price action will...

Read More »

Read More »

Key Dollar Developments Include Bottoming against the Dollar-Bloc

The US dollar rose against all the major currencies last week. The importance of the price action does not lie with the magnitude or the breadth of the advance. Instead, the two takeaway technical observations are 1) the seemingly one-way market for euro and yen ended and 2) the dollar-bloc currencies appear to have put … Continue reading...

Read More »

Read More »

FX Daily, May 5: Dollar Performance Turns More Nuanced

The US dollar is firm, near the best levels of the week against the euro, yen, and sterling. However, against the dollar-bloc and several actively traded emerging market currencies, including the Turkish lira and South African rand, the greenbac...

Read More »

Read More »

Greenback Firmer, but has it Turned?

There is one question many investors are asking after noting that with Cruz dropping out of the Republican primary, Trump has secured the nomination, and that is whether the dollar has turned. The greenback has extended yesterday’s reversal higher. The euro had briefly poked through $1.16 and closed on its lows a little below $1.15. …

Read More »

Read More »

FX Daily, May 02: New Month, Same Heavy Dollar

In quiet turnover, with China, Hong Kong, Singapore and London markets closed, the US dollar is trading with a heavier bias against all the major currencies. Lower commodity prices, including oil and copper, appears to be taking a toll on some emerging market currencies, including the South African rand. Japanese markets were closed last Friday …

Read More »

Read More »

Weekly Speculative Postions: Euro and Yen Exposure Trimmed ahead of FOMC and BOJ

Speculators in the futures market made mostly small position adjustments in the sessions leading up to the FOMC and BOJ meetings. During the Commitment of Traders reporting week ending April 26, the largest adjustment of speculative position in the currency futures was the 12.5 k build of gross long Australian dollar contracts. The accumulation …

Read More »

Read More »

Will the Dollar Bloom like May Flowers after April Showers?

April was a cruel month for the US dollar. It fell against all the major currencies; even those whose central banks have negative yields. The greenback also fell against nearly all the emerging market currencies, but the Philippine peso and the Polish zloty. Through the first four months of the year, the dollar is lower …

Read More »

Read More »

FX Daily, April 29: Dollar Losses Extended Ahead of the Weekend

There are two main forces in the foreign exchange market that are rippling through the capital markets. The first is the continued weaker dollar tone. The combination of what appears to be a stagnating US economy (0.5% annualized pace in Q1) and a market that does not believe the Federal Reserve will hike rates in … Continue reading...

Read More »

Read More »

Podcast Discussing Dollar, Fed, BOJ on Futures Radio Show

I had the privilege of being interviewed by Anthony Crudele, who is trader at the CME, for the Futures Radio Show.

There was much to discuss. The FOMC met yesterday. The market, judging from the Fed funds futures see little chance of a Ju...

Read More »

Read More »

Central Banks Roil Markets

The Bank of Japan defied expectations and its economic assessment to leave policy unchanged. The inaction spurred a 3% rally in the yen and an even larger slump in stocks. The financial sector took its the hardest and dropped almost 6%. The...

Read More »

Read More »

What is the BOJ Going to Do?

Under Kuroda's leadership the BOJ has surprised the market a number of times, most recently with the move to negative rates at the end of January.

It is not that such a move, which has been tried by several European central banks, was without...

Read More »

Read More »

FX Daily April 25: Dollar Pares Pre-Weekend Gains Against Euro and Yen

The US dollar starts what promises to be an eventful week giving back some the gains score in second half of last week against the euro and yen. Equity markets are extending their pre-weekend losses. Commodities are also trading with a heavier bias. Markets in Australia, New Zealand, and Italy are closed for national …

Read More »

Read More »