Tag Archive: Japan

They’ve Gone Too Far (or have they?)

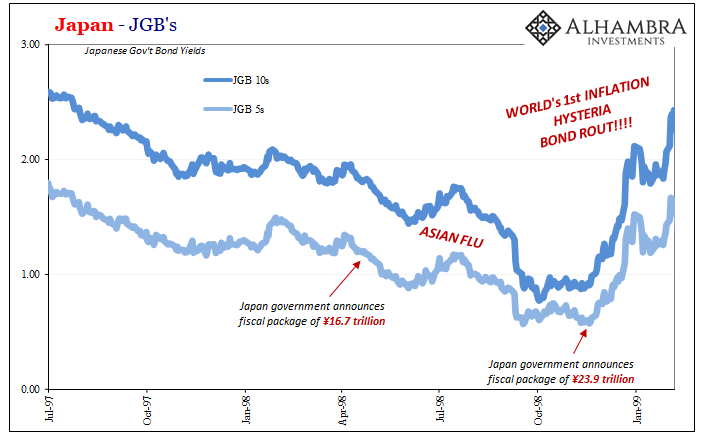

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

Seizing The Dirt Shirt Title

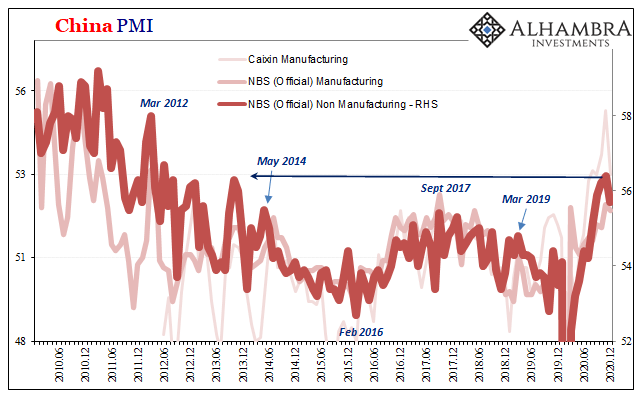

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

FX Daily, January 04: Rising Equities and Slumping Dollar Greet the New Year

Overview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week's 3.6% gain. It has not rallied for seven consecutive sessions.

Read More »

Read More »

FX Daily, November 27: Dollar Offered Ahead of the Weekend

Equities are finishing the week on a firm tone, while the US dollar remains heavy. In the Asia Pacific, only Australia and India did not end the week on a firm note. The MSCI Asia Pacific completed its fourth consecutive weekly gain, for around a 13% gain.

Read More »

Read More »

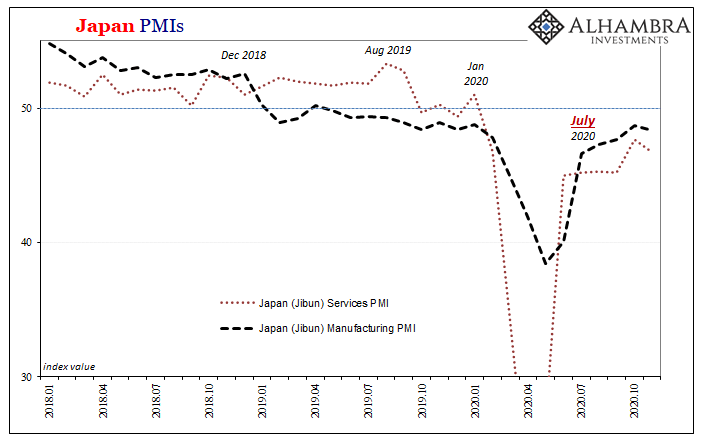

Deflation Returns To Japan, Part 2

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic.

Read More »

Read More »

FX Daily, November 20: US Treasury-Fed Dispute Spurs Handwringing but Immediate Market Impact was Exaggerated

Overview: News that the stimulus talks between the House Democrats and Senate Republicans was the excuse traders were looking for to extend the US equity gains yesterday, but shortly after the close, confirmation that Treasury was not going to agree to extend several Fed facilities sent stocks reeling.

Read More »

Read More »

FX Daily, November 18: Balancing Pandemic Surge with Optimism about Vaccine

News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600 continues to gyrate within Monday's range.

Read More »

Read More »

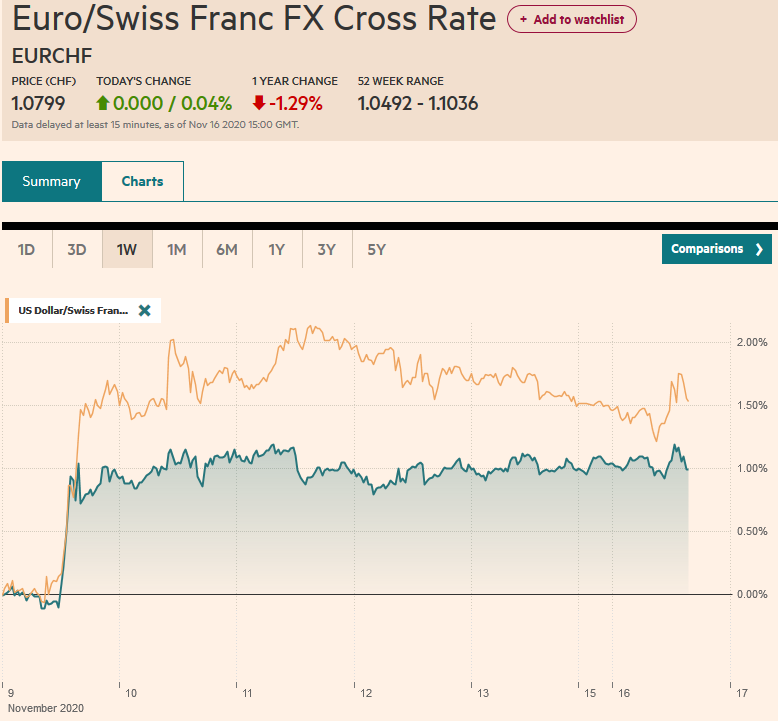

FX Daily, November 16: Risk-On Despite Surging Pandemic

Despite the surging pandemic and new restriction measure, risk-appetites appear strong to start the week. Led by 2% gains in the Nikkei and Taiwan's Taiex, all of the Asia Pacific region's equity markets advanced. European markets have followed suit and the Dow Jones Stoxx 600 is knocking on last week's eight-month high.

Read More »

Read More »

FX Daily, November 12: Nervous Calm in the Capital Markets

There is a nervous calm in the capital markets today. The equity rally in the Asia Pacific region stalled to end an eight-day rally, though the Nikkei's rally remains intact.

Read More »

Read More »

FX Daily. October 29: Markets Continue to Struggle

The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region.

Read More »

Read More »

FX Daily, October 1: Hope Springs Eternal

Speculation that a new round of fiscal stimulus from the US is possible is encouraging risk-taking today. Many large Asian centers were closed for holidays today, and a technical problem prevented the Tokyo Stock Exchange from opening.

Read More »

Read More »

FX Daily, September 24: Darkest Before Dawn

The two recent market developments, push lower in stocks, and higher in the dollar is continuing. Tuesday's gains in the S&P 500 and NASDAQ were unwound on Wednesday and this is helping drag global markets lower. The MSCI Asia Pacific Index fell for the fourth consecutive session today and many markets (India, Shenzhen, Taiwan, and Korea) fell more than 2% and most others were off more than 1%.

Read More »

Read More »

Uh Oh, The Dollar Has Caught A Bid

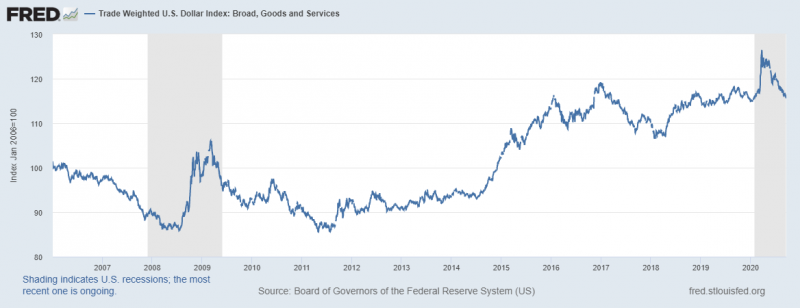

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »

Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?Not for nothing, every couple years when we do those (record low yields) that’s what “they”...

Read More »

Read More »

FX Daily, September 11: Still Reluctant to take Euro above $1.19 but Sterling Remains Unloved

Yesterday's roller-coaster price action has not had much impact on today's activity. The slide in US equities after early gains failed to prevent Japanese, Chinese, and Hong Kong equities from advancing, though other markets in the region were not as resilient.

Read More »

Read More »

Bottleneck In Japanese

Japan’s yen is backward, at least so far as its trading direction may be concerned. This is all the more confusing especially over the past few months when this rising yen has actually been aiding the dollar crash narrative while in reality moving the opposite way from how the dollar system would be behaving if it was really happening.

Read More »

Read More »

FX Daily, September 4: Markets Look for more Solid Footing, but Need to Get Passed US Jobs Data

The dramatic sell-off of US shares yesterday is the main focus, capturing the limelight from other forces, including today's US employment report. It was the third-worst session for the S&P 500 since the March 23 bottom, and the other two did not see follow-through selling.

Read More »

Read More »

FX Daily, September 1: Dollar Lurches Lower

The US dollar has been sold-off across the board. The euro approached $1.20, and sterling neared $1.3450. The greenback traded below CAD1.30 for the first time since January. Most emerging market currencies but the Turkish lira, are also advancing today.

Read More »

Read More »

FX Daily, August 31: Month-End Gyrations and the Fed’s Ad Hocery

Markets are searching for direction at month-end. Asia Pacific shares outside of Japan lower. Berkshire Hathaway confirmed taking a $6 bln stake in Japanese trading companies over the past year, and the pullback in the yen helped lift shares. The MSCI Asia Pacific Index rose 2% last week.

Read More »

Read More »