Tag Archive: Japan Core Machinery Orders

FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

The significant development this week has been the recovery of equities after last week's neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the sales of US bonds more than the resulting higher yields. Asia followed US equities higher.

Read More »

Read More »

FX Daily, January 17: Dollar Stabilizes After Marginal New Lows

After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the European session. The next result is a choppy but flattish consolidation compared with last week's closing prices.

Read More »

Read More »

FX Daily, December 13: Greenback Quiet Ahead of Five Central Bank Meetings

The Federal Reserve gets the balling rolling today with the FOMC meeting, which is most likely to deliver the third hike of the year. Tomorrow, four European central banks meet: Norway, Switzerland, the UK, and the ECB. The MSCI Asia Pacific Index rose nearly 0.3%, though Japanese and Indian shares were lower. In Europe, the Down Jones Stoxx 600 is paring yesterday's gains (-0.2%) led by utilities and telecom. Consumer discretion and financials are...

Read More »

Read More »

FX Daily, October 11: Markets Looking for a New Focus

The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday's ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday.

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, June 12: Ahead of Central Bank Meetings, Politics Dominates

The US dollar is trading within its pre-weekend range against the major currencies as participants await the central bank meeting starting in the middle of the week. The Federal Reserve, Bank of England, and the Bank of Japan meet.

Read More »

Read More »

FX Daily, March 13: Bonds and Equities Rally, Dollar Heavy

Hit by profit-taking ahead of the weekend, despite US jobs data that remove the last hurdle to another Fed hike this week, the greenback remains on the defensive. It has softened against all the major currencies and many of the emerging market currencies. The chief exception is those in eastern and central Europe.

Read More »

Read More »

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

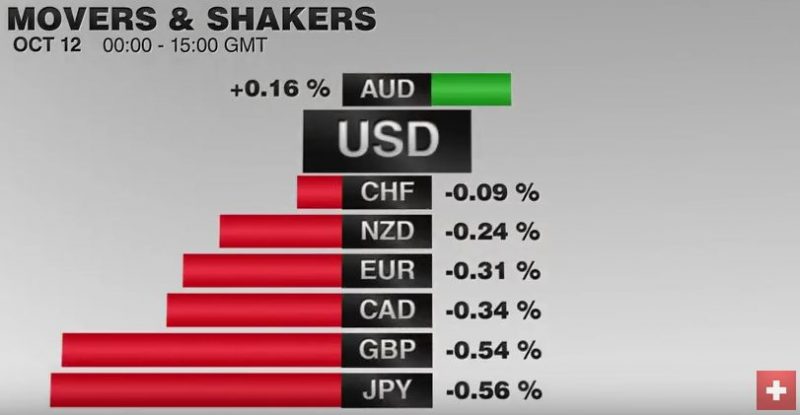

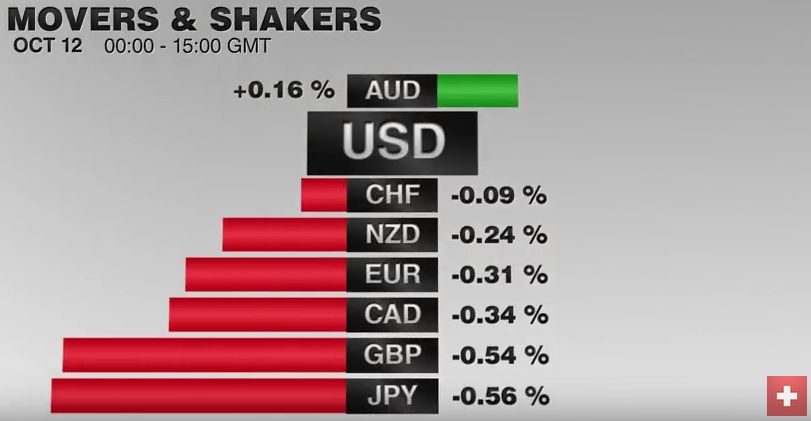

FX Daily, October 12: May Concedes to Parliament, Sterling Rises after Pounding

News that UK Prime Minister May has accepted that Parliament should vote on her plan for exiting the EU stopped sterling's headlong slide. Sterling had been pounded for roughly 8.5 cents since the start of the month including the last four sessions. The idea that parliament, where the Conservatives enjoy a slim majority, is less enthusiastic about Brexit may mean a less acrimonious divorce.

Read More »

Read More »

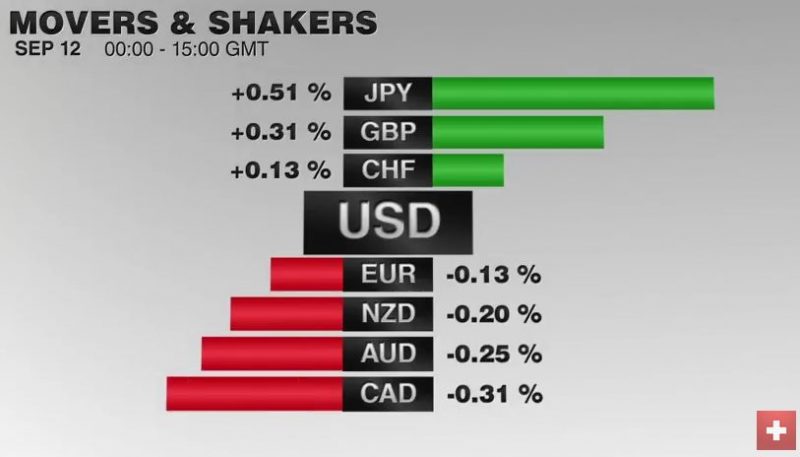

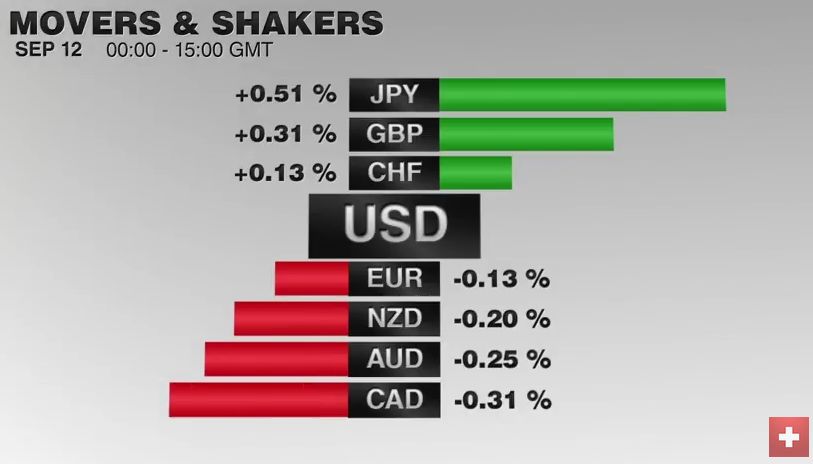

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »

FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE's Italian bank index is up 1.4% to extend its recovery into a fifth session.

Read More »

Read More »

FX Daily, July 11: Dollar Extends Gains

The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put together another fiscal stimulus package and the Bank of England may cut rates late this week are helping global equities.

Read More »

Read More »

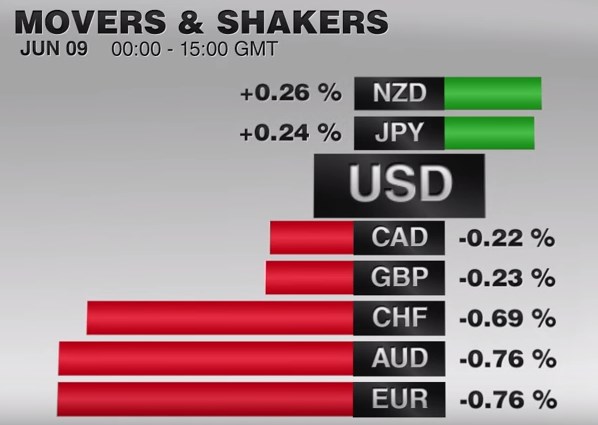

FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD.

The US dollar is posting modest upticks against most of the

European currencies and the Canadian and Australian dollars. However, it has fallen against the yen and taken out the

recent low, leaving little between it and the May 3 l...

Read More »

Read More »