Tag Archive: Janet Yellen

Their Gap Is Closed, Ours Still Needs To Be

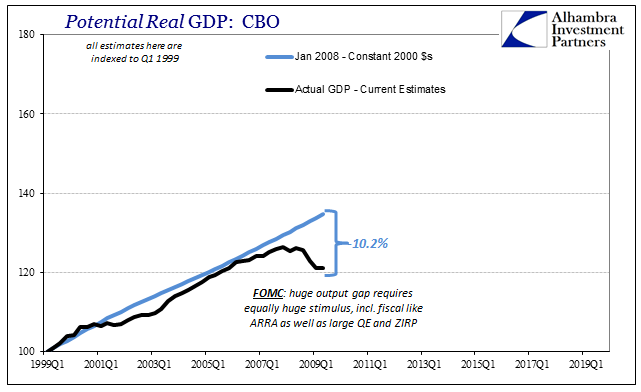

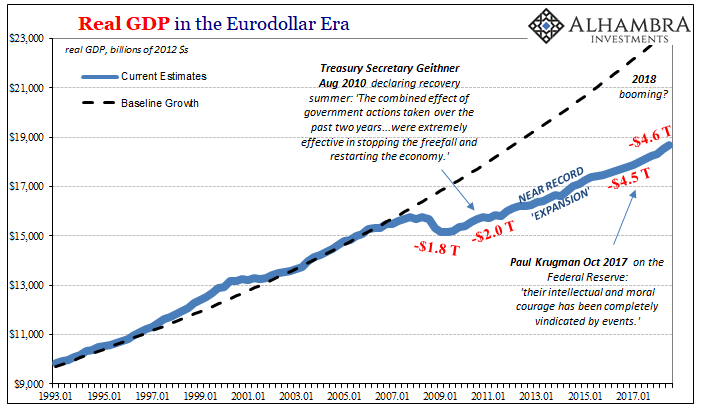

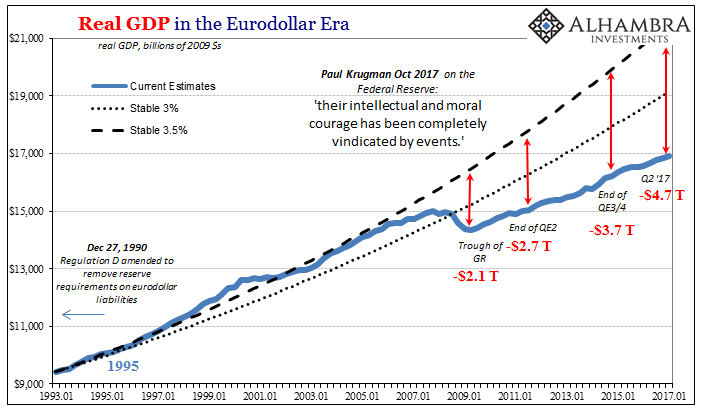

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »

Bi-Weekly Economic Review

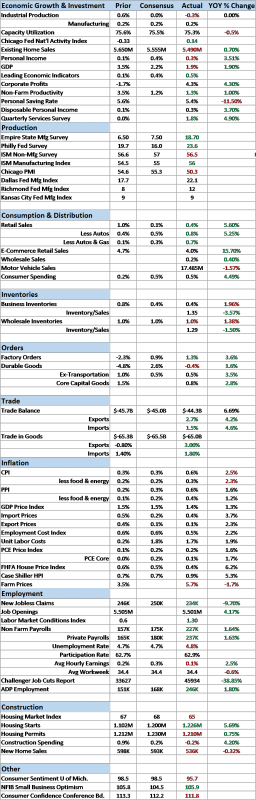

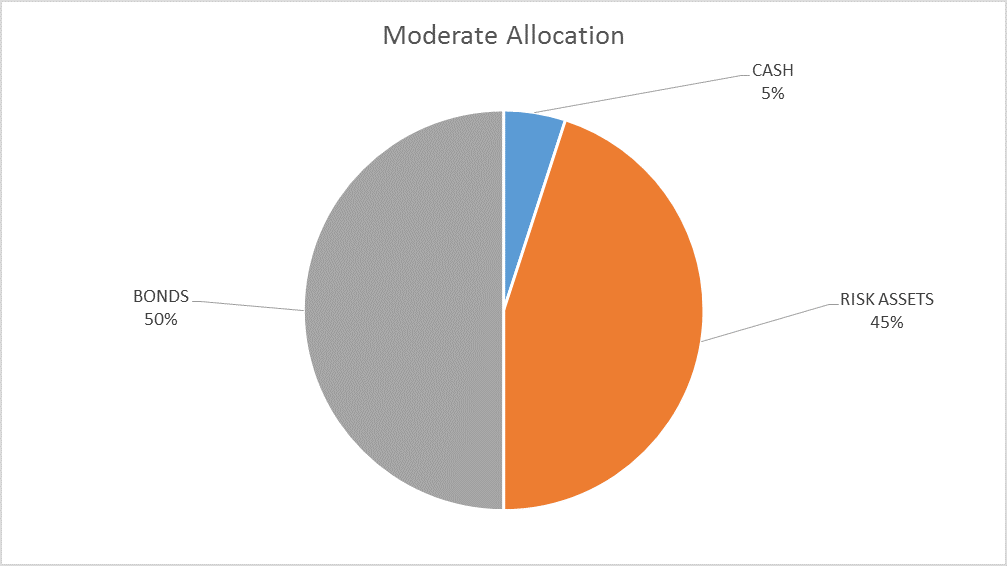

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

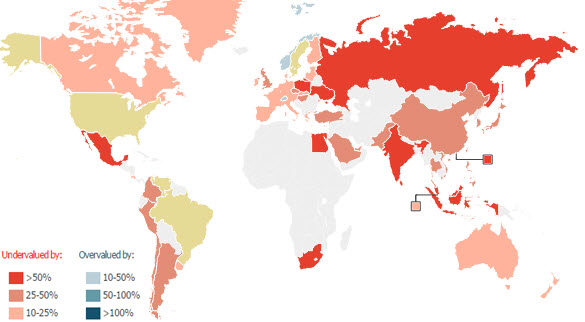

The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous. On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically motivated. Trump also called for the Federal Reserve to be audited.

Read More »

Read More »

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

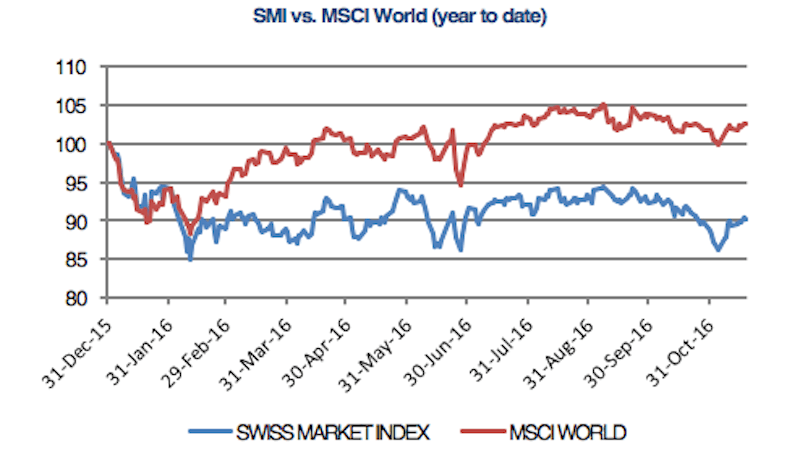

SMI up on post Trump rally

Swiss stocks continued to rise this week, in line with other global stocks thanks to a strong performance from financials which gained as investors weighted the prospects of higher interest rates in the US.

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

Jim Grant Puzzled by the actions of the SNB

James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold.

Read More »

Read More »

Financial Repression Is Now “In Play”

A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for...

Read More »

Read More »

Evacuate or Die…

BALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash.

Read More »

Read More »

Swiss central bank can cut rates further if needed, says bank president Jordan

The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted that the bank has already pushed rates quite far.

Read More »

Read More »

The Dying Middle Class

As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset owners, and the biggest borrowers during that period –...

Read More »

Read More »

FX Daily, September 22: Swiss Franc Strongest Currency Again

Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance.

Read More »

Read More »

Janet Yellen’s Shame

n honest capitalism, you do what you can to get other people to voluntarily give you money. This usually involves providing goods or services they think are worth the price. You may get a little wild and crazy from time to time, but you are always called to order by your customers.

Read More »

Read More »

How is Real Wealth Created?

An Abrupt Drop. Let’s turn back to our regular beat: the U.S. economy and its capital markets. We’ve been warning that the Fed would never make any substantial increase to interest rates. Not willingly, at least. Each time Fed chief Janet Yellen opens her mouth, out comes a hint that more rate hikes might be coming.

Read More »

Read More »