Tag Archive: Italy Gross Domestic Product

FX Daily, May 29: Month-End Profit-Taking Weighs on Equities as the Euro Pops Above $1.11

Overview: The announcement that President Trump will hold a press conference on China later today rattled investors yesterday after they had earlier shrugged off the escalation of tension between the US and China to take the S&P 500 up to its highest level in nearly three months. The S&P 500 reversed and settled on its lows, and this carried over into today's activity, which also may be reflecting month-end adjustments.

Read More »

Read More »

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »

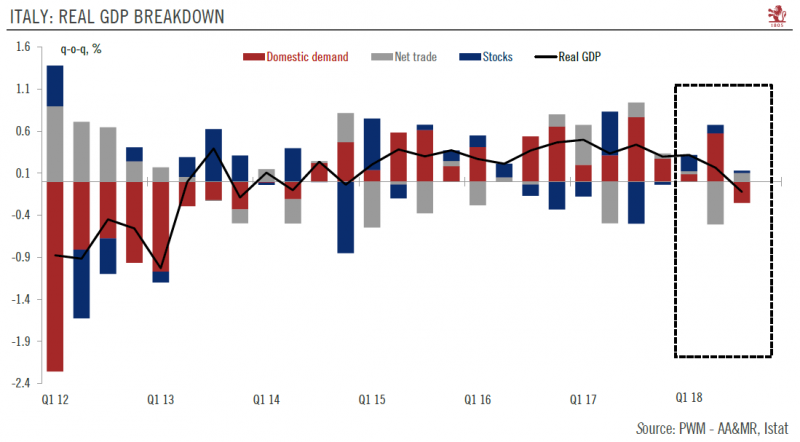

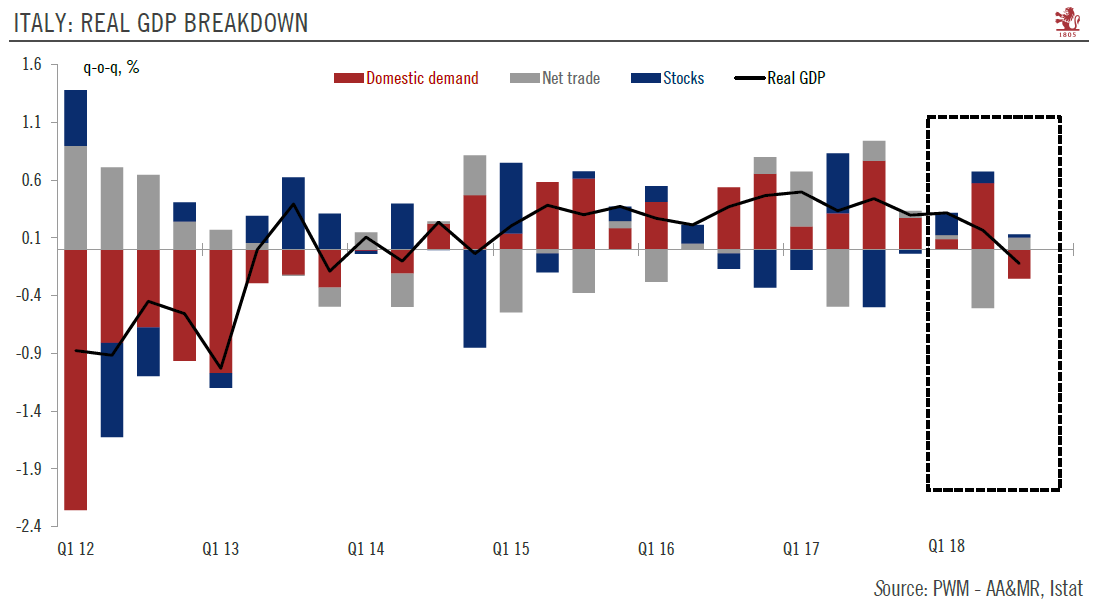

Growth Contraction puts pressure on Italian Government

The downward revision to 3Q GDP will make the Italian government’s targets more difficult to achieve and complicate the budget debate with Europe. The Italian statistical office’s (ISTAT) final reading showed that the economy shrank 0.1% q-o-q (-0.5% q-o-q annualised) in Q3, whereas a preliminary reading on October 30 showed that growth was flat.

Read More »

Read More »

FX Daily, March 02: Markets Unanchored?

The announcement of the US intention to impose tariffs on imported steel and aluminum on national security grounds has sent ripples through the capital markets. Yet there is certainly more going on here than that. The tariffs, justification, and magnitude have indicated and expected. After reversing lower on Tuesday and selling off on Wednesday, equity investors hardly needed a fresh reason to sell on Thursday.

Read More »

Read More »

FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. Moreover, the focus today on US CPI may prove for nought.

Read More »

Read More »

FX Daily, December 01: Dollar Consolidates Weekly Gain, while Equities Ease to Start New Month

The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher.

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

FX Daily, August 16: Swiss Franc and Yen Improve after Dovish Draghi Comments

Swiss Franc and Yen Improve after Dovish Draghi Comments, A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB's Draghi will not be discussing the central bank's monetary policy course at Jackson Hole confab, which will take place next week.

Read More »

Read More »

FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

The US dollar is mostly firmer against the major currencies. It is consolidating yesterday's losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday's lows. On the other hand, even strong data from Japan did not drive the yen higher.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

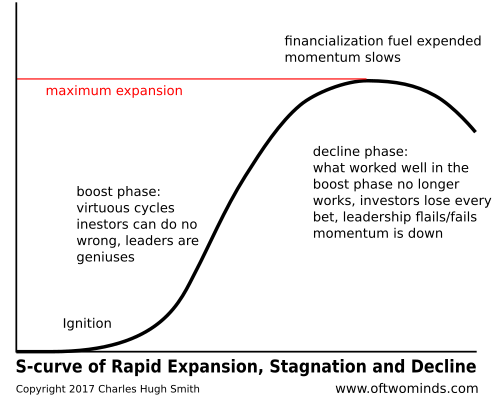

Who’s Playing The Long Game–and What’s Their Game Plan?

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

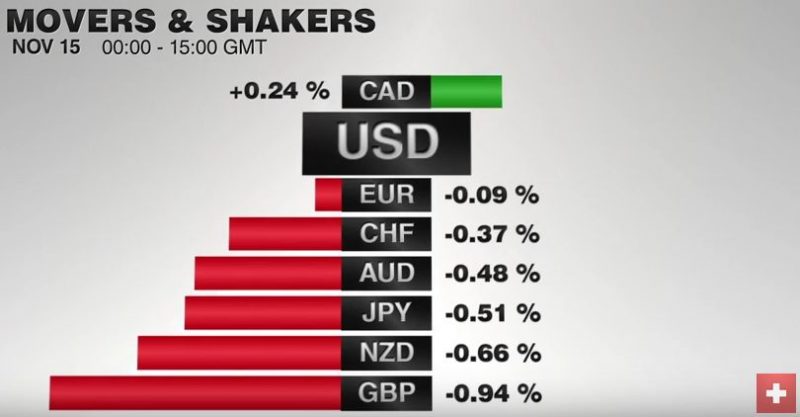

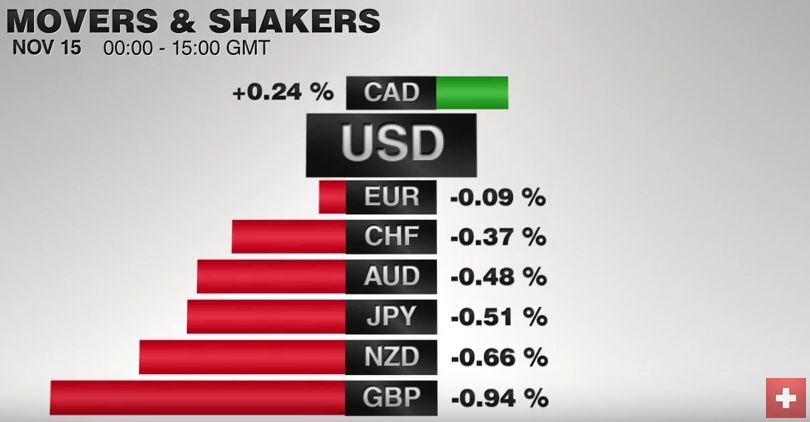

FX Daily, November 15: Investors Catch Breath, Markets Consolidate

After a dramatic run since the US election, the capital markets are consolidating today. It is a bit too restrained to such a Turn Around Tuesday is unfolding. The euro is struggling to sustain corrective upticks through $1.08, and after a pullback is, the greenback pushed back above the JPY108 level like a beach ball held under water.

Read More »

Read More »

The Italian Dilemma

The sudden panic about a potentially imminent Italian banking sector collapse back in July has somewhat subsided for now, but sooner or later the issue will inevitably rear its ugly head again.

Read More »

Read More »

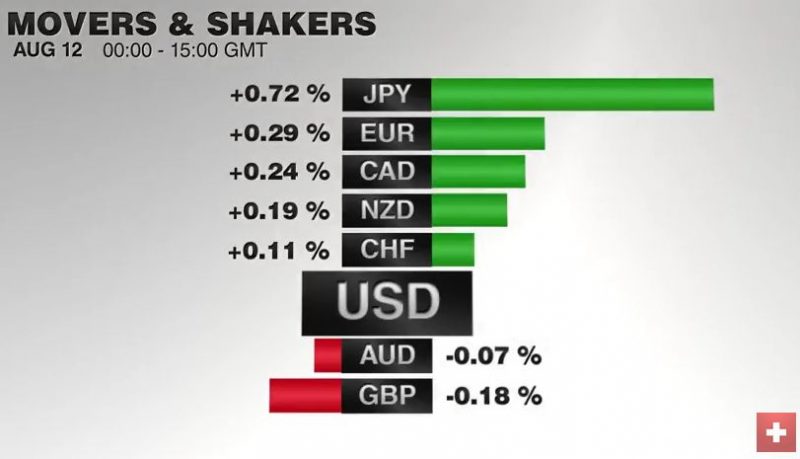

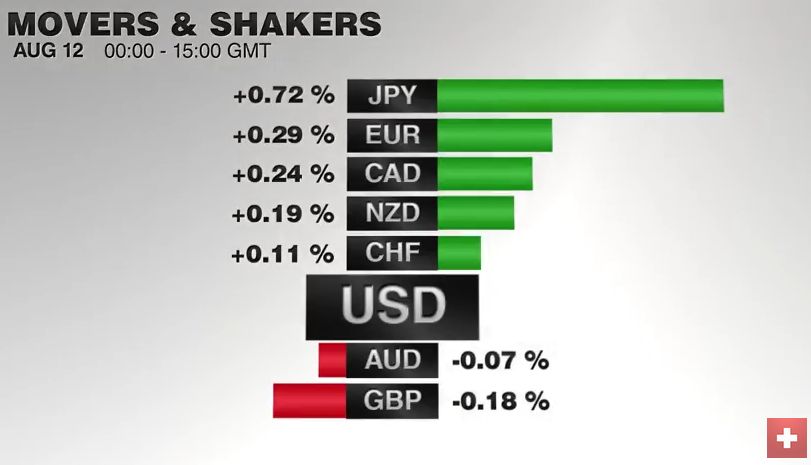

FX Daily, August 12: Summer Markets Grind into the Weekend

There is a general consolidative tone in the capital markets as the week draws to a close. The US retail sales report may offer a brief distraction, but it is unlikely to significantly shift expectations about the trajectory of Fed policy. Indeed, it might not really change investors' information set.

Read More »

Read More »