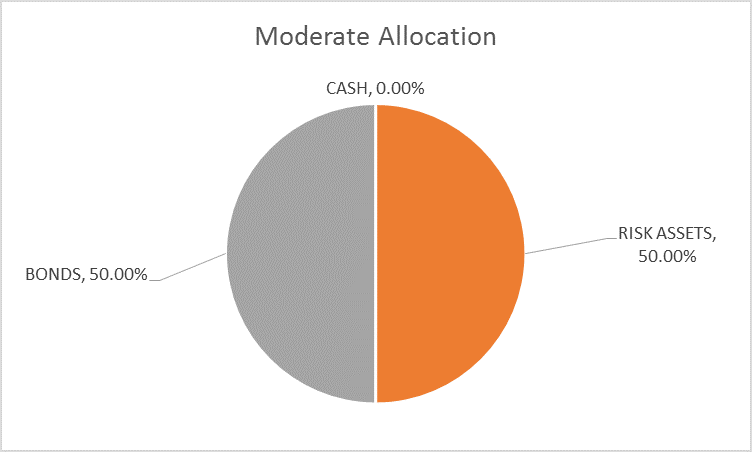

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Tag Archive: Investing

Fed GDP Projections

“It is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. In fact, as I have noted previously, the Federal Reserve are the worst economic forecasters on the planet.

Read More »

Read More »

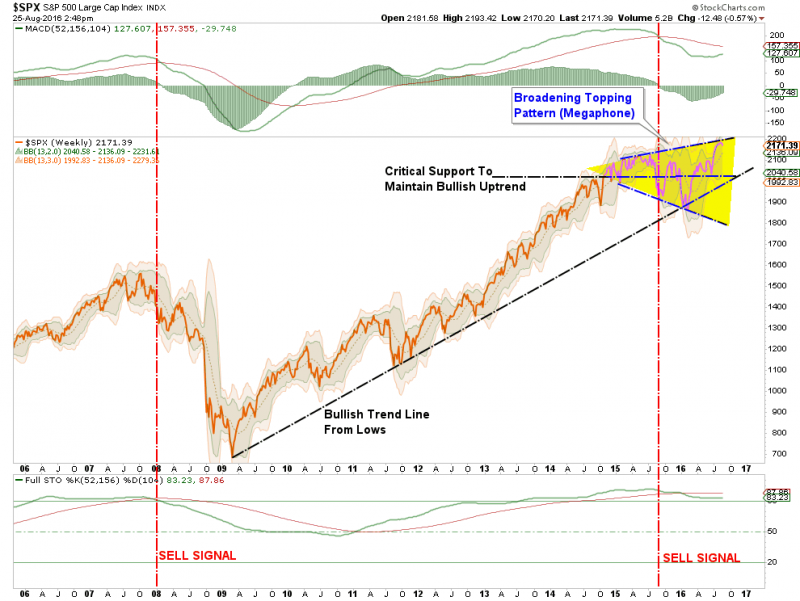

Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed ...

Read More »

Read More »

Weekend Reading Negative Rates: The Coin Flip Market

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party.

Read More »

Read More »