Tag Archive: IFO

An Anti-Inflation Trio From Three Years Ago

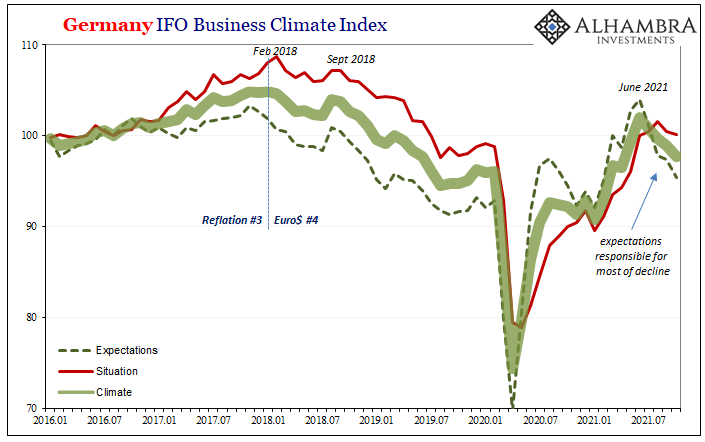

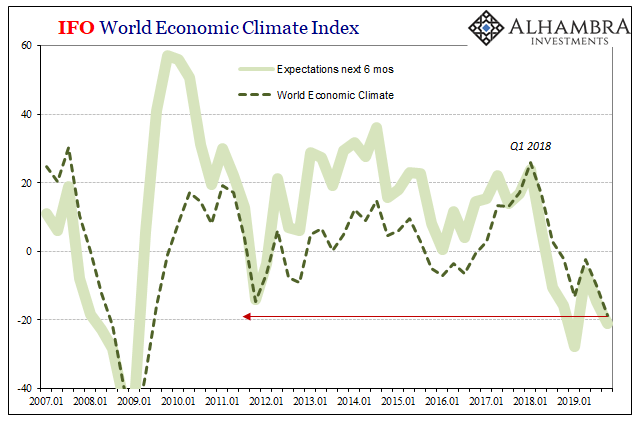

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential.

Read More »

Read More »

Stagnation Never Looked So Good: A Peak Ahead

Forward-looking data is starting to trickle in. Germany has been a main area of interest for us right from the beginning, and by beginning I mean Euro$ #4 rather than just COVID-19. What has happened to the German economy has ended up happening everywhere else, a true bellwether especially manufacturing and industry.

Read More »

Read More »

QE’s and Rate Cuts: Two Very Different Sets of Sentiment Drawn From Them

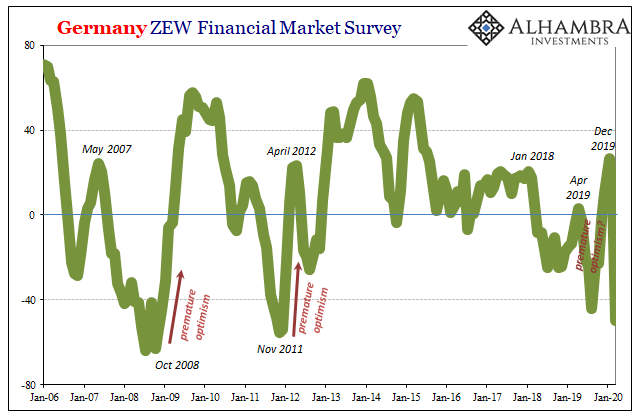

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work.

Read More »

Read More »

Diskussion beim IFO-Institut: Die Schuldengemeinschaft und Generationengerechtigkeit

Die Aufklärung für den mündigen Bürger über ESM, Eurobonds, Schuldengemeinschaft und Generationengerechtigkeit. Nehmen Sie sich die Zeit und Sie können die kommende Politik Merkels und den weiteren Verlauf der Eurokrise voraussehen, möglicherweise sogar mit ihrem Investment .

Read More »

Read More »

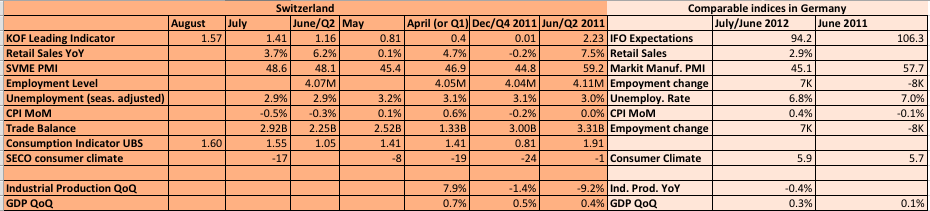

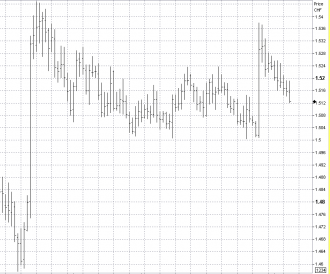

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »

Recent History of the Swiss franc, July 2009

A market view history of the EUR/CHF from the website ForexLive July 2009 EURCHF Offers 1.5250 Im hearing that EURCHF offers at 1.5250 are lined up ready to defend the level. There was an attempt to take it higher on Friday after the German IFO number but failed. 1.5250 is proving to be quite a level. … Continue reading »

Read More »

Read More »