Tag Archive: Helicopter Money

“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos. It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in.

Read More »

Read More »

“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB.

Read More »

Read More »

The Path to Inflation: “Helicopter Money”

Yet conventional economists are virtually unanimous that deflation is the danger and inflation is a "good thing" we need to spur so servicing existing debt becomes easier for debtors. Due to the deflationary pressures of technology and stagnant wages for the bottom 90%, the consensus sees low inflation as far as the eye can see.

Read More »

Read More »

The Point of War Is Not to Win

In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s.

Read More »

Read More »

A Convocation of Interventionists – Part 1

Modern Economics – It’s All About Central Planning. We are hereby delivering a somewhat belated comment on the meeting of monetary central planners and their courtier economists at Jackson Hole. Luckily timing is not really an issue in this context.

Read More »

Read More »

‘Last Economist Standing’ John Taylor Urges “Less Weird Policy” At Jackson Hole

I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it.

Read More »

Read More »

Investing in Gold in 2016: Global Paradigm Shifts in Politics and Markets

Crumbling Stability. In the past few months, we have witnessed a series of defining events in modern political history, with Britain’s vote to exit the EU, (several) terror attacks in France and Germany, as well as the recent attempted military coup in Europe’s backyard, Turkey. Uncertainty over Europe’s political stability and the future of the EU keeps growing.

Read More »

Read More »

The Helicopter Mortgage

Medical vs. Financial Engineering. I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later.

Read More »

Read More »

Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

A Nation of Crooks?

Apples to Oranges. PARIS – The stock market seemed chilled last week, like a corpse waiting for an autopsy. Monday morning, gold was falling in Europe… as investors anticipate a higher dollar. But we’ll return to the markets, the dollar and the absurdities wrought by our money system, tomorrow.

Read More »

Read More »

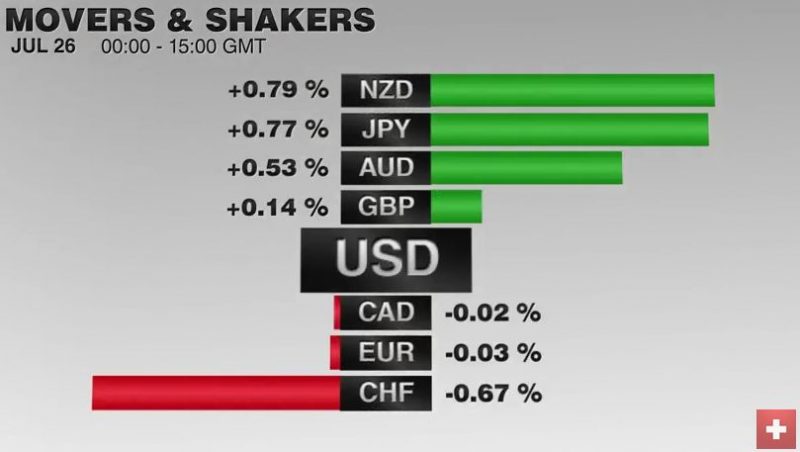

FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical.

Read More »

Read More »

Unsound Money Has Destroyed the Middle Class

DUBLIN – When you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite counter top – you become frustrated… and then… maniacal. You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane.

Read More »

Read More »

FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

A recent Reuters poll found about half of the 100 economists surveyed expect a hike in Q4, which really means December since the November meeting is too close to the national election. The other half is split between a Q3 rate hike (September) and some time in 2017. That said, two primary dealers anticipate no hike until the end of 2017.

Read More »

Read More »

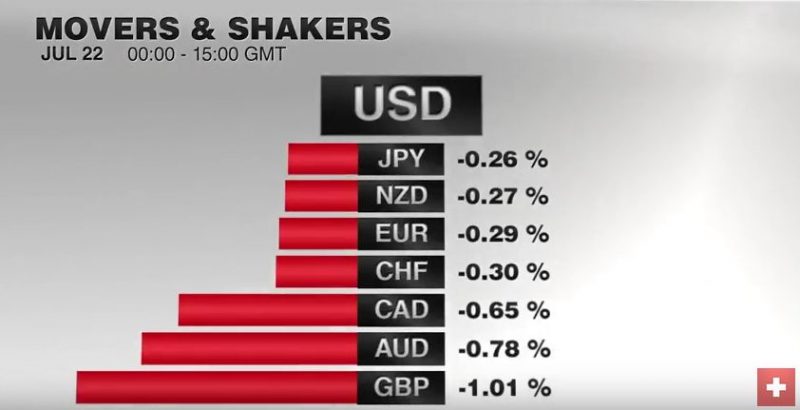

FX Weekly Review, July 18 – July 22: Will the FOMC Halt the Dollar’s Advance?

The US dollar gained against all the major currencies over the past week. It also rose against many emerging market currencies. A notable exception was the Chinese yuan.

Read More »

Read More »

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »

More Signs the End is Nigh

Hyperventilating Minds “What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be.

Read More »

Read More »

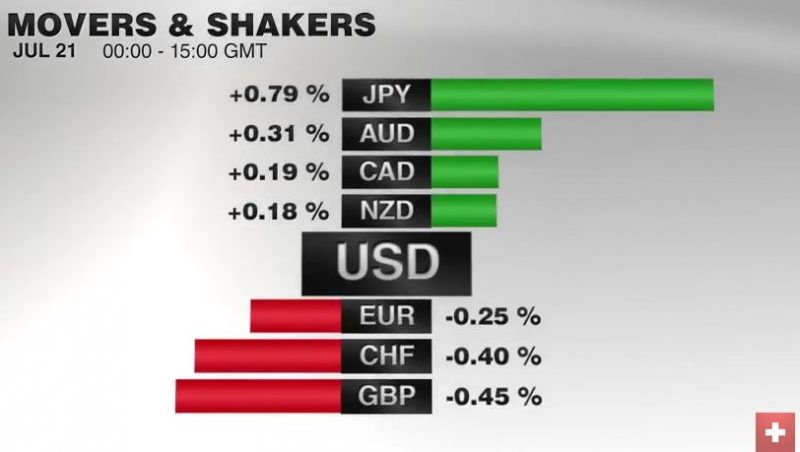

FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Monetary policy is said to have lost its impact on the foreign exchange market, as investors scratch their heads at the resilience of currencies with negative interest rates. Yet the price action in the action cannot be understood without recognizing the ongoing importance of monetary policy expectations.

Read More »

Read More »

The Central Planning Virus Mutates

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect.

Read More »

Read More »