Tag Archive: Gold

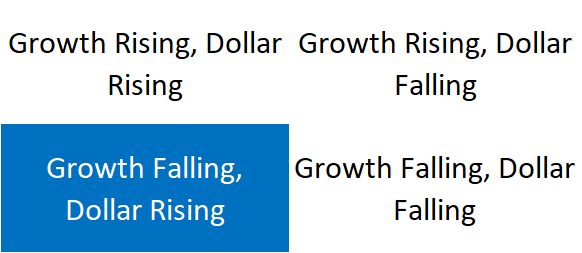

Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs.

Read More »

Read More »

Government interventions and the Cobra effect – Part II

Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime.

Read More »

Read More »

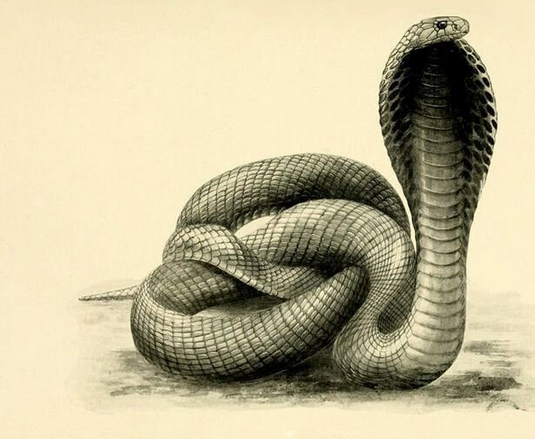

Government interventions and the Cobra effect – Part I

Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for.

Read More »

Read More »

Gold is Boring – That’s Why You Should Own It!

Gold and silver price actions have been the opposite of dramatic for months now, they have been boring. In the last 100 days, gold has moved sideways in the US$100 range between $1725 and $1825.

Read More »

Read More »

Corruption of the currency and decivilization – Part II

Many rational economists and students of history have written countless analyses on the gold standard and the terrible impact that its end has had on the world economy. However, as the Fall of Rome clearly demonstrates, the implications of the introduction of the fiat money system and of the limitless manipulation of the currency by the State reach much further.

Read More »

Read More »

50 years since the closure of the “gold window”

President Nixon’s unilateral decision to sever the last link between the dollar and gold had wide ranging and long lasting consequences for the global economy and for the entire monetary system. The end of sound money facilitated and accelerated the concentration of power at the top and the ability to manipulate the currency allowed politicians and central planners to further expand the state’s reach and push ahead with populist, reckless and...

Read More »

Read More »

Did Traders Get A Wink & Nod?

Good Day… And a Wonderful Wednesday to you! A quiet night for yours truly last night, as a lot of nights recently have been late… I sat out on the deck that overlooks the beach and ocean, and had my Bose speaker turned up and sang out loud along with the songs being played…

Read More »

Read More »

The battle for control over the future of money

It’s no secret that governments and central planners of all stripes have long detested the rise of private money and independent digital currencies. They have tried to stifle the burgeoning crypto industry from the moment it attracted mainstream attention. For years, they have continued to add regulatory hurdles and threaten crypto holders and investors, as well as companies in this space, with unreasonable tax burdens and unrealistic disclosure...

Read More »

Read More »

Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar.

Read More »

Read More »

The far-reaching implications of the amateur trading wave

Part II of II by Claudio Grass, Hünenberg See, Switzerland

Case in point: Silver “apes”

One of the most astounding elements of this shift in retail investing is the proof it offers for what many of us knew along: When people can freely and directly vote with their wallets and put their money where their mouth is, one gets a much clearer picture of what the public, the market or any other large group really thinks and really wants. In...

Read More »

Read More »

The far-reaching implications of the amateur trading wave

2020 certainly was a year of a lot of “firsts”, most them extremely destructive to the economy, to our societies and to our everyday lives. However, there were a few positive developments too, among them being the fact that it was the year that ordinary people discovered and entered financial markets.

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »

Freedom Is Not Free You Have To Fight For It, The People Will Demand Decentralization

Claudio begins his discussion with him taking a trip from Switzerland to Spain. On his travels he realized that the borders are open for cars and people were not asked for proof of vaccination. The people will begin to come together when they cannot function in everyday life because of inflation. People will look for decentralization because the globalist system does not work for the people. Freedom is not free you have to fight for it.

Read More »

Read More »

The Black Friday Stock Market Crash – Gareth Soloway

2021-11-30

by Stephen Flood

2021-11-30

Read More »