Tag Archive: Gold

“Whatever it takes” – Part II of II

The Fascist Boogeyman awakes again

The threat of a far-right takeover has been around for at least three decades in Europe and Italy has been one of the best “candidates” for the “beginning of the end” since the last European crisis ten years ago. Back then it was the Lega, led by Salvini, that fueled the scaremongering campaigns of the mainstream press, labeling every conservative policy point as basically pure fascism. Of course, none of those...

Read More »

Read More »

“Whatever it takes”:

In the case of Italy, it will take a whole lot more – Part I of II

When the collapse of the Italian government was officially announced, on July 21, many political observers both in Europe and across the rest of the West, were aghast. If Mario Draghi, the central banking messiah of the entire Old World, the man, the legend, the hero who rescued the Eurozone and its precious made up currency from the brink of complete annihilation, failed to...

Read More »

Read More »

Parity hysterics: What it means and what it doesn’t – Part II

Part II of II, by Claudio Grass, Hünenberg See, Switzerland

“Reverse currency wars”?

Although the parity event may have captured the attention of the mainstream financial press and most western citizens, there’s a much bigger shift that has been going on in the background, which received much less coverage.

Read More »

Read More »

Parity hysterics: What it means and what it doesn’t

There’s been a flurry of articles, news stories and headlines lately over the developments in the FOREX market, specifically over the moves of the EUR/USD currency pair. As headwinds on all levels, economic, geopolitical and social, got a lot worse in recent months for the Eurozone, the news-breaking, headline-dominating “parity” event finally came about, with the euro even breaking below parity on July 13, and it seems to have captivated global...

Read More »

Read More »

Gold and Inflation Q&A with David Forsyth

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »

Read More »

Private property rights under siege – Part II

An astonishing acceleration Even though the downhill trajectory we saw over the last decades in terms of property rights was bad enough, nothing could have ever prepared us for what the covid crisis would bring.

Read More »

Read More »

Private property rights under siege – Part I

Part I of II, by Claudio Grass, Hünenberg, Switzerland. It wouldn’t be an exaggeration to argue that private property rights, as understood by classic liberal thinkers, by those who embrace Austrian economic theory and by all member of an enlightened society, are not only the cornerstone, but also the last defense of human civilization and the Western way of life in particular.

Read More »

Read More »

Market Pulse: Mid-Year Update

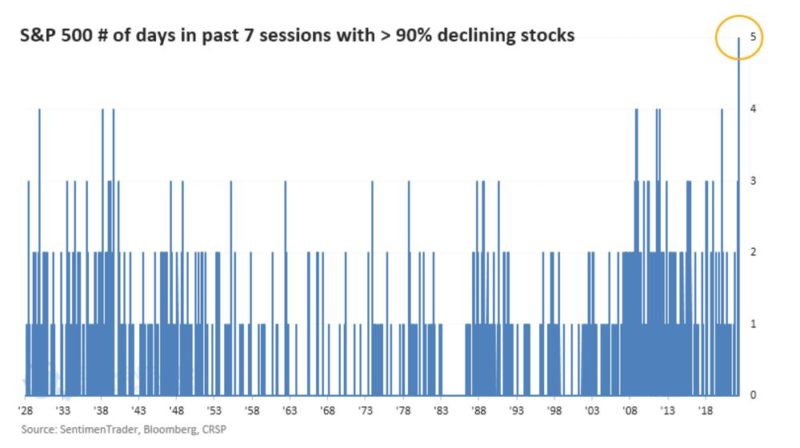

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

History Of Money and Evolution Suggests a Crash is Coming

2022-08-27

by Stephen Flood

2022-08-27

Read More »