Tag Archive: Gold

Inflation risk takes center stage – Part II of II

A lot of people might be aware of historical cases of hyperinflation, like that of Hungary and the Weimar Republic, or even contemporary ones, like that of Venezuela. And yet, these are taught or reported like extreme cases, very far removed from the daily experience of most modern Western citizens.

Read More »

Read More »

Marriage of Gold and Cryptocurrencies: A New Future?

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency.

Read More »

Read More »

Reality check: The “miracle recovery” narrative

Over the last few weeks, we’ve been constantly bombarded by news reports and “expert” analyses celebrating an incredible global economic recovery. They’re not even presented as projections or expectations anymore, but as a fact, as though the return to vibrant growth is already underway.

Read More »

Read More »

Precious metals are and always have been the ultimate insurance

As we enter the second quarter of 2021, the year during which so many mainstream analysts and politicians have predicted we’ll see a miraculous recovery from the covid crisis, it is becoming increasingly clear that the damage inflicted by the lockdowns and the shutdowns is really very extensive an persistent. Of course, I’m referring to the damage to the real economy, that is, to actual businesses, households and the countless citizens that were...

Read More »

Read More »

Is The Bull Market Over For Gold?

Gold has not made new highs in many months. Gold peaked last year at US$2067 on August 6. The 7 month down leg of more than 18% as been deep enough and long enough that some commentators are now saying that the bull market has now turned to a bear market for gold. Losing faith is understandable because falling prices feel bad. But this week we want to show that current prices may not reflect reality.

Read More »

Read More »

What Gold Says About UST Auctions

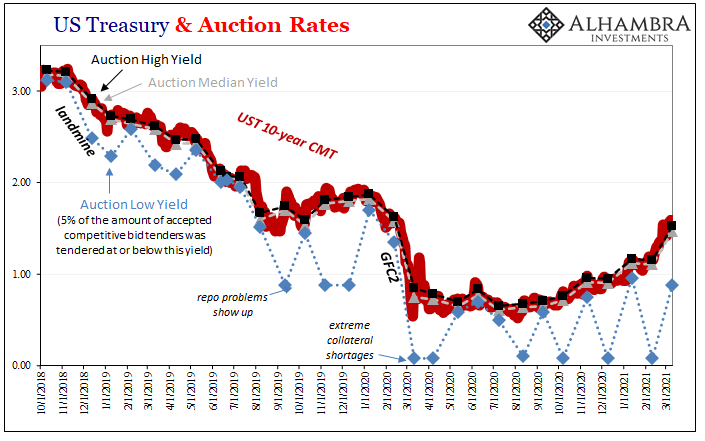

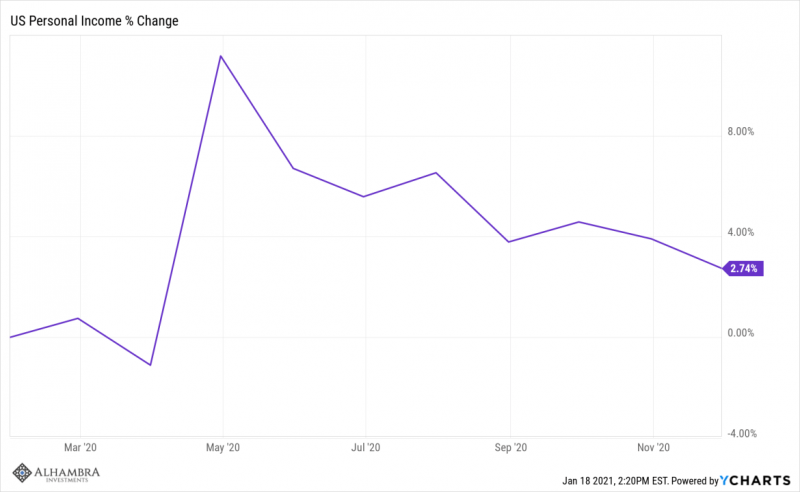

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first.

Read More »

Read More »

The bitcoin surge in its proper context

Over the last few weeks we’ve been witnessing a historic surge in the Bitcoin price, a seemingly unstoppable ride that the mainstream media headlines can hardly keep up with. Especially following the news that Elon Musks’ Tesla bought $1.5 in the cryptocurrency, sending it to new record highs, most of the media coverage appears to be focused on all the wrong things.

Read More »

Read More »

“The bank and the government have essentially blended into one entity”

A lot has been said and written about the impact of the Covid crisis on the global economy and on the prospects of a strong recovery in 2021. Especially since the start of the year, there seems to be a consensus among government officials, institutional leaders and mainstream market analysts and pundits, pointing to an extremely positive outlook.

Read More »

Read More »

Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag.

Read More »

Read More »

The far-reaching impact of the US election

The 2020 election was a roller coaster experience for both sides and for all International observers who understood its massive economic and geopolitical implications for the rest of the West.

Read More »

Read More »

“Gold is Money, Everything Else Is Credit” – J.P. Morgan

By now it is probably obvious, even to the most naive of mainstream narrative followers, that we are well past the point of no return on many fronts. Politics, on a national and global level, are never getting back to “normal”, the economy is already knee-deep in a severe recession, while social frictions and public discontent with governments, institutions and all kinds of rulers and central planners is on a sharp and dangerous trajectory.

Read More »

Read More »

Unless the US stops printing money, the dollar will collapse

Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about?

Read More »

Read More »

“Unless the US stops printing money, the dollar will collapse.”

We’re less than two weeks away from the US election, and yet this sense of utter confusion, bitter political conflict, and economic uncertainty that has been ominously hovering over the nation, as well as the rest of the world, doesn’t seem to have subsided.

Read More »

Read More »

US election: Red flags for investors

Outlook and wider impact. As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease.

Read More »

Read More »

Demand for Gold is Expected to Grow Exponentially in 2021

2021-05-06

by Stephen Flood

2021-05-06

Read More »