Tag Archive: gold silver ratio

Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins

Read More »

Read More »

The Economic Singularity, Report 11 Aug

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet.

Read More »

Read More »

I Know Usury When I See It, Report 4 Aug

“I know it, when I see it.” This phrase was first used by U.S. Supreme Court Justice Potter Stewart, in a case of obscenity. Instead of defining it—we would think that this would be a requirement for a law, which is of course backed by threat of imprisonment—he resorted to what might be called Begging Common Sense. It’s just common sense, it’s easy-peasy, there’s no need to define the term…

Read More »

Read More »

Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day.

Read More »

Read More »

The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists.

Read More »

Read More »

How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity.

Read More »

Read More »

More Squeeze, Less Juice, Report 7 Jul

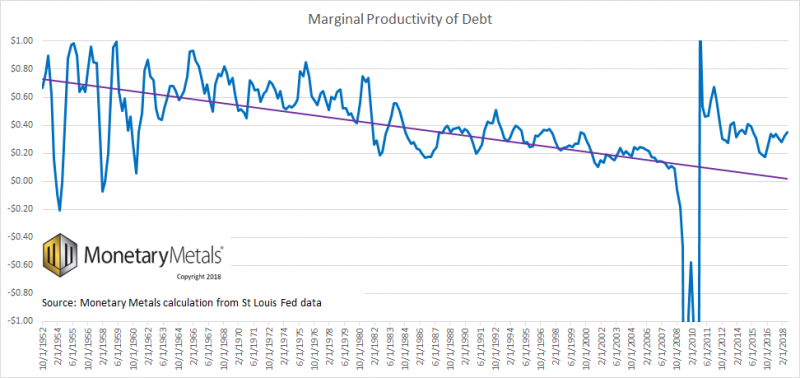

We have been writing on the flaws in GDP: that it is no measure of the economy, because it looks only at cash and not the balance sheet, and that there are positive feedback loops.

“OK, Mr. Smarty Pants,” you’re thinking (yes, we know you’re thinking this), “if GDP is not a good measure of the economy, then what is?!”

Read More »

Read More »

GDP Begets More GDP (Positive Feedback), Report 30 June

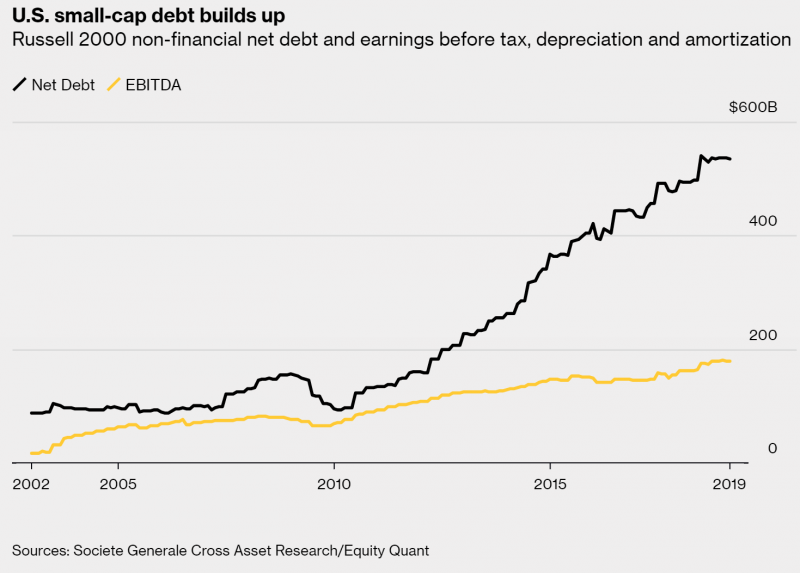

Last week, we discussed the fundamental flaw in GDP. GDP is a perfect tool for central planning tools. But for measuring the economy, not so much. This is because it looks only at cash revenues. It does not look at the balance sheet. It does not take into account capital consumption or debt accumulation. Any Keynesian fool can add to GDP by borrowing to spend. But that is not economic growth.

Read More »

Read More »

What Gets Measures Gets Improved, Report 23 June

Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”).

Read More »

Read More »

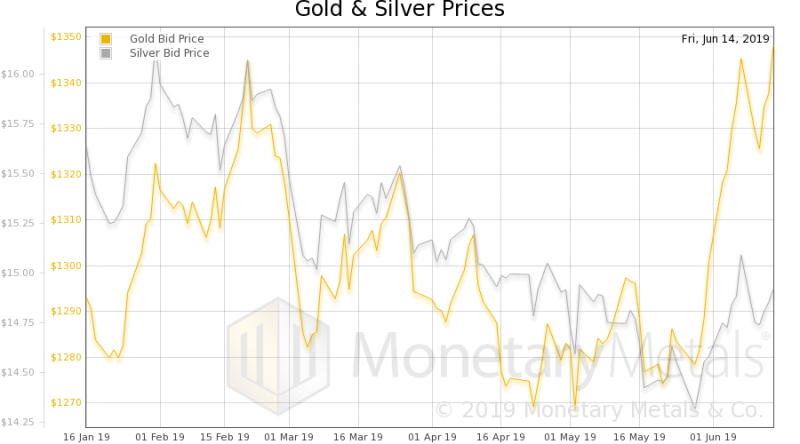

The Elephant in the Gold Room, Report 16 June

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and them bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy!

Read More »

Read More »

Irredeemable Currency Is a Roach Motel, Report 9 June

In what has become a four-part series, we are looking at the monetary science of China’s potential strategy to nuke the Treasury bond market. In Part I, we gave a list of reasons why selling dollars would hurt China. In Part II we showed that interest rates, being that the dollar is irredeemable, are not subject to bond vigilantes.

Read More »

Read More »

Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market.

Read More »

Read More »

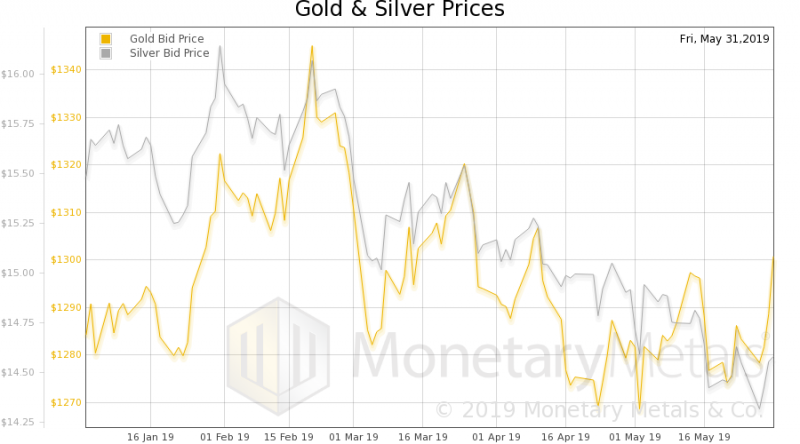

The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another currency, it merely tightens...

Read More »

Read More »

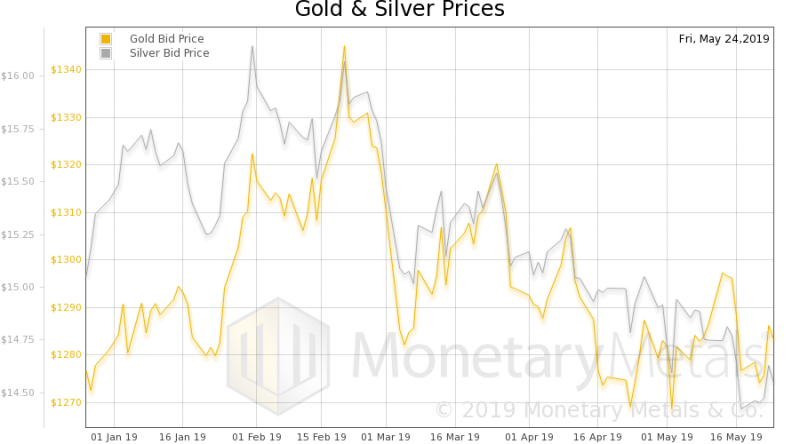

China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy.

Read More »

Read More »

The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good.

Read More »

Read More »

Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc.

Read More »

Read More »

Is Keith Weiner an Iconoclast? Report 28 Apr

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the price is down to $39.31. Down...

Read More »

Read More »

The Two Faces of Inflation, Report 22 Apr

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees.

Read More »

Read More »

New Inflation Indicator, Report 14 Apr

Last week, we wrote that regulations, taxes, environmental compliance, and fear of lawsuits forces companies to put useless ingredients into their products. We said: “For example, milk comes from the ingredients of: land, cows, ranch labor, dairy labor, dairy capital equipment, distribution labor, distribution capital, and consumable containers.”

Read More »

Read More »

What Causes Loss of Purchasing Power, Report 7 Apr

We have written much about the notion of inflation. We don’t want to rehash our many previous points, but to look at the idea of purchasing power from a new angle. Purchasing power is assumed to be intrinsic to the currency. We have said that the problem with the word inflation is that it treats two different phenomena as if they are the same.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Physical Gold vs ETFs: Ownership, Risk and Liquidity Compared

-

Meine Top Favoriten: Edelmetalle für 2026! #thorstenwittmann #edelmetalle #finanzstrategien

-

Wenig Gehalt, trotzdem glücklich?

Wenig Gehalt, trotzdem glücklich? -

Why Silver Shortages Appear Without Spot Price Spikes

-

How to Buy Gold Online Safely

-

unknown

unknown -

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos -

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

More from this category

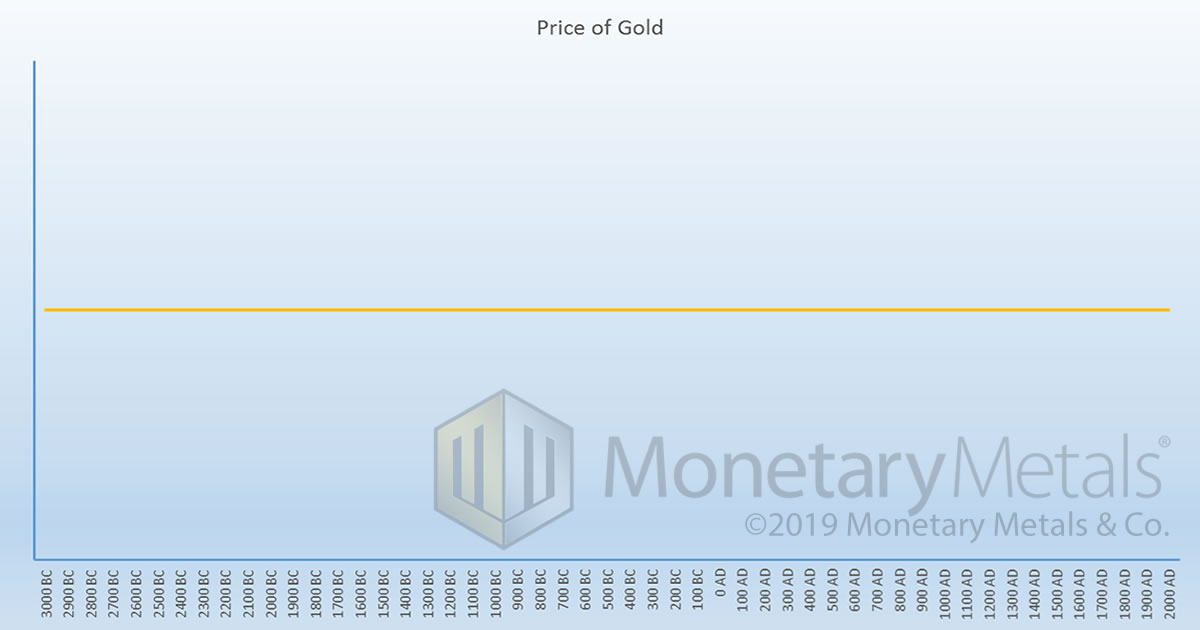

Long Term Gold Price Prediction

Long Term Gold Price Prediction22 Jul 2022

Gold Leads the Way for Silver

Gold Leads the Way for Silver10 Sep 2021

Wealth Consumption vs. Growth – Precious Metals Supply and Demand

Wealth Consumption vs. Growth – Precious Metals Supply and Demand3 Jan 2020

Open Letter to John Taft, Report 17 Dec

Open Letter to John Taft, Report 17 Dec18 Dec 2019

The End of an Epoch, Report 8 Dec

The End of an Epoch, Report 8 Dec10 Dec 2019

Money and Prices Are a Dynamic System, Report 1 Dec

Money and Prices Are a Dynamic System, Report 1 Dec3 Dec 2019

Raising Rates to Fight Inflation, Report 24 Nov

Raising Rates to Fight Inflation, Report 24 Nov26 Nov 2019

The Perversity of Negative Interest, Report 17 Nov

The Perversity of Negative Interest, Report 17 Nov18 Nov 2019

What’s the Price of Gold in the Gold Standard, Report 10 Nov

What’s the Price of Gold in the Gold Standard, Report 10 Nov12 Nov 2019

Targeting nGDP Targeting, Report 3 Nov

Targeting nGDP Targeting, Report 3 Nov5 Nov 2019

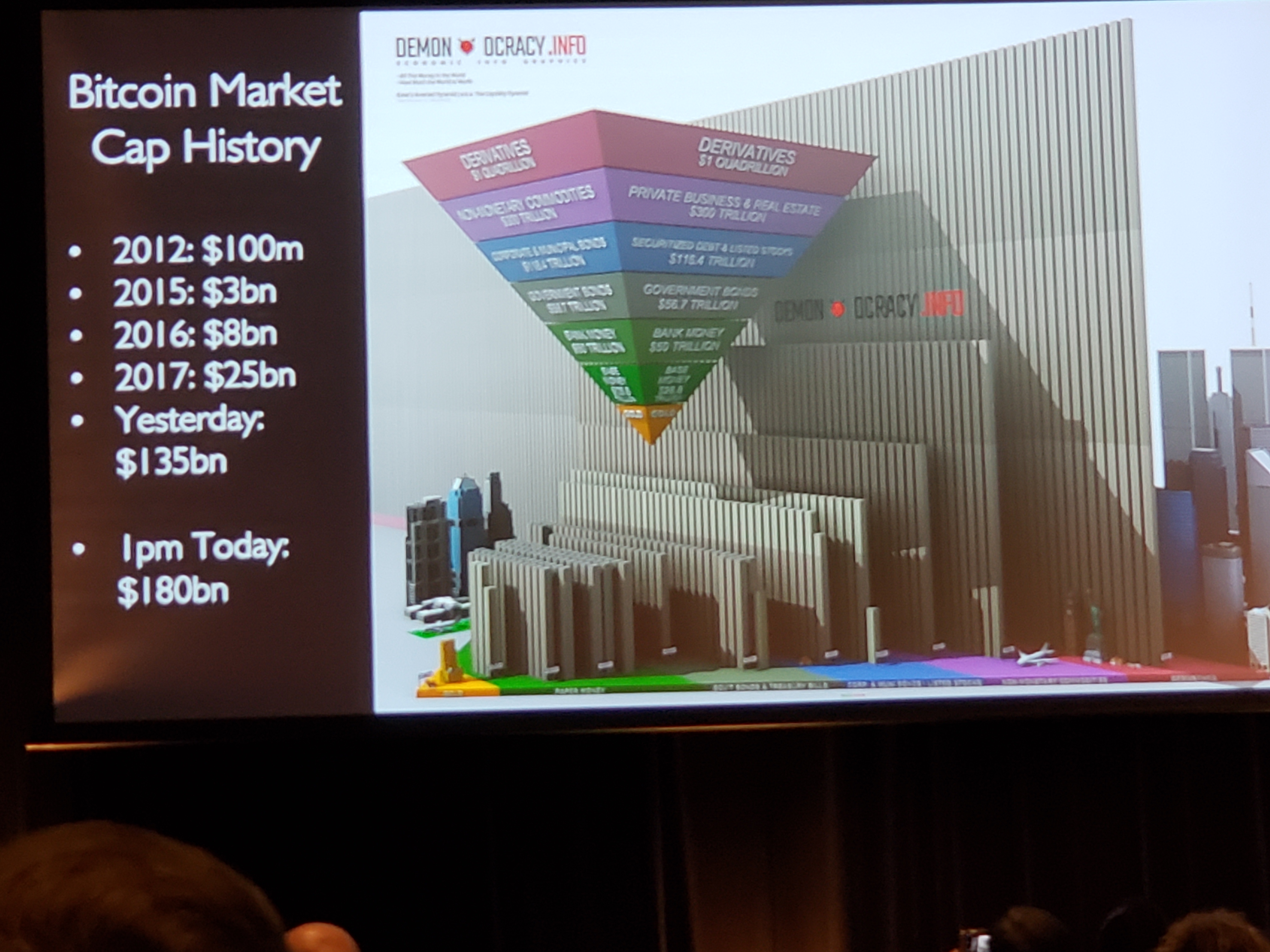

Bitcoin Myths, Report 27 Oct

Bitcoin Myths, Report 27 Oct28 Oct 2019

Wealth Accumulation Is Becoming Impossible, Report 20 Oct

Wealth Accumulation Is Becoming Impossible, Report 20 Oct22 Oct 2019

Motte and Bailey Fallacy, Report 13 Oct

Motte and Bailey Fallacy, Report 13 Oct15 Oct 2019

A Wealth Tax Consumes Capital, Report 6 Oct

A Wealth Tax Consumes Capital, Report 6 Oct7 Oct 2019

The Purchasing Power of Capital, Report 29 Sep

The Purchasing Power of Capital, Report 29 Sep1 Oct 2019

Treasury Bond Backwardation, Report 22 Sep

Treasury Bond Backwardation, Report 22 Sep24 Sep 2019

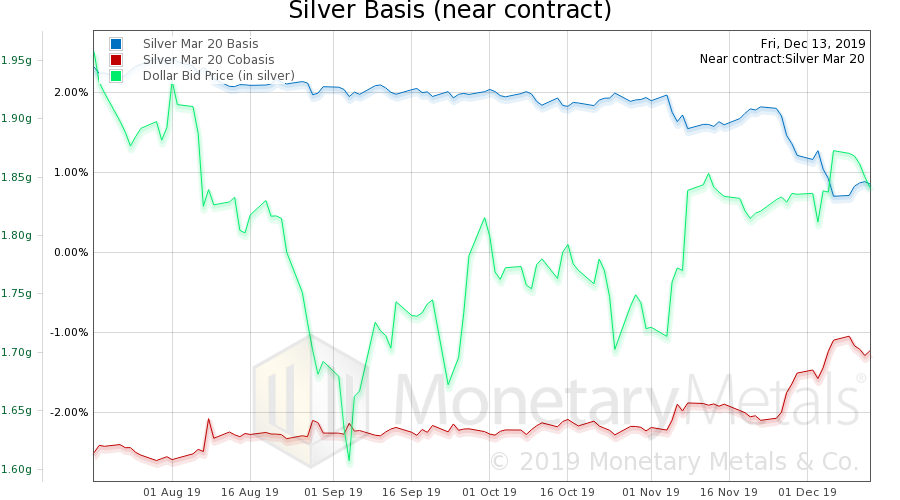

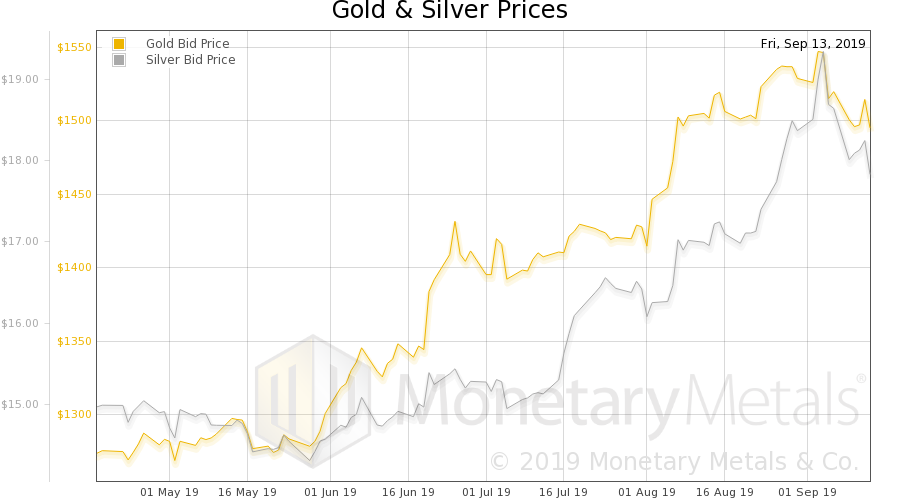

Why Are People Now Selling Their Silver? Report 15 Sep

Why Are People Now Selling Their Silver? Report 15 Sep17 Sep 2019

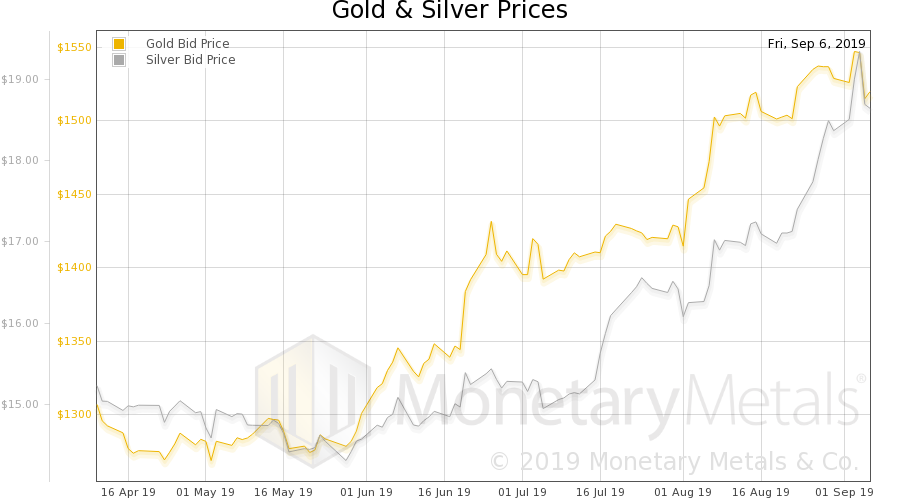

How Is Negative Interest Possible? Report 8 Sep

How Is Negative Interest Possible? Report 8 Sep10 Sep 2019

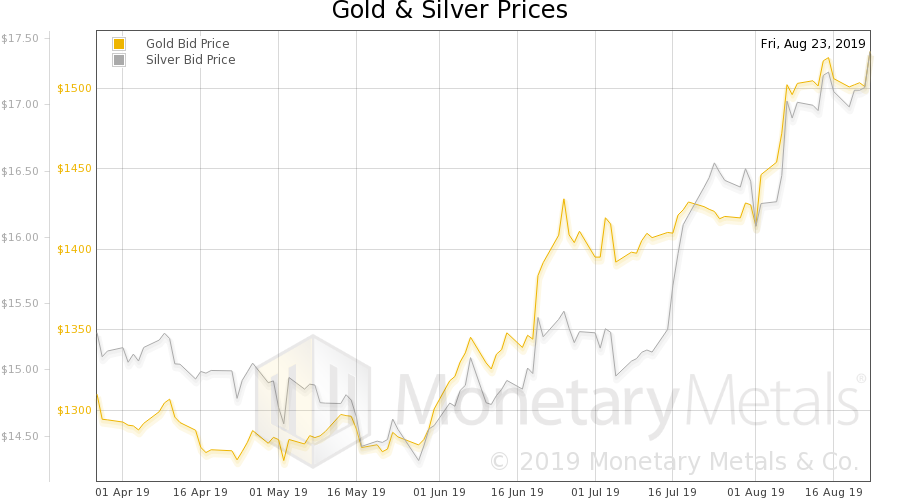

Asset Inflation vs. Consumer Goods Inflation, Report 1 Sep

Asset Inflation vs. Consumer Goods Inflation, Report 1 Sep3 Sep 2019

Directive 10-289, Report 25 Aug

Directive 10-289, Report 25 Aug26 Aug 2019