Tag Archive: Germany Trade Balance

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation’s exports and imports over a certain period. Sometimes a distinction is made between a balance of trade for goods versus one for services. If a country exports a greater value than it imports, it is called a trade surplus, positive balance, or a “favourable balance”, and conversely, if a country imports a greater value than it exports, it is called a trade deficit, negative balance, “unfavorable balance”, or, informally, a “trade gap”.

FX Daily, June 7: Jobs Data and Tariffs Dominate

Overview: Global equities continue to recover from the recent slide. Chinese and Hong Kong markets were on holiday today, but the MSCI Asia Pacific Index eked out a minor gain and ensured that its four-week slide ended. Europe's Dow Jones Stoxx 600 is up about 0.7% through the European morning.

Read More »

Read More »

FX Daily, May 10: Waiting for the Other Shoe to Drop

Overview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around $200 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese imports has begun. Also contrary to expectations, Chinese officials did not detail their response, though it is expected to be forthcoming.

Read More »

Read More »

FX Daily, July 09: Possibility of a Soft Brexit Excites Sterling (too Early?)

After a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and the softer dollar tone puts wind in sterling's sale. There is a GBP244 mln sterling option at $1.3375 that expires today. The June highs were set in the $1.3450-$1.3470 area.

Read More »

Read More »

Dollar and Yen Rise Amid Heightened Anxiety

With what promises to be an acrimonious G7 meeting, from which the isolated US President will depart early, and a broadening pressure in emerging markets, the US dollar turned better bid late yesterday and is recovering further today.

Read More »

Read More »

FX Daily, May 08: Dollar Races Ahead

The US dollar's surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are trapped at higher levels and the briefest and shallow pullbacks are new opportunities to adjust positions.

Read More »

Read More »

FX Daily, April 09: Asian and European Equities Shrug Off US Decline

US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing phase. No sanctions have gone to into effect. As the Economist points out, nearly 100 of the Chinese products the US proposed slap a tariff on are not currently being exported to the US. The US has a 60-day...

Read More »

Read More »

FX Daily, March 09: Today is about Jobs, but Not Really

The US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea's Kim Jong Un.

Read More »

Read More »

FX Daily, February 08: Dollar Firms, While Equities Search for Stability

The swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the MSCI Emerging Markets Index is off nearly as much, though the range was modest. European markets are also lower, and the range for the Dow Jones Stoxx 600 is the smallest in more than a week.

Read More »

Read More »

FX Daily, January 09: Dollar Correction Extended

The US dollar's upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen's modest gains have been registered despite the firmness in US rates and continued advance in equities; both factors associated with a weaker Japanese currency.

Read More »

Read More »

FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week's EU summit. To be sure, "sufficient progress," which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals.

Read More »

Read More »

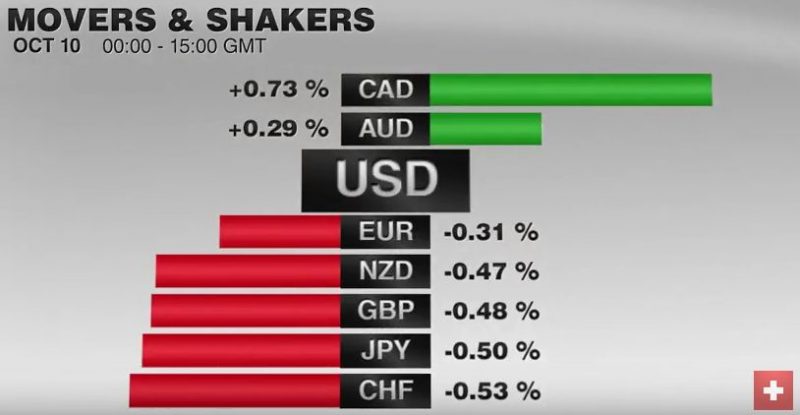

FX Daily, October 10: Dollar Pullback Extended

The US dollar's advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish...

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

FX Daily, August 08: Trade Featured as Dollar Drifts Lower

The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended their pre-weekend losses yesterday, and are trading within yesterday's range today.

Read More »

Read More »

FX Daily, July 10: Firm Dollar Tone may be Challenged by Softer Yields

The US dollar has begun the new week on a firm note, but the decline in yields limit the gains. The US 10-year yield is pulling back from the 2.40% area, which is it not been able to sustain gains above since Q1. European bond yields are also 1-3 basis points lower today after jumping last week.

Read More »

Read More »

FX Daily, June 09: Sterling Shocked, Dollar Broadly Firmer

What looked like a savvy move in late April has turned into a nightmare. Collectively, voters have denied the governing Conservative party a parliamentary majority. The uncertainty today does not lie yesterday with the known unknown, but with the shape of the next government and what it means for Brexit.

Read More »

Read More »

FX Daily, May 09: Dollar Firms amid Position Adjustments

The election of Macron as French President has set off a bout of position adjustment that has seen the euro push back into the $1.0850-$1.0950 range that had confined activity for the two weeks between the first and second rounds of the French presidential election.

Read More »

Read More »

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

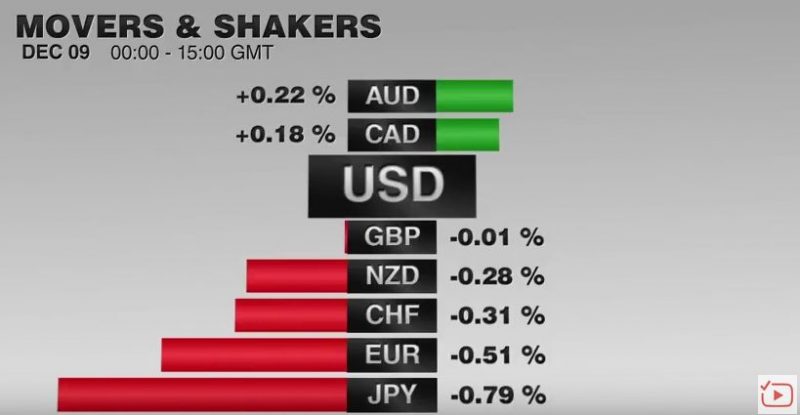

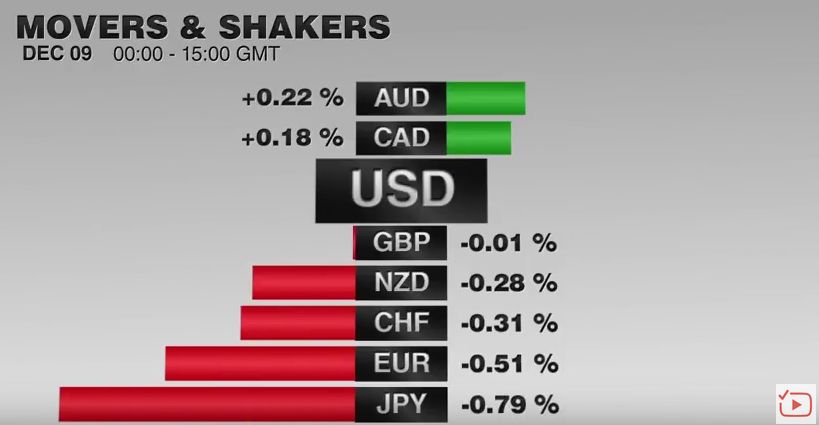

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

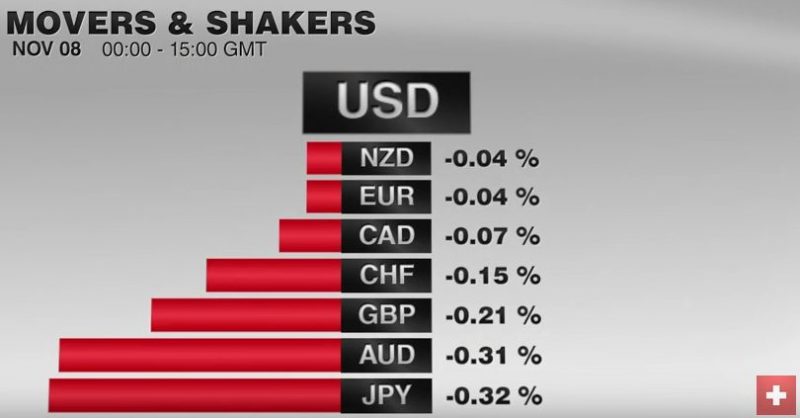

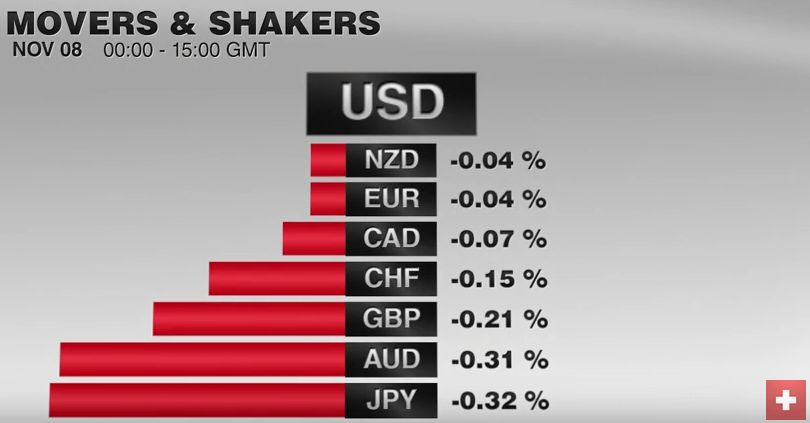

FX Daily, November 08: Consolidation Featured as Market Catches and Holds Breath

The equity markets snapped their losing streak yesterday and are consolidating today. The US dollar is narrowly mixed. The euro and sterling are slightly firmer, but well within yesterday's ranges. The dollar-bloc is a bit lower, and once again the Australian dollar is struggling to sustain moves above $0.7700.

Read More »

Read More »

FX Daily, October 10: Dollar after the Second Debate

The US dollar has started the new week on a firm note. The light news stream and holidays in Japan, Canada and the United States make for a subdued session. Notable exceptions to the dollar's gains are the Canadian dollar and Mexican peso. Both currencies appear to have been. underpinned by US political developments, the main feature of which is the implosion of the Trump campaign.

Read More »

Read More »