Tag Archive: Germany Producer Price Index

A Producer Price Index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

FX Daily, August 20: Marking Time Ahead of PMI and Powell

Overview: Global equities and bonds are firmer in quiet turnover, and the dollar is narrowing mixed in narrow ranges. The big events of the week, the eurozone flash PMI and Powell's speech at Jackson Hole still lie ahead. The MSCI Asia Pacific Index rose for the third consecutive session, led by Korea and Australia's 1%+ gains.

Read More »

Read More »

FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an Iranian drone in the Gulf helped spur gold to new six-year highs. There was some attempt to clarify the (NY Fed's) comments and the dollar has pared yesterday's losses.

Read More »

Read More »

FX Daily, June 19: Still Patient?

Overview: Risk-taking was bolstered by the dramatic shift in Draghi's rhetoric less than two weeks after the ECB meeting and a Trump's tweet announcing that there was going to be an "extended" meeting between him and Xi at the G20 meeting and that the respective staff would begin coordinating. It was later confirmed by the Chinese media.

Read More »

Read More »

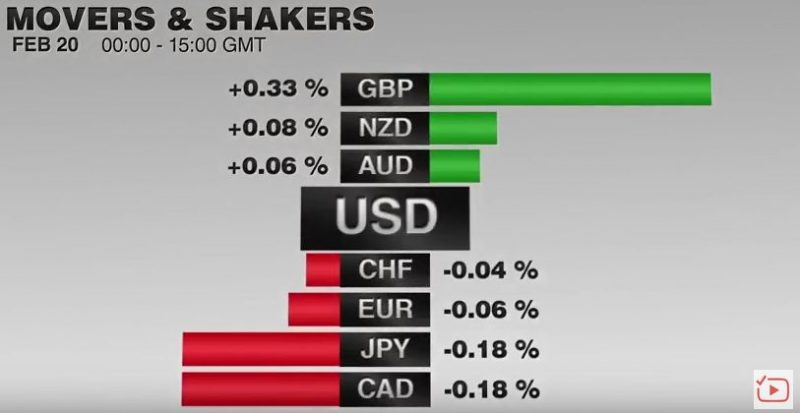

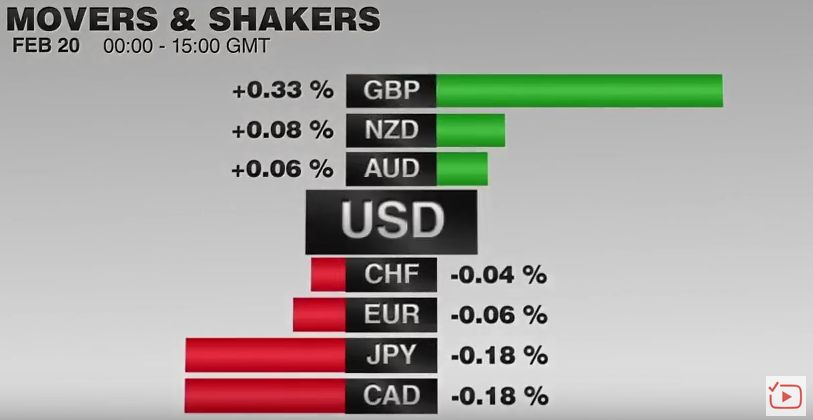

FX Daily, February 20: Dollar Trades Higher, but Stocks Challenged at Key Chart Point

The dollar is finding better traction today, building on the upside reversal seen before the weekend. The news stream has been light and it seems like primarily an issue of positioning rather than a change in sentiment or the consensus narrative. The focus has shifted from monetary policy and idea that the ECB and BOJ are exiting their extraordinary monetary policy to return of the twin deficit problem in the US.

Read More »

Read More »

FX Daily, January 19: Dollar Crushed as Government Shutdown Looms

The US dollar is broadly lower as the momentum feeds on itself. Asia is leading the way. The Japanese yen, Taiwanese dollar, Malaysian Ringgit, and South Korean won are all around 0.45% higher. Asian shares also managed to shrug off the weakness seen in the US yesterday. The MSCI Asia Pacific Index advanced 0.7%. It is the sixth consecutive weekly gain. The dollar's drop comes as US yields reach levels now seen in year. The 10-year yield is at its...

Read More »

Read More »

FX Daily, November 20: German Political Impasse Roils Euro…Briefly

News that the attempt to forge a four-party coalition in Germany collapsed Sunday saw the euro marked down in early Asian activity. The euro fell to nearly $1.1720 in the immediate response to the news, stabilized before turning higher in early European turnover. It quickly recovered and poked through $1.1800. The pre-weekend high was seen near $1.1820.

Read More »

Read More »

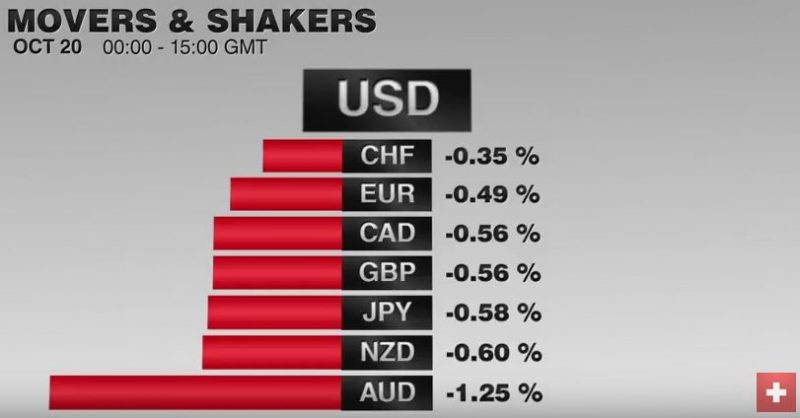

FX Daily, October 20:Tax Prospects Lift Rates and Dollar Ahead of Weekend

The US Senate approved a budget resolution that is a necessary step toward using a parliamentary maneuver that prevents the Democrats to block tax reform by filibuster. This has helped spur dollar gains against all the major currencies and nearly all the emerging market currencies.

Read More »

Read More »

FX Daily, September 20: Shrinkage and Beyond

After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to begin unwinding the emergency expansion of its balance sheet. The Fed's experience in QE, communication, and now unwinding, will be part of the information set other central banks can draw upon.

Read More »

Read More »

FX Daily, August 18: Dollar and Equities Trade Heavily Ahead of the Weekend

The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week's gain in half. The Dow Jones Stoxx did not completely escape the US carnage yesterday, but losses are accelerating today, with a nearly 1% decline following a 0.6% decline yesterday.

Read More »

Read More »

FX Daily, July 20: ECB Game Day

The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs, reaching almost $0.8000, it has reversed to toy with yesterday's low. A convincing break of that area (~$0.7910), especially on a closing basis, could be the kind of technical reversal that momentum traders take...

Read More »

Read More »

FX Daily, June 20: Officials Fill Vacuum of Data to Drive FX Market

The light economic calendar has cleared the field to allow officials to clarify their positions. Yesterday it was NY Fed President Dudley and Chicago Fed Evans who argued that economic conditions continued to require a gradual removal of accommodation. The Fed's Vice Chairman Fischer did not address US monetary policy directly but did note that housing prices were elevated and that low interest rates

contributed.

Read More »

Read More »

FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors' reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices.

Read More »

Read More »

FX Daily, April 20: Dollar and Yen Push Lower

With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday's rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00.

Read More »

Read More »

FX Daily, February 20: Marking Time on Monday

US markets are closed for the Presidents' Day holiday, but it hasn't prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today.

Read More »

Read More »

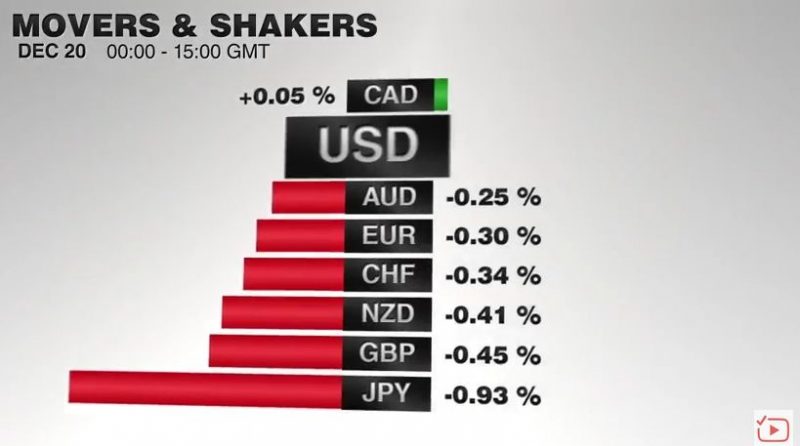

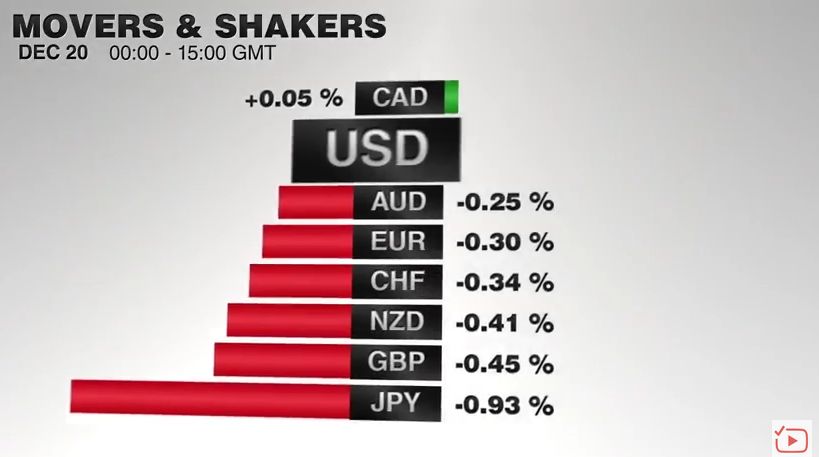

FX Daily, December 20: Yen Surrenders Yesterday’s Gains, while Euro Struggles to Hold above $1.04

The yen's incredible ride this year has been recapitulated in recent days. Consider that before last weekend; the US dollar reached a little above JPY118.40. At its extreme yesterday, the dollar fell to JPY116.55. Today it reached traded near JPY118.25 in the European morning, where it was encountering some offers.

Read More »

Read More »

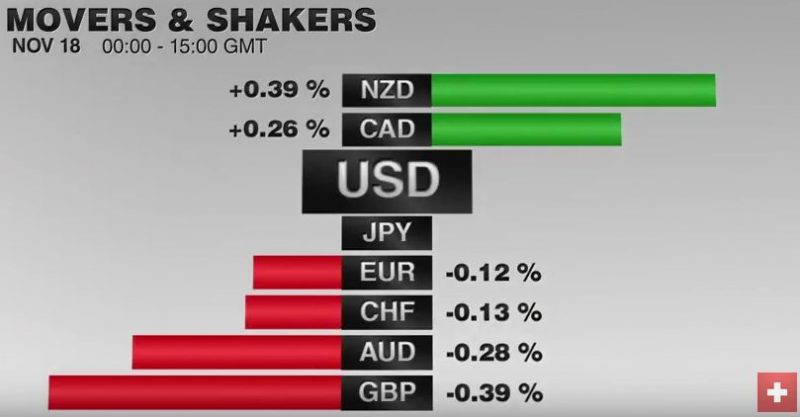

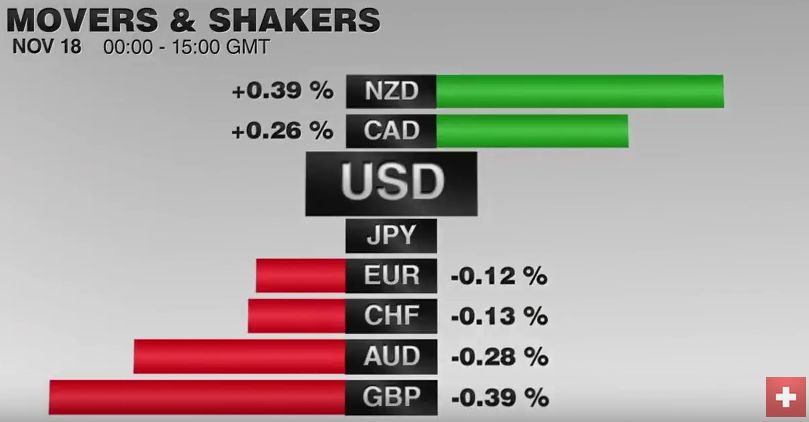

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

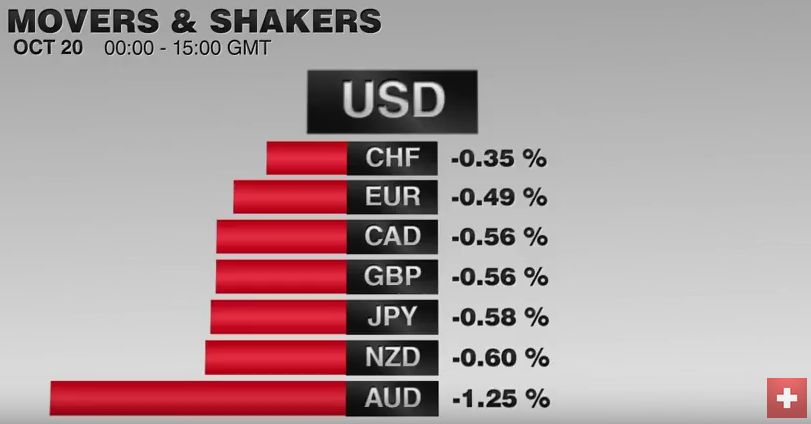

FX Daily, October 20: ECB Unlikely to Shake Dollar’s Slumber

GBP/CHF rates have fallen dramatically over the past month, as Sterling continues to find itself under pressure against the major currencies. However, despite these losses it is not all doom and gloom for those clients holding GBP, as Tuesday’s positive spike for the Pound proved. Currency does not move in a straight line and therefore we will see opportunities for those clients holding GBP to take advantage of, even if a sustainable Sterling...

Read More »

Read More »

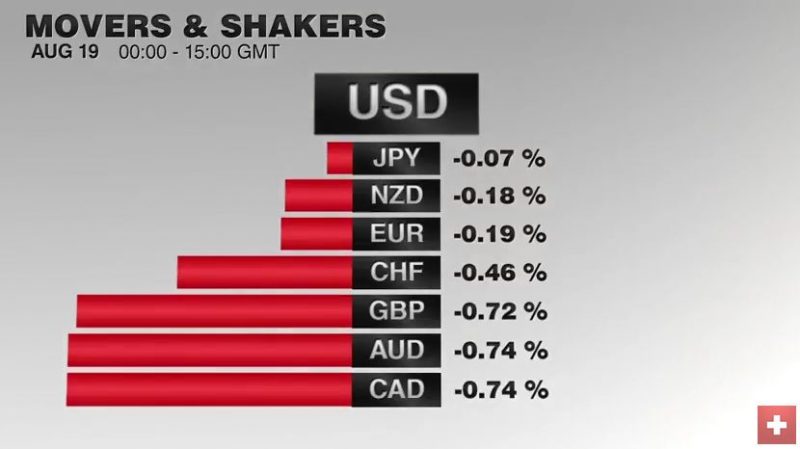

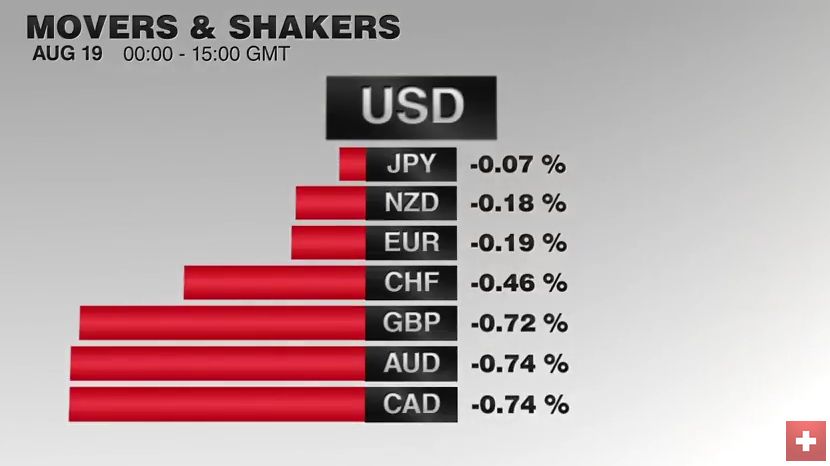

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »